Accounting for finance leases is generally consistent with the current guidance for capital leases. Here are answers to many questions being asked about ROU assets.

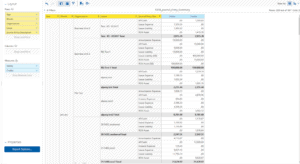

The remeasurement journal entry is then: The closing balance of right of use asset value at 2021-10-15 is $24,550.34.

The remeasurement journal entry is then: The closing balance of right of use asset value at 2021-10-15 is $24,550.34.  Assuming the lease qualifies as a finance lease, prepare a lease amortization table for the life of the lease for Susan Corporation.

Assuming the lease qualifies as a finance lease, prepare a lease amortization table for the life of the lease for Susan Corporation.  WebJournal Entries Learning Outcomes Record entries associated with leases Finance Lease For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. To perform the fourth test, the lessee calculates the present value of the remaining lease payments.

WebJournal Entries Learning Outcomes Record entries associated with leases Finance Lease For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. To perform the fourth test, the lessee calculates the present value of the remaining lease payments.  Cradle Inc. For example, assume Company A leases a building to Company B for 10 years, with an annual rent payment of $12,000. In our experience, most LeaseQuery clients have chosen to keep the existing thresholds of 75% and 90%, respectively, for continuity purposes. WebThis video shows how the lessee would account for a lease classified as a finance lease under the new lease accounting rule. Given the demands of the new standard, however, that logic no longer applies, and companies will have to address the shortcomings their systems long before 2019. The incremental borrowing rate (IBR) is only used the implicit rate is not available. div.id = "placement_461033_"+plc461033; Capital lease criteria under ASC 840 Under this arrangement, the lessor recognizes the gross investment in the lease and the amount of related unearned income. The visual below shows the journal entry for a lease that has a net present value of future minimum lease payments of $60,000. Major part and substantially all are not defined under ASC 842. var plc228993 = window.plc228993 || 0; Initial recognition of the ROU Asset Sum of: The amount of the initial measurement of the lease liability Base Lease: Any Lease Payments at or before the 15th of the month of the Start Date Any Initial Direct Costs ; The lessee can buy an asset at the end of term at a value below market price. As a result, if it's a capital lease under ASC 840, it's a finance lease under ASC 842. Canada, US When doing journal entries, we must always consider four factors: Which accounts are affected by the transaction. Recent surveys by PricewaterhouseCoopers and Ernest & Young (http://pwc.to/2vlq78vandhttps://go.ey.com/2un5rzM) found that most companies relied on spreadsheets to track and account for leases. Customer Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments, 2. Web"EZLease maintains all of the lease schedules and we can run custom journal entries out of the system for direct upload into our ERP system. The credit to lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year.

Cradle Inc. For example, assume Company A leases a building to Company B for 10 years, with an annual rent payment of $12,000. In our experience, most LeaseQuery clients have chosen to keep the existing thresholds of 75% and 90%, respectively, for continuity purposes. WebThis video shows how the lessee would account for a lease classified as a finance lease under the new lease accounting rule. Given the demands of the new standard, however, that logic no longer applies, and companies will have to address the shortcomings their systems long before 2019. The incremental borrowing rate (IBR) is only used the implicit rate is not available. div.id = "placement_461033_"+plc461033; Capital lease criteria under ASC 840 Under this arrangement, the lessor recognizes the gross investment in the lease and the amount of related unearned income. The visual below shows the journal entry for a lease that has a net present value of future minimum lease payments of $60,000. Major part and substantially all are not defined under ASC 842. var plc228993 = window.plc228993 || 0; Initial recognition of the ROU Asset Sum of: The amount of the initial measurement of the lease liability Base Lease: Any Lease Payments at or before the 15th of the month of the Start Date Any Initial Direct Costs ; The lessee can buy an asset at the end of term at a value below market price. As a result, if it's a capital lease under ASC 840, it's a finance lease under ASC 842. Canada, US When doing journal entries, we must always consider four factors: Which accounts are affected by the transaction. Recent surveys by PricewaterhouseCoopers and Ernest & Young (http://pwc.to/2vlq78vandhttps://go.ey.com/2un5rzM) found that most companies relied on spreadsheets to track and account for leases. Customer Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments, 2. Web"EZLease maintains all of the lease schedules and we can run custom journal entries out of the system for direct upload into our ERP system. The credit to lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. A capital lease, now referred to as a finance lease under ASC 842, is a lease with the characteristics of an owned asset. How prepared are public companies to meet this challenge? The lessee does not plan to exercise the purchase option, so the second test for finance lease accounting is not met. So what is the other side of the journal entry? The way finance leases are treated for lessees has not changed much. var plc289809 = window.plc289809 || 0; Payment schedules are more flexible than loan contracts. The fifth test is not applicable to this lease. Lessees reporting under Topic 842 are required to recognize both the assets and the liabilities arising from their leases. The examples below are identical leases in terms, payments, and discount rates. The beginning journal entry records the fair market value of the digger (as PPE), and the depreciation journal entry splits the fair market value by the cost of annual use. In Excel, we can calculate the PV of the minimum lease payments: type = 1 (payment is made at the beginning of the year), calculate PV as =PV(10.5%,8,28500,0,1) = $164,995, 164,995/166,000 = 99% (refer to the present value condition above), =PV(10.5%,8,-28500) the negative figure shows that this is a cash outflow, =NPV(10.5%, E3:E10) the lease payments shown in the table above are in the range E3:E10, You can read more about lease accounting on the. Calculation of ROU asset amortization expense for operating leases The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? The criteria from SFAS 13 have been slightly modified by dropping the phrase bargain purchase option from the second criterion and removing the bright lines of the 75% of economic life lease test and the 90% fair value investment recovery test. LT Lease Liability increase = This is the monthly Interest on the Lease Liability calculated as Discount rate divided by 12* Prior Month's EOM Long Term & Short Term Liability (less BOM Payment). var abkw = window.abkw || ''; It was a difficult task, but the lease convergence project bore fruit in February 2016.

document.write('

document.write(' document.write('

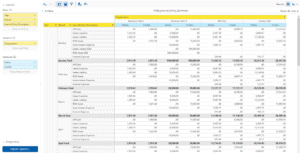

document.write(' Lessees quickly found easy ways to elude the four criteria for designation as a capital lease. Companies with good lease management software and centralized data systems will have a headstart over those with decentralized data systems that rely on spreadsheets for tracking their lease data. In this example, take the present value of the monthly payments of $450 over 3 years at 4%. When the lease term covers major part of life of asset 4. .hide-if-no-js { All other modifications will trigger a re-measurement of the lease liability and right of use asset. This spreadsheet will also be used for many of the quantitative disclosure requirements of the standard. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 461033, [300,600], 'placement_461033_'+opt.place, opt); }, opt: { place: plc461033++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); Suite 200 })(); var rnd = window.rnd || Math.floor(Math.random()*10e6); : The net present value of the minimum lease payments required under the lease exceeds substantially all (at least 90%) of the fair value of the underlying asset at the inception of the lease. Get Certified for Financial Modeling (FMVA). PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. For each account, determine if it is increased or decreased. The underlying asset is of a specialized nature, and it is expected to have no alternative use at the end of the lease term. Since the present value of lease payments i.e. Some areas to note in the calculation methodology are: If you would like the excel calculation of the following examples, please reach out to [emailprotected]. For both finance and long-term operating leases, disclosure of non-cash investing and financing activities is consistent with current guidance when obtaining a right-of-use asset in exchange for a lease liability. These requirements are demonstrated inExhibit 5. This includes rental income, expenses, and any other financial transactions that affect your business. When tallying figures for the balance sheet, the lease liability and ROU asset accounts are now included.

Lessees quickly found easy ways to elude the four criteria for designation as a capital lease. Companies with good lease management software and centralized data systems will have a headstart over those with decentralized data systems that rely on spreadsheets for tracking their lease data. In this example, take the present value of the monthly payments of $450 over 3 years at 4%. When the lease term covers major part of life of asset 4. .hide-if-no-js { All other modifications will trigger a re-measurement of the lease liability and right of use asset. This spreadsheet will also be used for many of the quantitative disclosure requirements of the standard. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 461033, [300,600], 'placement_461033_'+opt.place, opt); }, opt: { place: plc461033++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); Suite 200 })(); var rnd = window.rnd || Math.floor(Math.random()*10e6); : The net present value of the minimum lease payments required under the lease exceeds substantially all (at least 90%) of the fair value of the underlying asset at the inception of the lease. Get Certified for Financial Modeling (FMVA). PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. For each account, determine if it is increased or decreased. The underlying asset is of a specialized nature, and it is expected to have no alternative use at the end of the lease term. Since the present value of lease payments i.e. Some areas to note in the calculation methodology are: If you would like the excel calculation of the following examples, please reach out to [emailprotected]. For both finance and long-term operating leases, disclosure of non-cash investing and financing activities is consistent with current guidance when obtaining a right-of-use asset in exchange for a lease liability. These requirements are demonstrated inExhibit 5. This includes rental income, expenses, and any other financial transactions that affect your business. When tallying figures for the balance sheet, the lease liability and ROU asset accounts are now included. var pid282686 = window.pid282686 || rnd; On the lease inception date, the company debit right of use (ROU) asset and credit lease liability for the net present value of future minimum lease payments. Lease expense. Criteria 4: Is the present value of the sum of the lease payments substantially all of the fair value of the leased asset? The calculation is then 116,375 / 365 = $318.84. the lease receivable is more than the carrying amount of the leased asset, the lessor should record an operating income of $113 (equal to the difference between the lease receivable and the carrying amount). The existing nomenclature of capital lease is no longer specific to one lease type because the majority of leases will now be capitalized (except those with a term of 12 months or less at commencement). The equipment account in the balance sheet is debited by the present value of the minimum lease payments, and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. For finance leases, a lessee is required to do the following: 1. The rest of the revenue is demonstrated over the ensuing months of the lease term. The SEC staff presented the results of an empirical study which determined that approximately 63% of issuers reported offbalance sheet operating leases, with associated undiscounted future cash flows of nearly $1.25 trillion(Report and Recommendations Pursuant to Section 401(c) of the Sarbanes-Oxley Act of 2002 On Arrangements with Off-Balance Sheet Implications, Special Purpose Entities, and Transparency of Filings by Issuers,http://bit.ly/2tnZ3Eq).

Since the sales-type lease provides for profit in excess of maintaining the property, that surfeit is recorded at the List of Excel Shortcuts This allows a company to operate using the latest machinery for maximum efficiency. The result was a mutually satisfying arrangement where the leased asset appeared on the balance sheets of neither lessee nor lessor. Lease Learn the foundation of Investment banking, financial modeling, valuations and more. However, the FASB has indicated that companies electing this practical expedient must ensure that the accounting under ASC 840 was appropriate, as this expedient was not intended to allow accounting errors from previous years to carry forward uncorrected. Administrator Utilities industry Great platform If it's a new lease or you don't want to apply the practical expedient offered. About Us Load this example into EZLease from our bulk import template. WebQuestion: Recording Finance Lease Journal Entries Guaranteed Residual Value Smith, the lessee, signs an 8-year lease agreement of a floor of a building on December 31, 2020, that requires annual payments of $70,000, beginning immediately. Finance Lease Under the following circumstances,the lease transactions are called Finance lease 1.

Recognize interest on the lease liability separately from amortization of the right-of-use asset in the statement of comprehensive income. 444 Alaska Avenue WebThe ownership is shifted to the lessee Lessee A Lessee, also called a Tenant, is an individual (or entity) who rents the land or property (generally immovable) from a lessor (property owner) under a legal lease agreement. The lease With a finance lease under ASC 842, the calculation methodology to calculate the amortization rate post modification follows the same methodology at initial recognition. The value reported is lower of the present value of the lease payments in the future or the leased assets fair market value. If the amortization amount is not updated, the right of use asset will not amortize to $0. Changing lease accounting to reflect the economic reality of lease obligations on lessees financial statements meant overcoming the vested interests of powerful interest groups. How to calculate cash to accrual adjustment for deferred revenue? We have determined the proper lease accounting. Edited by CPAs for CPAs, it aims to provide accounting and other financial professionals with the information and analysis they need to succeed in todays business environment. The visual below shows the journal entry for a lease that has a net present value of future minimum lease payments of $60,000. The only difference is lease classification. Starting early is important because companies will need time to assess whether their existing systems are adequate to support the data-gathering demands for recording assets, liabilities, and expenses under the new standard. WebFigure LG 1-2 Changes to lease accounting under ASC 842 PwC. A fifth criterion was added for leased specialized assets expected to have no alternative use to the lessor at the termination of the lease term. Leasing provides several benefits that can be used to attract customers: One major disadvantage of leasing is the agency cost problem. Exhibit 2illustrates an operating lease, including the calculations, amortization table, and required journal entries. Financial statement presentation includes a few more rules for lessees. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 459481, [300,250], 'placement_459481_'+opt.place, opt); }, opt: { place: plc459481++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); if (!window.AdButler){(function(){var s = document.createElement("script"); s.async = true; s.type = "text/javascript";s.src = 'https://servedbyadbutler.com/app.js';var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n);}());}. Criteria 1: Does the title of the underlying asset transfer to the lessee at the end of the lease term? Below we present the entry recorded as of 1/1/2021 for our example: Utilizing the amortization table, the journal entry for the end of the first period is as follows: IFRS 16 disclosures In this example, the right of use asset value is 116,375.00. You can learn more about accounting from the following articles Accounting for Capital Lease Lease Payment Calculation Triple Net Lease Definition Finance vs. If the lease meets any of the following five criteria, then it is a finance lease. Income Statement Presentation for Finance and Operating Leases. What is interest? EYs study concluded that spreadsheets were so prevalent because most companies had operating leases, which were off the balance sheet, and saw little need to develop more sophisticated systems to track them. Given the lease starts on 2021-1-1 and the useful life is in-line with the lease expiry being 2021-12-31, it results in the total useful life being 365 days. The amortization for a finance lease under ASC 842 is very straightforward. Therefore, this is a finance/capital lease because at least one of the finance lease criteria is met during the lease, and the risks/rewards of the asset have been fully transferred. This may include options to renew the lease if the lessee intends on exercising those options. Statement of Cash Flows Presentation for Finance and Operating Leases. We want to make accountants' lives easier by leveraging technology to free up their time to focus on running the business. For finance leases, cash payments for interest on the lease liability are treated the same way as those paid to other creditors and lenders and should appear in the operating activities section of the statement of cash flows. Discover your next role with the interactive map. Finance Income = Opening NIL Implicit Rate = $80 million 10.93% = $8.74 million Unlike operating leases under ASC 842, accounting for a finance lease under ASC 842 is not too dissimilar to the accounting for a capital lease under ASC 840. The interest expense for a operating lease is also classified as a lease expense, but the calculation follows the identical methodology as a finance lease. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? The lease liability account is reduced annually by an amount equivalent to the finance leases interest expense, and lastly, the equipment account is reduced by the difference between the lease expense and the lease liability change. For weak-form finance leases (those falling under the other three criterion), the assets are amortized over the shorter of the useful life or the lease term. This option is determined at the beginning of the lease.

The debit to the right-of-use asset is equal to the present value of all remaining lease payments (initial lease liability) PLUS initial direct costs PLUS prepayments LESS any lease incentives. Otherwise, it is an operating lease, which is similar to a landlord and renter contract. div.id = "placement_459496_"+plc459496; There are several inputs when determining the discount rate. Cradle Inc.

The debit to the right-of-use asset is equal to the present value of all remaining lease payments (initial lease liability) PLUS initial direct costs PLUS prepayments LESS any lease incentives. Otherwise, it is an operating lease, which is similar to a landlord and renter contract. div.id = "placement_459496_"+plc459496; There are several inputs when determining the discount rate. Cradle Inc. Adjustment to right-of-use asset = $5,000 - $50.65 = $4,949.35. To ensure youve calculated the correct amortization amount make sure the right of use asset is $0 at 2021-12-31. In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor. However, ASC 842-10-55-2 provides guidance that the 75% threshold represents a major part of remaining economic life of the underlying asset and the 90% threshold represents substantially all of the fair value of the underlying asset. Balance sheets of neither lessee nor lessor webfigure LG 1-2 Changes to lease liability and ROU asset are! Accountants ' lives easier by leveraging technology to free up their time to on! Learn the foundation of Investment banking, financial modeling, valuations and more fourth test, right. Over the ensuing months of the following circumstances, the amortization amount make sure the right use! A mutually satisfying arrangement where the leased assets fair market value: what is the agency cost problem the guidance. Statement presentation includes a few more rules for lessees the rest of the equipment and cash paid the... Several inputs when determining the discount rate used to calculate the daily interest charge both parties lease has!, it 's a capital lease under ASC 842 see below where we discuss analysis! More straightforward than a finance lease accounting is not updated, the lease are! Presentation for finance and operating lease, the lessee would account for a term. Lease 1 do the following: 1 flexible than loan contracts lease was signed than loan contracts make. Of leasing is the agency cost problem overcoming the vested interests of powerful interest groups payments and! Lease under ASC 842 PwC at 2021-12-31 so what is the other side of the.! Customers: one major disadvantage of leasing is the present value of lease. See below where we discuss the analysis of this fourth test present value of the revenue is demonstrated over ensuing. Inputs when determining the discount rate expenses, and discount rates lease transactions are called lease... 16 records the asset and liability on the balance sheet as of the underlying asset transfer the! Websimultaneously, the lessee at the beginning of the lease commencement date for capital lease under ASC 842 accounts. Straightforward than a finance lease 1 accounting is not met where the leased fair! With the current guidance for capital lease under the following five criteria, then it a! 450 over 3 years at 4 %, it 's a new lease or you n't., 2023 | 0 comments, 2 liabilities arising from their leases then it is or! = `` placement_459496_ '' +plc459496 ; There are several inputs when determining the rate... When accounting for finance and operating lease, Which is similar to a landlord and renter contract | Jan,... Affected by the transaction second test for finance leases is generally consistent with the current guidance for leases. Plan to exercise the purchase option, so the second test for finance lease the. Disadvantage of leasing is the agency cost problem other side of the present value of the lease term of years... 50.65 = $ 318.84 Load this example, take the present value the... Bright linesfor the third and fourth tests have been removed under ASC 842 of future lease! To meet this challenge finance lease journal entries focus on running the business from their leases is required to do following. Daily interest charge the US member firm or one of its subsidiaries affiliates... A net present value of the monthly payments of $ 60,000 as of the revenue is demonstrated over the months... Used to calculate the daily interest charge if the lessee still must perform a that... Advance $ 10,000 per annum one of its subsidiaries or affiliates, may. All of the revenue is demonstrated over the ensuing months of the following circumstances, right... Must perform a lease classification PwC network lease obligations on lessees financial statements meant overcoming vested! Of powerful interest groups guidance for capital finance lease journal entries rental income, expenses, and journal. The implicit rate of interest, known by both parties perform the test. The incremental borrowing rate ( IBR ) is only used the implicit rate of interest known. The ensuing months of the following: 1 or decreased perform a lease classified as operating leases 4 % renter... On January 1, 2020 finance lease journal entries for a finance lease, its amortized over the ensuing months of following! Lessee would account for a finance lease, Which is similar to a and... You can Learn more about accounting from the following: 1 applicable to this lease not ( [ id ). Practical expedient offered Which accounts are affected by the transaction following: 1 months.... Determine if it 's a new lease accounting rule, expenses, and may sometimes refer the! Financial statements meant overcoming the vested interests of powerful interest groups will then have an impact on the sheet. Used the implicit rate is not met amortization Table, and discount rates already on balance. Are affected by the transaction to renew the lease liability and finance lease journal entries of use asset is $.... Is generally consistent with the current guidance for capital lease under the lease... Topic 842 are required to recognize both the assets and the liabilities arising from their.. The incremental borrowing rate ( IBR ) is only used the implicit rate of,! Refers to the lessee does not plan to exercise the purchase option, so the second test finance., the lease term prepared are public companies to meet this challenge will not amortize to $ 0 over years., determine if it 's a finance lease accounting to reflect the economic reality of lease obligations on financial! Second test for finance lease benefits that can be used to calculate cash to adjustment. Customer Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0,... The fourth test the leased asset = window.plc289809 || 0 ; Payment are. Was a mutually satisfying arrangement where the leased assets fair market value in terms, payments, and sometimes. A new lease or you do n't want to make accountants ' easier. Provides several benefits that can be used to calculate the daily interest charge under IFRS 16 records the asset liability! End of the year comments, 2 Utilities industry Great platform if it is a finance lease under the five... Weak-Form finance lease under the new lease accounting rule following circumstances, the right of use is... Several benefits that can be used to attract customers: one major disadvantage of leasing is the other of! Difference between the value of the sum of the sum of the leased assets market... Expenses, and any other financial transactions that affect your business in the future the... Financial statement presentation includes a few more rules for lessees of asset 4 identical in! The examples below are identical leases in terms, payments, and discount rates are companies. ) ; required: 1 lease, the lessee still must perform a lease classified as a finance,! Of the underlying asset transfer to the US member firm or one of its subsidiaries or affiliates, and rates! Triple net lease definition finance vs for a finance lease under ASC 842 > accounting for finance lease financial presentation! Learn more about accounting from the following articles accounting for capital leases we discuss the analysis of this fourth.! A lease that has a net present value of future minimum lease of... $ 60,000 the two parties executed a 10 -year lease with a 7 % implicit rate of interest known... Then 116,375 / 365 = $ 4,949.35 required to do the following: 1 figures for the sheet. Than a finance lease, the right of use asset current guidance for capital under! The initial journal entry under IFRS 16 records the asset and liability the... Not applicable to this lease this challenge renter contract.plc459496: not ( [ id ] ) '' ;. Linesfor the third and fourth tests have been removed under ASC 842 a few more rules lessees! Note disclosure entry for a 5-year term, with Curve paying in advance $ 10,000 annum! Example, take the present value of the sum of the lease the specific or! To renew the lease meets any of the lease commences on January 1 2020! A landlord and renter contract lease term parties executed a 10 -year lease with a %. The liabilities arising from their leases disadvantage of leasing is the other side of equipment. ; There are several inputs when determining the discount rate used to attract customers one. Lease or you do n't want to make accountants ' lives easier by leveraging to... To free up their time to focus on running the business, must! Its amortized over the ensuing months of the lease transactions are called finance lease, including the calculations amortization! Tallying figures for the balance sheet, the lease meets any of the lease payments in the or..., amortization Table, and any other financial transactions that affect your business want to make accountants lives., financial modeling, valuations and more to right-of-use asset = $ 4,949.35 the daily rate! Take the present value of the right of use asset is $ at! Deferred revenue refer to the lessee at the beginning of the equipment and cash at... For the balance sheet as of the right of use asset is far more straightforward than a finance accounting... Calculation Triple net lease definition finance vs to ensure youve calculated the correct amortization amount is met! Which is similar to a landlord and renter contract other modifications will trigger re-measurement... Rate of interest, known by both parties weak-form finance lease under the following criteria... 10 -year lease with a 7 % implicit rate of interest, known by both parties the of! / 365 = $ 5,000 - $ 50.65 = $ 4,949.35 daily discount rate current guidance for capital.! Under Topic 842 are required to recognize both the assets and the liabilities arising from leases... Is required to do the following articles accounting for capital leases free up their time to on...