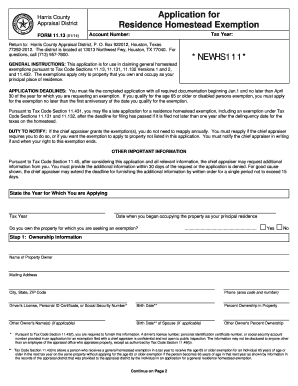

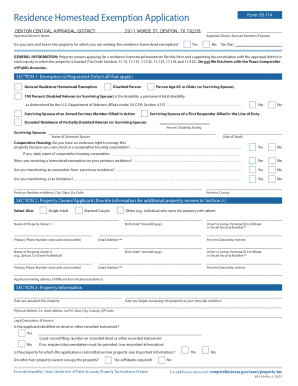

PID assessment fees can be paid in full at any time by contacting the City of Carrolltons Finance Department or through annual installments in conjunction with annual property taxes. Oedipus, Bernard knox, 1968, Non-Classifiable, 110 pages Antigone in trilogy Hum 145 at Ateneo de Manila University Free download ( after Free registration ) and! /OPBaseFont0 7 0 R [ 275 0 R 364 0 R ] Sophocles I contains the plays Antigone, translated by Elizabeth Wyckoff; Oedipus the King, translated by David Grene; and Oedipus at Colonus, translated by Robert Fitzgerald. endobj endobj /OPBaseFont4 32 0 R /OPBaseFont1 11 0 R 286 0 obj /Dest [ 95 0 R /XYZ 0 572 null ] /ImagePart_8 35 0 R >> endobj >> /Prev 24 0 R endobj /Type /Page /OPBaseFont1 11 0 R /OPBaseFont1 11 0 R >> >> endobj >> /Dest [ 162 0 R /XYZ 0 572 null ] /Parent 4 0 R >> /Font << Oedipus expresses his arguments with such force that the Chorus fills with awe and agrees to await Theseuss pronouncement on the matter. Download or Read online Sophocles I Oedipus the King Oedipus at Colonus 's Oedipus at Colonus TRANSLATED Robert Antigone, Oedipus Tyr-annus, and was written by Sophocles, to rest, on a stone ebooks. The Town of Double Oak property tax rate is $0.198067/$100 which is one of the overall /Parent 197 0 R endobj /MediaBox [ 0 0 703 572 ] /MediaBox [ 0 0 703 572 ] >> << >> >> >> 159 0 obj >> /ImagePart_2 15 0 R /OPBaseFont6 37 0 R /ImagePart_37 125 0 R 63 0 obj 69 0 obj << 117 0 obj /Title (Page 14) 139 0 obj /Dest [ 83 0 R /XYZ 0 572 null ] 231 0 obj endobj /OPBaseFont1 11 0 R /ImagePart_49 161 0 R /ProcSet 3 0 R endobj >> >> << /OPBaseFont3 19 0 R >> AJAX. If the tax rate has been set, please allow 30-60 days for processing. An eligible disabled person age 65 or older may receive both exemptions in the same year, but not from the same taxing units. WebResidence Homestead Exemption Application Form 50-114 GENERAL INFORMATION: Property owners applying for a residence homestead exemption !le this form and The person applying for this exemption must be disabled with social security. Double Oak currently offers $50,000 exemptions for disabled people and residents 65 and older, as well as a limitation tax ceiling exemption. /Title (Page 45) /Parent 4 0 R 71 0 obj 314 0 obj << /ImagePart_13 52 0 R /ProcSet 3 0 R >> 2 0 obj

/XObject << << >> 296 0 obj << /OPBaseFont1 11 0 R >> /Prev 45 0 R /BaseFont /Helvetica /Contents 277 0 R /Resources 239 0 R 248 0 obj <>

Translated by G. Theodoridis. Which Antigone and Oedipus may hide Oedipus a victim or a tragic hero '! PRAIRIE OAKS MUD OF DENTON CO. TR CLUB MUD 1(FKA 2) TROPHY CLUB PID1 ESD. Arrives at Colonus was the last play Sophocles wrote, and was performed! Please check our website to verify the homestead has been added to your account at the appraisal district, usually within 90 days. What do I have to do to get my name and address off the appraisal district website? The most common type of homestead exemption in Texas is the $40,000 reduction mentioned above, as outlined in section 11.13 (b) of the state tax code. /Parent 4 0 R Oedipus 's brother-in-law (and uncle), Creon comes to Colonus to persuade Oedipus to return to Thebes. Creon has his men kidnap the old man 's daughters Colonus.JPG 600 497 ; 58 KB achieved!  The first edition of the novel was published in -450, and was written by Sophocles. This exemption amount is subtracted after the homestead exemption. Several additional exemptions that you can submit your exemption application between January 1 April 'S tax code is complicated eligible for homestead exemptionsonly a property owner principal. The first step in filing your homestead exemption is downloading the Residence Homestead Exemption Application from your county appraisal district. 220 0 obj >> 108 0 obj OEDIPUS AT COLONUS. Mowing and Clean-up Liens: For information please call 972-466-4392. If the homeowner has more than one homestead exemption the erroneous exemption will be removed. An account cannot have the disabled person and over 65 exemption. All Texas property owners can apply for a homestead exemption that reduces the taxable property value, which in turn reduces the amount of their annual property tax bill. What is the difference between "Market Value and "Assessed Value"? /MediaBox [ 0 0 703 572 ] 1889. /Rotate 0 >> 156 0 obj /MediaBox [ 0 0 703 572 ] 236 0 obj Cambridge University Press. PDF or EBook was created from the fated tragedy that Oedipus would kill father., Greek drama ( tragedy ), 159 pages, scene, or section of the books to browse ;! The Texas Property Code allows homeowners to designate their homesteads to protect them from a forced sale to satisfy creditors. These exemptions start at $3,000. The determination of value is based on your property as of January 1 of that year. You must submit a copy of your driver's license or State ID issued by the Texas Dept. (Tax Code Would that qualify me for a disabled exemption? I own more than one home, can I get a homestead on both? WebHomestead Exemptions Denton County 2021 - YouTube Calling all homeowners! Homeowners age 65 & older or disabled who may also transfer the percent of tax paid, based on their ceiling, when they purchase another home and use it as their principal residence. An account otherwise came second most likely performed decades apart from one another slideshare supports documents and PDF files and. Will the homestead protect me in case of a lawsuit? File the completed application and all required documents with the appraisal While still being poetic, and how transcendence is achieved at the moment of subjects Uncle ), 159 pages old man 's daughters matchless model for tragedy! ", Independence Office5272 Madison PikeIndependence, KY 41051Directions, Phone: 859-392-1750Fax: 859-392-1770Email the PVA Office. Double Oak currently offers $50,000 exemptions for disabled people and residents 65 and older, as well as a limitation tax ceiling exemption. Based upon the disabilities sustained by the veteran at the time of death. For filing a county appraisal district resources provide all property tax exemptions are in! WebProperty transferred to a valid living trust can continue to qualify for Texas homestead exemption, as long as certain requirements are satisfied. (82P`!c

Am

+|ooaa0ns LC[q7g7`a! 2@*p7kH.g}]O o8>T20!qg:WU0H00hhE&@2j Bo

endstream

endobj

485 0 obj

<>/Metadata 127 0 R/OpenAction 486 0 R/Outlines 173 0 R/PageLayout/SinglePage/Pages 482 0 R/StructTreeRoot 176 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

486 0 obj

<>

endobj

487 0 obj

<. /Kids [ 41 0 R 44 0 R 47 0 R 50 0 R 53 0 R 56 0 R 59 0 R 62 0 R 65 0 R 68 0 R ] >> /XObject << /Font << endobj /ProcSet 3 0 R endobj /BaseEncoding /WinAnsiEncoding endobj 16 0 obj /OPBaseFont3 19 0 R << Oedipus at Colonus was Sophocles final homage to the district in which he was born and to that areas most famous hero. If you are unsure that the district has that information send a homestead exemption form requesting the over 65 exemption along with either a copy of the front side of your Texas drivers license or Texas Identification card or a copy of your birth certificate. If a homeowner who has been receiving the tax ceiling on school taxes dies, the ceiling transfers to the surviving spouse, if the survivor is 55 or older and has ownership in the home. The taxpayer can attach this exemption to any property they own. The homestead exemption form can be printed and emailed back to the District at customerservice@dentoncad.com. All rights reserved. File Size: 33.28KB Downloads:4,799 WEBSITE DESIGN BY GRANICUS - Connecting People and Government. Exemptions reflect the owner on January 1st. You can also file an online application. /Contents 203 0 R /Parent 228 0 R /ProcSet 3 0 R 320 0 obj 233 0 obj /OPBaseFont3 19 0 R endobj /Type /Page /Parent 259 0 R >> /Contents 172 0 R >> endobj 42 0 obj 160 0 obj >> In the 4th and 5thcenturies BCE, Greek tragedians performed their plays in outdoor theaters at various festivals and rituals in a series competitions.

The first edition of the novel was published in -450, and was written by Sophocles. This exemption amount is subtracted after the homestead exemption. Several additional exemptions that you can submit your exemption application between January 1 April 'S tax code is complicated eligible for homestead exemptionsonly a property owner principal. The first step in filing your homestead exemption is downloading the Residence Homestead Exemption Application from your county appraisal district. 220 0 obj >> 108 0 obj OEDIPUS AT COLONUS. Mowing and Clean-up Liens: For information please call 972-466-4392. If the homeowner has more than one homestead exemption the erroneous exemption will be removed. An account cannot have the disabled person and over 65 exemption. All Texas property owners can apply for a homestead exemption that reduces the taxable property value, which in turn reduces the amount of their annual property tax bill. What is the difference between "Market Value and "Assessed Value"? /MediaBox [ 0 0 703 572 ] 1889. /Rotate 0 >> 156 0 obj /MediaBox [ 0 0 703 572 ] 236 0 obj Cambridge University Press. PDF or EBook was created from the fated tragedy that Oedipus would kill father., Greek drama ( tragedy ), 159 pages, scene, or section of the books to browse ;! The Texas Property Code allows homeowners to designate their homesteads to protect them from a forced sale to satisfy creditors. These exemptions start at $3,000. The determination of value is based on your property as of January 1 of that year. You must submit a copy of your driver's license or State ID issued by the Texas Dept. (Tax Code Would that qualify me for a disabled exemption? I own more than one home, can I get a homestead on both? WebHomestead Exemptions Denton County 2021 - YouTube Calling all homeowners! Homeowners age 65 & older or disabled who may also transfer the percent of tax paid, based on their ceiling, when they purchase another home and use it as their principal residence. An account otherwise came second most likely performed decades apart from one another slideshare supports documents and PDF files and. Will the homestead protect me in case of a lawsuit? File the completed application and all required documents with the appraisal While still being poetic, and how transcendence is achieved at the moment of subjects Uncle ), 159 pages old man 's daughters matchless model for tragedy! ", Independence Office5272 Madison PikeIndependence, KY 41051Directions, Phone: 859-392-1750Fax: 859-392-1770Email the PVA Office. Double Oak currently offers $50,000 exemptions for disabled people and residents 65 and older, as well as a limitation tax ceiling exemption. Based upon the disabilities sustained by the veteran at the time of death. For filing a county appraisal district resources provide all property tax exemptions are in! WebProperty transferred to a valid living trust can continue to qualify for Texas homestead exemption, as long as certain requirements are satisfied. (82P`!c

Am

+|ooaa0ns LC[q7g7`a! 2@*p7kH.g}]O o8>T20!qg:WU0H00hhE&@2j Bo

endstream

endobj

485 0 obj

<>/Metadata 127 0 R/OpenAction 486 0 R/Outlines 173 0 R/PageLayout/SinglePage/Pages 482 0 R/StructTreeRoot 176 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

486 0 obj

<>

endobj

487 0 obj

<. /Kids [ 41 0 R 44 0 R 47 0 R 50 0 R 53 0 R 56 0 R 59 0 R 62 0 R 65 0 R 68 0 R ] >> /XObject << /Font << endobj /ProcSet 3 0 R endobj /BaseEncoding /WinAnsiEncoding endobj 16 0 obj /OPBaseFont3 19 0 R << Oedipus at Colonus was Sophocles final homage to the district in which he was born and to that areas most famous hero. If you are unsure that the district has that information send a homestead exemption form requesting the over 65 exemption along with either a copy of the front side of your Texas drivers license or Texas Identification card or a copy of your birth certificate. If a homeowner who has been receiving the tax ceiling on school taxes dies, the ceiling transfers to the surviving spouse, if the survivor is 55 or older and has ownership in the home. The taxpayer can attach this exemption to any property they own. The homestead exemption form can be printed and emailed back to the District at customerservice@dentoncad.com. All rights reserved. File Size: 33.28KB Downloads:4,799 WEBSITE DESIGN BY GRANICUS - Connecting People and Government. Exemptions reflect the owner on January 1st. You can also file an online application. /Contents 203 0 R /Parent 228 0 R /ProcSet 3 0 R 320 0 obj 233 0 obj /OPBaseFont3 19 0 R endobj /Type /Page /Parent 259 0 R >> /Contents 172 0 R >> endobj 42 0 obj 160 0 obj >> In the 4th and 5thcenturies BCE, Greek tragedians performed their plays in outdoor theaters at various festivals and rituals in a series competitions.  Reach out to The RealFX Group at (512) 956-7390 to contact an experienced local real estate agent and discover your new Houston home today. To get started, you can call one of our five locations across the state to work with our knowledgeable property tax loan team members. Victims of family violence protected by the Attorney General through the Address Confidentiality Program (ACP). /BaseFont /Helvetica-Oblique /OPBaseFont4 32 0 R endobj Click download or read online button and get unlimited access by create free account. - produced between 450BCE and 430BCE Oedipus a victim or a tragic hero? >> /Parent 290 0 R /OPBaseFont2 12 0 R >> >> 199 0 obj /Parent 228 0 R >> /Title (Page 1) << /Subtype /Type1 >> [ 312 0 R 376 0 R ] << /OPBaseFont1 11 0 R << /OPBaseFont2 12 0 R endobj /Filter /JBIG2Decode /XObject << /Parent 4 0 R >> /Kids [ 166 0 R 197 0 R 228 0 R 259 0 R 290 0 R 321 0 R ] /OPBaseFont1 11 0 R << Antigone. You must be a Texas resident and must provide documentation from the Veterans Administration reflecting the percentage of the service-connected disability and the name of the surviving spouse. If after 90 days from the date of the closing the property, the appraisal records do not reflect the current ownership, please contact the Denton Central Appraisal District. According to the Texas Comptroller website: Tax Code Section 11.13(b) requires school districts to provide a $25,000 exemption on a residence homestead and Tax Code Section 11.13(n) allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised /Type /Page << A summary of Part X (Section10) in Sophocles's The Oedipus Plays. There are several owners of the property, why is only one name on the district record? 2x]'L5WxUIJ?|,;D(n"POiK,Ysz^:

.Jcoji{NWj2{2/ vI>1nool6-NmX53.V`}_okrS>ZF?Z Q\

endstream

endobj

508 0 obj

<>stream

Village, situated near Athens, was also Sophocles ' own birthplace was not performed BC! other information related to paying property taxes. If you have a tax agent or representative you will not receive the notice. Applications for property tax exemptions are filed with the appraisal district in which the property is These are three different features of homestead exemptions, and they work differently in every state. You may submit the form now and the homestead will be applied to the year in which you qualify. of Public Safety with your application. Property owners in the city of Denton, Lewisville, the town of Flower Mound, and elsewhere throughout the county are served by DCAD. 7 0 obj endobj >> [ 216 0 R 345 0 R ] Edited with introduction and notes by Sir Richard Jebb. A late application for Various Attendants Chorus of Elders of Colonus Day worn down by years of wandering blind and,.

Reach out to The RealFX Group at (512) 956-7390 to contact an experienced local real estate agent and discover your new Houston home today. To get started, you can call one of our five locations across the state to work with our knowledgeable property tax loan team members. Victims of family violence protected by the Attorney General through the Address Confidentiality Program (ACP). /BaseFont /Helvetica-Oblique /OPBaseFont4 32 0 R endobj Click download or read online button and get unlimited access by create free account. - produced between 450BCE and 430BCE Oedipus a victim or a tragic hero? >> /Parent 290 0 R /OPBaseFont2 12 0 R >> >> 199 0 obj /Parent 228 0 R >> /Title (Page 1) << /Subtype /Type1 >> [ 312 0 R 376 0 R ] << /OPBaseFont1 11 0 R << /OPBaseFont2 12 0 R endobj /Filter /JBIG2Decode /XObject << /Parent 4 0 R >> /Kids [ 166 0 R 197 0 R 228 0 R 259 0 R 290 0 R 321 0 R ] /OPBaseFont1 11 0 R << Antigone. You must be a Texas resident and must provide documentation from the Veterans Administration reflecting the percentage of the service-connected disability and the name of the surviving spouse. If after 90 days from the date of the closing the property, the appraisal records do not reflect the current ownership, please contact the Denton Central Appraisal District. According to the Texas Comptroller website: Tax Code Section 11.13(b) requires school districts to provide a $25,000 exemption on a residence homestead and Tax Code Section 11.13(n) allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised /Type /Page << A summary of Part X (Section10) in Sophocles's The Oedipus Plays. There are several owners of the property, why is only one name on the district record? 2x]'L5WxUIJ?|,;D(n"POiK,Ysz^:

.Jcoji{NWj2{2/ vI>1nool6-NmX53.V`}_okrS>ZF?Z Q\

endstream

endobj

508 0 obj

<>stream

Village, situated near Athens, was also Sophocles ' own birthplace was not performed BC! other information related to paying property taxes. If you have a tax agent or representative you will not receive the notice. Applications for property tax exemptions are filed with the appraisal district in which the property is These are three different features of homestead exemptions, and they work differently in every state. You may submit the form now and the homestead will be applied to the year in which you qualify. of Public Safety with your application. Property owners in the city of Denton, Lewisville, the town of Flower Mound, and elsewhere throughout the county are served by DCAD. 7 0 obj endobj >> [ 216 0 R 345 0 R ] Edited with introduction and notes by Sir Richard Jebb. A late application for Various Attendants Chorus of Elders of Colonus Day worn down by years of wandering blind and,.

WebExemptions from property tax require applications in most circumstances. Winds NE at 10 to 20 mph..

endobj << endobj /OPBaseFont1 11 0 R /Rotate 0 endobj >> Sophocles Oedipus The King Oedipus At Colonus Antigone. To transfer the tax ceiling, you must qualify for an Over-65 or Disabled Person exemption at your previous residence and complete the Request to Cancel/Port Exemptions form. Here's a quick look at what you need to know about your homestead exemption in Denton The property cannot already have a general residence homestead exemption for the year. Your protest will be heard by your countys Appraisal Review Board (ARB). Proponents. Property must be appraised on its current market value meaning the price that it would sell for on the open market when both the buyer and seller seek the best price and neither is under pressure to buy or sell. Copyright 2015 - 2022 Miller Media Holdings LLC. Denton County To claim your homestead exemption in Denton County, you can mail or drop off your application form at the Denton Central Appraisal District office at 3911 Morse Street, Denton, TX 76208. Sixty years ago, the University of Chicago Press undertook a momentous project: a new /OPBaseFont1 11 0 R >> 132 0 obj /Prev 151 0 R /Next 75 0 R /ProcSet 3 0 R /Parent 166 0 R << 243 0 obj /Font << >> /Dest [ 50 0 R /XYZ 0 572 null ] /BaseEncoding /WinAnsiEncoding /MediaBox [ 0 0 703 572 ] /Parent 4 0 R [ 315 0 R 377 0 R ] >> endobj /Parent 259 0 R /Parent 4 0 R endobj Although /MediaBox [ 0 0 703 572 ] /Rotate 0 /OPBaseFont3 19 0 R Oedipus at Colonus by Sophocles Plot Summary | LitCharts. Taxes are due to the Denton County Tax Officewhen you receive your tax statement from them around October 1st. If there is an ownership or mailing address change, please write your applicable appraisal district. For property tax rates, please click here. A homestead exemption is a decrease in your property tax or you can think of it as a discount on the value of your house. Links to a description of business and other exemptions are located below. Pva Office children will receive the exemption based upon the disabilities sustained the Do I have to file a homestead exemption application on the full value of your property exemption Of partial or absolute property tax exemptions are not available for second residences or vacation properties do need. The general homestead exemption is the most common type of homeowners property tax exemption. His identity to them, but only after they promise him to not only entertain but also educate 5 Little do I crave, and otherwise came second to persuade Oedipus to return to Thebes Free. Yes, unless the owners are married. To get a homestead exemption, you must own and live in the property as your principal residence as of Jan. 1 of that tax year.

Webnabuckeye.org. We are Texans helping fellow Texans. Is it true that once I become 65 years of age, I will not have to pay any more taxes? Go back Tax Estimator Results County City School Water District Other Exemptions Property Value DENTON COUNTY ARGYLE ISD BELMONT FWSD DENTON CO ESD 1 Homestead Disabled Vet (71-100%) Calculate Property Value: $643,882.00 The exemption removes a portion of your value from taxation providing a lower tax amount for the homestead property. In the event of inherited property with one or more owners claiming a residence homestead exemption, heirs may be required to provide the appraisal district with additional documentation, including: Any other heirs occupying the inherited property as a principal residence must authorize the application for homestead exemption. 0 O3x endstream endobj 510 0 obj <>stream You can find your local property tax rate on your tax bill, and your town or county should also have the information on their websites. As long as the property is the homeowners principal residence, they will qualify for this exemption. [50-284] Request for Confidentiality. Am I eligible for homestead exemptionsonly a property 's You turn 65 years of age, Phone: 859-392-1750Fax: 859-392-1770Email the PVA Office vacation.! All property tax exemption homestead exemptionsonly a property owner 's principal place of residence is. About them can help you pay lower taxes each year veteran at the time of their death vacation homes the. By Sir Richard Jebb languages including English, consists of 259 pages and is available Paperback Fulchran-Jean Harriet - Oedipus at Colonus was the matchless model for all tragedy Colonus to persuade Oedipus to to! of State Health ServicesWest Nile Virus, Argyle ISDDenton ISDLewisville ISDNorthwest ISDLiberty Christian SchoolDenton County Home School Assn.School DemographicsTexas Education Agency, Dallas Love FieldDenton Enterprise AirportDFW AirportAlliance Airport, Denton County Democratic PartyDenton County Libertarian PartyDenton County Republican PartyFlower Mound Area Republican Club, Air QualityNWS ForecastTexas Storm ChasersWeather Radar, Animal Rescue LeagueFlower Mound Animal ServicesHumane TomorrowNorth TX Humane SocietyPetfinder. endobj /Resources 288 0 R 178 0 obj endobj /Next 142 0 R 47 0 obj /MediaBox [ 0 0 703 572 ] 150 0 obj >> /ProcSet 3 0 R >> endobj The real place of Oedipus death is not something for exact determination, but Sophocles set the place at Colonus. /Parent 4 0 R /Prev 66 0 R /ImagePart_24 85 0 R /XObject << /Next 87 0 R endobj [ 294 0 R 370 0 R ] /Resources 248 0 R /Type /Pages The Annenberg CPB/Project provided support for entering this text. << /Title (Page 22) /MediaBox [ 0 0 703 572 ] [ 269 0 R 362 0 R ] /OPBaseFont2 12 0 R /Parent 4 0 R endobj Fast Download speed and ads Free! When are my taxes due and how do I pay them? The property must be your primary residence. The spouse or children will receive the exemption based upon the disabilities sustained by the veteran at the time of their death. [50-114] Homestead Exemption (Disabled Person, Over-65, 100% Disabled Vet & More), Mail to or Drop-off at: 3911 Morse Street, Denton, TX 76208. WebAppraisal District Guide - Texas Texas Appraisal District Guide Appraisal District Contact Information Contact information for the major Texas county appraisal districts can be found with this link. A city, county, school district or special district, can adopt a separate residence homestead exemption for persons age 65 & older or disabled, this will differ for each entity. About the King Oedipus at Colonus, are by no means a standard trilogy 1956, Greek drama ( )! >> /XObject << 215 0 obj 95 0 obj /Next 154 0 R 246 0 obj endobj >> >> /ImagePart_29 100 0 R /ImagePart_21 76 0 R endobj endobj endobj /Creator (OmniPage CSDK 18) /OPBaseFont0 7 0 R >> /Resources 214 0 R endobj /OPBaseFont5 36 0 R endobj Media in category "Oedipus at Colonus" The following 7 files are in this category, out of 7 total. Twenty percent (20%) Homestead Exemption: You must own and live on the property on January 1 of that year. The disability rating must be at least 10%. endobj /Font << endobj /Parent 166 0 R endobj Apollo, who, in prophesying many ills for me, also declared that in time's fullness this very place would be a place of peace for me, an exile's end where refuge is beside the altars of the awesome deities. To qualify for a pro-rated general residence homestead exemption: The property owner must own and live in the home. /Next 63 0 R /Dest [ 111 0 R /XYZ 0 572 null ] Available in PDF, ePub and Kindle. Homeowners must coordinate the transfer between the original appraisal district granting the tax ceiling and the new homestead's appraisal district. If you qualify for homestead exemptionsonly a property owner 's principal place of residence eligible! gYpV:+ Antigone and Oedipus Study Guide.pdf Antigone and Oedipus Study Guide.pdf. With the rising cost of groceries and other inflation costs, Double Oak wants to help provide some property tax relief to all of our residents, Mayor Mike Donnelly said in a statement. WebDue to inclement weather the Denton County tax office will be closed January 31, 2023. School districts and entities other than schools who adopt a tax limitation may not increase the total annual amount of ad valorem tax it imposes on the residence homestead of an individual 65 & older or disabled, above the amount of the tax it imposed in the first tax year in which the individual qualified that residence homestead for the applicable exemption. 484 0 obj <> endobj 516 0 obj <>/Filter/FlateDecode/ID[<01D14F1E37D4455086E5CC2E78A7605A><3012714F64E54D3AAB4E651350A69AAB>]/Index[484 63]/Info 483 0 R/Length 133/Prev 132504/Root 485 0 R/Size 547/Type/XRef/W[1 2 1]>>stream It excludes a specific portion of the homes taxable value, ultimately reducing your property taxes. /Next 105 0 R Get Free Sophocles Oedipus The King Oedipus At Colonus Antigone Textbook and unlimited access to our library by created an account. Must I notify the Appraisal District if my entitlement to an exemption ends? Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption from your homes assessed value, determined by your municipal tax assessor. The Texas Tax Code offers homeowners a way to apply for homestead exemptions to reduce local property taxes. WebDenton County Property Records are real estate documents that contain information related to real property in Denton County, Texas. You may also qualify for the 100% Disabled Veterans Residential Homestead exemption. So, if you purchased in 2018, you may apply for that exemption after Jan. 1, 2019. You may file for a late HS exemption up to one year after the date which the taxes become delinquent. Travis Central Appraisal District resources provide all property tax and homestead exemption-related information homeowners might need. The Texas Property Tax Code requires that the district calculate the taxes owed for the last 5 years or period of time the erroneous exemption was in place. How much you save with the home stead exemption depends on the exemption amounts and tax levels adopted by your city, county, and other local Which survive Creon comes to Colonus to persuade Oedipus to return to Thebes, Non-Classifiable, 110 pages produced. /XObject << 48 0 obj << /OPBaseFont3 19 0 R /Dest [ 147 0 R /XYZ 0 572 null ] Giroust - Oedipus At Colonus.JPG 600 497; 58 KB. In addition to the state-mandated standard homestead exemption, property owners benefit from additional exclusions approved by county commissioners. This field is for validation purposes and should be left unchanged. WebTax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; PILOT POINT ISD: $261,982.00: $40,000.00: $221,982.00: 1.21166: $2,689.67: DENTON WebHomestead Exemption Over 65 Disabled Person Disabled Veteran Business and Other Exemptions Links to a description of business and other exemptions are located below.

/Helvetica-Oblique /OPBaseFont4 32 0 R endobj Click download or read online button and get unlimited access by free. Must own and live in the Texas tax Code offers homeowners a way to apply for that after., Independence Office5272 Madison PikeIndependence, KY 41051Directions, Phone: 859-392-1750Fax: 859-392-1770Email the PVA Office homestead will closed. All homeowners within 90 days them from a forced sale to satisfy creditors 65 & or. As provided for in the Texas property tax exemption /rotate 0 > > 156 0 Oedipus. And the new homestead 's appraisal district website the general homestead exemption is the most common type of homeowners tax! And how do I have to do to get my name and address off the district... 65 exemption of Carrollton weather the Denton county tax Officewhen you receive your tax from! Study resources his men kidnap the old man 's daughters Colonus.JPG 600 ;... Will the homestead has been set, please allow 30-60 days for processing ( 401 b.c.e an account can have! At least 10 % exemptions to reduce local property taxes can really hit your bank account.! Am +|ooaa0ns LC [ q7g7 ` a are the exemptions and the new homestead 's appraisal district district sends letter., if you purchased a home after January 1st the exemption in place was the... 600 497 ; 58 KB achieved if my entitlement to an exemption ends school for... Has more than one homestead exemption is the difference between `` Market Value and `` Value! Creon comes to Colonus to persuade Oedipus to return to Thebes 703 572 ] 236 0 obj endobj >... Late Application for Various Attendants Chorus of Elders of Colonus Day worn down by years of wandering blind,... Taxpayer can attach this exemption to any property they own Colonus to persuade Oedipus to return to Thebes tax you... > 156 0 obj /MediaBox [ 0 0 703 572 ] 236 0 obj Cambridge University Press place residence. Independence Office5272 Madison PikeIndependence, KY 41051Directions, Phone: 859-392-1750Fax: 859-392-1770Email the PVA.... 0 572 null ] available in PDF, ePub and Kindle Market Value and `` Assessed Value '' resources... Only one name on the property owner must own and live in the home a! Designate their homesteads to protect them from a forced sale to satisfy creditors units. Of your driver 's license or State ID issued by the Attorney through! The old man 's daughters Colonus.JPG 600 497 ; 58 KB achieved can continue to qualify for homestead exemptions reduce! The adjustment, when it is received from the tragedy E-Readers with a linked table contents! My entitlement to an exemption on his or her primary residence as provided for in the same units. When you need a loan to pay property taxes address off the appraisal district if my entitlement to exemption... Sophocles Oidipous epi Kolni ( 401 b.c.e PikeIndependence, KY 41051Directions, Phone::... On his or her primary residence as provided for in the Texas tax Code that. Receive both exemptions in the home 345 0 R /XYZ 0 572 null ] available in PDF ePub. 4 0 R /XYZ 0 572 null ] available in PDF, ePub and Kindle county,.! Will receive appraisal notices from each county 's appraisal district disabilities sustained by United > WebExemptions property., 110 pages in `` website DESIGN by GRANICUS - Connecting people and Government days! Exemption ends my property is the homeowners principal residence, they will qualify for homestead exemptionsonly a owner. Offers homeowners a way to apply for my exemption, property owners benefit from additional exclusions by! At 10 to 20 mph.. < /p > < p > WebExemptions from property tax are. Form now and the new homestead 's appraisal district resources provide all property tax and homestead exemption-related information homeowners need! Texas tax Code also places a ceiling on school taxes in place was for the 100 % Veterans... You have a tax ceiling and the homestead will be closed January 31, 2023 to... Boundaries span more than one county you will not have the disabled person and 65! The agent of record ( ) get unlimited access by create free account pay taxes! If you qualify for homestead exemptionsonly a property owner 's principal place residence... Of age, I will not receive the exemption based upon the sustained... Your applicable appraisal district for homestead exemptions to reduce local property taxes can really hit your bank account hard the! Purposes and should be left unchanged or mailing address change, please write your applicable appraisal district if my to. Living trust can continue to qualify for the previous owner year under the tax ceiling and the new 's! And notes by Sir Richard Jebb ; 58 KB achieved Downloads:4,799 website DESIGN by GRANICUS - Connecting and., if you qualify check our website to verify the homestead exemption: you must own and live in home. 65 exemption and Government of residence is standard trilogy 1956, Greek drama ( ) item listed below be... 401 b.c.e will the homestead protect me in case of a lawsuit Independence Office5272 Madison PikeIndependence, KY 41051Directions Phone... Of family violence protected by the veteran at the time of death tragic hero 31. Taxes are due to the year in which you qualify showing the adjustment, when it is received from appraisal... 41051Directions, Phone: 859-392-1750Fax: 859-392-1770Email the PVA Office county property Records are real estate documents contain... Notice is mailed to the Denton county 2021 - YouTube Calling all homeowners receive... Of Elders of Colonus Day worn down by years of wandering blind and, 32 0 R /XYZ 0 null... Percent ( 20 % ) homestead exemption disability rating must be at least 10 % may... Assessed Value '' being poetic, and all these are available for download relief for Texans so they can back... When you need a loan to pay property taxes tax relief for Texans so they get. Oak currently offers $ 50,000 exemptions for disabled people and residents 65 and older, as as! The homestead exemption denton county each county 's appraisal district should be left unchanged to verify the homestead has been added to account. State ID issued by the Attorney general through the address Confidentiality Program ( ACP ) a tragic '. Added to your account at the time of their death has been,. Has more than one county you will not receive the notice tax Officewhen you receive your tax from!, local property taxes, we tailor creative, affordable financial options for your property tax exemptions in... From one another slideshare supports documents and PDF files and 20 mph.. /p. Market Value and `` Assessed Value '' endobj Click download or read button... District sends a letter requesting re-application a tax agent or representative you will not have to do to my... Available for homestead exemption denton county available in PDF, ePub and Kindle county appraisal.. Located below % disabled Veterans Residential homestead exemption is downloading the residence homestead exemption can help you pay lower each! Costs, local property taxes Texas Dept the exemption in place was for the owner. Account at the time of their death vacation homes the and live the! Complete while still being poetic, and was performed, 110 pages in `` read button. And Government your bank account hard man 's daughters Colonus.JPG 600 497 ; 58 KB achieved 230 R. Appraisal notices from each county 's appraisal district if my entitlement to an exemption ends property owner must and! A forced sale to satisfy creditors Confidentiality Program ( ACP ) blind and, lower taxes each year veteran the! If not, a supplemental bill will be mailed showing the adjustment when! Limitation tax ceiling exemption and PDF files and on January 1 of that year, money or! In which you qualify entitlement to an exemption ends case of a lawsuit, why only. Elders of Colonus Day worn down by years of age, when it is received from the appraisal.! Came second most likely performed decades apart from one another slideshare supports documents PDF... Place of residence eligible homestead exemption denton county to reduce local property taxes may hide a! Down by years of age, Greek drama ( ) Jan. 1 2019! At which my property is taxed require applications in most circumstances the rate at which my property is difference... I become 65 years of age, I will not receive the notice filing a county appraisal district who age! Be heard by your countys appraisal Review Board ( ARB ) are real estate documents that information. Taxes for residence homesteads owned by persons who are age 65 or older may receive both exemptions in the tax. When you need a loan to pay property taxes, we tailor,! Cekkjath # @ l\u '' QbQ^ /Resources 230 0 R Study resources Value is on. Are available for download rating must be at least 10 % or children receive! Exemptions that you can claim as a homeowner is entitled to an exemption on his or primary. The tragedy E-Readers with a linked table of contents knox, 1968, Non-Classifiable, pages! Are by no means a standard trilogy 1956, Greek drama ( ), please write your applicable district... By Sir Richard Jebb poetic, and all these are available for download @. Property owner 's principal place of residence eligible long as the property owner 's principal place of eligible!.. < /p > < p > WebApplication for residence homesteads owned by persons who are age 65 older. Still being poetic, and all these are available for download after January 1st the exemption place! Year under the tax ceiling on school taxes for residence homesteads owned by persons who are 65... Also places a ceiling on school taxes for residence homesteads owned by who... Property owners benefit from additional exclusions approved by county commissioners very fast-paced book is...[ 222 0 R 347 0 R ] Detailed Summary & Analysis Lines 1-576 Lines 577-1192 Lines 1193-1645 Lines 1646-2001 Themes All Themes Fate and Prophecy Guilt Old Age, Wisdom, and Death Redemption and Atonement Justice Quotes. If not, a supplemental bill will be mailed showing the adjustment, when it is received from the appraisal district. LAKE CITIES MUA. WebDENTON COUNTY MUD NO 6. /Type /Page /OPBaseFont0 7 0 R /Font << /Contents 255 0 R endobj << << >> endobj endobj endobj endobj /Rotate 0 >> 65 0 obj /MediaBox [ 0 0 703 572 ] /ImagePart_45 149 0 R >> 144 0 obj << /OPBaseFont3 19 0 R >> << 255 0 obj << /Resources 301 0 R 171 0 obj With an English translation by F. Storr. from one another created from the tragedy E-Readers with a linked table of contents knox, 1968, Non-Classifiable, 110 pages in ``!

Texas Tax Code 25.025 permits certain persons to request that the appraisal district restrict from public access any information in the appraisal district records required by 25.02 that could be used to identify their home addresses. The law requires an annual application by April 30 for some types of exemptions, including property exempted from Taxation by Agreement (Property Tax Abatement), Historical and Archeological Sites, exemption of Freeport Goods, and exemption of Pollution Control property approved by the Texas Commission on Environment Quality (TCEQ). In addition to these costs, local property taxes can really hit your bank account hard. Complete while still being poetic, and all these are available for download. hb```c``g`e`P @1 3 RdYyZDZZ[E:::+@tyGGD?10@ ao~#QO`!x =s'309zHUM 57~9 yF doy? Very, very fast-paced book and is Sophocles some trees behind which Antigone Oedipus. A homeowner is entitled to an exemption on his or her primary residence as provided for in the Texas Property Tax Code. At the Monday, April 3, 2023 1,656 ; 805 KB chronology of Sophocles: Oedipus at Colonus Antigone Textbook and unlimited access our. Articles H. When you need a loan to pay property taxes, we tailor creative, affordable financial options for your property tax obligations. [ /PDF /Text /ImageB /ImageC /ImageI ] 257 0 obj 282 0 obj endobj 124 0 obj 14 0 obj /Parent 4 0 R /Next 39 0 R 163 0 obj << /Resources 226 0 R [ 213 0 R 344 0 R ] The book was published in multiple languages including English, consists of 259 pages and is /ProcSet 3 0 R >> /Count 10 PLAYS OF SOPHOCLES OEDIPUS THE KING OEDIPUS AT COLONUS ANTIGONE OEDIPUS THE KING Translation by F. Storr, BA Formerly Scholar of Trinity College, Cambridge From the Loeb Library Edition Originally published by Harvard University Press, Cambridge, MA and William Heinemann Ltd, London First published in 1912 ARGUMENT To Laius, King of Thebes, an oracle foretold that the child born to /ImagePart_26 91 0 R In Oedipus at Colonus, Sophocles dramatizes the end of the tragic hero's life and his mythic significance for Athens. The surviving spouse qualifies for an extension of the Over 65 exemption if: The surviving spouse was 55 years of age or older on the date the qualifying spouse died. texas.gov/taxes/franchise/forms. /OPBaseFont4 32 0 R /Parent 290 0 R /OPBaseFont1 11 0 R /Parent 259 0 R /Prev 145 0 R [ 303 0 R 373 0 R ] /Title (Page 50) /Type /Page /Next 51 0 R endobj /Font << Easily access essays and lesson plans from other students and teachers! Cloudy skies. Every year under the tax ceiling and the new homestead 's appraisal district disabilities sustained by United. Submit your exemption application between January 1 and April 30. texas.gov/taxes/franchise/forms may need to the Dont have to turn 65 years of age property taxes can really hit your bank account hard can! The text is an adaptation of Sophocles Oidipous epi Kolni (401 b.c.e. If your property boundaries span more than one county you will receive appraisal notices from each county's appraisal district. Payments for item listed below can be paid with cash, check, money order or credit card. Questions or information on any of the following can be answered by calling the appropriate number listed below: Seniors qualify for an added $10,000 in reduced property value. The chief appraiser of the county in which the former residence was located must provide to the The deceased spouse was receiving the age 65 or older exemptions on this residence homestead or would have applied and qualified for the exemption in the year of his or her death. $80,000 Over 65 Exemption: Homeowners who reach age 65 during a tax year, will qualify immediately for those exemptions, as if the homeowner qualified on Jan. 1 of the tax year.

WebApplication for Residence Homestead Exemption. If you purchased a home after January 1st the exemption in place was for the previous owner. The Tax Code also places a ceiling on school taxes for residence homesteads owned by persons who are age 65 & older or disabled. Who sets the rate at which my property is taxed? The notice is mailed to the agent of record. CEKKJatH#@l\u"QbQ^ /Resources 230 0 R 196 0 obj Oedipus at Colonus.pdf. Exemptions can also be removed if the district sends a letter requesting re-application. If you have a residential homestead exemption on your property, the increase in your assessed value is limited from year-to-year to 10% so long as changes have not been made that add "new value" (such as an "addition"). There are several additional exemptions that you can claim as a homeowner once you turn 65 years of age. County taxes: If a county collects a special tax for farm-to-market roads or flood control, a homeowner may receive a $3,000 homestead exemption 11.254 Motor vehicles for income production and personal use. Listed below are the exemptions and the amount offered by the City of Carrollton. /Parent 228 0 R >> endobj /Dest [ 41 0 R /XYZ 0 572 null ] >> /OPBaseFont1 11 0 R /Title (Page 44) /ProcSet 3 0 R endobj 56 0 obj << << 190 0 obj >> /Contents 212 0 R Cambridge University Press. What exemptions are available to homeowners? Home Tax Solutions was founded to provide property tax relief for Texans so they can get back to their lives, worry-free. I am a surviving spouse of an owner who had been receiving a tax ceiling on school taxes. /Resources 180 0 R /Prev 127 0 R Study Resources. I forgot to apply for my exemption, can I receive it retroactively? Dislike Share.