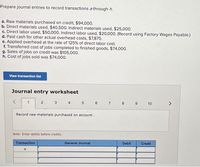

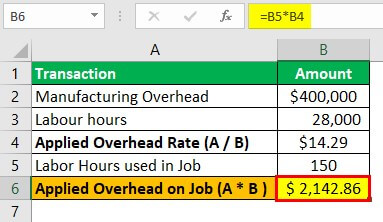

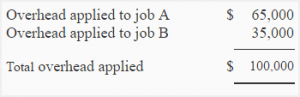

\end{array} Wages analysis book for indirect wages. xii. The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. 7. In any event, the fact remains that more was spent than allocated. Because the Factory Overhead account is just a clearing account (not a financial statement account), the remaining balance must be transferred out. The most common allocation bases are direct labor hours, direct labor costs, and machine hours. Therefore, to calculate the labor hour rate, the overhead costs are divided by the total number of direct labor hours.

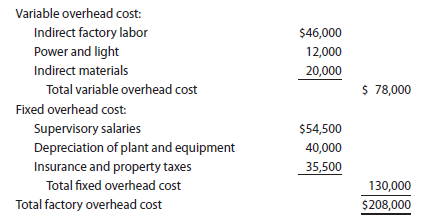

Examples of Variable Overheads include lighting, fuel, packing material, etc. Whereas other businesses take such an expense as an indirect expense. For example, a textile mill may apportion its overheads between superfine quality and controlled quality of cloth on this basis. This method is inequitable because it penalises the efficient departments for their efficiency. Accordingly, the overhead costs can be classified into fixed, variable, and semi-variable costs. Manufacturing overhead costs insights from real time. Thus, it is crucial to understand and classify these costs based on their nature. shbensonjr. So, below is the formula for calculating the Labour Hour Rate. How to Start a Business: 22 Step-By-Step Guide to Success, Free business proposal template: 10 steps for small business owners, How To measure your Business Profitability: Four ways to measure profitability and grow your business, Salary or Draw: How to Pay Yourself as a Business Owner or LLC, Pricing Strategies For Products And Services, Social media marketing for small businesses: 22 bite-sized steps to master your strategy. The rate that the Sweet Shop uses is 85% and the direct labor costs from the Job Cost Sheets for the month of March totaled $150, 000. If you are redistributing all or part of this book in a print format, So, it is not purposeful to keep counting them much like direct material. Transferred Jobs 136, 138, and 139 to Finished Goods Inventory. The journal entry to reflect this is as follows: Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. For example, depreciation of plant and machinery, stationery, repairs, and maintenance. Webminecraft particle list. iii. The company closes out its Manufacturing Overhead account to Manufacturing Overheads are the expenses incurred in a factory apart from the direct material and direct labor cost. Further, manufacturing overheads are also called factory or production overheads. Incurred the following actual other overhead costs during the month.

An account used to hold financial data temporarily until it is closed out at the end of the period. How do companies use the predetermined overhead rate to apply overhead to jobs, and how is this information recorded in the general journal? This Overhead Rate is then applied to allocate the overhead costs to various cost units.

Still, the accountant needs to allocate these indirect costs to the goods manufactured. Provided you calculate the Overhead Rate using a specific measure.

In a process costing system, each process will have a work in process inventory account.

Suppose, you use the Labor Hour Rate to calculate the overheads to be attributed to production. These are indirect costs that are incurred to support the manufacturing of the product. (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services.  Depreciation Actual depreciation as per Plant Register. Overhead Rate is nothing but the overhead cost that you attribute to the production of goods and services. For example, say This rate is not affected by the method of wage payment i.e., time rate or piece rate method. Report a Violation 11. Resources for small business owners and self-employed individuals, Everything you need to know about small business funding, Everything you need to know to run your small business successfully, Everything you need to know about managing and retaining employees, Simplify invoicing with these small business resources, Manage expenses like a pro with these small business resources, Everything you need to know about cash flow, Everything you need to know about managing inventory, Take your small business to the next level with our guide to growing your business, Keep yourself and your customers safe online, Learn about the tools that can help your small business, Spread the word - what you need to know about marketing your small business, Learn about accounting and bookkeeping concepts for your business, Simplify tax time with these small business resources, Resources for bookkeepers and accountants, See our small business tools and templates hub, https://quickbooks.intuit.com/global/resources/expenses/understand-overhead-costs/, https://quickbooks.intuit.com/oidam/intuit/sbseg/en_row/blog/images/07/The-Inventory-Turnover-Balancing-Act-featured-row.jpg, https://https://quickbooks.intuit.com/global/resources/expenses/understand-overhead-costs/, Overhead Costs: Meaning, Types, and Examples - QuickBooks. If the costs for direct materials, direct labor, and factory overhead were $522,200, $82,700, and $45,300, respectively, for 16,000 equivalent units of production, the conversion cost per equivalent unit was $8.00.

Depreciation Actual depreciation as per Plant Register. Overhead Rate is nothing but the overhead cost that you attribute to the production of goods and services. For example, say This rate is not affected by the method of wage payment i.e., time rate or piece rate method. Report a Violation 11. Resources for small business owners and self-employed individuals, Everything you need to know about small business funding, Everything you need to know to run your small business successfully, Everything you need to know about managing and retaining employees, Simplify invoicing with these small business resources, Manage expenses like a pro with these small business resources, Everything you need to know about cash flow, Everything you need to know about managing inventory, Take your small business to the next level with our guide to growing your business, Keep yourself and your customers safe online, Learn about the tools that can help your small business, Spread the word - what you need to know about marketing your small business, Learn about accounting and bookkeeping concepts for your business, Simplify tax time with these small business resources, Resources for bookkeepers and accountants, See our small business tools and templates hub, https://quickbooks.intuit.com/global/resources/expenses/understand-overhead-costs/, https://quickbooks.intuit.com/oidam/intuit/sbseg/en_row/blog/images/07/The-Inventory-Turnover-Balancing-Act-featured-row.jpg, https://https://quickbooks.intuit.com/global/resources/expenses/understand-overhead-costs/, Overhead Costs: Meaning, Types, and Examples - QuickBooks. If the costs for direct materials, direct labor, and factory overhead were $522,200, $82,700, and $45,300, respectively, for 16,000 equivalent units of production, the conversion cost per equivalent unit was $8.00.

The estimated annual overhead cost is $340,000 per year. These are the costs that your business incurs for producing goods or services and selling them to customers. Overhead Rate = (Overheads/Direct Wages) * 100. That is, such expenses increase with increasing production and decrease with decreasing production. Thus, advertising costs incurred on promoting your bakery products helps in the smooth running of your business. Because manufacturing overhead is applied at a rate of $30 per direct labor hour, $180 (= $30 6 hours) in overhead is applied to job 50. What Security Software Do You Recommend Ask Leo. WebDuring July, the packaging department incurred $13,000 of direct labor costs and indirect labor of $1,000. Overheads relating to service cost centres. iii. Indirect Material Overheads include costs incurred on: Indirect Labor Overheads include Salaries/wages paid to: Other Manufacturing Overheads include costs incurred on: Simply, totaling the Overhead Costs either for the factory or for various divisions for your business is not sufficient. Standing order numbers are used for covering the factory overheads. 19 Intro to Sales and Leases, Daniel F Viele, David H Marshall, Wayne W McManus, C Bill Thomas, Walter T Harrison, Wendy M Tietz, Rural inclusion/exclusion: rural gentrificati. Store-keeping and materials handling Number of stores requisitions. That is, these expenses remain fixed only up to a certain level of output. How do companies assign manufacturing overhead costs, such as factory rent and factory utilities, to individual jobs? Furthermore, these costs decrease with an increase in output and increase with a decrease in output. For example, indirect wages of production department A is to be allocated to Department A only. Two terms are used to describe this differenceunderapplied overhead and overapplied overhead. Methods of absorption of factory overheads 5. Prepare journal entries for the above transactions for the It does not require any special accounting records to be kept for its operation. That is, such labor supports the production process and is not involved in converting raw materials into finished goods. (ii) Apportionment of Service Departments overheads among Production Departments. The factory overhead is first apportioned to the different machines or groups of machines. Thus, overhead costs are expenses incurred to provide ancillary services. Question: Because manufacturing overhead costs are applied to jobs based on an estimated predetermined overhead rate, overhead applied (credit side of manufacturing overhead) rarely equals actual overhead costs incurred (debit side of manufacturing overhead). WebApplied overhead is the amount of the manufacturing overhead that is assigned to the goods produced. As the name suggests, the semi-variable costs are the expenses that are partially fixed and partially variable. This document/information does not constitute, and should not be considered a substitute for, legal or financial advice. Single and Departmental Overhead Absorption Rates | Accounting, Overhead Absorption: Rate, Examples, Formula and Methods, Absorption of Factory Overheads: 7 Methods | Cost Accounting, What is Factory Overhead: Examples, Formula, Items, Steps, Methods and Distribution, Factory Overheads Steps: Collection, Classification, Allocation, Apportionment and Absorption, Factory Overheads Methods of Absorption (With Formulas, Advantages and Disadvantages), Top 3 Stages Involved in Distribution of Factory Overhead. This method does not take into account factors other than labour. Examples of Factory Overhead 3. 15,000 This method is commonly used in those industries where machines are primarily used because in these industries overheads are mostly concerned with machines. Further, the Distribution Overheads refer to the costs incurred from the time when the product is manufactured in the factory till you deliver it to the customer. Examples of indirect costs include salaries of supervisors and managers, quality control cost, insurance, depreciation, rent of manufacturing facility, etc. It may be on the basis of services rendered by a particular item of expense to different departments or by survey method. ii. Fixed overhead costs include rent, mortgage, government fees and property taxes. These expenses are wages paid to indirect workers, contribution to provident funds or any social security scheme, depreciation, normal idle time wages etc. WebFinding the right answers is about talking to the right people. WebA manufacturer incurred the following actual factory overhead costs: indirect materials, $7,900; indirect labor (factory wages payable), $10,700; depreciation on factory The Factory Overheads refer to the expenses incurred to run the manufacturing division of your company. As per this method, you charge overheads to production based on the number of machine-hours used on a particular job. Job 153 used a total of 2,000 machine hours. When there is no variation in the wage rates of pay. WebBudget Actual Direct labor hours P600,000 P550, Factory overhead costs 720,000 680, The factory overhead for Woodman for the year is.  the salary of the quality assurance staff. It is argued that both material and labour give rise to factory overheads, they should be taken into account for determining the amount to be debited to various jobs in respect of factory overheads. iv.

the salary of the quality assurance staff. It is argued that both material and labour give rise to factory overheads, they should be taken into account for determining the amount to be debited to various jobs in respect of factory overheads. iv.

A process cost accounting system records all actual factory overhead costs directly in the Work in Process account. Source: Photo courtesy of prayitno, http://www.flickr.com/photos/[emailprotected]/5293183651/. For example, in a textile industry the yarn and clothes departments are production departments while those of a boiler house and repairs are service departments. It is easy to understand. Interest included in Hire Purchase Original price of machine. Behavior refers to the change in the cost with respect to the change in the volume of the output. Advantages and Disadvantages. Accordingly, overhead costs are divided by direct labor costs. are licensed under a, Prepare Journal Entries for a Process Costing System, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Inventory Computation for Packaging Department. Now, we know that there are certain costs that increase with an increase in output and decrease with a decrease in output. The Overhead Costs form an important part of the production process. Both metals are quite different in prices and by applying the same percentage for both will be obviously incorrect. Canada Goose Is a 900 winter jacket really worth it.  i. of employees engaged on machines. Is overhead overapplied or underapplied? WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. The price charged to customers is often negotiated based on cost. Explain your answer.

i. of employees engaged on machines. Is overhead overapplied or underapplied? WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. The price charged to customers is often negotiated based on cost. Explain your answer.

Furthermore, this will remain constant within the production potential of your business. 4. viii. Boeing provides products and services to customers in 150 countries and employs 165,000 people throughout the world. OVERHEAD: 1. Utilities (heat, water, and power) $21,000 2. Rent on factory equipment $16,000 3. Miscellaneous factory overhead costs $3,000 *: Other accounts such as Cash may also be credited. MFG. OVERHEAD: - If actual and applied manufacturing overheadu000bare not equal, a year-end adjustment is required. vii. WebA process cost accounting system records all actual factory overhead costs directly in the Work in Process account. Note that the manufacturing overhead account has a debit balance when overhead is underapplied because fewer costs were applied to jobs than were actually incurred. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, Answer: Underapplied by P20, 39. Thus each job will be assigned $30 in overhead costs for every direct labor hour charged to the job. The $2,000 is closed to each of the three accounts based on their respective percentages. Question: Since the manufacturing overhead account is a clearing account, it must be closed at the end of the period. The bill will be paid next month. For example, you own a bakery and incur advertising costs to promote your bakery products. Under this method specific criteria are laid down after careful survey for apportionment of charge for different service functions. During the same period, the Manufacturing Overhead applied to Work in Process was $62,000. This is because there can be a permanent change in the, Further as per GAAP, a manufacturer needs to include the following costs in his inventory and the, Repairs and Maintenance Employees in Manufacturing Unit, Electricity and Gas Used in the Manufacturing Facility, Rent, Property Taxes, and Depreciation on the factory facility, Know how these costs impact your business. v. The estimated hours forming the base for calculation should often be compared with the actual hours worked and necessary adjustments affected. This is usually done by using a predetermined annual overhead rate. Furthermore, Overhead Costs appear on the income statement of your company. When material cost forms a greater part of the cost of production. ii. Journal entry to record manufacturing overhead cost: The manufacturing overhead cost applied to the job is debited to work in process account. The journal entry for the applied manufacturing overhead cost, computed in the above example, would be made as follows: A D V E R T I S E M E N T Furthermore, Overhead Costs appear on the. What is the journal entry to record the applied factory Heating Floor area occupied or technical estimate. Rent Area or volume of building. The process of creating this estimate requires the calculation of a predetermined rate. This method uses prime cost as the basis for calculating the overhead rate. Prime Cost is nothing but the total of direct materials and direct labor cost of your business. of hours devoted by Supervisor. and you must attribute OpenStax. Inventories Raw materials Work in process Finished goods < Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual). It needs to be an activity common to each department and influential in driving the cost of manufacturing overhead. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. Such costs are the supplementary costs that you incur to facilitate your production process. These costs depend upon the type and the nature of your business. These services help in carrying out the production of goods or services uninterruptedly. Acquisition Costs: AbbVie periodically acquires other companies in order to expand its On the other hand, the indirect expenses are the ones that you incur either before or after you sell the products or services. If a job is completed or worked by two or more machines, the hours spent on each machine are multiplied by the rate of that related machine, and the overheads so calculated for the different machines in total are the overheads chargeable to the job. Dec 12, 2022 OpenStax. When labour forms the predominant part of the total cost. live tilapia for sale uk; steph curry practice shots; california fema camps WebThe complexity for minimum component costs has increased at a rate of roughly a factor of two per year. However, such an increase in expenses is not in proportion with the increase in the level of output. So let us define overhead cost and understand the overhead cost formula as well as how to calculate the overhead cost. vi.  Please contact your financial or legal advisors for information specific to your situation.

Please contact your financial or legal advisors for information specific to your situation.  This is called allocation of overheads.. Most companies use a normal costing system to track product costs. Terms and conditions, features, support, pricing, and service options subject to change without notice. This book uses the Apportionment is the allotment of proportions of items of cost to cost centres or cost units on suitable basis after they are collected under separate standing order numbers. Web3. Thus, neglecting overheads can prove to be costly for your business while estimating the price of a product or controlling expenses. Now, you must remember that factory overheads only include indirect factory-related costs. The cost of utilities required to run a factory, such as water, electricity, internet, gas and others are also part of a factory's overhead. Content Filtration 6. In other words, such expenses would increase if the output goes beyond such a level. If the variable is quantitative, then specify whether the variable is discrete or continuous. WebOther Fields Homework Help. Companies recognizing the need to simultaneously produce products with high quality, low cost, and instant availability have adopted a just-in-time processing philosophy. This is because such an expense would directly help you in providing legal services. *The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/5-5-prepare-journal-entries-for-a-process-costing-system, Creative Commons Attribution 4.0 International License. ii. = $8.00 27 DLH = $216 The manufacturing overhead cost assigned to the job is recorded on the job cost sheet of that particular job. Underapplied overhead13 occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). Material prices are often subject to considerable fluctuations which are not accompanied by similar changes in overheads. Hence, following are the steps for calculating the overhead costs of your business. Applied overhead to work in process. Pinacle Corp. budgeted $700,000 of overhead cost for the current year.

This is called allocation of overheads.. Most companies use a normal costing system to track product costs. Terms and conditions, features, support, pricing, and service options subject to change without notice. This book uses the Apportionment is the allotment of proportions of items of cost to cost centres or cost units on suitable basis after they are collected under separate standing order numbers. Web3. Thus, neglecting overheads can prove to be costly for your business while estimating the price of a product or controlling expenses. Now, you must remember that factory overheads only include indirect factory-related costs. The cost of utilities required to run a factory, such as water, electricity, internet, gas and others are also part of a factory's overhead. Content Filtration 6. In other words, such expenses would increase if the output goes beyond such a level. If the variable is quantitative, then specify whether the variable is discrete or continuous. WebOther Fields Homework Help. Companies recognizing the need to simultaneously produce products with high quality, low cost, and instant availability have adopted a just-in-time processing philosophy. This is because such an expense would directly help you in providing legal services. *The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/5-5-prepare-journal-entries-for-a-process-costing-system, Creative Commons Attribution 4.0 International License. ii. = $8.00 27 DLH = $216 The manufacturing overhead cost assigned to the job is recorded on the job cost sheet of that particular job. Underapplied overhead13 occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). Material prices are often subject to considerable fluctuations which are not accompanied by similar changes in overheads. Hence, following are the steps for calculating the overhead costs of your business. Applied overhead to work in process. Pinacle Corp. budgeted $700,000 of overhead cost for the current year. .png)

Such expenses are, however, not directly related to production, selling, and distribution. These factory-related indirect costs include indirect material, indirect labor, and other indirect manufacturing overheads. Summary: Applies principles of cost accounting to conduct studies which provide detailed cost information not supplied by general accounting systems by performing the following duties. Print New Topic : During March, Pendergraph Corporation incurred $60,000 of actual Manufacturing Overhead costs. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. The actual manufacturing overhead costs incurred in a period are recorded as debits in the manufacturing overhead account. This page titled 2.4: Assigning Manufacturing Overhead Costs to Jobs is shared under a CC BY-NC-SA 3.0 license and was authored, remixed, and/or curated by Anonymous via source content that was edited to the style and standards of the LibreTexts platform; a detailed edit history is available upon request. Pinacle's plantwide allocation base, machine hours, was budgeted at 100,000 hours.Actual machine hours were 80,000. Thus, below is the formula to calculate the overhead rate using the direct labor cost as the base. As mentioned above, the overhead rate can be calculated in various ways using different measures. !

Such expenses are, however, not directly related to production, selling, and distribution. These factory-related indirect costs include indirect material, indirect labor, and other indirect manufacturing overheads. Summary: Applies principles of cost accounting to conduct studies which provide detailed cost information not supplied by general accounting systems by performing the following duties. Print New Topic : During March, Pendergraph Corporation incurred $60,000 of actual Manufacturing Overhead costs. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. The actual manufacturing overhead costs incurred in a period are recorded as debits in the manufacturing overhead account. This page titled 2.4: Assigning Manufacturing Overhead Costs to Jobs is shared under a CC BY-NC-SA 3.0 license and was authored, remixed, and/or curated by Anonymous via source content that was edited to the style and standards of the LibreTexts platform; a detailed edit history is available upon request. Pinacle's plantwide allocation base, machine hours, was budgeted at 100,000 hours.Actual machine hours were 80,000. Thus, below is the formula to calculate the overhead rate using the direct labor cost as the base. As mentioned above, the overhead rate can be calculated in various ways using different measures. !

Actual overhead is indirect factory costs that have been incurred. However, the basic formula for calculating basic rates is as follows: Overhead Rate = Indirect Costs/Specific Measure. are also assigned to each jetliner. Recorded the cost of goods sold for Jobs 136 and 138. That is to say, such services by themselves are not of any use to your business. It is suitable when most of the work is done manually. As many of the overheads also vary with time, this method produces satisfactory results. D. Prepare an entry to record the assignment of manufacturing overhead to work in process. Copyright 10. iii. It is important to assign these Overhead Costs to various products, jobs, work orders, etc.