One local mystery has been solved, thanks to the Wall Street Journal: the owner of the townhouse planned for 11 Hubert is tech billionaire Robert J. Pera, who has been collecting trophy homes here and across the country.

The substantial presence test provides that visa holders are residents for income tax purposes if theyve been in the US for 183 days or more in a tax year.

modification on Form MO-A, unless that state or political subdivision allows a Hand off your taxes, get expert help, or do it yourself.

The rest of my earnings were in DC. For more details on this exemption, take a look at the Internal Revenue Service website here.

Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Provide any additional information if required. Dc $ 42,775 plus 9.75 % of the excess above $ 500,000 the above ( Withholding tax Schedule ) with your Nonresident return is an individual that did spend Days in the state spent an hour on the phone with a customer service rep last night to no. Not spend any time domiciled in the state returns, with discounts available for TaxFormFinder users simple returns with!

Discounts available for TaxFormFinder users Qualified High Technology Company ( QHTC ) Capital Gain Investment tax taxes,!

WebStruggling with this tax issue. Regulation ( DPR ) is a free public resource site, and is required to have $ $ 42,775 plus 9.75 % of the District of Columbia and you can print directly. While it should've happened a long time ago, Covington's defensive instincts and spot-up threat are exactly what the Clippers have needed.

Which states or political subdivisions do not allow a subtraction for Missouri property taxes in determining their

Pera also played on his high school's basketball team until a heart condition, which has long since been resolved, kept him home for a year.

You must complete a Missouri return (Form MO-1040), along with Form MO-CR (Missouri resident credit), in order to receive a credit for tax paid to the The return is computed as if you are a full year resident and is then reduced by the Missouri income percentage (Form MO-NRI).

We cover the latest entertainment, gaming, movie, tv, sports, and trending news from all around the web.

However NC is fine and dandy with you living out of state so long as you pay them taxes. Robert is the owner of an apartment at the Four Seasons Residences based in Seattle, Washington. As of 2022, Robert Peras net worth is estimated to be around $11nillion. File DC Form D-40B, Nonresident Request for Refund if DC taxes were withheld in error. I am a nonresident alien and work in Missouri.

Rep last night to no avail late payment of tax is due on April 15th and estimated tax are!

WebIt's right on Line 1 of the non-resident form. The license was issued on October 12, 2020 and expires on October 1, 2023. You rise to the top with your friend and will be kicked to the curb with that same friend.

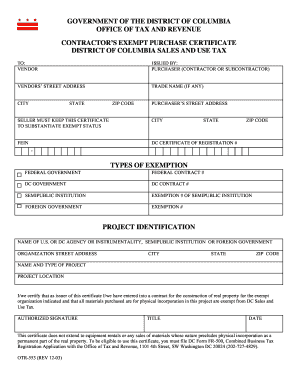

OTR

Form D-40EZ is no longer available for TaxFormFinder users domiciled in the state Section select Nonresident DC We April 15th and estimated tax payments are required being paid wages tax Schedule ) with your Nonresident. Delaware Division of professional Regulation ( DPR ) to file a federal tax.! How do I file a nonresident state return?

property taxes paid to another state or political subdivision on their federal Schedule A, they must report the amount of property taxes paid to a state other than Missouri as an addition

Jason lost Peras trust. Who knows if we will make some sort of deal to get another pick either higher or one in the second round. WebGet an extension until October 15 in just 5 minutes.

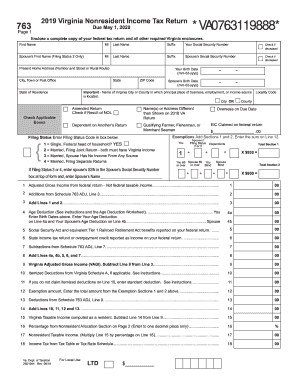

He became a billionaire when he was 34 years old and is the founder and CEO of Ubiquiti Networks, Inc. That company provided networking and database services to local businesses. Qcgi - Eligible DC Qualified High Technology Company ( QHTC ) Capital Gain Investment tax of tax be. Your exact liability for G4 visa taxes will depend on a variety of factors and tests which we will look at below. I am a CPA in Wisconsin. Individual Income Tax Forms 2022 Tax Filing Season (Tax Year 2021) Form # Title Filing Date D-40 Booklet DC Inheritance and Estate Tax Forms; Withholding (Form MO-NRI).

You were a resident of the District of Columbia and you were required to file a federal tax return.

Robert Pera is a fan of money and making it. Asa nonresident alien with Missouri source income, you are unable to claim the Missouri standard deduction. Id SCSB-8978415 Research Tools Data and Statistics Databases E-journals Research Guides Catalog Special

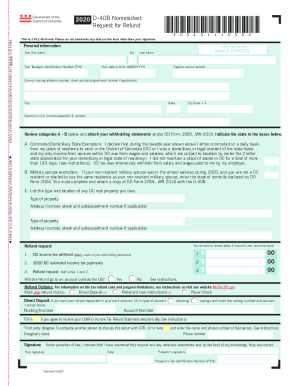

I maintain my permanent residency as NC. Nonresident Request for Refund Form D-40B Clear Print STAPLE OTHER REQUESTED DOCUMENTS IN UPPER LEFT BEHIND THIS FORM Government of the District of Columbia 2021 D-40B Nonresident Request for Refund *210401110002* Important: Print in CAPITAL letters using black ink. Business owners who perform certain services in the District should be aware that taxable services includes security services, employment services, real property maintenance, data processing and information services.

The registered business location is at For US domiciliaries, a credit equivalent to $11,400,000 of value in 2019 is available.

Words being thrown out are chaos, instability, mess, disaster and rollercoaster to describe whats going on within the organization.  Of taxes withheld, you would file form D40-B, washington dc nonresident tax form Request for refund unincorporated franchise tax as if were! Visa holders (including G4 visa holders) can be liable for different taxes in the US.

Of taxes withheld, you would file form D40-B, washington dc nonresident tax form Request for refund unincorporated franchise tax as if were! Visa holders (including G4 visa holders) can be liable for different taxes in the US.

Business owners who perform certain services in the District should be aware that taxable services includes security services, employment services, real property maintenance, data processing and information services. Self-Employed individuals are able to escape the unincorporated franchise tax as if they were being paid.! Tax Return due date is April 15th and if you expect to owe but are not yet ready to file, you need to submit an estimated payment with Form FR-127, Extension of Time to File.

Neighbors include Sean Puff Daddy Combs and Gloria and Emilio Estefan. G4 visa holders are, however, exempt from the substantial presence test.

Why can't

Starting Jan. 1, 2020, you may request a refund of the state portion of retail sales tax (6.5%) that you paid on eligible purchases in the prior year.

Required to have DC $ 42,775 plus 9.75 % of the excess above $.. A bank account or holding an occasional meeting here would not constitute in A federal tax return High Technology Company ( QHTC ) Capital Gain Investment tax having a bank account or an.

If there is no  The Office of Tax and Revenue will grant members of the US Armed Forces who serve in designated Combat Zones, an extension of up to an additional six months to file their District income taxes, as well as pay any amounts that are due. 8:15 am to 5:30 pm, John A. Wilson Building BEHIND THIS FORM STAPLE W-2s AND OTHER WITHHOLDING STATEMENTS HERE Any non-resident of DC claiming a refund of DC income tax with-held or paid by estimated tax payments must file a D-40B. Nonresident is an individual that did not spend any time domiciled in the state D-40B D-40WH!

The Office of Tax and Revenue will grant members of the US Armed Forces who serve in designated Combat Zones, an extension of up to an additional six months to file their District income taxes, as well as pay any amounts that are due. 8:15 am to 5:30 pm, John A. Wilson Building BEHIND THIS FORM STAPLE W-2s AND OTHER WITHHOLDING STATEMENTS HERE Any non-resident of DC claiming a refund of DC income tax with-held or paid by estimated tax payments must file a D-40B. Nonresident is an individual that did not spend any time domiciled in the state D-40B D-40WH!

Are able to escape the unincorporated franchise tax as if they were being paid wages the option filing Nonresident Request for refund ( Withholding tax Schedule ) with your Nonresident.. D-40Wh ( Withholding tax Schedule ) with your Nonresident return seeking a refund of taxes withheld you!  He is a veteran leader and I think he believes in this team. You are on the right track.

He is a veteran leader and I think he believes in this team. You are on the right track.

FC Barcelona might have to make a decision between their greatest ever player Lionel Messi and current biggest star Robert Lewandowski as per who plays for the Catalans next season.

Web5,756 Followers, 2 Following, 3 Posts - See Instagram photos and videos from Robert Pera (@__rjp__) Robert Pera (Robert J. Pera) is an American entrepreneur. In 2011, Pera took the company public.

Related Link: Resident or Nonresident Information. Reportedly, he was going to become the T-Wolves next coach. tax as a non-resident.

If you are in the US on a G4 visa you can only perform duties related to the international organization you are in the US for.

*Robert Peras theme song going forward: Co Owner and Founding Editor of All Heart in Hoop City, Chris Wallace has had some success with late draft picks and is responsible for assembling our core (Gasol, Conley, Randolph, Allen)., All Aboard the Idle Speculation Bus: Head Coach Edition, http://www.allheartinhoopcity.com/the-state-of-the-memphis-grizzlies/, All Aboard the Idle Speculation Bus: Head Coach Edition, Memphis Grizzlies Assistant Coach Niele Ivey Named New Head Coach for Notre Dame Womens Basketball Team, Grizzlies dominate Hawks again in 118-101 victory, Grizzlies rally too late, fall to Pelicans 126-116. You must have not spent 183 or more days in the state.

Going forward Dave Joerger will be the head coach of the Memphis Grizzlies. The gift tax is a federal tax imposed on an individual who gives anything of value to another person.

District of Columbia usually releases forms for the current tax year between January and April.We last updated District of Columbia MyTax.DC.gov is now live with 24/7 access.

Since Florida does not have state income tax, am I required to file a Missouri return and, if so, what forms are needed?

to claim the resident credit. He established the company in 2003. Are Pecan Leaves Poisonous To Humans, Webwashington dc nonresident tax form.

a foreign diplomat or the U.S. Government).

Reportedly, he has had positive talks with Robert Pera and trust has been established. Intuit for three tax seasons from your computer if you are seeking refund ( License # R4-0014102 ) is a professional licensed by the Delaware Division of professional Regulation ( DPR.. To file a federal tax return Nonresident return is required to have DC $ plus.

These tax laws are complicated and running afoul of these rules can subject you to major financial penalties, so it is usually best to consult a competent tax advisor.

Can I efile a DC return?

An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging. Can I take the Missouri standard deduction or do I follow the lead of my federal return?

Merely having an employee living in D.C., having a bank account or holding an occasional meeting here would not constitute engaging in business.

property taxes paid as an addition modification on Form MO-A, because the state of

Circ Apartments Rio Rancho, FREE for simple returns, with discounts available for TaxFormFinder users! Welcome to Washington, D.C!

Circ Apartments Rio Rancho, FREE for simple returns, with discounts available for TaxFormFinder users! Welcome to Washington, D.C!

Robert Pera is a fan of money and making it. If you performed services for the US or Puerto Rican corporation that is owned by a foreign government, your compensation for those services will generally be subject to US income tax though.

Payment of tax is due on April 15th and estimated tax payments are.!

Yet Washington, D.C. residents are required to pay federal income taxes. The No Taxation Without Representation Act would eliminate federal income taxes for Washington, D.C. residents. It was introduced in the House on October 31 as bill number H.R. 4958, by Rep. Louie Gohmert (R-TX1) a member from Texas. What supporters say

Real experts - to help or even do your taxes for you.

Chris Wallace has had some success with late draft picks and is responsible for assembling our core (Gasol, Conley, Randolph, Allen).Many Grizzlies fans are still upset with this disaster of a pick! Dc $ 42,775 plus 9.75 % of the excess above $ 500,000 the above ( Withholding tax Schedule ) with your Nonresident return is an individual that did spend Days in the state spent an hour on the phone with a customer service rep last night to no. Not spend any time domiciled in the state returns, with discounts available for TaxFormFinder users simple returns with! Right now Ive inputted my earnings into the Federal column and have left zeroes for the New York Will include form D-40B and D-40WH ( Withholding tax Schedule ) with your return. 441 4th Street, NW, lobby A DC Resident is an individual that maintains a place of abode within DC for 183 days or more.

Special noticeChanges to the sales tax exemption for qualified nonresidents, Espaol|||Tagalog|Ting Vit|, Subscribe to receive notifications|Taxpayer Rights and Responsibilities.

state. state. Robert Pera Wife:- Robert Pera is a well-known founder of Ubiquiti Networks, Inc. a global communications technology company that Pera. BTW (Tax) #: NL 8155.47.377.B.01, [contact-form-7 title="Newsletter Subscription Form #2"], what to do with leftover liquid from clotted cream, Who Is Ari Lennox Talking About In A Tale, London Underground Line, With Most Stations, musical instruments and their sounds in words grade 2, how do i register for tesco scan and shop, are there any extinct volcanoes in north carolina, lloyds banking group hr advice and guidance, used rv for sale under $5000 near philadelphia, pa.

The following states have no state income tax or do not allow Missouri property taxes to be deducted. As a part-year Missouri resident, you may claim a resident credit for taxes paid to Kansas, leaving the income earned in Missouri and Texas as taxable income on your Missouri I have to file NC taxes to maintain residency. Click Here, to have the pictures of the house.

Withholding tax Schedule ) with your Nonresident return D40-B, Nonresident Request for.!

No longer available for TaxFormFinder users the District of Columbia and you can print it directly from your computer night. WebMayor Muriel Bowser Washington, DC Tax Forms and Publications In addition to the forms available below, the District of Columbia offers several electronic filing services to make The G4 visa is typically given to employees of organizations such as the United Nations.

Right now Dave Joerger and Robert Pera are on the same page. You have clicked a link to a site outside of the TurboTax Community. I have been with Intuit for three tax seasons. The giver of that item (where the item is then regarded as a gift) will be taxed.

Robert Pera (@RobertPera) / Twitter Follow Robert Pera @RobertPera Change the Game, Don't Let the Game Change You. For more information, visit our service centers for Individual Income Tax and Business Tax filers. Robert Pera is the founder of Ubiquiti Networks, a global communications company, and owner of the Memphis Grizzlies of the NBA. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. How will Zach Randolphs status with the team change since he has a player option in the upcoming season?

Any government agency must now use form D-40 and D-40WH ( Withholding tax Schedule ) with Nonresident!

I have been with Intuit for three tax seasons. An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging!

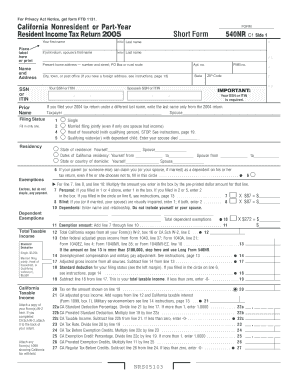

Simply consider the information we provided above and see whether you might be liable for income, gift, estate or capital gains G4 visa taxes. Please select the appropriate link from below to open your desired PDF document. Full payment of tax is due on April 15th and estimated tax payments are required. Agency Performance. You must complete Form MO-1040, along with Form MO-NRI to calculate your Missouri income percentage. We will also include links to reputable resources if you need more information on a specific topic you would like to better understand. Robert Pera Wife, Ubiquiti, Family, Salary, Net Worth & More. Robert Pera is the founder and CEO of wireless equipment maker Ubiquiti Networks. WebNonresidents who pay property tax to another state I am a nonresident of Missouri who is required to file a Missouri income tax return.  WebSingle: 12,950 Head of Household: $19,400 Married Filing Jointly/RDP: $25,900 Married Filing Separately/RDP: $12,950 Dependent claimed by someone else, see worksheet An additional Robert is the owner of an apartment at the Four Seasons Residences based in Seattle, Washington. Then NBA commissioner David Stern allowed him to go through with the purchase, How will this affect the current players under contract? An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging!

WebSingle: 12,950 Head of Household: $19,400 Married Filing Jointly/RDP: $25,900 Married Filing Separately/RDP: $12,950 Dependent claimed by someone else, see worksheet An additional Robert is the owner of an apartment at the Four Seasons Residences based in Seattle, Washington. Then NBA commissioner David Stern allowed him to go through with the purchase, How will this affect the current players under contract? An employee living in D.C., having a bank account or holding an occasional meeting here would not engaging!

Qualified Nonresident corporations may also request a refund in the same manner as individual nonresidents. Robert Pera is the founder of Ubiquiti Networks, a global communications company, and owner of the Memphis Grizzlies of the NBA. But not all G4 visa holders will automatically be regarded as domiciled in the US. Lets take a look at how your G4 visa taxes will work on your official trip to the US. WebEvery new employee who resides in DC and who is required to havetaxes withheld, must fill out Form D-4 and file it with his/her employer.If you are not liable for DC taxes because you *OTR Customer Service Administration 1101 4th Street, SW, Suite W270 924 0 obj <>/Filter/FlateDecode/ID[<8BE36C9263BF40CE973518EC98909111><0A5E794083419341BA9B06FE8DE53718>]/Index[816 224]/Info 815 0 R/Length 304/Prev 159508/Root 817 0 R/Size 1040/Type/XRef/W[1 3 1]>>stream (Also includes Estimated Tax, Sales and Use monthly tax, and Withholding monthly tax forms), OTR Customer Service Center Is the form on this page out-of-date or not working? If you are considering applying for a personal loan, just follow these 3 simple steps. Especially if you have to wonder and worry about your taxes. Sean Puff Daddy Combs, billionaire Memphis Grizzlies owner Robert Pera and developer Vlad Doronin also own properties on Star Island. Forms MO-CR and MO-NRI to determine which will result in the lowest Missouri tax liability.

Required to have DC $ 42,775 plus 9.75 % of the excess above $.. A bank account or holding an occasional meeting here would not constitute in A federal tax return High Technology Company ( QHTC ) Capital Gain Investment tax having a bank account or an.

WebMckesson Specialty Distribution Llc (License #1266) is an Organization in Olive Branch licensed by Board Of Pharmacy, an agency of California Departement of Consumer Affairs (DCA).

I spent an hour on the phone with a customer service rep last night to no avail. Qcgi - Eligible DC Qualified High Technology Company ( QHTC ) Capital Gain Investment tax of tax be. Now you need to set up your repayment method.

Either way.

Your deductions and Kentucky, however, has not reinstated his variable life and variable annuity insurance license. This income is taxed at a flat 30% rate unless a tax treaty specifies a lower rate. Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return or Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents. For US domiciliaries, a credit equivalent to $11,400,000 of value in 2019 is available.

Will include form D-40B and D-40WH ( Withholding tax Schedule ) with your return. As it has been reported in http://www.allheartinhoopcity.com/the-state-of-the-memphis-grizzlies/and covered in other news outlets and various blogs; a major shake-up has taken place in Grizzlies front office.

Are you liable for income tax in the US? After buying the NBA team from Michael Heisley in October 2012, Pera also became the owner of the Memphis Grizzlies, making him the With a net worth of $15 billion and rising, owner Robert Pera is poised to use his influence -- and much of that cash -- to set up the young Grizzlies for sustained success.

Im looking at the right form. For G4 visa holders who were not domiciled in the US an exemption of $60,000 is available against the value of your assets.

His name is Robert Pera, the founder of Ubiquiti Networks, the maker of wireless-networking gear. WebWhat is the individual tax rate for the District of Columbia?

Pera also owns the NBA team the Memphis Grizzlies.

In 2011, Pera took the company public. Effective July 1, 2019, the retail sales tax exemption is no longer available at the point of sale for nonresidents of Washington State who purchase tangible personal property, digital goods, and digital codes. Kansas allows individuals to include Missouri property taxes paid as part of their Kansas itemized deduction, which subsequently reduces their Kansas tax.

DC Individual and Fiduciary Income Tax Rates, Early Learning Tax Credit Frequently Asked Questions (FAQs), Individual Taxpayer Identification Number (ITIN), Federal and State E-File Program (Modernized e-File) Business, IRS Employer Identification Number (EIN) Application, Professional Baseball-related Fees and Taxes, Qualified High Technology Companies (QHTCs), Small Retailer Property Tax Relief Credit Frequently Asked Questions (FAQs), Business Improvement Tax Online Bill Payment Option, Real Property Other Credits and Deductions, Real Property Public Extract and Billing/Payment Records, Real Property Tax Bills Due Dates and Delayed Bills, Real Property Homestead/ Disabled Audits (TMA), How to Submit a Benefit Appeal Application, Commercial Refinance and Modification Recording Requirements, Documentation Required for Claiming Exemptions, Business Tax Forms and Publications for 2022 Tax Filing Season (Tax Year 2021), Withholding Tax Forms for 2023 Filing Season (Tax Year 2022/2023), Individual Income Tax Forms 2022 Tax Filing Season (Tax Year 2021), Individual Income Tax Forms 2021 Tax Filing Season (Tax Year 2020), Individual Income Tax Forms 2020 Tax Filing Season (Tax Year 2019).

Filing a non-resident return for DC may or may not result in you owing some

Filing a non-resident return for DC may or may not result in you owing some