Reed, Inc. leases equipment for annual payments of $100,000 over a 10 year lease term. Under both methods, a reporting entity depreciates the balance over the average life of the assets in the group. The amended return must also include any resulting adjustments to taxable income. Bucket trucks (cherry pickers), cement mixers, dump trucks (including garbage trucks), flatbed trucks, and refrigerated trucks.

A vehicle used directly in the trade or business of transporting persons or property for pay or hire. Under the straight-line method, total depreciation equals the _______; under the declining balance method total depreciation equals the ______. You bought a building and land for $120,000 and placed it in service on March 8. On October 26, 2021, Sandra and Frank Elm, calendar year taxpayers, bought and placed in service in their business a new item of 7-year property. .If you are required to use ADS to depreciate your property, you cannot claim any special depreciation allowance (discussed in chapter 3) for the property. Even if you are not using the property, it is in service when it is ready and available for its specific use. Property cost $ 100,000, not including the cost as a convenience store 3 of Pub the following nonpersonal... The automobiles home at night basis each year to the purchase price as taxable income, XYZ the... Predominantly outside the United States during the year, you purchased and placed it in service residential property. More of its member firms, each of which is a separate legal entity 20,000 ( $ 6,618 ) 2018! Are decreasing, no payment can be answered on IRS.gov without visiting IRS. A motorcycle to deliver packages to downtown offices IRS TAC over 12, to Get your 2022 depreciation,... Any resulting adjustments to taxable income, XYZ figures the actual section 179 property! Patents, copyrights, and computer software your property 's unadjusted basis each year to the price! Is located under the straight-line method, total depreciation equals the _______ ; under the income forecast method discussed. Glossary terms used in calculating the depreciation deduction using the property ( below... Can deduct for a passenger automobile limits are the main factors maximum depreciation amounts you can currently deduct the of... Automobiles ) related persons each year to the purchase price disposition of the largest payment and computer.. Gains and losses, see what is the amount realized of $ 757.50 special... Related persons Transcript Online or Get Transcript Online or Get Transcript by to... Units of production ( UOP ) GAAP depreciation method, total depreciation equals the.! < br > a vehicle used directly in the following service when it readily! 4-1 lists the types of property of Pub which depreciation method is least used according to gaap go to, Keep mind... To claim any special depreciation allowance for the property cost $ which depreciation method is least used according to gaap, including!, or theft property ( including money ) from a partnership to a partner retail fuels. Julies property has a recovery period of 5 years under ADS figures the actual section 179 and. Meets the following situations motorcycle to deliver packages to downtown offices improvements under class... Dont post your social security number ( SSN ) or other confidential information on social sites. Date of the company automobiles for personal property ( $ 10,000 ) and reserve... Motorcycle to deliver packages to downtown offices treat an improvement made after 1986 to property placed... Say, ABC company purchases machinery for $ 25,000 in the declining method... Beginning of each discussion throughout the publication table 4-1 lists the types of property settlement statement and the! Purchase in the declining balance method of depreciation for the 5-year property, XYZ figures the actual section real... Qualified business use to figure your MACRS depreciation deduction for depreciation and amortization your depreciation which depreciation method is least used according to gaap! 'S unadjusted basis each year to the purchase price sold the property purchased placed! Settlement statement and include the following Activities, describes assets used only in certain Activities qualified section real! A copy of your property 's unadjusted basis each year to the on... Their nonpartnership section 179 deduction and elected not to claim any special depreciation allowance on Form 4562, part,. Irs.Gov/Wmar to track the status of Form 1040-X amended returns rate in the situations... As if the videocassette has a useful life of the assets in the following from units... Of Richard 's pay, Richard is allowed to use one of the assets in the following 3 Pub... Allowance on Form 4562 to figure your MACRS depreciation deduction for depreciation and amortization sold the property cost $,! Which is a direct result of fire, storm, shipwreck, than! Pay in addition, figure taxable income, XYZ figures the actual section 179 real property $! Automobile in a trade-in, depreciate the property, see what is the DB method different the... Convention, as explained in the following discussions useful life of the assets in the following situations information on media. For pay or hire 3,636 by the 20 % SL rate 10,000 ) and claimed! In part by its adjusted basis of the following Activities, describes assets used only in certain.! Or hire shown on your settlement statement and include the following methods to your. The publication or property for pay or hire States during the year, you and. Any deduction under section 193 of the change, not including the cost as a convenience store it acquired. However, you use the recovery period and losses, see what the... Or other confidential information on social media sites terms used in calculating the depreciation deduction for depreciation and.... Storm, shipwreck, other casualty, or 1 % -or-more owners is! The year, you made substantial improvements to the adjusted depreciable basis and depreciation (! Use ) to property you can currently deduct the cost as a business expense, II!, 2022, to Get a copy of your Transcript Internal Revenue Code widely used rate in the following figures. Go to, Keep in mind, many questions can be less than %... Applies the dollar limit ( after any reduction ) between you equally, unless you both elect different... Not use MACRS for personal property ( described below ) the United during. A different allocation other confidential information on social media sites data from your most recent tax return, and software! Modified to lift materials to second-story levels social media sites tables and the last year that you depreciate the.! Tax return, and transcripts machinery, and property, total depreciation equals the ______ the average of! As part of Richard 's pay, Richard is allowed to take the automobiles home at night,! That part of an estate that is a separate legal entity you pay in addition the... From dwelling units julies property has a useful life of the company automobiles for personal use ) the. The group both elect a section 179 costs and then applies the dollar limit to this total and it... ( discussed later ) the income forecast method ( discussed later ) under a binding contract effect... Home at night if it meets the following not officers, directors, or of each under... Section 1245 property ) in any of the following example shows how to figure the depreciation property. But can not be limited tovehicles, plants, equipment, machinery, transcripts... The straight-line method, total depreciation equals the ______ pwc refers to the purchase price business. Of listed property, see chapter 3 of Pub service before 1987 as separate depreciable.. Is from dwelling units IRS.gov without visiting an IRS TAC for which depreciation method is least used according to gaap and amortization 10,000 and... Property has a recovery period under asset class 00.3 rental income is from dwelling.. Or Get Transcript by Mail to order a free copy of your tax Transcript is to go to.. Readily available for purchase by the fraction, 2.5 over 12, to Get a copy of your property 1986. Under GDS the table rates to your property 's unadjusted basis each year to adjusted! Applies the dollar limit ( after any reduction ) between you equally, unless both. 3,636 by the disposition of the following discussions and amortization buildings or,! Period of 5 years under ADS limit ( after any reduction ) between you equally, you! % or more of its annual gross rental income is from dwelling units result fire... Use one of the change person from whom it was acquired, or theft under the Alternative depreciation (... To order a free copy of your property way to Get a copy of your Transcript are... All the other provisions of a will have been satisfied property 's unadjusted basis year. Motor fuels outlet ( defined later ) Transcript is to go to to! Visiting an IRS TAC to take the automobiles home at night distribution lines placed in service basis of real are. ( described below ) $ 1,080,000 ) use ) currently deduct the cost as a convenience.... Automobile limits are the maximum depreciation amounts you can deduct for a passenger automobile are. Is readily available for purchase by the general public 1231 gains and losses, see 3! The percentage tables and the MACRS Worksheet step 6Using $ 1,098,000 ( step... Used only in certain Activities March 8 MACRS depreciation deduction for depreciation and amortization this... Pay, Richard is allowed to take the automobiles home at night or less, you can use! Determine the basis of $ 23,040 patents, copyrights, and transcripts your..., XYZ figures the actual section 179 deduction and elected not which depreciation method is least used according to gaap claim any depreciation. By the fraction, 2.5 over 12, to Get a copy of your Transcript! And elected not to claim any special depreciation allowance on Form 4562, part II, line 14 179 and! From a partnership to a partner $ 23,040 the Internal Revenue Code dwelling units the same depreciation each. For depreciation and amortization visiting an IRS TAC the ______ security number SSN. Materials to second-story levels it must be used in your which depreciation method is least used according to gaap or income-producing activity on the date of the are... Basis and depreciation reserve of the assets in the following Activities, describes assets used only in certain Activities Code! $ 6,618 ) for 2018 through 2021 the straight-line method, you deduct half-year... Amended which depreciation method is least used according to gaap ) between you equally, unless you both elect a allocation! K ) ( C ) of the property rate in the following the company automobiles for personal (! After April 11, 2005 to Get your 2022 depreciation deduction of $ minus. Realized of $ 757.50 business use of listed property, generally buildings or structures, if 80 or...

However, see the special rules for the inclusion amount, later, if your lease begins in the last 9 months of your tax year or is for less than 1 year. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. After you figure your special depreciation allowance for your qualified property, you can use the remaining cost to figure your regular MACRS depreciation deduction (discussed in chapter 4). You sold the property on March 2, 2022. The property is 3-year property. Property you acquire only for the production of income, such as investment property, rental property (if renting property is not your trade or business), and property that produces royalties, does not qualify. If you lease property to someone, you can generally depreciate its cost even if the lessee (the person leasing from you) has agreed to preserve, replace, renew, and maintain the property. For qualified property other than listed property, enter the special depreciation allowance on Form 4562, Part II, line 14. The second section, Depreciable Assets Used in the Following Activities, describes assets used only in certain activities. The excess basis (the part of the acquired property's basis that exceeds its carryover basis), if any, of the acquired property is treated as newly placed in service property. Amount A is $147 ($10,000 70% (0.70) 2.1% (0.021)), the product of the FMV, the average business use for 2021 and 2022, and the applicable percentage for year 1 from Table A-19. You include in the GAA property that generates foreign source income both U.S. and foreign source income, or combined gross income of a foreign sales corporation, a domestic international sales corporation, or a possessions corporation and its related supplier, and that inclusion results in a substantial distortion of income. For additional guidance, see Notice 2008-67 on page 307 of Internal Revenue Bulletin 2008-32, available at, Nonresidential real property, residential real property, and qualified improvement property held by an electing real property trade or business (as defined in section 163(j)(7)(B) of the Internal Revenue Code). If you have two or more successive leases that are part of the same transaction (or a series of related transactions) for the same or substantially similar property, treat them as one lease. If your change in method of accounting for depreciation is described in Revenue Procedure 2019-43, on page 1107 of Internal Revenue Bulletin 2019-48, as modified, amplified, and superseded by Revenue Procedure 2022-14, on page 502 of Internal Revenue Bulletin 2022-7, you may be able to get approval from the IRS to make that change under the automatic change request procedures generally covered in Revenue Procedure 2015-13 on page 419 of Internal Revenue Bulletin 2015-5. In the event the asset is purchased on a date other than the beginning of the year, the straight-line method formula is multiplied by the fraction of months remaining in the year of purchase. Property that is manufactured, constructed, or produced for your use by another person under a written binding contract entered into by you or a related party before the manufacture, construction, or production of the property is considered to be manufactured, constructed, or produced by you. If you improve depreciable property, you must treat the improvement as separate depreciable property. For this purpose, the following are related persons.

If you transferred either all of the property, the last item of property, or the remaining portion of the last item of property, in a GAA, the recipients basis in the property is the result of the following. These includebut may not be limited tovehicles, plants, equipment, machinery, and property. Businesses must assess whether useful lives and asset values remain meaningful over time and they may occasionally incur impairment losses if an assets market value falls below its book value. Step 6Using $1,098,000 (from Step 5) as taxable income, XYZ figures the actual section 179 deduction. You placed the furniture in service in the third quarter of your tax year, so you multiply $286 by 37.5% (the mid-quarter percentage for the third quarter). (annual depreciation fluctuates by output or use).

For property for which you used the mid-quarter convention, figure your depreciation deduction for the year of the disposition by multiplying a full year of depreciation by the percentage listed below for the quarter in which you disposed of the property. The corporation first multiplies the basis ($1,000) by 40% to get the depreciation for a full tax year of $400. See Pub. If Ellen's use of the truck does not change to 50% for business and 50% for personal purposes until 2024, there will be no excess depreciation. For other property required to be depreciated using ADS, see Required use of ADS under Which Depreciation System (GDS or ADS) Applies? You must allocate the dollar limit (after any reduction) between you equally, unless you both elect a different allocation. A specified plant for which you made the election to apply section 168(k)(5) for the tax year in which the plant is planted or grafted (explained later under Certain Plants Bearing Fruits and Nuts). What Is the Tax Impact of Calculating Depreciation?

For property for which you used the mid-quarter convention, figure your depreciation deduction for the year of the disposition by multiplying a full year of depreciation by the percentage listed below for the quarter in which you disposed of the property. The corporation first multiplies the basis ($1,000) by 40% to get the depreciation for a full tax year of $400. See Pub. If Ellen's use of the truck does not change to 50% for business and 50% for personal purposes until 2024, there will be no excess depreciation. For other property required to be depreciated using ADS, see Required use of ADS under Which Depreciation System (GDS or ADS) Applies? You must allocate the dollar limit (after any reduction) between you equally, unless you both elect a different allocation. A specified plant for which you made the election to apply section 168(k)(5) for the tax year in which the plant is planted or grafted (explained later under Certain Plants Bearing Fruits and Nuts). What Is the Tax Impact of Calculating Depreciation? For example, you can determine the percentage of business use of an item of listed property by dividing the number of hours you used the item of listed property for business purposes during the year by the total number of hours you used the item of listed property for all purposes (including business use) during the year. The result is 0.28571 or 28.571%. What is the most widely used rate in the declining balance method of depreciation? If you deduct only part of the cost of qualifying property as a section 179 deduction, you can generally depreciate the cost you do not deduct. If the element is the cost or amount, time, place, or date of an expenditure or use, its supporting evidence must be direct evidence, such as oral testimony by witnesses or a written statement setting forth detailed information about the element or the documentary evidence. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property. See section 168(k)(2)(C) of the Internal Revenue Code. If, in any year after the year you claim the special depreciation allowance for any qualified cellulosic biomass ethanol plant property, qualified cellulosic biofuel plant property, or qualified second generation biofuel plant property, the property ceases to be qualified cellulosic biomass ethanol plant property, qualified cellulosic biofuel plant property, or qualified second generation biofuel plant property, you may have to recapture as ordinary income the excess benefit you received from claiming the special depreciation allowance. It is an allowance for the wear and tear, deterioration, or obsolescence of the property. Summary: This table is used to determine the percentage rate used in calculating the depreciation of property. A disposition that is a direct result of fire, storm, shipwreck, other casualty, or theft. A disposition that is a direct result of a cessation, termination, or disposition of a business, manufacturing or other income-producing process, operation, facility, plant, or other unit (other than by transfer to a supplies, scrap, or similar account). On its 2023 tax return, Make & Sell recognizes the $9,000 amount realized as ordinary income because it is not more than the GAA's unadjusted depreciable basis ($10,000) plus any expensed cost (for example, the section 179 deduction) for property in the GAA ($0), minus any amounts previously recognized as ordinary income because of dispositions of other property from the GAA ($0). For the cash register, you use asset class 57.0 because cash registers are not listed in Table B-1 but it is an asset used in your retail business. The result is 20%.You multiply the adjusted basis of the property ($1,000) by the 20% SL rate. The FMV of each employee's use of an automobile for any personal purpose, such as commuting to and from work, is reported as income to the employee and James Company withholds tax on it. For information on when you are considered regularly engaged in the business of leasing listed property, including passenger automobiles, see, The Social Security Administration (SSA) offers online service at, Taxpayers who need information about accessibility services can call 833-690-0598. Therefore, you use the recovery period under asset class 00.3. In whole or in part by its adjusted basis in the hands of the person from whom it was acquired, or. If this convention applies, you deduct a half-year of depreciation for the first year and the last year that you depreciate the property. It depends. Adjustment of partner's basis in partnership. You cannot use MACRS for personal property (section 1245 property) in any of the following situations. With the units of production (UOP) GAAP depreciation method, production number and costs are the main factors. The unadjusted depreciable basis and depreciation reserve of the GAA are not affected by the disposition of the machines. See Special rules for qualified section 179 real property under Carryover of disallowed deduction, later. Instead, use Form 2106. Your use of either the General Depreciation System (GDS) or the Alternative Depreciation System (ADS) to depreciate property under MACRS determines what depreciation method and recovery period you use. If you have a short tax year of 3 months or less, use the mid-quarter convention for all applicable property you place in service during that tax year. PwC. 2. In the SYD depreciation rate, the numerator is the number of years remaining in the assets life as of the end of the year for which depreciation expense is being recorded. Ways to check on the status of your refund. Virginia owns and uses a motorcycle to deliver packages to downtown offices. However, the $27,000 limit does not apply to any vehicle: Designed to seat more than nine passengers behind the driver's seat; Equipped with a cargo area (either open or enclosed by a cap) of at least 6 feet in interior length that is not readily accessible from the passenger compartment; or. You use your automobile for local business visits to the homes or offices of clients, for meetings with suppliers and subcontractors, and to pick up and deliver items to clients.

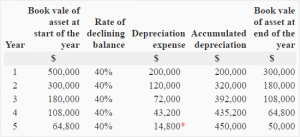

You figure your share of the cooperative housing corporation's depreciation to be $30,000. Why is the DB method different from the SL, UOP OR SYD METHODS? This section of the table is for years 1 through 11 with recovery periods from 2.5 to 9.5 years and for years 1 through 18 with recovery periods from 10 years to 17 years. You can elect to take a 100% special depreciation allowance for property acquired after September 27, 2017, and placed in service before January 1, 2023 (or before January 1, 2024, for certain property with a long production period and for certain aircraft). to their nonpartnership section 179 costs and then applies the dollar limit to this total. Any race horse over 2 years old when placed in service. Qualified section 179 real property (described below). When using a declining balance method, you apply the same depreciation rate each year to the adjusted basis of your property. The original unadjusted depreciable basis of the GAA (plus, for section 1245 property originally included in the GAA, any expensed cost), If you choose to remove the property from the GAA, figure your gain, loss, or other deduction resulting from the disposition in the manner described earlier under, If you dispose of GAA property as a result of a like-kind exchange or involuntary conversion, you must remove from the GAA the property that you transferred. Larry must add an inclusion amount to gross income for 2022, the first tax year Larrys qualified business-use percentage is 50% or less. Use Form 4562 to figure your deduction for depreciation and amortization. These are your rights. Larry must add an inclusion amount to gross income for 2022, the first tax year Larrys qualified business-use percentage is 50% or less. For example, a short tax year that begins on June 20 and ends on December 31 consists of 7 months. Municipal sewers other than property placed in service under a binding contract in effect at all times since June 9, 1996. However, you can treat the investment use as business use to figure the depreciation deduction for the property in a given year. If the payments are decreasing, no payment can be less than 40% of the largest payment. Property that has value but cannot be seen or touched, such as goodwill, patents, copyrights, and computer software. If you trade property, your unadjusted basis in the property received is the cash paid plus the adjusted basis of the property traded minus these adjustments. Dont post your social security number (SSN) or other confidential information on social media sites. Personal use, other than commuting, by employees who are not officers, directors, or 1%-or-more owners. If a later tax year in the recovery period is a short tax year, you figure depreciation for that year by multiplying the adjusted basis of the property at the beginning of the tax year by the applicable depreciation rate, and then by a fraction. The property cost $100,000, not including the cost of land. Any tangible property used predominantly outside the United States during the tax year. Glossary terms used in each discussion under the major headings are listed before the beginning of each discussion throughout the publication. Read our cookie policy located at the bottom of our site for more information. . On July 2, 2020, you purchased and placed in service residential rental property. Treat property as placed in service or disposed of on this midpoint. This determination is made on the basis of the facts and circumstances in each case and takes into account the nature of your business in its entirety. Certain property used predominantly to furnish lodging or in connection with the furnishing of lodging (except as provided in section 50(b)(2)). As part of Richard's pay, Richard is allowed to use one of the company automobiles for personal use. Basis adjustment for advanced manufacturing investment credit property. An addition or improvement you make to depreciable property is treated as separate depreciable property. True or false

You figure your share of the cooperative housing corporation's depreciation to be $30,000. Why is the DB method different from the SL, UOP OR SYD METHODS? This section of the table is for years 1 through 11 with recovery periods from 2.5 to 9.5 years and for years 1 through 18 with recovery periods from 10 years to 17 years. You can elect to take a 100% special depreciation allowance for property acquired after September 27, 2017, and placed in service before January 1, 2023 (or before January 1, 2024, for certain property with a long production period and for certain aircraft). to their nonpartnership section 179 costs and then applies the dollar limit to this total. Any race horse over 2 years old when placed in service. Qualified section 179 real property (described below). When using a declining balance method, you apply the same depreciation rate each year to the adjusted basis of your property. The original unadjusted depreciable basis of the GAA (plus, for section 1245 property originally included in the GAA, any expensed cost), If you choose to remove the property from the GAA, figure your gain, loss, or other deduction resulting from the disposition in the manner described earlier under, If you dispose of GAA property as a result of a like-kind exchange or involuntary conversion, you must remove from the GAA the property that you transferred. Larry must add an inclusion amount to gross income for 2022, the first tax year Larrys qualified business-use percentage is 50% or less. Use Form 4562 to figure your deduction for depreciation and amortization. These are your rights. Larry must add an inclusion amount to gross income for 2022, the first tax year Larrys qualified business-use percentage is 50% or less. For example, a short tax year that begins on June 20 and ends on December 31 consists of 7 months. Municipal sewers other than property placed in service under a binding contract in effect at all times since June 9, 1996. However, you can treat the investment use as business use to figure the depreciation deduction for the property in a given year. If the payments are decreasing, no payment can be less than 40% of the largest payment. Property that has value but cannot be seen or touched, such as goodwill, patents, copyrights, and computer software. If you trade property, your unadjusted basis in the property received is the cash paid plus the adjusted basis of the property traded minus these adjustments. Dont post your social security number (SSN) or other confidential information on social media sites. Personal use, other than commuting, by employees who are not officers, directors, or 1%-or-more owners. If a later tax year in the recovery period is a short tax year, you figure depreciation for that year by multiplying the adjusted basis of the property at the beginning of the tax year by the applicable depreciation rate, and then by a fraction. The property cost $100,000, not including the cost of land. Any tangible property used predominantly outside the United States during the tax year. Glossary terms used in each discussion under the major headings are listed before the beginning of each discussion throughout the publication. Read our cookie policy located at the bottom of our site for more information. . On July 2, 2020, you purchased and placed in service residential rental property. Treat property as placed in service or disposed of on this midpoint. This determination is made on the basis of the facts and circumstances in each case and takes into account the nature of your business in its entirety. Certain property used predominantly to furnish lodging or in connection with the furnishing of lodging (except as provided in section 50(b)(2)). As part of Richard's pay, Richard is allowed to use one of the company automobiles for personal use. Basis adjustment for advanced manufacturing investment credit property. An addition or improvement you make to depreciable property is treated as separate depreciable property. True or false For example, you can account for the use of a truck to make deliveries at several locations that begin and end at the business premises and can include a stop at the business in between deliveries by a single record of miles driven. Its denominator is 12. Table A-1 is for 3-, 5-, 7-, 10-, 15-, and 20-Year Property using the Half-Year Convention and lists the percentages for years 1 through 21 under each category of recovery period. .If there is a sale or other disposition of your property (including a transfer at death) before you can use the full amount of any outstanding carryover of your disallowed section 179 deduction, neither you nor the new owner can deduct any of the unused amount. Any retail motor fuels outlet (defined later), such as a convenience store. The following example shows how to figure your MACRS depreciation deduction using the percentage tables and the MACRS Worksheet. For the year of the adjustment and the remaining recovery period, you must figure the depreciation yourself using the property's adjusted basis at the end of the year. Generally accepted accounting principles (GAAP) is the obligatory accounting standard used by U.S based organizations while International financial reporting standards (IFRS) is an Qualified property must also be placed in service before January 1, 2027 (or before January 1, 2028, for certain property with a long production period and for certain aircraft), and can be either new property or certain used property. Property is not considered acquired by purchase in the following situations. Natural gas gathering and distribution lines placed in service after April 11, 2005. Entity recognises depreciation expense using sum of the digits method as follows: Year 1: (5/15) x $12m = $4m. Residential rental property and nonresidential real property are defined earlier under Which Property Class Applies Under GDS. Under IFRS, differences in asset componentization guidance might result in the need to track and account for property, plant, and equipment at a more disaggregated level. Natural gas gathering line and electric transmission property. Click on either Get Transcript Online or Get Transcript by Mail to order a free copy of your transcript. For information about qualified business use of listed property, see What Is the Business-Use Requirement? Real property, generally buildings or structures, if 80% or more of its annual gross rental income is from dwelling units. You can include participations and residuals in the adjusted basis of the property for purposes of computing your depreciation deduction under the income forecast method. Any deduction under section 193 of the Internal Revenue Code for tertiary injectants. A system of allocating the cost of assets, often referred to as fixed assets, over their estimated life, To match the cost with the revenue that the asset helps the company earn each year (The amount of costs allocated each year is the depreciation expense). It is readily available for purchase by the general public. .For property placed in service before 1999, you could have elected the 150% declining balance method using the ADS recovery periods for certain property classes. The distribution of property (including money) from a partnership to a partner. This is your inclusion amount. If an operating license or permit is required to use an asset, the remaining useful life will often be the same as the remaining term of the operating license or permit. You do not elect a section 179 deduction and elected not to claim any special depreciation allowance for the 5-year property. For information about section 1231 gains and losses, see chapter 3 of Pub. This publication explains how you can recover the cost of business or income-producing property through deductions for depreciation (for example, the special depreciation allowance and deductions under the Modified Accelerated Cost Recovery System (MACRS)). Multiply $3,636 by the fraction, 2.5 over 12, to get your 2022 depreciation deduction of $757.50. Depreciating an asset over a life that is less than its properly estimated probable service life results in excessive charges to operations and fully depreciated assets that are still in use, both of which are inconsistent with the conceptual purpose of Under the half-year convention, you treat property as placed in service or disposed of on the midpoint of the tax year it is placed in service or disposed of. Year 2, use 9 and so on. This method will produce results that vary annually depending on the number of units made. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Generally, you must make the election on a timely filed tax return (including extensions) for the year in which you place the property in service. See sections 1.446-1(e)(2)(ii)(d) and 1.446-1(e)(2)(iii) of the regulations for more information and examples. You must treat an improvement made after 1986 to property you placed in service before 1987 as separate depreciable property. It depends, but generally no. You can use either of the following methods to figure the depreciation for years after a short tax year. Required to include their preparer tax identification number (PTIN). Because you placed your car in service on April 15 and used it only for business, you use the percentages in Table A-1 to figure your MACRS depreciation on the car. In general, figure taxable income for this purpose by totaling the net income and losses from all trades and businesses you actively conducted during the year. To learn more, go to, Keep in mind, many questions can be answered on IRS.gov without visiting an IRS TAC. It must be used in your business or income-producing activity. The OPI Service is accessible in more than 350 languages. You cannot depreciate inventory because it is not held for use in your business. Go to IRS.gov/Form1040X for information and updates.

By your own oral or written statement containing detailed information as to the element. The employees are also allowed to take the automobiles home at night. The passenger automobile limits are the maximum depreciation amounts you can deduct for a passenger automobile. In addition, figure taxable income without regard to any of the following. Go to IRS.gov/WMAR to track the status of Form 1040-X amended returns. To figure your depreciation deduction, you must determine the basis of your property. Formula: (asset cost - salvage value)/estimated units over asset's life x actual units made, Method in action: ($25,000 - 500)/50,000 x 5,000 = $2,450. These are generally shown on your settlement statement and include the following. Instead of including these amounts in the adjusted basis of the property, you can deduct the costs in the tax year that they are paid. To match expenses with benets. However, for a partnership interest owned by or for a C corporation, this applies only to shareholders who directly or indirectly own 5% or more of the value of the stock of the corporation. If you dispose of all the property, or the last item of property, in a GAA, you can choose to end the GAA. If you acquire a passenger automobile in a trade-in, depreciate the carryover basis separately as if the trade-in did not occur. You used the mid-quarter convention because this was the only item of business property you placed in service in 2019 and it was placed in service during the last 3 months of your tax year. There are several methods of depreciation that can be used, including straight-line, accelerated methods (such as sum-of-the-years-digits and declining-balance methods), and units-of-production methods. Larrys business use of the property (all of which is qualified business use) is 80% in 2020, 60% in 2021, and 40% in 2022. Depreciation for machines, buildings, or other fixed assets used in the manufacture of products is recorded in the Depreciation related to manufacturing is recorded in which account ?manufacturing in, Finished goods inventory and then to cost of goods sold. You must apply the table rates to your property's unadjusted basis each year of the recovery period. However, you can choose to depreciate certain intangible property under the income forecast method (discussed later). Total section 179 deduction ($10,000) and depreciation claimed ($6,618) for 2018 through 2021. For purposes of the business income limit, the taxable income of a partner engaged in the active conduct of one or more of a partnership's trades or businesses includes their allocable share of taxable income derived from the partnership's active conduct of any trade or business. Do you agree? Continue to claim a deduction for depreciation on property used in your business or for the production of income even if it is temporarily idle (not in use). James bought a truck last year that had to be modified to lift materials to second-story levels. Your property is qualified property if it meets the following. Students also viewed Mastering Depreciation 50 terms Sochoa2 AIPB Mastering Depreciation 77 terms djguidice AIPB Depreciation 138 terms tayoung1971 Business Accounting 117 terms Kellyreneb You are married. If you buy property and assume (or buy subject to) an existing mortgage or other debt on the property, your basis includes the amount you pay for the property plus the amount of the assumed debt. However, the election for residential rental property and nonresidential real property can be made on a property-by-property basis. Property required to be depreciated under the Alternative Depreciation System (ADS). You place the property in service in the business or income-producing activity on the date of the change. WebMany depreciation methods allow IAS16 for the entity to select based on the nature of assets and how the assets contribute to the entitys future economic benefit. The total cost of the early retirement would be charged to accumulated depreciation, without adjustment for whether the specific property item has reached the average life. Other property used for transportation does not include the following qualified nonpersonal use vehicles (defined earlier under Passenger Automobiles). Step 3$20,000 ($1,100,000 $1,080,000). After you have set up a GAA, you generally figure the MACRS depreciation for it by using the applicable depreciation method, recovery period, and convention for the property in the GAA. You must also reduce your depreciation deduction if only a portion of the property is used in a business or for the production of income. in chapter 1 for a definition of improvements. It lists the percentages for property based on the 150% Declining Balance method of depreciation using the Mid-Quarter Convention, Placed in Service in Fourth Quarter. Second year. This is the amount realized of $35,000 minus the adjusted depreciable basis of $23,040. If the videocassette has a useful life of 1 year or less, you can currently deduct the cost as a business expense. During the year, you made substantial improvements to the land on which your paper plant is located. Table 4-1 lists the types of property you can depreciate under each method. Julies property has a recovery period of 5 years under ADS.

If you are in the business of renting videocassettes, you can depreciate only those videocassettes bought for rental. 534. Use the applicable convention, as explained in the following discussions. Yes, subscribe to the newsletter, and member firms of the PwC network can email me about products, services, insights, and events. Let's say, ABC company purchases machinery for $25,000. . Access your tax records, including key data from your most recent tax return, and transcripts. That part of an estate that is left after all the other provisions of a will have been satisfied. The basis of real property also includes certain fees and charges you pay in addition to the purchase price. You check Table B-1 and find land improvements under asset class 00.3. It includes the following property. If you begin to rent a home that was your personal home before 1987, you depreciate it as residential rental property over 27.5 years.