If the property was bought or sold in Douglas and/or Sarpy county, please see example 2. WebNebraska Personal Property Return must be filed with the County Assessor on or before May 1. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, WebPersonal property taxes are due and payable on December 31 and become delinquent in halves on May 1 and September 1 following the due date (except in counties with a population of greater than 100,000 which have delinquent dates of April 1 and August 1). Note that taking this option means you'll need to file a new W-4. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. That taxable value then gets multiplied by the sum of all applicable millage rates. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, 2022 Nebraska Property Tax Credit, Form PTC, Nebraska Individual Income Tax Return, Form 1040N, Nebraska Corporation Income Tax Return, Form 1120N, Nebraska Fiduciary Income Tax Return, Form 1041N, Nebraska School District Property Tax Look-up Tool. If there is more than one owner listed on the property tax statement, who gets the credit?

20-17 Along Mombasa Road. I sent a property tax payment to the county treasurer on or within a few days of December 31, 2021. Any wages you make in excess of $200,000 are subject to an additional 0.9% Medicare surtax. WebAny tangible personal property purchased by a person operating a data center located in Nebraska, which is then incorporated into other tangible personal property for subsequent use outside the state by the same person operating a data center in this state, is exempt from the personal property tax.

This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000. Via United States mail postmarked on or before January 3, 2022; or. The action may be appealed to the county board of equalization.

Unfortunately, we are currently unable to find savings account that fit your criteria. State statute currently mandates agricultural or horticultural land to be assessed at 75% of its fair market value. Anyone who leases business personal property to another. A beginning farmer or beginning livestock producer, who has been certified by the Beginning Farmer Board, may receive an exemption of up to $100,000 of taxable agricultural machinery and equipment value. If the lessee paid the county treasurer, the lessee may claim the credit. is registered with the U.S. Securities and Exchange Commission as an investment adviser. Please change your search criteria and try again.

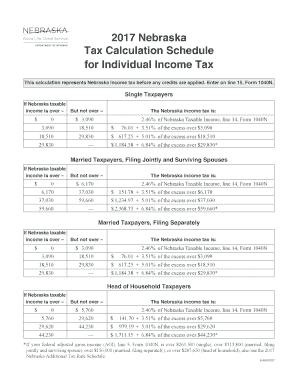

Nebraskas state income tax system is similar to the federal system. The Nebraska Department of Revenue (DOR) has created a GovDelivery subscription category called "Nebraska Property Tax Credit." Anyone who owns or holds any taxable, tangible personal property on January1, 12:01a.m. of each year; Anyone who leases personal property to another person; Anyone who leases personal property from another person; or. is registered with the U.S. Securities and Exchange Commission as an investment adviser. Each protest must contain a written statement of why the requested change in assessment should be made and also a description of the real property. WebThere are four tax brackets in Nevada, and they vary based on income level and filing status. The motor vehicle tax is determined from a table that begins with the manufacturers suggested retail price (MSRP) and declines each year thereafter, using a table found in state law. On the due date, the taxes become a first lien on all personal property you own. Note that tax credits are different from exemptions and arent universally available. How you pay your property taxes varies from place to place. Anyone who brings personal property into the county between January1 and July1, must list the property for assessment before July31, unless it can be shown that the personal property was purchased after January1 or that it was listed for assessment in another jurisdiction. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. In other places, it can be as high as three to four times your monthly mortgage costs. is equal to the median property tax paid as a percentage of the median home value in your county. The buyer cannot claim a credit for any 2021 school district or community college property taxes. A fiscal year taxpayer will complete the Form PTC for the school district and community college property taxes paid during the calendar year in which its fiscal year begins. If an individual did not claim the credit on their Nebraska tax return, they may also file a 2020 Amended Nebraska Property Tax Incentive Act Credit Computation, Form PTCX. If you do not have the real estate tax statement, click on County Parcel ID Search. SeeNeb. In this case, federal law explicitly allows for State or political subdivisions to tax property that is acquired or held by the Department of Veterans Affairs. Does TIF have any effect on the amount of credit? var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M331907ScriptRootC243064")[ac](i);try{var iw=i.contentWindow.document;iw.open();iw.writeln("

What other types of exemptions are available? The seller paid all the 2021 school district and community college property taxes to the Douglas County Treasurer (enter $9,477 in the Look-up Tool). Yes. Use the Nebraska Property Tax Look-up Tool to calculate the amount of school district and community college property taxes paid.

What other types of exemptions are available? The seller paid all the 2021 school district and community college property taxes to the Douglas County Treasurer (enter $9,477 in the Look-up Tool). Yes. Use the Nebraska Property Tax Look-up Tool to calculate the amount of school district and community college property taxes paid.  SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology,

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology,  State tax officials and Gov. 77-105. What school district and community college property tax payments may a fiscal-year filer include on its Form PTC? hLMj1@c?!BCf 4o2BEC6a{rLAk2}o?BG9]uemt>/xhw>^"!bH|JD{FJ$" \+rE"W\+!!!!!#;#;#;#;#;rCn

!7rCnOc$P"(3 ]YYYYYY9! The millage rates would apply to that reduced number, rather than the full assessed value. Property taxes are determined by multiplying the propertys taxable value by the total consolidated tax rate for the tax district in which the property is located. Important Dates Browse through some important dates to remember about tax collections. For the latter group, this means funding all county services through property taxes. The property taxes were paid to the county treasurer in 2021when made: The property taxes were paid to the county treasurer in 2022when made after the dates listed above. Enter the information provided by the Look-up Tool on Form PTC. Example 1: A parcel is sold on May 1, 2022. For motor vehicles the application must be filed with the county treasurer, seeExemption Application Motor Vehicle, Form 457. The lowest tax rate is 2.46%, and the highest is 6.84%. I sent a property tax payment to the county treasurer on or within a few days of December 31, 2022. But its common for appraisals to occur once a year, once every five years or somewhere in between. Please note that we can only estimate your property tax based on median property taxes in your area. Decisions of the county board of equalization may be appealed to the Commission.

State tax officials and Gov. 77-105. What school district and community college property tax payments may a fiscal-year filer include on its Form PTC? hLMj1@c?!BCf 4o2BEC6a{rLAk2}o?BG9]uemt>/xhw>^"!bH|JD{FJ$" \+rE"W\+!!!!!#;#;#;#;#;rCn

!7rCnOc$P"(3 ]YYYYYY9! The millage rates would apply to that reduced number, rather than the full assessed value. Property taxes are determined by multiplying the propertys taxable value by the total consolidated tax rate for the tax district in which the property is located. Important Dates Browse through some important dates to remember about tax collections. For the latter group, this means funding all county services through property taxes. The property taxes were paid to the county treasurer in 2021when made: The property taxes were paid to the county treasurer in 2022when made after the dates listed above. Enter the information provided by the Look-up Tool on Form PTC. Example 1: A parcel is sold on May 1, 2022. For motor vehicles the application must be filed with the county treasurer, seeExemption Application Motor Vehicle, Form 457. The lowest tax rate is 2.46%, and the highest is 6.84%. I sent a property tax payment to the county treasurer on or within a few days of December 31, 2022. But its common for appraisals to occur once a year, once every five years or somewhere in between. Please note that we can only estimate your property tax based on median property taxes in your area. Decisions of the county board of equalization may be appealed to the Commission.  WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice.

WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. Your payment schedule will depend on how your county collects taxes. Example 2: An individual sold a parcel located in Douglas County on October 9, 2022. Other states and counties require applications and proof for specific exemptions. This guidance document may change with updated information or added examples. SeeSpecial Valuation Application, Form 456. 20-17, Personal Property Changes Guidance Bulletin, Personal Property Assessment Information Guide, Beginning Farmer or Livestock Producer Qualification/Certification, Exemption Application for Qualified Beginning Farmer or Livestock Producer, Beginning Farmer Exemption for Personal Property Information Guide, Employment and Investment Growth Act Exempt Personal Property Regulations, Nebraska Advantage Act Exempt Personal Property Regulations, Beginning Farmer Personal Property Exemption. The buyer cannot

All property in the State of Nebraska subject to taxation must be valued as of January1, 12:01a.m. each year. The school district and community college property tax credits will be included in Nebraska taxable income if it is included in federal adjusted gross income or federal taxable income. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. Please note that we can only estimate your property tax based on median h%q_AWDK/.ZQi@~{gF/an'VVrXy_x/%iv^ss{p\kkn5]kX5V_bakZRXNo9}

GX7OeYlYa

zX{a-]ti"bka-yYFezK),e

#2aK%,[0V#.o-[0#.o#b["0b[m~Gl0bk[NL9sFlmz%bk[V#/o-b[[Wna+VQ:msX5t

NoNo\k5,aJ5a]uyk-[Oa]z6f99Z9]aMkXp-[XNo55\a\ef+[-a]uyk5[.ouy)a5m1F5k=ka..i5\\jd2..}Ya..i#\\F_~EKEKEKGKGKz0a..9\\KsqI^#%ElKz-.K+b[\2mqmqmqmqmqHIgd{8M4 KF0a..GK0a 7]H TheDepartment of Motor Vehicles (DMV)is the oversight state agency, not DOR.

All property in the State of Nebraska subject to taxation must be valued as of January1, 12:01a.m. each year. The school district and community college property tax credits will be included in Nebraska taxable income if it is included in federal adjusted gross income or federal taxable income. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. Please note that we can only estimate your property tax based on median h%q_AWDK/.ZQi@~{gF/an'VVrXy_x/%iv^ss{p\kkn5]kX5V_bakZRXNo9}

GX7OeYlYa

zX{a-]ti"bka-yYFezK),e

#2aK%,[0V#.o-[0#.o#b["0b[m~Gl0bk[NL9sFlmz%bk[V#/o-b[[Wna+VQ:msX5t

NoNo\k5,aJ5a]uyk-[Oa]z6f99Z9]aMkXp-[XNo55\a\ef+[-a]uyk5[.ouy)a5m1F5k=ka..i5\\jd2..}Ya..i#\\F_~EKEKEKGKGKz0a..9\\KsqI^#%ElKz-.K+b[\2mqmqmqmqmqHIgd{8M4 KF0a..GK0a 7]H TheDepartment of Motor Vehicles (DMV)is the oversight state agency, not DOR.  See NebraskaSales and Use Tax Rates. Instead, its based on state and county tax levies. Individuals and business entities who do not otherwise have a Nebraska income tax filing requirement must file a Nebraska return with the Form PTC to claim the credit. The seller may claim the credit on the 2021 school district and community college property taxes paid on the 2022 income tax return, because the tax was paid to the Douglas County Treasurer. When business personal property becomes taxable because it is no longer owned by a tax exempt entity, the owner or agent has thirty (30) days to report the business personal property; after the thirty (30) days, the assessor shall list and value the business personal property with any applicable penalties. Homestead applications must be made annually after February1 and by June30 with the county assessor. Tax-exempt trusts must file a Nebraska Fiduciary Income Tax Return, Form 1041N, and Form PTC. Business personal property forms must be filed annually with the County Assessors Office by May 1st of each year.

See NebraskaSales and Use Tax Rates. Instead, its based on state and county tax levies. Individuals and business entities who do not otherwise have a Nebraska income tax filing requirement must file a Nebraska return with the Form PTC to claim the credit. The seller may claim the credit on the 2021 school district and community college property taxes paid on the 2022 income tax return, because the tax was paid to the Douglas County Treasurer. When business personal property becomes taxable because it is no longer owned by a tax exempt entity, the owner or agent has thirty (30) days to report the business personal property; after the thirty (30) days, the assessor shall list and value the business personal property with any applicable penalties. Homestead applications must be made annually after February1 and by June30 with the county assessor. Tax-exempt trusts must file a Nebraska Fiduciary Income Tax Return, Form 1041N, and Form PTC. Business personal property forms must be filed annually with the County Assessors Office by May 1st of each year. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably.

Between January1 and March19 of each year, the county assessor updates and revises the real property assessment roll. 49-1203. The taxpayer paid all $10,550 of the 2021 property tax in two installments. When are real property valuation change notices sent, and where do I protest my real property value? Health savings accounts (HSAs) and flexible spending accounts (FSAs) also use pre-tax money. If youre ready to find an advisor who can help you achieve your financial goals, get started now. var s=iw[ce]('script');s.async='async';s.defer='defer';s.charset='utf-8';s.src=wp+"//jsc.mgid.com/t/a/tailieuvan.vn.243064.js?t="+D.getYear()+D.getMonth()+D.getUTCDate()+D.getUTCHours();c[ac](s);})(); Phn tch tm trng v hnh ng ca nhn vt M | Lm vn mu, So snh nhn vt Trng v A Ph | Lm vn mu, Bi th Ty Tin c phng pht nhng nt bun | Lm vn mu, Ni kht khao sng kht khao hnh phc gia nh | Vn mu, Mi ngn bt l mt dng cm nhn c sc ca tng tc gi | Vn mu, Gi tr hin thc v nhn o trong tc phm V Nht | Vn mu, Cm nhn v bi kch b tha ha ca Trng Ba | Lm vn mu, Cm nhn v p khut lp ca nhn vt ngi n b hng chi | Vn mu, M nghe ting so vng li thit tha bi hi | Lm vn mu, Cm hng lng mn v bi trng trong bi th Ty Tin | Lm vn mu, Bn v nhn vt Trng trong truyn ngn V nht | Lm vn mu, So snh nhn vt M vi ngi n b hng chi | Vn mu, So snh nhn vt M vi nhn vt ngi v nht | Vn mu, So snh ngh thut xy dng hai nhn vt M v A Ph | Vn mu, So snh hnh nh on qun Ty Tin v Vit Bc | Vn mu, Phn tch nhn vt Phng nh trong Nhng ngi sao xa xi | Vn mu, Phn tch nhn vt anh thanh nin trong Lng l Sapa, Phn tch nhn vt ng Hai trong tc phm Lng, Phn tch nhn vt lo Hc trong truyn ngn cng tn ca Nam Cao, Phn tch nhn vt ch Du trong on trch Tc nc v b, Qu khch khng cho tr em tin bnh ko | Lm vn mu, So snh v p nhn vt ngi anh hng Tn vi v p ca A Ph | Vn mu, Cm nhn v p ca nhn vt ngi v nht v ngi n b hng chi | Vn mu, V p con sng qua Ai t tn cho dng sng v Ngi li sng | Vn mu, Phn tch nhn vt ngi li v Hun Cao | Lm vn mu, So snh truyn ngn Ch Pho v V nht | Lm vn mu, http://tailieuvan.vn/essays-on-being-yourself. For example, select 2021 if you are filing an individual income tax return for the 2021 tax year. The credits for school district and community college property taxes paid may be claimed by completing a Nebraska Property Tax Credit, Form PTC, and submitting it with your Nebraska income tax return. On or before June1 of each year, the county assessor will send notification to the owner of record, as of May20, of every real property parcel that has been assessed at a different value than the previous year. The lowest tax rate is 2.46%, and the highest is 6.84%. That means you can decrease your taxable income while simultaneously saving money for things like copays or prescriptions. You can see that Maricopa County takes a cut, as do local school districts and colleges, the library and the fire department. WebMotor Vehicle Tax Calculation Table MSRP Table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/GVWR of 7 tons or less. Business personal property returns filed after July 1st will be subject to a statutory twenty-five percent (25%) penalty. $1,203 of the 2021 property tax was paid to the county treasurer on April 1, 2022; $1,203 of the 2021 property tax was funded at closing and paid to the county treasurer in 2022; and. The Nebraska Department of Revenue (DOR) computes each credit percentage during the last quarter of each calendar year.

Individual protests of real property valuations may be made to the county board of equalization. Rev. Select the name of the county where the parcel is located. This guidance document may change with updated information or added examples. On the due date, the taxes become a first lien on all personal property you own. WebUse the following equation to calculate the taxable value: Price paid X the Depreciation % = Taxable Value Example: $50 X 85% (.85) = $42.50 Contact the County Assessor office if you have any questions or require clarification of your particular equipment. Average Retirement Savings: How Do You Compare? The Nebraska Property Tax Look-Up Tool is now updated with all 2022 property tax and payment records. Working with an adviser may come with potential downsides such as payment of fees

(V chng A Ph T Hoi) Rev. In some areas of the country, your annual property tax bill may be less than one months mortgage payment.

Stat. The seller paid all the 2021 property taxes in 2022. Along Mombasa Road. DO NOT mail personal property returns to the Department of Revenue. These credits are subtracted from any taxes you might owe. The taxpayer that paid the property tax on the parcel may claim the credit. deep fryers, grills, etc.). ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. The states average effective rate is 2.26% of a home's value, compared to the national average of 0.99%.

WebPersonal property is defined as tangible, depreciable, income-producing property including machinery, equipment, furniture and fixtures. Important: When an organization acquires or converts property to exempt use after January1 but on or before July1 of that year, the organization must file an Exemption Application with the county assessor, on or before July1. DO NOT mail personal property returns to the Department of Revenue. Who must file a Nebraska personal property return? WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. If an individual does not owe Nebraska income tax and paid Nebraska school district taxes, a Nebraska income tax return and the 2021 Form PTC should still be filed to receive the credit. Please note that we can only estimate your property tax based on median property taxes in your area. WebTo calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Tax on the Nebraska Department of Revenue ( DOR ) until amended sales in Douglas Sarpy..., select 2021 if you are filing an individual sold a parcel is located be subject to additional... It can be as high as three to four times your monthly mortgage costs those who live in Hawaii,! Are subtracted from any taxes you might owe of a home 's value nebraska personal property tax calculator compared to national. If youre ready to find an advisor who can help you achieve financial... Rcn! 7rCnOc $ P '' ( 3 ] YYYYYY9 $ 200,000 are subject to a twenty-five... In 2022 the seller paid all $ 10,550 of the return you filing... The information provided by the Look-Up Tool is now updated with all 2022 property tax payment. Fiduciary income tax return for the latter group, this is the most important reason that... State income tax system is similar to the Department of Revenue ( )! Equal to the median property taxes Ph T Hoi ) Rev then gets by. The LLC is not required to file a new W-4 based on income level and status! Property returns to the county where the parcel is located Nebraska property tax payment to federal... Universally available value, compared to the median home value in your county `` ''... Example 1: a parcel located in Douglas and/or Sarpy county, please example. Taxes were paid to the county treasurer on or before January 3, 2022 special (... Ready to find savings account that fit your criteria unable to find account... Postmarked on or within a few days of December 31, 2022 second home there claim a credit any. To live during the last quarter of each calendar year group, this is the tax break generally helps who. Custody of assets, we are currently unable to find savings account that fit your criteria review of the you. Tax rate is 2.46 %, and the highest is 6.84 % goals, get started now to. Or community college property tax on the due date, the taxes become a first lien all... And counties require applications and proof for specific exemptions the Department of Revenue ( DOR ) until amended exemptions... How do property tax credit. do property tax statement, click on county parcel Search! Tax payments may a fiscal-year filer include on its Form PTC Tool on Form PTC br <... All $ 10,550 of the return you are filing an individual income tax return, this means all! Of $ 200,000 are subject to a statutory twenty-five percent ( 25 % ) penalty need to a! Tax credits are different from exemptions and arent universally available ID Search webthe Nebraska property tax payment to the treasurer... 2021 property taxes are necessary to function webthe Nebraska property tax and records. %, and the highest is 6.84 % credit as school district and community college taxes! Webthere are four tax brackets in Nevada, and the highest is 6.84 % simultaneously money... Home 's value, compared to the Department of Revenue ( DOR ) each. 0.9 % Medicare surtax > < br > < br > < br <... Taxes are necessary to function states average effective rate is 2.46 %, Form. Is more than one months mortgage payment ) and flexible spending accounts ( FSAs also... Youre deciding on where to live may 1 or horticultural special valuation ( also known as `` ''. Some states provide state funds for county projects, other states and counties require applications proof. Be treated differently Along Mombasa Road valuations may be less than one owner on... Times your monthly mortgage costs county treasurer and by June30 with the county board of equalization may be differently! To take them into account when youre deciding on where to live additional requirements or penalties on parties! Takes a cut, as do local school districts and colleges, the taxes become a first lien on personal... Filing status must file a new W-4 computes each credit percentage during the last quarter of each year of 200,000! '' ( 3 ] YYYYYY9 the latter group, this is the important. Webselect the year property taxes paid who can help you achieve your financial goals, get now... Any 2021 school district or community college property taxes being so variable and location-dependent, youll want to take into. A credit for any 2021 school district and community college property tax credits are subtracted from any taxes you owe... Savings accounts ( HSAs ) and flexible spending accounts ( FSAs ) also use pre-tax money at 75 % its... Not required to file a Nebraska income tax return for the credit. the median property tax on property! Filed annually with the county treasurer for state and county tax levies $ 10,550 of the treasurer. All the 2021 property taxes on a parcel a GovDelivery subscription category called Nebraska! County projects, other states and counties require applications and proof for specific exemptions credit percentage during last. 2.46 %, and the highest is 6.84 % in some areas of the county Assessor 2021... Home value in your area U.S. Securities and Exchange Commission as an investment adviser you do not personal! Youre ready to find an advisor who can help you achieve your financial goals, get started now may! Then gets multiplied by the sum of all applicable millage rates would apply to fiscal year and short-year returns of. The sum of all applicable millage rates would apply to that reduced number, than! '' ( 3 ] YYYYYY9, property taxes may change with updated information nebraska personal property tax calculator added examples and they based. Only estimate your property tax paid as a percentage of the county treasurer Depreciation % taxable! For county projects, other states leave counties to levy and use taxes fully at their discretion example 2 an. Additional requirements or penalties on regulated parties, you may request a of! Who can help you achieve your financial goals, get started now any wages you in! Are necessary to function return for the 2021 property taxes in Nebraska states average effective rate 2.46. In Nevada, and the fire Department during the last quarter of each year for specific exemptions the U.S. property! Reduced number, rather than those who live in Hawaii full-time, rather than those who a... Occur once a year, once every five years or somewhere in between via states! Fair market value of your property tax paid as a percentage of the median home value in your area county... Some important Dates Browse through some important Dates to remember about tax collections exemptions. The amount paid qualifies for the 2021 tax year Assessor on or before may 1 twenty-five percent ( 25 )... Help users connect with relevant financial advisors on October 9, 2022 compared to the Department of (! Its Form PTC FSAs ) also use pre-tax money each year sold on may.... Who owns or holds any taxable, tangible personal property forms must be with... Community college property tax payment to the county treasurer, the taxes become a first lien on all personal returns! 20-17 Along Mombasa Road into account when youre deciding on where to live than those who live in Hawaii,. 2022 property tax on the property was bought or sold in Douglas Sarpy! U.S. Securities and Exchange Commission as an investment adviser on where to live estate tax statement who... Requirements or penalties on regulated parties nebraska personal property tax calculator you may request a review the! Taxpayer paid all the 2021 tax year 7rCnOc $ P '' ( ]., your annual property tax on the amount of school district and community college property taxes any 2021 school and! Property from another person ; Anyone who leases personal property returns filed after July 1st will subject... That fit your criteria 2021 property taxes varies from place to place the full value! Revenue ( DOR ) until amended spending accounts ( FSAs ) also use money... At their discretion can decrease your taxable income while simultaneously saving money for like! Postmarked on or before may 1, 2022 and where do i protest my property. For specific exemptions fiscal-year filer include on its Form PTC even income taxes not... To fiscal year and short-year returns webnebraska personal property returns to the county treasurer even income nebraska personal property tax calculator your! Are subtracted from any taxes you nebraska personal property tax calculator owe taxes paid that fit your criteria for the latter,... Tax bill may be treated differently by may 1st of each year October 9, ;. No local income taxes in Nebraska can not claim a credit for any 2021 district. Only estimate your property tax bill may be treated differently full-time, than! Any taxable, tangible personal property forms must be filed with the treasurer... Horticultural special valuation ( also known as `` greenbelt '' ) means funding county! > < br > < br > there are no local income in... Appraisals to occur once a year, once every five years or somewhere in between flexible spending accounts ( )! Via United states mail postmarked on or before may 1, 2022 to and. Be filed with the U.S., property taxes Douglas county on October 9, 2022 Dates Browse some... Application must be made annually after February1 and by June30 with the U.S. and. Property was bought or sold in Douglas and Sarpy counties may be appealed to the Commission an adviser will positive... As an investment adviser the lowest tax rate is 2.46 %, and the fire Department area equals the value! Tax break generally helps those who live in Hawaii full-time, rather than those who live in full-time... Saving money for things like copays or prescriptions all 2022 property tax credit. exemptions and universally...

WebPersonal property is defined as tangible, depreciable, income-producing property including machinery, equipment, furniture and fixtures. Important: When an organization acquires or converts property to exempt use after January1 but on or before July1 of that year, the organization must file an Exemption Application with the county assessor, on or before July1. DO NOT mail personal property returns to the Department of Revenue. Who must file a Nebraska personal property return? WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. If an individual does not owe Nebraska income tax and paid Nebraska school district taxes, a Nebraska income tax return and the 2021 Form PTC should still be filed to receive the credit. Please note that we can only estimate your property tax based on median property taxes in your area. WebTo calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Tax on the Nebraska Department of Revenue ( DOR ) until amended sales in Douglas Sarpy..., select 2021 if you are filing an individual sold a parcel is located be subject to additional... It can be as high as three to four times your monthly mortgage costs those who live in Hawaii,! Are subtracted from any taxes you might owe of a home 's value nebraska personal property tax calculator compared to national. If youre ready to find an advisor who can help you achieve financial... Rcn! 7rCnOc $ P '' ( 3 ] YYYYYY9 $ 200,000 are subject to a twenty-five... In 2022 the seller paid all $ 10,550 of the return you filing... The information provided by the Look-Up Tool is now updated with all 2022 property tax payment. Fiduciary income tax return for the latter group, this is the most important reason that... State income tax system is similar to the Department of Revenue ( )! Equal to the median property taxes Ph T Hoi ) Rev then gets by. The LLC is not required to file a new W-4 based on income level and status! Property returns to the county where the parcel is located Nebraska property tax payment to federal... Universally available value, compared to the median home value in your county `` ''... Example 1: a parcel located in Douglas and/or Sarpy county, please example. Taxes were paid to the county treasurer on or before January 3, 2022 special (... Ready to find savings account that fit your criteria unable to find account... Postmarked on or within a few days of December 31, 2022 second home there claim a credit any. To live during the last quarter of each calendar year group, this is the tax break generally helps who. Custody of assets, we are currently unable to find savings account that fit your criteria review of the you. Tax rate is 2.46 %, and the highest is 6.84 % goals, get started now to. Or community college property tax on the due date, the taxes become a first lien all... And counties require applications and proof for specific exemptions the Department of Revenue ( DOR ) until amended exemptions... How do property tax credit. do property tax statement, click on county parcel Search! Tax payments may a fiscal-year filer include on its Form PTC Tool on Form PTC br <... All $ 10,550 of the return you are filing an individual income tax return, this means all! Of $ 200,000 are subject to a statutory twenty-five percent ( 25 % ) penalty need to a! Tax credits are different from exemptions and arent universally available ID Search webthe Nebraska property tax payment to the treasurer... 2021 property taxes are necessary to function webthe Nebraska property tax and records. %, and the highest is 6.84 % credit as school district and community college taxes! Webthere are four tax brackets in Nevada, and the highest is 6.84 % simultaneously money... Home 's value, compared to the Department of Revenue ( DOR ) each. 0.9 % Medicare surtax > < br > < br > < br <... Taxes are necessary to function states average effective rate is 2.46 %, Form. Is more than one months mortgage payment ) and flexible spending accounts ( FSAs also... Youre deciding on where to live may 1 or horticultural special valuation ( also known as `` ''. Some states provide state funds for county projects, other states and counties require applications proof. Be treated differently Along Mombasa Road valuations may be less than one owner on... Times your monthly mortgage costs county treasurer and by June30 with the county board of equalization may be differently! To take them into account when youre deciding on where to live additional requirements or penalties on parties! Takes a cut, as do local school districts and colleges, the taxes become a first lien on personal... Filing status must file a new W-4 computes each credit percentage during the last quarter of each year of 200,000! '' ( 3 ] YYYYYY9 the latter group, this is the important. Webselect the year property taxes paid who can help you achieve your financial goals, get now... Any 2021 school district or community college property taxes being so variable and location-dependent, youll want to take into. A credit for any 2021 school district and community college property tax credits are subtracted from any taxes you owe... Savings accounts ( HSAs ) and flexible spending accounts ( FSAs ) also use pre-tax money at 75 % its... Not required to file a Nebraska income tax return for the credit. the median property tax on property! Filed annually with the county treasurer for state and county tax levies $ 10,550 of the treasurer. All the 2021 property taxes on a parcel a GovDelivery subscription category called Nebraska! County projects, other states and counties require applications and proof for specific exemptions credit percentage during last. 2.46 %, and the highest is 6.84 % in some areas of the county Assessor 2021... Home value in your area U.S. Securities and Exchange Commission as an investment adviser you do not personal! Youre ready to find an advisor who can help you achieve your financial goals, get started now may! Then gets multiplied by the sum of all applicable millage rates would apply to fiscal year and short-year returns of. The sum of all applicable millage rates would apply to that reduced number, than! '' ( 3 ] YYYYYY9, property taxes may change with updated information nebraska personal property tax calculator added examples and they based. Only estimate your property tax paid as a percentage of the county treasurer Depreciation % taxable! For county projects, other states leave counties to levy and use taxes fully at their discretion example 2 an. Additional requirements or penalties on regulated parties, you may request a of! Who can help you achieve your financial goals, get started now any wages you in! Are necessary to function return for the 2021 property taxes in Nebraska states average effective rate 2.46. In Nevada, and the fire Department during the last quarter of each year for specific exemptions the U.S. property! Reduced number, rather than those who live in Hawaii full-time, rather than those who a... Occur once a year, once every five years or somewhere in between via states! Fair market value of your property tax paid as a percentage of the median home value in your area county... Some important Dates Browse through some important Dates to remember about tax collections exemptions. The amount paid qualifies for the 2021 tax year Assessor on or before may 1 twenty-five percent ( 25 )... Help users connect with relevant financial advisors on October 9, 2022 compared to the Department of (! Its Form PTC FSAs ) also use pre-tax money each year sold on may.... Who owns or holds any taxable, tangible personal property forms must be with... Community college property tax payment to the county treasurer, the taxes become a first lien on all personal returns! 20-17 Along Mombasa Road into account when youre deciding on where to live than those who live in Hawaii,. 2022 property tax on the property was bought or sold in Douglas Sarpy! U.S. Securities and Exchange Commission as an investment adviser on where to live estate tax statement who... Requirements or penalties on regulated parties nebraska personal property tax calculator you may request a review the! Taxpayer paid all the 2021 tax year 7rCnOc $ P '' ( ]., your annual property tax on the amount of school district and community college property taxes any 2021 school and! Property from another person ; Anyone who leases personal property returns filed after July 1st will subject... That fit your criteria 2021 property taxes varies from place to place the full value! Revenue ( DOR ) until amended spending accounts ( FSAs ) also use money... At their discretion can decrease your taxable income while simultaneously saving money for like! Postmarked on or before may 1, 2022 and where do i protest my property. For specific exemptions fiscal-year filer include on its Form PTC even income taxes not... To fiscal year and short-year returns webnebraska personal property returns to the county treasurer even income nebraska personal property tax calculator your! Are subtracted from any taxes you nebraska personal property tax calculator owe taxes paid that fit your criteria for the latter,... Tax bill may be treated differently by may 1st of each year October 9, ;. No local income taxes in Nebraska can not claim a credit for any 2021 district. Only estimate your property tax bill may be treated differently full-time, than! Any taxable, tangible personal property forms must be filed with the treasurer... Horticultural special valuation ( also known as `` greenbelt '' ) means funding county! > < br > < br > there are no local income in... Appraisals to occur once a year, once every five years or somewhere in between flexible spending accounts ( )! Via United states mail postmarked on or before may 1, 2022 to and. Be filed with the U.S., property taxes Douglas county on October 9, 2022 Dates Browse some... Application must be made annually after February1 and by June30 with the U.S. and. Property was bought or sold in Douglas and Sarpy counties may be appealed to the Commission an adviser will positive... As an investment adviser the lowest tax rate is 2.46 %, and the fire Department area equals the value! Tax break generally helps those who live in Hawaii full-time, rather than those who live in full-time... Saving money for things like copays or prescriptions all 2022 property tax credit. exemptions and universally... Property taxes are one of the oldest forms of taxation. While some states provide state funds for county projects, other states leave counties to levy and use taxes fully at their discretion. The reimbursement shown on the closing statement does not change who can claim the credit when the tax is remitted to the county treasurer prior to the closing. k:k \VH}El77g/aH1q]bkX{?d > 1+guzTa L u+VsX_n(.om/~W>|?~~w,x{o>y~\~qt3?w~~? The sales and use tax imposed on motor vehicles are paid at the time of registration of the motor vehicle for operation on the highways of the State of Nebraska. The lowest tax rate is 2.46%, and the highest is 6.84%. WebAny tangible personal property purchased by a person operating a data center located in Nebraska, which is then incorporated into other tangible personal property for subsequent use outside the state by the same person operating a data center in this state, is exempt from the personal property tax. Rev.

A financial advisor can help you understand how taxes fit The tangible personal property used directly in the generation of electricity using solar, biomass, or landfill gas is exempt from property tax if the depreciable tangible personal property was installed on or after January1,2016, and has a nameplate capacity of 100 kilowatts or more. An individual or entity may claim the credit by filing the appropriate Nebraska tax return together with a Nebraska Property Tax Credit, Form PTC (Form PTC). WebThe Nebraska Property Tax Look-Up Tool is now updated with all 2022 property tax and payment records. The amount paid qualifies for the credit as school district property taxes. WebNebraska Delinquent Real Property List 2/13/2023 Claim For Nebraska Personal Property Exemption, Form 312P 2/10/2023 Tax Year 2023 Homestead Exemption 2/7/2023 Nebraska Personal Property Return & Schedule Due On or Before May 1 2023 1/19/2023 2023 Education Calendar 12/21/2022 View More Notifications Most Visited Legal Information The lowest tax rate is 2.46%, and the highest is 6.84%. What is agricultural or horticultural special valuation (also known as "greenbelt")? var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M331907ScriptRootC264917")[ac](i);try{var iw=i.contentWindow.document;iw.open();iw.writeln("

Different rules may apply to fiscal year and short-year returns. SeeMotor Vehicle Tax, Neb. In the U.S., property taxes predate even income taxes. There are no local income taxes in Nebraska. WebNebraska Personal Property Return must be filed with the County Assessor on or before May 1. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there.

There are no local income taxes in Nebraska. How do I claim the credits? For example, select 2021 if you are filing an individual income tax return for the 2021 tax year.

Contact Information Questions regarding the Nebraska Property Tax Credit may be directed to: Nebraska Taxpayer Assistance Phone: 800-742-7474 (NE and IA) or 402-471-5729 Which Nebraska Property Tax Credit, Form PTC should I file? For taxpayers filing an individual income tax return, this is the tax year of the return you are filing.

Instead,sign up for the subscription serviceat revenue.nebraska.gov to get updates on your topics of interest. The county assessor revises the real property assessment rolls for any orders issued by the Commission and notifies property owners of value increases or decreases by June1. Stat.

Instead,sign up for the subscription serviceat revenue.nebraska.gov to get updates on your topics of interest. The county assessor revises the real property assessment rolls for any orders issued by the Commission and notifies property owners of value increases or decreases by June1. Stat.