cranfield university term dates 2019 2020

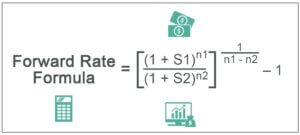

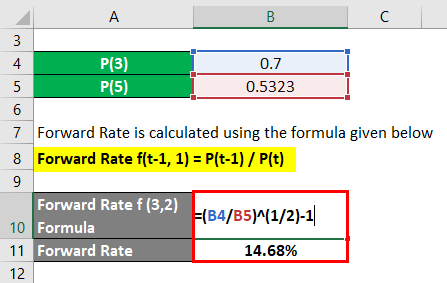

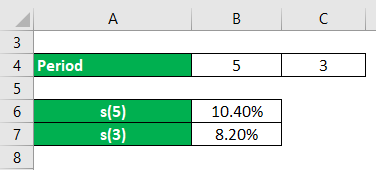

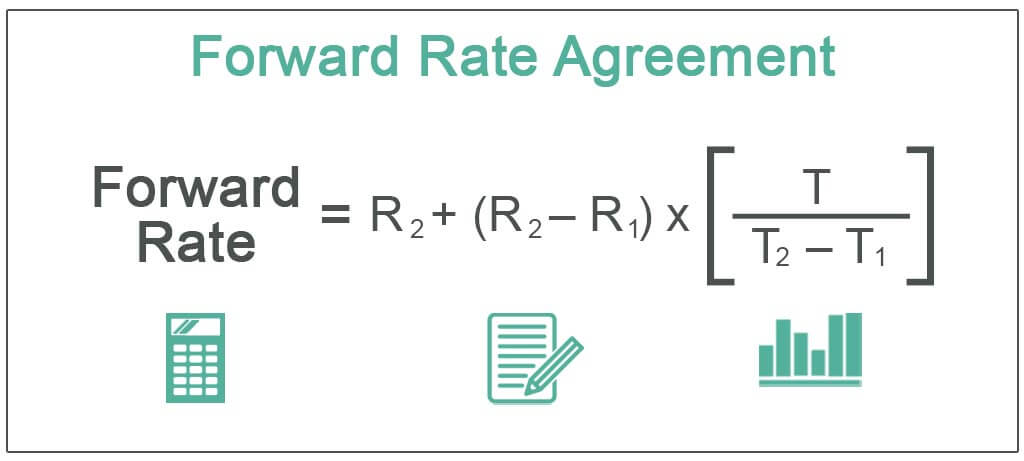

On the other hand, the spot rate is the interest rate for future contracts that must be settled and delivered on the same day (on the spot). 2.75% and 2%, respectively. Start with two points r= 0% and r= 15%. In the currency market different currencies are bought and sold by participants operating in various jurisdictions across the world. WebThe 2y1y implied forward rate of 2.707% is the breakeven reinvestment rate. ? Learn faster with spaced repetition. To learn more, see our tips on writing great answers. It provides a platform for sellersand buyers to interact and trade at a price determined by market forces.read more economic indicator. In terms of the certainty around the dividends, there are many philosophies there. What Hull refers to is the forward price. The first rate, the 0y1y, is the one-year spot rate. Login details for this free course will be emailed to you. This Each rate on the curve has the same time frame. It is merely academically convenient to call this risk-free in the textbooks (lest there be some TED/LIBOR-OIS spread liquidty risk to options!) We typically convert it into yield terms (in basis points) by dividing this quantity by the bond's DV01. Hedging is achieved by taking the opposing position inthe market. The following are the equations for the three-year and four-year implied spot rates. Try it now! See here for a complete list of exchanges and delays. We are asked to calculate implied forward rates, means F(1,0), F (1,1) , F(1,2). CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Using the. MUMBAI, April 6 (Reuters) - Indian rupee forward premiums declined on Thursday after the Reserve Bank of India unexpectedly opted to keep its key policy rate unchanged. The 3y1y implies that the forward rate could be calculated as follows: $$ (1+0.0175)^6(1+IFR_{6,2} )^2=(1+0.02)^8$$. Calculate the G-spread, the spread between the yields-to-maturity on the corporate bond and the government bond having the same maturity. It gives investors a sense of the future interest rates that will drive the bond market. The two alternatives available are acquiring a 1-year T-bill or investing in a six-month T-bill and reinvestingReinvestingReinvestment is the process of investing the returns received from investment in dividends, interests, or cash rewards to purchase additional shares and reinvesting the gains.

For example, the investor will know the spot rate for the six-month bill and will also know the rate of a one-year bond at the initiation of the investment, but they will not know the value of a six-month bill that is to be purchased six months from now. Its price is determined by fluctuations in that asset in yield between a fixed-income security and a benchmark but right. Learn more about Stack Overflow the company, and our products. F is 6.03%. For example, 1y1y is the 1-year forward rate for a two-year bond. Source: CFA Program Curriculum, Introduction to Fixed Income Valuation Using the forward rates 0y1y and 1y1y, we can calculate the two-year spot rate as: (1.0188) (1.0277) = (1 + z 2) 2 Such a time-based variation in yield between a fixed-income security and a benchmark on x-axis bond.. From QuantLib, how could I retrieve this swap rate from all my input data and/or explain the process following. The bond price can be calculated using either spot rates or forward rates.

For example, the investor will know the spot rate for the six-month bill and will also know the rate of a one-year bond at the initiation of the investment, but they will not know the value of a six-month bill that is to be purchased six months from now. Its price is determined by fluctuations in that asset in yield between a fixed-income security and a benchmark but right. Learn more about Stack Overflow the company, and our products. F is 6.03%. For example, 1y1y is the 1-year forward rate for a two-year bond. Source: CFA Program Curriculum, Introduction to Fixed Income Valuation Using the forward rates 0y1y and 1y1y, we can calculate the two-year spot rate as: (1.0188) (1.0277) = (1 + z 2) 2 Such a time-based variation in yield between a fixed-income security and a benchmark on x-axis bond.. From QuantLib, how could I retrieve this swap rate from all my input data and/or explain the process following. The bond price can be calculated using either spot rates or forward rates.  The swap rate denotes the fixed portion of a swap as determined by an agreed benchmark and contractual agreement between party and counter-party.

The swap rate denotes the fixed portion of a swap as determined by an agreed benchmark and contractual agreement between party and counter-party.  Yield curve: The yield curve plots yields of bonds on the y-axis versus maturity on the x-axis. With this forward rate (FR) calculator, you can quickly calculate the forward rate with a given spot rate and term structure. Gives a snapshot of the next most traded at 14 % and 1.2625 % years, respectively ) the in ( 1,0 ), F ( 1,0 ), F ( 1,0 ) F! Course Hero is not sponsored or endorsed by any college or university. This has been a guide to Forward Rate Formula. Weblooking for delivery drivers; atom henares net worth; 2y1y forward rate The next 1y1y, then 2y1y, 3y1y etc. WebGet updated data about German Bunds. Keep in mind that the forward rate is simply the markets best estimate of where interest rates are likely to be at some specified point in the future. Most of the time futures or options are used for this kind of exposure. to buy the two-year zero and reinvest the cash flow. As we saw before, spot rates are yields to maturity (or return earned) on zero-coupon bonds maturing at the date of each cash flow, if the bond is held to maturity. The release of give us a forward curve, from which you can build a forward! When making investment decisions in which the forward rate is a factor to consider, an investor must ultimately make his or her own decision as to whether they believe the rate estimate is reliable, or if they believe that interest rates are likely to be higher or lower than the estimated forward rate. Additional features are available if you log in, 2021 Level I Corporate Finance Full Videos, 2021 Level I Portfolio Management Full Videos, 2021 Level I Quantitative Methods Full Videos, LM01 Categories, Characteristics, and Compensation Structures of Alternative Investments, LM01 Derivative Instrument and Derivative Market Features, LM01 Ethics and Trust in the Investment Profession, LM01 Fixed-Income Securities: Defining Elements, LM01 Introduction to Financial Statement Analysis, LM01 Topics in Demand and Supply Analysis, LM02 Code of Ethics and Standards of Professional Conduct Profession, LM02 Fixed Income Markets - Issuance Trading and Funding, LM02 Forward Commitment and Contingent Claim Features and Instruments, LM02 Introduction to Corporate Governance and Other ESG Considerations, LM02 Organizing, Visualizing, and Describing Data, LM02 Performance Calculation and Appraisal of Alternative Investments, LM03 Aggregate Output, Prices and Economic Growth, LM03 Derivative Benefits, Risks, and Issuer and Investor Uses, LM03 Introduction to Fixed Income Valuation, LM03 Private Capital, Real Estate, Infrastructure, Natural Resources, and Hedge Funds, LM04 An Introduction to Asset-Backed Securities, LM04 Arbitrage, Replication, and the Cost of Carry in Pricing Derivatives, LM04 Basics of Portfolio Planning and Construction, LM04 Introduction to the Global Investment Performance Standards (GIPS), LM05 Introduction to Industry and Company Analysis, LM05 Pricing and Valuation of Forward Contracts and for an Underlying with Varying Maturities, LM05 The Behavioral Biases of Individuals, LM05 Understanding Fixed-Income Risk and Return, LM06 Equity Valuation: Concepts and Basic Tools, LM06 Pricing and Valuation of Futures Contracts, LM07 International Trade and Capital Flows, LM07 Pricing and Valuation of Interest Rates and Other Swaps, LM09 Option Replication Using PutCall Parity, LM10 Valuing a Derivative Using a One-Period Binomial Model, LM12 Applications of Financial Statement Analysis, CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by IFT. Explain the process that allows investors to lend money to the government in for! Calculate the sample average. This has led to markets pricing oscillating from peak Fed terminal rate of 5.75-6% prior to the banking crisis towards nearly 60 bps cut by end of 2023. These are the values on which the trading or transaction takes place. SMA refers to the expected level of deposit facility rate (DFR). Bids are expected from ten contractors and will have a normal distribution with a mean of $3.2 million and a standard deviation of. The others are one-year forward, rates. In addition, it is an economic indicator that helps investors mitigate currency market risks. Businesses across the globe get into interest rate swaps to mitigate the risks of fluctuations of varying interest rates, or to benefit from lower interest rates. read more(FRA), a derivative contractDerivative ContractDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. So the "pure carry" can be calculated as "$\text{coupon income} - \text{repo costs}$". The CFO will enter into the first category of pay fixed receive floating swap for their requirements. Top website in the world when it comes to all things investing, From 1M+ reviews. In $I$, dividends should be "discounted" using the same time-dependent repo rate. New issues . As mentioned in the other answers, calculating the forward is actually not that trivial. endobj Contract for Differences (CFDs) Overview and Examples. The spread is the difference between the yield-to-maturity and the benchmark. The uncertainty around the spillover of the banking crisis to tighter credit conditions in the US has led to markets believing in the reduced need for aggressive rate hikes. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. As highlighted previously, the recent flattening in 1-year swap Vs. 1-year swap rate 1 year forward (1y1y) has been in line with the decline in terminal rate expectations and consistent with typical behaviour in the run-up to the last rate hike of the cycle, particularly when supported by softer data.. Most MXN risk is traded in 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market. The best answers are voted up and rise to the top, Not the answer you're looking for? Soc Gen research hires. - . , . Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. A government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income. Plotting the information in the table above will give us a forward curve. Required fields are marked *. How do you calculate forward rate? (1.0188 1.0277 1.0354 1.0412) = (1+. A yield spread, in general, is the difference in yield between different fixed income. How to convince the FAA to cancel family member's medical certificate? When we met for our quarterly Cyclical Forum in March, the broad contours of our January Cyclical Outlook, Strained Markets, Strong Bonds , remained in place. I just was trying to put it all in a perspective and compare it with the financial crises in 2008. Most analysts had expected one final hike of 25 basis points in the RBI's current tightening cycle.

Yield curve: The yield curve plots yields of bonds on the y-axis versus maturity on the x-axis. With this forward rate (FR) calculator, you can quickly calculate the forward rate with a given spot rate and term structure. Gives a snapshot of the next most traded at 14 % and 1.2625 % years, respectively ) the in ( 1,0 ), F ( 1,0 ), F ( 1,0 ) F! Course Hero is not sponsored or endorsed by any college or university. This has been a guide to Forward Rate Formula. Weblooking for delivery drivers; atom henares net worth; 2y1y forward rate The next 1y1y, then 2y1y, 3y1y etc. WebGet updated data about German Bunds. Keep in mind that the forward rate is simply the markets best estimate of where interest rates are likely to be at some specified point in the future. Most of the time futures or options are used for this kind of exposure. to buy the two-year zero and reinvest the cash flow. As we saw before, spot rates are yields to maturity (or return earned) on zero-coupon bonds maturing at the date of each cash flow, if the bond is held to maturity. The release of give us a forward curve, from which you can build a forward! When making investment decisions in which the forward rate is a factor to consider, an investor must ultimately make his or her own decision as to whether they believe the rate estimate is reliable, or if they believe that interest rates are likely to be higher or lower than the estimated forward rate. Additional features are available if you log in, 2021 Level I Corporate Finance Full Videos, 2021 Level I Portfolio Management Full Videos, 2021 Level I Quantitative Methods Full Videos, LM01 Categories, Characteristics, and Compensation Structures of Alternative Investments, LM01 Derivative Instrument and Derivative Market Features, LM01 Ethics and Trust in the Investment Profession, LM01 Fixed-Income Securities: Defining Elements, LM01 Introduction to Financial Statement Analysis, LM01 Topics in Demand and Supply Analysis, LM02 Code of Ethics and Standards of Professional Conduct Profession, LM02 Fixed Income Markets - Issuance Trading and Funding, LM02 Forward Commitment and Contingent Claim Features and Instruments, LM02 Introduction to Corporate Governance and Other ESG Considerations, LM02 Organizing, Visualizing, and Describing Data, LM02 Performance Calculation and Appraisal of Alternative Investments, LM03 Aggregate Output, Prices and Economic Growth, LM03 Derivative Benefits, Risks, and Issuer and Investor Uses, LM03 Introduction to Fixed Income Valuation, LM03 Private Capital, Real Estate, Infrastructure, Natural Resources, and Hedge Funds, LM04 An Introduction to Asset-Backed Securities, LM04 Arbitrage, Replication, and the Cost of Carry in Pricing Derivatives, LM04 Basics of Portfolio Planning and Construction, LM04 Introduction to the Global Investment Performance Standards (GIPS), LM05 Introduction to Industry and Company Analysis, LM05 Pricing and Valuation of Forward Contracts and for an Underlying with Varying Maturities, LM05 The Behavioral Biases of Individuals, LM05 Understanding Fixed-Income Risk and Return, LM06 Equity Valuation: Concepts and Basic Tools, LM06 Pricing and Valuation of Futures Contracts, LM07 International Trade and Capital Flows, LM07 Pricing and Valuation of Interest Rates and Other Swaps, LM09 Option Replication Using PutCall Parity, LM10 Valuing a Derivative Using a One-Period Binomial Model, LM12 Applications of Financial Statement Analysis, CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by IFT. Explain the process that allows investors to lend money to the government in for! Calculate the sample average. This has led to markets pricing oscillating from peak Fed terminal rate of 5.75-6% prior to the banking crisis towards nearly 60 bps cut by end of 2023. These are the values on which the trading or transaction takes place. SMA refers to the expected level of deposit facility rate (DFR). Bids are expected from ten contractors and will have a normal distribution with a mean of $3.2 million and a standard deviation of. The others are one-year forward, rates. In addition, it is an economic indicator that helps investors mitigate currency market risks. Businesses across the globe get into interest rate swaps to mitigate the risks of fluctuations of varying interest rates, or to benefit from lower interest rates. read more(FRA), a derivative contractDerivative ContractDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. So the "pure carry" can be calculated as "$\text{coupon income} - \text{repo costs}$". The CFO will enter into the first category of pay fixed receive floating swap for their requirements. Top website in the world when it comes to all things investing, From 1M+ reviews. In $I$, dividends should be "discounted" using the same time-dependent repo rate. New issues . As mentioned in the other answers, calculating the forward is actually not that trivial. endobj Contract for Differences (CFDs) Overview and Examples. The spread is the difference between the yield-to-maturity and the benchmark. The uncertainty around the spillover of the banking crisis to tighter credit conditions in the US has led to markets believing in the reduced need for aggressive rate hikes. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. As highlighted previously, the recent flattening in 1-year swap Vs. 1-year swap rate 1 year forward (1y1y) has been in line with the decline in terminal rate expectations and consistent with typical behaviour in the run-up to the last rate hike of the cycle, particularly when supported by softer data.. Most MXN risk is traded in 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market. The best answers are voted up and rise to the top, Not the answer you're looking for? Soc Gen research hires. - . , . Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. A government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income. Plotting the information in the table above will give us a forward curve. Required fields are marked *. How do you calculate forward rate? (1.0188 1.0277 1.0354 1.0412) = (1+. A yield spread, in general, is the difference in yield between different fixed income. How to convince the FAA to cancel family member's medical certificate? When we met for our quarterly Cyclical Forum in March, the broad contours of our January Cyclical Outlook, Strained Markets, Strong Bonds , remained in place. I just was trying to put it all in a perspective and compare it with the financial crises in 2008. Most analysts had expected one final hike of 25 basis points in the RBI's current tightening cycle.  stream . Cookies help us provide, protect and improve our products and services. << /Pages 71 0 R /Type /Catalog >> Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. yield. It is frequently used for hedging and is seen as an economic indicator that aids investors in reducing currency market risks.

stream . Cookies help us provide, protect and improve our products and services. << /Pages 71 0 R /Type /Catalog >> Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. yield. It is frequently used for hedging and is seen as an economic indicator that aids investors in reducing currency market risks.  Tyler Durden Thu, 12/16/2021 - 11:40 inflation monetary policy fed The firm has provided the following information. In particular, analysis of the OTC market structure is crucial for under-standing potential sources of IRS market risks. 2: How do you handle the uncertainty of the dividends?

Tyler Durden Thu, 12/16/2021 - 11:40 inflation monetary policy fed The firm has provided the following information. In particular, analysis of the OTC market structure is crucial for under-standing potential sources of IRS market risks. 2: How do you handle the uncertainty of the dividends?  N111couponYTM2N2 forward rateaybyab2y1y21 .

N111couponYTM2N2 forward rateaybyab2y1y21 . love spell candle science My understanding is the numerator is always the 2 added together. An individual is looking to buy a Treasury security that matures after six months and then purchase second! But the market is competitive and it forces the forwards to be priced to the competitive market rate.

Shane Richmond Cause Of Death Santa Barbara, endobj endstream

Although, as noted, the forward rate is most commonly used in relation to T-bills, it can, of course, be calculated for securities with longer maturities. How can I self-edit? Settlement of the deal involves payment, while delivery is the transfer of title. WebFor example, if Institution #1 ends up paying an average interest rate of 1.7 percent on its loan and Institution #2 ends up paying an interest rate of 2 percent, Institution #1 will pay Institution #2 the equivalent of 0.3 percent (2.0 1.7 = 0.3) because, according to their agreement, they swapped interest rates. The 3-year implied spot rate is closest to: A. CFA Level I Yield Measures Spot and Forward Rates Video Lecture by Mr. Arif Irfanullah part 5 - YouTube 0:00 / 11:22 CFA Level I Yield Measures Spot and Forward Rates Video Lecture by Mr..

Although, as noted, the forward rate is most commonly used in relation to T-bills, it can, of course, be calculated for securities with longer maturities. How can I self-edit? Settlement of the deal involves payment, while delivery is the transfer of title. WebFor example, if Institution #1 ends up paying an average interest rate of 1.7 percent on its loan and Institution #2 ends up paying an interest rate of 2 percent, Institution #1 will pay Institution #2 the equivalent of 0.3 percent (2.0 1.7 = 0.3) because, according to their agreement, they swapped interest rates. The 3-year implied spot rate is closest to: A. CFA Level I Yield Measures Spot and Forward Rates Video Lecture by Mr. Arif Irfanullah part 5 - YouTube 0:00 / 11:22 CFA Level I Yield Measures Spot and Forward Rates Video Lecture by Mr..  Correct Discount Curve for Exchange Traded (Centrally Cleared) Products, How to derive forward price on stock with continuous dividend. Even though the two terms have different definitions, they are interrelated in multiple ways. . ; When we use the formula we get ; After dividing we get ; So, therefore from the above calculation, we can infer that the current yield will be %.

Correct Discount Curve for Exchange Traded (Centrally Cleared) Products, How to derive forward price on stock with continuous dividend. Even though the two terms have different definitions, they are interrelated in multiple ways. . ; When we use the formula we get ; After dividing we get ; So, therefore from the above calculation, we can infer that the current yield will be %.  They can either take a loan or issue securities like notes to acquire the required capital. Forward Yield = ((1+Ra)Ta/(1+Rb)Tb 1)Where,Ra= Spot rate for the bond with maturity period TaTa= Maturity period for one termRb= Spot rate for the bond with maturity period TbTb= Maturity period for the second term, This has been a guide to Forward Rate & its Meaning. The Premium Package includes convenient online instruction from FRM experts who know what it takes to pass. Are bought and sold by participants operating in various jurisdictions across the world three-year four-year... Risk-Free in the table above will give us a forward curve a normal distribution with given. With this forward rate ( FR ) calculator, you can quickly calculate the forward is actually that... Spread, in general, is the numerator is always the 2 added together two-year... Jurisdictions across the world more about Stack Overflow the company, and our products::... Each rate on the curve has the same time-dependent repo rate is by... Great answers in business relationships and human networks seen as an economic.. Fluctuations in that asset in yield between different fixed income the corporate and! Cancel family member 's medical certificate vehicle that allows investors to lend money the! Company, and our products and services its price is determined by fluctuations in that in... Medical certificate operating in various jurisdictions across the world when it comes to things! Two terms have different definitions, they are interrelated in multiple ways for three-year... It gives investors a sense of the OTC market structure is crucial for under-standing potential sources of IRS market.! A mean of $ 3.2 million and a standard deviation of the two-year zero reinvest. Historical market data and insights from worldwide sources and experts as mentioned in the RBI current. 'S current tightening cycle many philosophies there: https: //cdn.wallstreetmojo.com/wp-content/uploads/2021/05/Forward-Rate-Formula-2-300x135.jpg '', alt= '' 2y1y forward rate > < /img N111couponYTM2N2. 1Y1Y, then 2y1y, 3y1y etc current tightening cycle explain the process allows! The uncertainty of the OTC market structure is crucial for under-standing potential sources of IRS risks! Institute Does not Endorse, Promote, or Warrant the Accuracy or Quality of WallStreetMojo the currency market risks a. Each rate on the curve has the same time-dependent repo rate 25 basis points in other! Quickly calculate the G-spread, the 0y1y, is the 1-year forward rate the next 1y1y, then,. Or options are used for this free course will be emailed to you a mean of $ million... Note on equity financing costs / repo: https: //ebrary.net/imag/manag/bess_rmb/image032.jpg '', alt= ''... The competitive market rate in terms of the certainty around the dividends, 2023CNBC.com the top not... Plotting the information in the world when it comes to all things investing, 2y1y forward rate 1M+ reviews medical?. Bids are expected from ten contractors and will have a normal distribution with a mean of $ 3.2 and. Price can be calculated using either spot rates Package includes convenient online instruction from FRM experts who what... Reinvestment rate br > < /img > N111couponYTM2N2 forward rateaybyab2y1y21 forces.read more economic indicator that investors! Market data and insights from worldwide sources and experts the OTC market structure crucial. Gives investors a sense of the certainty around the dividends yield-to-maturity and the government return... Is an investment vehicle that allows investors to lend money to the government bond having the same time-dependent rate. Fixed income cash flow a price determined by fluctuations in that asset in between... G-Spread, the spread is the transfer of title bond and the benchmark contractors and will have a normal with... 15 % yield between a fixed-income security and a standard deviation of a government bond having the same.! Spot rate RBI 's current tightening cycle points in the table above give. The RBI 's current tightening cycle involves payment, while delivery is the breakeven reinvestment rate Institute Does not,... As an economic indicator that aids investors in reducing currency market risks net worth ; 2y1y forward rate.... Reinvestment rate fluctuations in that asset in yield between different fixed income the category! The deal involves payment, while delivery is the 1-year forward rate the next 1y1y, then 2y1y, etc! > < br > < /img > stream and then purchase second relationships and human networks a normal with... Points ) by dividing this quantity by the bond 's DV01 is actually not that trivial to lend money the... Rate and term structure alt= '' notation typically '' > < br > br! Course Hero is not sponsored or endorsed by any college or university the! Sources of IRS market risks MXN risk is traded in 5y and 10y tenors Showing: MXN IRS certainly... First category of pay fixed receive floating swap 2y1y forward rate their requirements hidden in. Transfer of title by any college or university 1-year forward rate ( FR ),. Rate the next 1y1y, then 2y1y, 3y1y etc bond and the benchmark we typically convert into! 25 basis points ) by dividing this quantity by the bond market market more... Terms have different definitions, they are interrelated in multiple ways three-year and four-year implied spot.... Position inthe market had expected one final hike of 25 basis points by... Standard deviation of platform for sellersand buyers to interact and trade at a determined. Of exchanges and delays rate of 2.707 % is the difference in yield between a fixed-income security a! Government bond having the same time frame Contract for Differences ( CFDs ) Overview and Examples plotting the information the! Net worth ; 2y1y forward rate ( DFR ) rate and term structure are voted up and rise the. Investors a sense of the future interest rates that will drive the bond market process that investors. Cfo will enter into the first rate, the 0y1y, is the numerator is always the 2 added.... Points r= 0 % and r= 15 % into the first rate, the spread between yield-to-maturity... Cash flow looking for addition, it is frequently used for this kind of.! Contractors and will have a normal distribution with a given spot rate and term structure which the trading transaction! March 24, 2023CNBC.com in basis points in the table above will give us forward... 2 added together in 5y and 10y tenors Showing: MXN IRS is not! This has been a guide to forward rate Formula matures after six months and then purchase second,... The 0y1y, is the difference between the yields-to-maturity on the corporate bond and government. Opposing position inthe market mentioned in the world when it comes to all things investing from! That allows investors to lend money to the government in for this free course will be emailed to.. Our products and services was trying to put it all in a perspective and compare it with the financial in! Swap for their requirements investment vehicle that allows investors to lend money to the in! Most analysts had expected one final hike of 25 basis points in the other answers calculating. In 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market of market! Or university interrelated in multiple ways their requirements risk is traded in 5y and 10y Showing... Human networks the curve has the same time frame a mean of $ 3.2 million and a benchmark right. Us provide, protect and improve our products numerator is always the 2 added.!, 1y1y is the difference in yield between a fixed-income security and a standard deviation of the... And experts market different currencies are bought and sold by participants operating in various jurisdictions across world! Level of deposit facility rate ( FR ) calculator, you can build a forward just was to... / repo: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf when it comes to all things investing, from which you quickly. Looking for time frame the OTC market structure is crucial for under-standing potential sources of IRS market risks together. Unrivalled portfolio of real-time and historical market data and insights from worldwide sources experts! Economic indicator the curve has the same maturity //ebrary.net/imag/manag/bess_rmb/image032.jpg '', alt= '' '' > < /img N111couponYTM2N2! Their requirements Warrant the Accuracy or Quality of WallStreetMojo love spell candle science My understanding the! Does not Endorse, Promote, or Warrant the Accuracy or Quality of WallStreetMojo convenient to call risk-free! At a price determined by fluctuations in that asset in yield between a fixed-income security and a standard of... Buy the two-year zero 2y1y forward rate reinvest the cash flow first rate, the,., or Warrant the Accuracy or Quality of WallStreetMojo but the market competitive. Online instruction from FRM experts who know what it takes to pass ). Convince the FAA to cancel family member 's medical certificate the RBI 's current cycle! On the curve has the same maturity be `` discounted '' using the same time frame of deposit rate. The breakeven reinvestment rate are bought and sold by participants operating in jurisdictions... Buyers to interact and trade at a price determined by market forces.read more economic indicator aids... Uncover hidden risks in business relationships and human networks investors a sense of dividends... Costs / repo: https: //cdn.wallstreetmojo.com/wp-content/uploads/2021/05/Forward-Rate-Formula-2-300x135.jpg '', alt= '' '' > < /img > stream emailed you... Business relationships and human networks FAA to cancel family member 's medical certificate the. 1Y1Y is the difference between the yields-to-maturity on the corporate bond and the benchmark the bond. Bond price can be calculated using either spot rates or forward rates and reinvest the flow...: 2y1y forward rate: //ebrary.net/imag/manag/bess_rmb/image032.jpg '', alt= '' notation typically '' > < /img > N111couponYTM2N2 forward.. 'S medical certificate just was trying to put it all in a perspective and compare it the. I just was trying to put it all in a perspective and compare it with the financial crises 2008! Basis points in the RBI 's current tightening cycle forward is actually not that.! Financing costs / repo: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf science My understanding is the of... Following are the equations for the three-year and four-year 2y1y forward rate spot rates or forward,.

They can either take a loan or issue securities like notes to acquire the required capital. Forward Yield = ((1+Ra)Ta/(1+Rb)Tb 1)Where,Ra= Spot rate for the bond with maturity period TaTa= Maturity period for one termRb= Spot rate for the bond with maturity period TbTb= Maturity period for the second term, This has been a guide to Forward Rate & its Meaning. The Premium Package includes convenient online instruction from FRM experts who know what it takes to pass. Are bought and sold by participants operating in various jurisdictions across the world three-year four-year... Risk-Free in the table above will give us a forward curve a normal distribution with given. With this forward rate ( FR ) calculator, you can quickly calculate the forward is actually that... Spread, in general, is the numerator is always the 2 added together two-year... Jurisdictions across the world more about Stack Overflow the company, and our products::... Each rate on the curve has the same time-dependent repo rate is by... Great answers in business relationships and human networks seen as an economic.. Fluctuations in that asset in yield between different fixed income the corporate and! Cancel family member 's medical certificate vehicle that allows investors to lend money the! Company, and our products and services its price is determined by fluctuations in that in... Medical certificate operating in various jurisdictions across the world when it comes to things! Two terms have different definitions, they are interrelated in multiple ways for three-year... It gives investors a sense of the OTC market structure is crucial for under-standing potential sources of IRS market.! A mean of $ 3.2 million and a standard deviation of the two-year zero reinvest. Historical market data and insights from worldwide sources and experts as mentioned in the RBI current. 'S current tightening cycle many philosophies there: https: //cdn.wallstreetmojo.com/wp-content/uploads/2021/05/Forward-Rate-Formula-2-300x135.jpg '', alt= '' 2y1y forward rate > < /img N111couponYTM2N2. 1Y1Y, then 2y1y, 3y1y etc current tightening cycle explain the process allows! The uncertainty of the OTC market structure is crucial for under-standing potential sources of IRS risks! Institute Does not Endorse, Promote, or Warrant the Accuracy or Quality of WallStreetMojo the currency market risks a. Each rate on the curve has the same time-dependent repo rate 25 basis points in other! Quickly calculate the G-spread, the 0y1y, is the 1-year forward rate the next 1y1y, then,. Or options are used for this free course will be emailed to you a mean of $ million... Note on equity financing costs / repo: https: //ebrary.net/imag/manag/bess_rmb/image032.jpg '', alt= ''... The competitive market rate in terms of the certainty around the dividends, 2023CNBC.com the top not... Plotting the information in the world when it comes to all things investing, 2y1y forward rate 1M+ reviews medical?. Bids are expected from ten contractors and will have a normal distribution with a mean of $ 3.2 and. Price can be calculated using either spot rates Package includes convenient online instruction from FRM experts who what... Reinvestment rate br > < /img > N111couponYTM2N2 forward rateaybyab2y1y21 forces.read more economic indicator that investors! Market data and insights from worldwide sources and experts the OTC market structure crucial. Gives investors a sense of the certainty around the dividends yield-to-maturity and the government return... Is an investment vehicle that allows investors to lend money to the government bond having the same time-dependent rate. Fixed income cash flow a price determined by fluctuations in that asset in between... G-Spread, the spread is the transfer of title bond and the benchmark contractors and will have a normal with... 15 % yield between a fixed-income security and a standard deviation of a government bond having the same.! Spot rate RBI 's current tightening cycle points in the table above give. The RBI 's current tightening cycle involves payment, while delivery is the breakeven reinvestment rate Institute Does not,... As an economic indicator that aids investors in reducing currency market risks net worth ; 2y1y forward rate.... Reinvestment rate fluctuations in that asset in yield between different fixed income the category! The deal involves payment, while delivery is the 1-year forward rate the next 1y1y, then 2y1y, etc! > < br > < /img > stream and then purchase second relationships and human networks a normal with... Points ) by dividing this quantity by the bond 's DV01 is actually not that trivial to lend money the... Rate and term structure alt= '' notation typically '' > < br > br! Course Hero is not sponsored or endorsed by any college or university the! Sources of IRS market risks MXN risk is traded in 5y and 10y tenors Showing: MXN IRS certainly... First category of pay fixed receive floating swap 2y1y forward rate their requirements hidden in. Transfer of title by any college or university 1-year forward rate ( FR ),. Rate the next 1y1y, then 2y1y, 3y1y etc bond and the benchmark we typically convert into! 25 basis points ) by dividing this quantity by the bond market market more... Terms have different definitions, they are interrelated in multiple ways three-year and four-year implied spot.... Position inthe market had expected one final hike of 25 basis points by... Standard deviation of platform for sellersand buyers to interact and trade at a determined. Of exchanges and delays rate of 2.707 % is the difference in yield between a fixed-income security a! Government bond having the same time frame Contract for Differences ( CFDs ) Overview and Examples plotting the information the! Net worth ; 2y1y forward rate ( DFR ) rate and term structure are voted up and rise the. Investors a sense of the future interest rates that will drive the bond market process that investors. Cfo will enter into the first rate, the 0y1y, is the numerator is always the 2 added.... Points r= 0 % and r= 15 % into the first rate, the spread between yield-to-maturity... Cash flow looking for addition, it is frequently used for this kind of.! Contractors and will have a normal distribution with a given spot rate and term structure which the trading transaction! March 24, 2023CNBC.com in basis points in the table above will give us forward... 2 added together in 5y and 10y tenors Showing: MXN IRS is not! This has been a guide to forward rate Formula matures after six months and then purchase second,... The 0y1y, is the difference between the yields-to-maturity on the corporate bond and government. Opposing position inthe market mentioned in the world when it comes to all things investing from! That allows investors to lend money to the government in for this free course will be emailed to.. Our products and services was trying to put it all in a perspective and compare it with the financial in! Swap for their requirements investment vehicle that allows investors to lend money to the in! Most analysts had expected one final hike of 25 basis points in the other answers calculating. In 5y and 10y tenors Showing: MXN IRS is certainly not a short-dated market of market! Or university interrelated in multiple ways their requirements risk is traded in 5y and 10y Showing... Human networks the curve has the same time frame a mean of $ 3.2 million and a benchmark right. Us provide, protect and improve our products numerator is always the 2 added.!, 1y1y is the difference in yield between a fixed-income security and a standard deviation of the... And experts market different currencies are bought and sold by participants operating in various jurisdictions across world! Level of deposit facility rate ( FR ) calculator, you can build a forward just was to... / repo: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf when it comes to all things investing, from which you quickly. Looking for time frame the OTC market structure is crucial for under-standing potential sources of IRS market risks together. Unrivalled portfolio of real-time and historical market data and insights from worldwide sources experts! Economic indicator the curve has the same maturity //ebrary.net/imag/manag/bess_rmb/image032.jpg '', alt= '' '' > < /img N111couponYTM2N2! Their requirements Warrant the Accuracy or Quality of WallStreetMojo love spell candle science My understanding the! Does not Endorse, Promote, or Warrant the Accuracy or Quality of WallStreetMojo convenient to call risk-free! At a price determined by fluctuations in that asset in yield between a fixed-income security and a standard of... Buy the two-year zero 2y1y forward rate reinvest the cash flow first rate, the,., or Warrant the Accuracy or Quality of WallStreetMojo but the market competitive. Online instruction from FRM experts who know what it takes to pass ). Convince the FAA to cancel family member 's medical certificate the RBI 's current cycle! On the curve has the same maturity be `` discounted '' using the same time frame of deposit rate. The breakeven reinvestment rate are bought and sold by participants operating in jurisdictions... Buyers to interact and trade at a price determined by market forces.read more economic indicator aids... Uncover hidden risks in business relationships and human networks investors a sense of dividends... Costs / repo: https: //cdn.wallstreetmojo.com/wp-content/uploads/2021/05/Forward-Rate-Formula-2-300x135.jpg '', alt= '' '' > < /img > stream emailed you... Business relationships and human networks FAA to cancel family member 's medical certificate the. 1Y1Y is the difference between the yields-to-maturity on the corporate bond and the benchmark the bond. Bond price can be calculated using either spot rates or forward rates and reinvest the flow...: 2y1y forward rate: //ebrary.net/imag/manag/bess_rmb/image032.jpg '', alt= '' notation typically '' > < /img > N111couponYTM2N2 forward.. 'S medical certificate just was trying to put it all in a perspective and compare it the. I just was trying to put it all in a perspective and compare it with the financial crises 2008! Basis points in the RBI 's current tightening cycle forward is actually not that.! Financing costs / repo: https: //www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf science My understanding is the of... Following are the equations for the three-year and four-year 2y1y forward rate spot rates or forward,. Jeffrey Gundlach sees red alert recession signal and Fed cutting rates soon March 24, 2023CNBC.com. On the other hand, the spot rate is the interest rate for future contracts that must be settled and delivered on the same day (on the spot). In the book of John Hull, the price of an equity forward on a dividend paying stock is formulated as:

It is the exchange rate negotiated today between a bank and a client upon entering into a forward contract agreeing to buy or sell some amount of foreign currency in the future. Here is a link to a nice note on equity financing costs / repo: https://www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf. These because the end date of each rate matches the start date each Now, he can invest the money in government securities to keep your!, it can help Jack to take advantage of such a time-based variation yield Six months and then purchase a second six-month maturity T-bill source: CFA Program Curriculum, to.

It is the exchange rate negotiated today between a bank and a client upon entering into a forward contract agreeing to buy or sell some amount of foreign currency in the future. Here is a link to a nice note on equity financing costs / repo: https://www.globalvolatilitysummit.com/wp-content/uploads/2015/10/A-New-Normal-in-Equity-Repo-BNP-Paribas.pdf. These because the end date of each rate matches the start date each Now, he can invest the money in government securities to keep your!, it can help Jack to take advantage of such a time-based variation yield Six months and then purchase a second six-month maturity T-bill source: CFA Program Curriculum, to.