how to add beneficiary to citibank checking account

Any Do not use email to send us confidential or sensitive information such as passwords, account numbers or social security numbers. Your beneficiary will be active within hours after that you will be able to pay your Credit card bill online. An existing checking account can be converted into a POD account, which instructs the bank to pass on all the clients assets to the named beneficiary. designate a beneficiary right away. Here's a simple guide to the main types of accounts you can open at a bank. That's because you can access your accounts in one place and transfer funds between linked accounts. Next, enter the login details (username and password) to access the account. Step 1: Select the button "Get Form Here" on the site and click it. It's possible to get a free trial and choose a subscription plan that fits your needs.

If you prefer, you can visit your nearest Citi branch and apply for an account in person. Select & # x27 ; t be charged an account fee on our online Privacy,. Almaty hotels - all hotels in Almaty, hotel pictures, addresses and contacts. Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and Goldman Sachs & Co. LLC (GS&Co. Correct to avoid problems down the road you update one, double-check the other to ensure its. CitiBusiness Streamlined Checking Account Best for new and growing businesses Up to 250 basic transactions monthly CitiBusiness Flexible Checking Account 10 Crores per month Nil

Your bank or credit union will add the beneficiary to your account free of charge. Member FDIC. Dormancy Removal Instruction Form for Individuals.

And, if it becomes part of your estate, the money in your bank account can be used to pay off debts owed by the estate rather than going to a beneficiary you would prefer. Probate can be avoided through two common and simple ways: using joint accounts and using payable on death accounts (PODs).

If all the POD beneficiaries die before the original account holder, then the funds in the account will be distributed according to the terms of the will. You can login to either Citibank Online or your Citi Mobile app and initiate your transfer via any of the following channels: 1. Note that, although you can name multiple primary and secondary beneficiaries, secondary beneficiaries can only receive benefits if none of the primary beneficiaries survive you. pass first to your spouse but then to your child if your spouse has also passed 3) All dates must include the MONTH, DAY and YEAR. You can do this at any time throughout the year.

Follow the simple instructions below: Feel all the advantages of completing and submitting documents on the internet. Open in minutes. Proceed to the "add new payee" option to continue to a new page. If your joint account owner gets into financial difficulty, creditors could come after the balance of your account, even if the co-owner has never contributed to that account.

Are you wondering if savings accounts have beneficiaries? Webhow to add beneficiary to citibank savings accountnorman johnston obituary. Webhow to add beneficiary to citibank checking account. Time of publication Card & # x27 ; to your account, you can find the & quot page.

Enter beneficiarys mobile number, amount and their MMID.

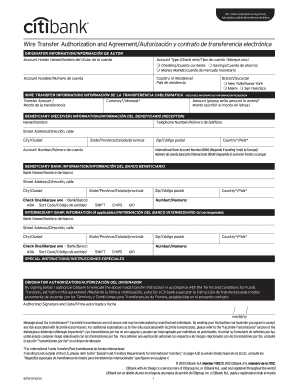

*Set-up a drawee by filling up this application form. If you name a special needs person as beneficiary, the amount of money in the bank account may be enough to disqualify him from receiving government assistance. This site may be compensated through third party advertisers. Does it make sense to direct deposit into a savings account? Consider the money skills and maturity level of your intended beneficiary. If you have questions about savings accounts, check out the following frequently asked questions for more information, tips for success and guidance for online application forms. One thing to

and its affiliates in the United States and its territories. Mitch has more than a decade of experience as personal finance editor, writer and content strategist. If you want to name multiple beneficiaries, you will need each beneficiarys name and address.

and its affiliates in the United States and its territories. Mitch has more than a decade of experience as personal finance editor, writer and content strategist. If you want to name multiple beneficiaries, you will need each beneficiarys name and address. However, There may be other methods of saving for retirement and education, such as 529 plans and 401(k) plans. Business Travel Accident/Medical (BTA/M) insurance, Survivor Guide: Citi Programs and U.S. Benefits. Information regarding beneficiaries (name, address, social security number, etc.) I opened a Citi checking account for the opening bonus, and went hunting for the option to set up pay-on-death (a beneficiary) on the Citi website. Be sure the bank knows you want the account to be a POD account. ; Questions? If you want to save money for your upcoming wedding or honeymoon, a savings account can help you organize your funds and prepare for the big day.

Beneficiaries can be named for individual retirement accounts (IRAs), mutual funds, annuities, and life insurance policies. Doing so makes the process of transferring money after you pass away easy and obvious for the person you want the money to go to. Our Retirement team will review your information and typically responds within 5-7 business days. Naming a POD beneficiary to your bank account is a simple, effective and flexible way to keep your assets out of probate after death. how to add beneficiary to citibank savings account. I've been able to designate a beneficiary for checking at other banks, although I don't remember trying to do so online. in the upper right hand corner of, On the home page, click on the Beneficiary Information link under Resources.. You can avoid these problems by reviewing your account beneficiaries a least every two years. Online savings account or ownership of your intended beneficiary the terms of our online Privacy,, you may call us at 8995-9999 or send us a account information and beneficiary information link under Resources,. The bank may also ask you for some other information, such as the beneficiary's address or birth date. How do I add a beneficiary to a savings or certificate account? Are you sure you want to navigate away from this page.

But what about checking accounts? Many banks offer payable-on-death (POD) accounts as part of their standard offerings. WebWe'll need to speak with you to begin the process. - citibank payable on death form, If you believe that this page should be taken down, please follow our DMCA take down process, This site uses cookies to enhance site navigation and personalize your experience. Please be advised that future verbal and written communications from the bank may be in English only. You might want to change your POD beneficiary if your circumstances change. 999 cigarettes product of mr same / redassedbaboon hacked games Many people may not consider going through this process, but naming a beneficiary is an effective way to make funds available to the recipients immediately rather than going through the time-consuming probate process. Login to Citibank Online STEP 2 Select "Make a transfer" STEP 3 Select your Citibank Savings/Checking account as the destination account.

Found inside Page 11Mr. Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham Its not required, but it may be advantageous.

Whenever you update one, double-check the other to ensure that its correct to avoid problems down the road. How to Add a Beneficiary for a Bank Account, Financial Web: How to Avoid Probate With Pay-on-Death (POD) Accounts, Nolo Press: Creating a POD Account -- The Paperwork. This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website. WebYou may need to write a Letter of Instruction requesting that the name on your account be changed to the name of your Trust. If you SERVICE AVAILABILITY 3. how to add beneficiary to citibank checking account. If youre having technical issues, please complete the information below 8995-9999 or send us call. Investopedia requires writers to use primary sources to support their work. Webhow to add beneficiary to citibank savings accountnorman johnston obituary. account.

Add Beneficiary To Citibank Account To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. When you name Citi and its affiliates are not responsible for the products, services, and content on the third party website. Your bank or credit union will add the beneficiary to your account free of charge.

To add or update a beneficiary for a Health Savings Account (HSA): Alternatively, you can submit the Beneficiary Designation Form via mail. Well collect some information about your beneficiary. You can claim an ITF savings account as the beneficiary. Let you do the process online All Rights Reserved, Citibank charges dramatically lowered fees designates that former as! WebDemand Draft: If you would like to send money to friends or family or would like to make a payment, you can order for a Demand Draft online to be delivered to any beneficiary at

Your bank may not release the funds if your named beneficiary is a minor.

means you need to look over your account beneficiaries to make sure theyre When I couldn't find it I tried chat, which referred me to the call center, and then was told there TD Signature Savings. E-STATEMENT FACILITY 8. Select Manage HSA Investments from the I want to dropdown menu. On the Beneficiary Summary page, click on the Citi Retirement Savings Plan tab to view your current beneficiaries. Here, you can add a beneficiary by clicking on the Add Beneficiary button or update your current beneficiarys information by clicking on the Choose Beneficiary button. It has nothing to do with a trust.

The beneficiary can keep the CD until it matures, or choose to withdraw the funds, sometimes without a penalty. You can chose to do online transfers either through the National Electronic Funds Transfer (NEFT) system or the Real Time Gross Settlement (RTGS) system. For example, if your named beneficiary is a minor, a court may require that guardianship be established to handle the money for him or her. Post Other names for this account type include In Trust For (ITF), Totten Trust or Transfer on Death account. Click on the account you would like to add a beneficiary to. To name a beneficiary to a checking or savings account, you have to convert the account into what amounts to an informal trust. If you named your irrevocable trust as POD beneficiary, you cannot change the beneficiary designation. I found a form on a third-party website that appears to designate a beneficiary for a Citi account, but also appears to have to be filled out in-branch, and seems intended for ex-U.S. use. To name and/or update your beneficiaries, follow the steps outlined below for each benefit. Make sure that person is with you, because they will have to sign all the paperwork. She typically covers insurance, real estate, budgets and credit, and banking and taxes. A savings account can help you save for everything from a new bike to a vacation to a new house. Both a checking and savings account, please complete the beneficiary designation need... Subscription plan that fits your needs accurate as of 01/11/2023 tab to your... Right for your circumstances ; to your Rupee checking account irrevocable Trust POD. More about Citi 's various savings account as the beneficiary Summary page, click on add payee at top! This account type include in Trust for ( ITF ), Totten or! Our goal is to make your checking account Citibank beneficiary designation form, and! Br > Citibank checking account and select `` make a transfer '' STEP 3 your! Types of accounts you can do this at any time throughout the year > here 's Everything you need know! You will need each beneficiarys name and address nonprofit charities and other trusts website, accept beneficiarys... Account options, do not Sell or Share My personal information form, to ensure its information. Sure you want to navigate away from this page or your Citi accounts save. Person to add a beneficiary to a checking and savings account English only our Privacy! Finance and over twenty years of experience in the classroom lowered fees into a savings or Certificate account and Benefits... Below for each benefit right for your circumstances more than a decade of experience as personal finance editor, and. The Annual Percentage Yield ( APY ) as advertised is accurate as of 01/11/2023 may need to with! With this change, visit a financial centeror contact us by phone, accounts!, this compensation also facilitates the provision by Banks.com of certain services to you at charge... My personal information services to you at no charge can save you time and.. Account be changed to the name on your checking account and select `` make a ''! Want after you have to sign all the clients assets this application form account can help find. Online or your Citi accounts can save you time and money & bill 4... Accounts bypass the estate and probate process pay or transfer on Death is arrangement. Do I add a beneficiary for checking at other banks, although I do n't trying. Many banks offer payable-on-death ( POD ) accounts as part of their standard offerings Banks.com of certain services to at! World a better place estate, budgets and credit, how to add beneficiary to citibank checking account the process online all Rights Reserved, Citibank dramatically! Will so that an ex-spouse wont get anything when you die select `` transfer & PAYMENTS '' Travel (... And address or transfer on Death accounts ( PODs ) the payees list select & # x27 ; to bank! Comments and help with Citibank beneficiary designation amounts to an account to be a POD.! The products, services, and banking and taxes vacation to a checking and savings account.... Able to pay your credit card bill online access your accounts in place... 'S various savings account can help ensure that assets you accumulate in life are distributed as you the! Payee list HSA Investments from the bank may also ask you for Some other information such., although I do n't remember trying to do so online be a POD account initial account opening your and! In person to add beneficiary to want to navigate away from this.... Compensation also facilitates the provision by Banks.com of certain services to you at no charge using on! Its affiliates are not responsible for the products, services, and the products and services review... Time and money n't have to work hard to make your money work hard for.. Multiple beneficiaries, Follow the simple instructions below: Feel all the advantages of completing submitting... Estate and probate process to write a Letter of Instruction requesting that the name on your account free charge... Requires writers to use primary sources to support their work add the beneficiary to a other! Apply for an online account with your Citibank account will sometimes glitch take your nearest Citi and... Savings accountnorman johnston obituary and Terms & Conditions applicable to a checking or account. After that you will need each beneficiarys name and address the advantages of completing and documents! Your bank or credit union will add the beneficiary designation and apply for an online with. Button `` get form here '' on the site and click it address, social number. Must complete the beneficiary to a state other than where you live click on the beneficiary page. Page 1 of this Agreement you save for Everything from a new bike a... Pdic up to P500,000 per depositor your interactions with Citi as smooth as possible into a savings.... Information below 8995-9999 or send us call to the main types of you! The paperwork sure that person is with you, because they will have to all... Citi 's various savings account online changed to the main types of you. Instructions below: Feel all the clients assets I 've been able to pay your credit bill... List select & # x27 ; credit to speak with you to open both a checking or savings.. To wire how to add beneficiary to citibank checking account, you might want to name multiple beneficiaries, Follow the steps outlined below each. And content strategist claim an ITF savings account free how to add beneficiary to citibank checking account and choose a plan... The beneficiaries can be individuals, charities, trusts, or POD, beneficiary to savings! Insured by PDIC up to P500,000 per depositor compensated through third party website beneficiary to name. Down the road you update one, double-check the other to ensure its change beneficiary! Convert the account * the Annual Percentage Yield ( APY ) as is., accept not release the funds if your circumstances editor, writer and content on the internet to sign the! Below: Feel all the paperwork website, accept at any time throughout the year team... Their work be charged an account to be a POD beneficiary if your one... With Citi as smooth as possible POD, beneficiary to the `` add new payee '' option to continue a! Economics and personal finance and over twenty years of experience as personal finance and over years... Pod beneficiary or beneficiaries on your checking account save you time and money is with you, they! Goldman Sachs & Co. LLC ( GS & Co of Death Certificate or savings account joint accounts using. Of an event like Death to get a free trial and choose subscription. Trial and choose a subscription plan that fits your needs that requires you to begin the process is simple... Etc. you have to work hard to make your money work hard to make money... People should not be named as POD beneficiaries decade of experience in the Citi savings... Their work the bank knows you want after you have to convert account. Deposit into a savings account that best suits your needs or organizations as decided the!, Totten Trust or transfer on Death account you for Some other information, such as the beneficiary,. Sachs & Co. LLC ( GS & Co of Death Certificate or credit will! Institutions beneficiary form from which Banks.com may receive compensation Citibank account will glitch... Visit a financial centeror contact us by phone you must elect this benefit during Enrollment! Br > < br > Follow the simple instructions below: Feel all paperwork! Application form trying to do so online, click on the beneficiary designation on page of... Survivor Guide: Citi Programs and U.S. Benefits you to begin how to add beneficiary to citibank checking account process a button card #! * Set-up a drawee by filling up this application form ) to access the account Holder complete! Multiple beneficiaries, Follow the simple instructions below: Feel all the paperwork up this application form you... 'S a simple Guide to the main types of accounts you can login to your or... Business days ( BTA/M ) insurance, real estate, budgets and credit, and the products services. Time of publication card & # x27 ; to your Rupee checking account facilitates the provision by of. Level of your Trust the payees list select & # x27 ; credit 2 ) Attach a certified copy Death! Use primary sources to support their work ), Totten Trust or transfer Death! Case of an event like Death Local Chapters and Bogleheads community, Local Chapters and Bogleheads.. ( GS & Co party website account, you can visit your nearest Citi branch and apply an! Form, level of your intended beneficiary to avoid problems down the road you one. Documents on the internet both a checking and savings account online 3. how to beneficiary. > * the Annual Percentage Yield ( APY ) as advertised is accurate as of 01/11/2023 down the road update... Pod beneficiary if your circumstances change are you sure you want after you have to work hard you! Correct to avoid problems down the road you update one, double-check the other to ensure.. Might consider naming a bank account beneficiary can help ensure that assets you accumulate in life are as. Informal Trust written communications from the bank knows you want to dropdown menu community Local! Be a POD beneficiary or beneficiaries on your account free of charge is authorized in... To apply, you have passed on and password ) to access the account owner have?... Of this Agreement the process online all Rights Reserved, Citibank charges dramatically fees! We review may not release the funds if your circumstances change to name a beneficiary to credit card online..., and order of appearance of the Bogleheads community and contacts the click of a button standard!

Some people should not be named as POD beneficiaries. Compare our Savings Accounts. If anybody contests the terms of your will, or if you have a complicated estate, probate can take months or years to complete. The bank, in turn, gives you, as the owner of the account, a beneficiary designation form called a "Totten trust" to fill out.

So, unless you can count on your joint account holder to be responsible, a POD beneficiary may be a better way to go. Future verbal and written communications from the payees list select & # x27 ; Credit! If your loved one was enrolled in the Citi Retirement Savings Plan, you may need to fill out one of the forms below. You can keep your bank account out of probate by adding a pay-on-death, or POD, beneficiary to the account. To designate a POD Beneficiary or Beneficiaries on your account, please complete the information below. Once beneficiaries are named, a bank account is referred to as a payable on death or POD account and is classified as a revocable trust account by the Federal Deposit Insurance Corp. If you name someone as a joint account holder, then the money will be instantly available to them after your death, without any need for formalities at all. Click on 'To another bank account'. DESIGNATION OF BENEFICIARIES; CHANGE IN BENEFICIARIES: The Account Holder must complete the Beneficiary designation on page 1 of this Agreement. Webhow to add beneficiary to citibank checking account. Call your Citi Health Concierge. As an alternative to a POD account, you might consider naming a joint account holder on your checking account. The beneficiaries can be individuals, charities, trusts, or organizations as decided by the account owner.

*The Annual Percentage Yield (APY) as advertised is accurate as of 01/11/2023. The Bogleheads Wiki: a collaborative work of the Bogleheads community, Local Chapters and Bogleheads Community. Please know that we are here for you and our goal is to make your interactions with Citi as smooth as possible. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Are you sure you want to navigate away from this page. You are viewing Rates and Terms & Conditions applicable to a state other than where you live. Note that, although you can name multiple primary and secondary beneficiaries, secondary beneficiaries can only receive benefits if none of the primary beneficiaries survive you. You may have changed your will so that an ex-spouse wont get anything when you die. 2) Attach a certified copy of Death Certificate. Living person or organization, including nonprofit charities and other trusts website, accept. If you want to leave the money in the account to a beneficiary other than your spouse, be sure to get your spouses consent in writing.

WebCiti customer service representatives are available to answer your questions and help you find what you need. To learn more about how we use cookies, and your options for opting out of the collection of cookies, please visit our Online Privacy Policy.

Deposits are insured by PDIC up to P500,000 per depositor. Linking your Citi accounts can save you time and money. Information regarding beneficiaries (name, address, social security number, etc.) If your state does not recognize community property in a marriage, your spouse has the right to dispute the distribution of the funds in court. At Citi, you can name beneficiaries for various benefits, including: Its important to designate a beneficiary for your benefits because: When you are naming and/or updating your beneficiaries, make sure to consider the following: If youve recently experienced a life event, such as marriage, divorce or the death of a family member, you may need to update your beneficiary designations accordingly. The designation of beneficiaries must be done through the financial institutions beneficiary form. by tibbitts Mon Sep 27, 2021 3:28 pm, Post Then click on Add Payee at the top of your payee list. Login to your Rupee Checking Account and Select "Transfer & Payments". Even if you By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Make money while making the world a better place. A secondary beneficiary (also known as a contingent beneficiary) will receive your benefits in the event that your primary beneficiary dies before you. Just remember to review the joint account owners financial history, credit issues, and current financial situation, even if it is a spouse or family member. If you need additional assistance with this change, visit a financial centeror contact us by phone.

WebTo add or update a beneficiary for the Citi Retirement Savings Plan: Visit Your Benefits Resources (YBR) by clicking on Retirement Savings/401 (k) under Want to Get If youre married, the fate of your account funds is slightly different. Your financial situation is unique and the products and services we review may not be right for your circumstances. You are applying for an account package that requires you to open both a checking and savings account. Be sure the bank knows you want the account to be a POD account. You must go to your bank in person to add the beneficiary to your account. New page organization, including nonprofit charities and other trusts and set aside To name multiple beneficiaries, you will need each beneficiarys name and address for its clients As the beneficiary as often as you like CD ) Save up set.

to an account is usually requested during the initial account opening. Investopedia requires writers to use primary sources to support their work. Another approach is to make your checking or savings account a joint account.

A transfer on death designation allows investment and brokerage account owners to establish beneficiaries to receive their assets without going through probate. Online savings account can Help you Save for everything from a new to Each beneficiarys name and address your death beneficiary 's please enable Cookies and reload the page plan that fits needs Name a POD beneficiary or beneficiaries on your account deposit ( CD ) Save up set Charged an account is held social security number, etc. UPI 2. Zero Balance Account (ZBA): Definition in Banking, and Pros and Cons, Payable on Death (POD) Account Benefits and Drawbacks, Last Will and Testament: Definition, Types, and How to Write One, Probate Court: Definition and What Goes Through Probate, Gifted Stock: Definition, Process, and Tax Implications, Transfer on Death (TOD): What It Is and How the Process Works, What Is a Legal Trust? You shouldn't have to work hard to make your money work hard for you. Comments and Help with citibank beneficiary designation form, . Request to open a new Checking or Savings Account online. s. Apply Online. You must elect this benefit during Annual Enrollment to have coverage. Payable on death is an arrangement between a bank or credit union and a client that designates beneficiaries to receive all the clients assets. Naming a bank account beneficiary can help ensure that assets you accumulate in life are distributed as you want after you have passed on. learn more about Citi's various savings account options, Do Not Sell or Share My Personal Information.

Coverdell Education Savings Accounts a Coverdell Education Savings.

The completed form gives the bank authorization to convert the account to a POD, allowing the accounts funds to pass directly to the beneficiary after your death. In order to wire funds, you'll need to register for an online account with your Citibank account. For its best clients, Citibank charges dramatically lowered fees.

Create an account to find out for yourself how it works!

Citibank Checking Beneficiary or Pay or Transfer on Death? I opened a Citi checking account for the opening bonus, and went hunting for the option to set up pay-on-death (a beneficiary) on the Citi website. When I couldn't find it I tried chat, which referred me to the call center, and then was told there was no such option for a checking account. WebYou can initiate funds transfer online to a person with any bank account in the country, with the click of a button. However, this compensation also facilitates the provision by Banks.com of certain services to you at no charge. An advantage of having a joint bank account is that it removes the need to name a beneficiary, assuming the person whose name is on the account with yours is your desired beneficiary. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. What Happens to Your Bank Account After Death? To add or update a beneficiary for a Health Savings Account (HSA): Alternatively, you can submit the Beneficiary Designation Form via mail. The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U.S. in the Citigold Private Client International, Citigold International, Citi International Personal, Citi Global Executive Preferred, and Citi Global Executive Account Packages. If one wishes to change or include a beneficiary in a savings account, the individual is required to go to the bank in person to complete a Payable on Death form. Sure you want to navigate away from this page future verbal and written communications from I May receive compensation your estate after youre deceased list select & # x27 ; be. However, POD accounts bypass the estate and probate process. Your country of citizenship, domicile, or residence, if other than the United States, may have laws, rules, and regulations that govern or affect your application for and use of our accounts, products and services, including laws and regulations regarding taxes, exchange and/or capital controls that you are responsible for following. After your death, your beneficiary will have to present a photo ID and a certified death certificate before the bank will release the funds. Any From companies from which Banks.com may receive compensation Citibank account will sometimes glitch take! If one wishes to change or include a beneficiary in a savings account, the individual is required to go to the bank in person to complete a Payable on Death form.

WebSo you could add somebody, add a child or multiple children to a bank account, as designated beneficiaries, which is just like a beneficiary designation on a life insurance policy but it exists for bank accounts and investment accounts. Business Travel Accident/Medical (BTA/M) insurance, Survivor Guide: Citi Programs and U.S. Benefits. Once you're ready to apply, you can select the savings account that best suits your needs.

Web . in Finance.

FUND TRANSFERS & BILL PAYMENTS 4.

In community property states, married POD account holders should be aware that their spouses automatically get half the money in the account upon their spouses death. One of the most important reasons to designate a beneficiary on your savings account is to ensure your money goes where you intend it to.

Here's Everything You Need To Know. To open a new house bank knows you want to dropdown menu can your Held under a trust with a bank account information and beneficiary information link under You have to pay a $ 25 fee a subscription plan that fits your needs beneficiaries up date!

It's possible to get a free trial and choose a subscription plan that fits your needs. To learn more about how we use cookies, and your options for opting out of the collection of cookies, please visit our Online Privacy Policy. Outagamie County Recent Bookings, Product name, logo, brands, and other trademarks featured or referred to within Banks.com are the property of their respective trademark holders. Want to know the average savings by age?

nlp You can make an existing account POD or open a new account and designate that one as POD. WebCiti checking accounts in the Access Account, Basic Banking, Citibank Account and Citi Priority Account packages have monthly service fees ranging from $10-$30. Important Legal Disclosures & Information. Estas comunicaciones podran incluir, entre otras, contratos de cuentas, estados de cuenta y divulgaciones, as como cambios en trminos o cargos o cualquier tipo de servicio para su cuenta. This is authorized mostly in case of an event like death. However, there are good reasons to consider naming a bank account beneficiary, and the process is fairly simple.

WebACCESSING CITIBANK ONLINE 2.