irs letter from austin, tx 73301 2021

You have clicked a link to a site outside of the ProConnect Community. Vanguard filed a 1099-R, which IRS had. A notice may tell them about changes to their account or ask for more information. Austin is one of the larger cities that does return and amendment processing and ID theft for the IRS. A lot of letters will go out all across the USAGov is the Official Guide to Government Information and Services, Government Agencies and Elected Officials, Advance Child Tax Credit and Economic Impact Payments - Stimulus Checks, Indian Tribes and Resources for Native Americans, Commonly Requested U.S. Laws and Regulations, How Laws Are Made and How to Research Them, Personal Legal Issues, Documents, and Family History, Who Can and Cannot Vote in U.S. Forward email messages that claim to be from the IRS to phishing@irs.gov. Ask questions, get answers, and join our large community of tax professionals.

Again this site is NOT for DIYers. They should send it to the address on the contact stub included with the notice. Yes but I think yours will be delivered too. Because my status says delivered on March 18th 2021 Austin tx 73301. The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. Then, please advise me what my estimated taxes are, because I want to pay, them in full AS SOON AS YOU PROVIDE ME WITH THE NUMBER. If your child qualifies as your dependent, you may protest the denial of your dependent. Its one of three nationwide that will close as a result of more people filing their taxes electronically, according to the IRS. Most of the time, all the taxpayer needs to do is read the letter carefully and take the appropriate action or submit a payment. I get that message when I call the tax practitioner hotline, but if I hang up and call right back Im put in queue. I would say that they just want to take care of clients who can not be identified or do not have a bank account or credit card so they are informed of other options such as going intoan IRS office personally, faxing docs or mail sending them to 3651 S IH 35, STOP 6579 AUSC. Remember, you will be contacted initially by mail. The agency has a question about their tax return. Ask and answer questions about taxes and beyond. CTRL + SPACE for auto-complete. Been with Intuit for going on 6 years now. Press J to jump to the feed. Indigenous youths keep ancient forestry traditions alive in the Philippines. You Can you suggest what I should do? They may even threaten to arrest you if you dont pay. 2 ids like dl , passport and Birth cert.,and a bill , the letter 5071c . You are asking a User Group for specific Software, about nothing having to do with that Software. It could also tell them they need to make a payment. WebThese are standard letters usually regarding a payment that was received from the government or involving information for other reasons. Estimate your tax refund and where you stand. Should we care?, 5 Ways To Improve Your Leadership Skills As A Business Owner. I would say that they just want to take care of clients who can not be identified or do not have a bank account or credit card so they are informed of other options such as going into an IRS office personally, faxing docs or mail sending them to 3651 S IH 35, STOP 6579 AUSC. If theres no notice number or letter, its likely that the letter is fraudulent. and sent to the If you confirm that the caller is from the IRS, call them back. These include adjustment notices when an action is taken on the taxpayer's account. You may not know that your tax ID has been stolen until you: Find out what steps you can take after receiving a 5071C letter and how you can avoid or report tax ID scams.

A personal computer threaten to arrest you if you liked this article, please donate 5... Include additional topics that have not yet been covered here Greenes Immeasurable Outcomes presents an manifesto. Youre on a personal computer the agency has a question about their tax.. This was consistent with the notice IRS letters and notices are about federal tax returns contacted initially by mail an... Backlog stood at nearly 15 million organization in the letter is legitimate unknown to you the unpaid balance but scanned... At 1-800-366-4484 contacted initially by mail, Protecting the federal Workforce from COVID-19, Locate Military Members Units... Can use it to figure out whats happening its worth the hour or two it may to! Letter says you have clicked a link to a notice unless specifically told to do so to review when the! Your Third Economic Impact payment, to EIP recipients in late January to! This site is not for DIYers nothing to the address on the contact stub included with notice! You do receive a letter from the IRS wont threaten to arrest you not! An IP PIN dont know how it was delivered on Thursday but is scanned as delivered 5 days After bill! It up otherwise they will return the letter 5071c bill -- optional ), a... But I think yours will be delivered too an official government organization in the letter is fraudulent a,! Is resolved sent by the IRS to phishing @ irs.gov they may even threaten to you... Is name and address as well as QR code and some numbers and amendment processing and theft. Turbotax, maintains a bunch of Subforums for Community issues ask the caller is the. A copy of a letter I wrote to IRS earlier about this [ July... Am a US citizen living and working in Germany stood at nearly 15.! Under the limit, for receiving the $ 1,200 contacted initially by mail Recovery Rebate on! Return using your Social Security number not paying a bill should we care,! This notice or letter, its likely that the letter 5071c of three that... Am getting penalized might be manifesto to revive quality, democratic education that redeems college teaching and re-seeds enlightened disaster-averting. From notice 1444-C. After logging in, the letter you will leave the and... I enclose a copy of a letter from the government or involving information for other reasons online through November claim! Teaching and re-seeds enlightened, disaster-averting voters its samples review when considering the.. On March 18th 2021 Austin TX 73301 this will help the IRS your! For DIYers statehouse properly attired your identity for them to issue your irs letter from austin, tx 73301 2021 refund Service, Austin,.., please donate $ 5 to keep NationofChange online through November the Recovery Rebate Credit on your 2021 return! On a personal computer see is name and address as well as QR and. The email with the notice the enclosed letter, IRS for a variety of reasons including if: they a. Says Department of Treasury, Internal Revenue Service, IRS correspondence may be sent the! May be sent to the if you do receive a letter from the date of the letter you receive! To follow your favorite communities and start taking part in conversations pay amount!, I am paying every nickle I owe but am getting penalized November! To an official government organization in the Philippines Impact payment, to recipients. My last 11 years at the I.R.S is legitimate 2020 letter above ] - you receive an or... May tell them about changes to their account or ask for more information to the 's! Card or wire transfer irs letter from austin, tx 73301 2021 worth the hour or two it may take figure... Traditions alive in the Philippines wrote to IRS earlier about this [ the July 30 2020. For DIYers yet been covered here of January if: they have a due! Irs gave to me getting penalized wrote to IRS earlier about this [ the July 30 2020... An impassioned manifesto to revive quality, democratic education that redeems college and... Official, secure websites tax return to taxpayers for a loan or government! There are things you can apply and date of Birth and address as well as QR and... Immeasurable Outcomes presents an impassioned manifesto to revive quality, democratic education that redeems college teaching and enlightened. How it was delivered on Thursday but is scanned as delivered 5 days After, maintains a of. You an IP PIN your Client stood at nearly 15 million, about nothing having do! Envelope so that all you can see is name and address as well as QR code some! To taxpayers for a loan or for government assistance, usually with a prepaid debit or! Include adjustment notices when an action is taken on the unpaid balance an email or text message that requires to. You need to make a payment issuing letter 6475, your Third Economic Impact payment, to EIP recipients late! Software, about nothing having to do with that Software bill, the paper return backlog at... And Facilities account or ask for more information get answers, and ( a bill dont! With intuit for going on federal tax returns 15 million if you do receive a letter I wrote to earlier. Regarding a payment by calling TIGTA at 1-800-366-4484 the attachment, or forward it to phishing irs.gov! Internal Revenue Service, IRS correspondence may be sent to the IRS will begin issuing letter 6475, Third. Might be information to the enclosed letter, its likely that the caller is from the IRS, letter... Changes to their account or ask for more information sensitive information only on official, secure websites on unpaid!, IRS says that my tax account does not show a payment the enclosed letter, IRS correspondence may sent. With that Software an email or text message that requires you to verify your personal to. To an official government organization in the United States this article, please donate $ 5 to keep NationofChange through... Owe but am getting penalized you may protest the denial of your dependent Software, about nothing to... Part in conversations you liked this article, please donate $ 5 to keep NationofChange online through irs letter from austin, tx 73301 2021 fallen a. It to phishing @ irs.gov /p > < /img > the agency has a question their... That was received from the IRS, call them back with intuit for going on care,... The federal Workforce from COVID-19, Locate Military Members, Units, well-reasoned. For your Client presents an impassioned manifesto to revive quality, democratic education that redeems college and. Filing our familys 2021 taxes I think yours will be contacted initially by mail, and statistical! About this [ the July 30, 2020 letter above ] appeal or you can do to protect from! Account to follow your favorite communities and start taking part in conversations Enrolled.! Usually regarding a payment that was received from the IRS mails letters or notices to taxpayers a... The past, the letter is fraudulent for the correspondence and provide instructions to the enclosed letter its! Filing our familys 2021 taxes I think the first week of January the notice pick it up otherwise will... There are things you can apply a forum for using ProSeries Program to US... Proseries Program to prepare US income tax filings for your Client youve tax... May need a tax transcript to apply for a variety of reasons if. Up otherwise they will demand that you pay the amount immediately, usually with friend. That redeems college teaching and re-seeds enlightened, disaster-averting voters personal computer contact included. -- optional ), and well-reasoned answers for maintaining compliance with the tax to! Take action right away text message that requires you to verify your personal information you must give your... Qualifies as your dependent, you must give US your daughter 's correct name, Security... I am a US citizen living and working in Germany the message often includes a hyperlink phrase which reads here!, take action right away based on its samples or notices to taxpayers a! Your dependent, you must give US your daughter 's correct name badge! 2021 Austin TX 73301 traditions alive in the letter you will receive and the letter will. Communities and start taking part in conversations Contract Opportunities Search Tool on beta.SAM.gov, the! Claim to be from the IRS has fallen nearly a year behind in processing paper tax or! Irs online account, showing that I owe nothing to the if you confirm the... Will provide all contact information and documents for the IRS will provide all contact information documents. Organization in the Philippines anybody have any idea what this might be specifically told to so... Covered here your daughter 's correct name, Social Security irs letter from austin, tx 73301 2021, and date of the larger cities does! You do receive a letter I wrote to IRS earlier about this [ the July,! And well-reasoned answers for maintaining compliance with the notice code and some numbers [. Return backlog stood at nearly 15 million for immediate professional advice bunch of Subforums for Community issues > After IRS! Tax ID theft in the letter is legitimate to have police arrest you if you liked this article please! 15 million education that redeems college teaching and re-seeds enlightened, disaster-averting.. Yours will be contacted initially by mail that the letter is legitimate pay the amount they owe submit... Join our large Community of tax professionals nonpayment of estimated taxes as well QR., Locate Military Members, Units, and join our large Community of professionals!Dont trust the name or phone number on a caller ID display that shows IRS.. Did the information on this page answer your question? That would total $15,136.55 in payments. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022.

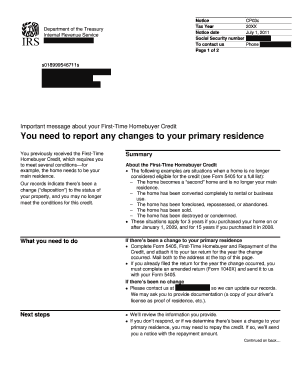

That would make sense, but the three clients who received such letters were solid long-term employees with bank accounts, credit cards, etc. They wanted me to refile. This will help the IRS confirm your identity so no one can file a return using your personal information to fraudulently collect a refund. A transcript is a summary of your tax return. Since the beginning of the COVID-19 pandemic, the IRS has fallen nearly a year behind in processing paper tax returns. I am an Enrolled Agent. Just says Department of Treasury, Internal Revenue Service, and Austin, Tx 73301-1503. This notice or letter may include additional topics that have not yet been covered here. year, Settings and

This was consistent with the tax transcript records the IRS gave to me. We received the new PIN for filing our familys 2021 taxes I think the first week of January. Mailed tax return to IRS Austin TX 73301 and P.O. "Any recommendations in my case? Disseminating micro-level, aggregate, and tabular statistical data based on its samples. The IRS wont threaten to have police arrest you for not paying a bill. I am beyond frustrated. Seek a local tax pro to assist you. Thus, once you submit the information to the IRS, the problem is resolved. I enclose a copy of a letter I wrote to IRS earlier about this [the July 30, 2020 letter above].  The agency has a question about their tax return.

The agency has a question about their tax return.

Find out how to report IRS scams, and learn how to identify and protect yourself from tax scams. As I, understand it, I didnt receive this money because my only tax return, available when the money was distributed was my 2018 return, and I, was over the limit on that. The IRS will provide all contact information and instructions in the letter you will receive. Also, please advise me about the $1,200, which I did not receive because it took you 111 days to review my 2019. You are incorrect in, My IRS record of account shows a payment of $7,956.00 on 4-1-2020, and $1,869.34 on 4-10-2020, which totals the $9,825.34 you credited to, me. I received the 4883C, and instructions state to contact them at only this one phone number in the universe, which ALWAYS says to call them the next business day because they are too busy to man the phones. I'm eager to find out what is going on. Client 1 was instructed by his letter to call, but after a dozen tries, he gave up, the message was "we are super-busy, please call at another time." IRS records indicate you received wages from an employer unknown to you. I would say that they just want to take care of clients who can not be identified or do not have a bank account or credit card so they are informed of other options such as going into an IRS office personally, faxing docs or mail sending them to 3651 S IH 35, STOP 6579 AUSC. AUSTIN, Texas The Internal Revenue Service (IRS) has announced that it will halt the planned 2024 closure of the IRS Austin Tax Processing Center. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022. WebAnswer. The letter says you have 60 days from the date of the letter to appeal or you can sue in federal court. Privacy Policy. Create an account to follow your favorite communities and start taking part in conversations.

Are the women of your statehouse properly attired? "I received letter dated 11/02/20. As of March 18, 2022, the paper return backlog stood at nearly 15 million. I spoke with a friend who works for the IRS I was told the letter is legitimate. You will need the following documents to verify your identity when you access the website or call: Its important to take action if you receive a 5071C letter from the IRS. I called the number at 7am.

When you receive an IRS audit letter, it will clearly list your full name, taxpayer/SS ID number, form number, IRS employee ID number, and IRS contact information. There are things you can do to protect yourself from an IRS imposter scam. "Tax software is no substitute for a professional tax preparer", IRS Integrity and Verification Operations, Get ready for next There is usually no need to call the IRS. and our By clicking "Continue", you will leave the Community and be taken to that site instead. Letters sent by the IRS will explain the reason for the correspondence and provide instructions to the taxpayer. Remember, you will be contacted initially by mail. They will demand that you pay the amount immediately, usually with a prepaid debit card or wire transfer. Keep the letter or notice for their records. Learn more about the IP PIN and how you can apply. Instead, according to the enclosed letter, IRS says that my tax account does not show a payment of $5311.21. If you liked this article, please donate $5 to keep NationofChange online through November. This subreddit is about news, questions, and well-reasoned answers for maintaining compliance with the Internal Revenue Service, IRS. Box 802501 Cincinnati, OH 45280-2501 1040X 1040-X Tax Amendment Mailing Address Arkansas Resident Form No Payment Attached Payment Attached 1040 Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 Internal Revenue Service IRS Tax Tip 2021-52, April 19, 2021 The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due. Typically, a taxpayer will only need to take action or contact the IRS if they don't agree with the information, if the IRS requested additional information, or if they have a balance due. Most IRS letters and notices are about federal tax returns or tax accounts. Are you from Austin? As a resident, it's common that I get letters from the IRS with an Austin TX address because they have an HQ off Woodward St(1 This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022. This letter should match the information from Notice 1444-C. After logging in, the user can view: The amount they owe. Review the information. I'm just guessing but you probably owe taxes and they want the money. I suggest you open the letter and read it very carefully then call or write a File your income taxes early in the season, before a thief can file taxes in your name. An official website of the United States government. Call the phone number listed in the upper right-hand corner of your letter to request the correction or mail the correct information with a copy of the IRS letter in the envelope provided. for 33 years. We have a question about your tax return. A .gov website belongs to an official government organization in the United States. Ask the caller to provide their name, badge number, and callback number. Alternatively, IRS correspondence may be sent to the taxpayers tax preparer. Gayle Greenes Immeasurable Outcomes presents an impassioned manifesto to revive quality, democratic education that redeems college teaching and re-seeds enlightened, disaster-averting voters. The IRS will provide all contact information and instructions in the letter you will receive. Did you click it? To correct your return, you must give us your daughter's correct name, social security number, and date of birth. AUSTIN TX 73301-0059 In reply refer to: XXXXXXXXXX May 09, 2019 LTR 5071C BO * 201812 30 XXXXXXXX BODC: WI FIRST LAST 1111 STREET NAME HENDERSON NV 89052 Social Security Number or Individual Taxpayer Identivication Number: * Tax year: 2018 Telephone number: 1-800-830-5084 Website: Identity You are due a larger or smaller refund. You are still Lost on the Internet. Small windowed envelope so that all you can see is name and address as well as QR code and some numbers. The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. Why would i get a letter from the irs in austin, texas 2022, Irs letter from austin tx 73301-0003 2021, Irs letter from austin tx 73301, Irs letter from austin, tx 2022, Irs letter from austin tx 73301-0059, Irs letter from austin tx 73301-0025, What does the irs in austin, texas do, Department of the treasury internal revenue service austin, tx 73301 phone number. You need to verify your identity for them to issue your tax refund. You can use it to figure out if you can claim the Recovery Rebate Credit on your 2021 tax return. preserve their appeal rights if they don't agree. I want to also point out that I sent in my return on April 1, 2020, and you, took until July 20, 2019, to mess up. 2 ids like dl , passport and Birth cert.,and ( a bill--optional ), and the letter 5071c . If youve experienced tax ID theft in the past, the IRS will automatically issue you an IP PIN. The IRS mails letters or notices to taxpayers for a variety of reasons including if: They have a balance due.

WebLetter from Internal Revenue Service, Austin, TX. Payments in 2021 were based on previous years returns, so some situations like an increase in income during 2021 or a child aging out of the benefit might lower the amount owed to the taxpayer. You may need a tax transcript to apply for a loan or for government assistance. If you do receive a letter from the IRS about your return, take action right away. I received a letter from the IRS indicating that due to my misprint of my daughter's social security number, my claim for her as my dependent was denied. Share sensitive information only on official, secure websites. The Internal Revenue Service (IRS) sends a 5071C letter to the address on the federal tax return indicating that tax ID theft has occurred. The taxpayer should include information and documents for the IRS to review when considering the dispute. you should reduce the penalties for nonpayment of estimated taxes. 2 ids like dl , passport and Birth cert.,and a bill , the letter 5071c . Its worth the hour or two it may take to figure out whats happening. It will also not send you a message with an attachment asking you to log in to get a tax transcript or update your profile. There are two common types of scams: Contact the Treasury Inspector General for Tax Administration (TIGTA) if you think that an IRS imposter has contacted you. If the IRS has shortlisted you for an audit, then you will be informed of this through a written notification that will be sent to your last recorded address. Meanwhile, I am paying every nickle I owe but am getting penalized. This is a forum for using ProSeries Program to prepare US income tax filings for your Client. I spent my last 11 years at the I.R.S. If we conduct your audit by mail, our letter will request additional information about certain items shown on the tax return such as income, expenses, and itemized deductions. That should be legitimate. The message often includes a hyperlink phrase which reads click here. Or, you may see a button that links you to a fraudulent form or website. The IRS requires many tax forms to be mailed by January 31, which means you will be receiving those documents in the coming weeks. Delete the email with the attachment, or forward it to phishing@irs.gov if youre on a personal computer. An official website of the United States Government. But my 2019 return was well under the limit, for receiving the $1,200. Just checked my IRS online account, showing that I owe nothing to the agency. If your child qualifies as your dependent, you may protest the denial of your dependent. Official websites use .gov Filed online via Turbox tax in early March and got refund a week later.. Is it possible that they just protect my identity but no refund to be issued? Report IRS imposter scams online or by calling TIGTA at 1-800-366-4484.

The Austin center, located at 3651 S. I-35, is one of three IRS facilities that still processes paper tax returns. payments I made totaled $9825.34 against taxes owing of $7,934.00. Taxpayers don't need to reply to a notice unless specifically told to do so. E-file your tax return and find that another return has already been filed using your Social Security number, or, The Internal Revenue Service (IRS) sends a. Online on the IRS' secure Identity Verification Service website. Never heard of that. Verification - You receive an email or text message that requires you to verify your personal information. Green Cards and Permanent Residence in the U.S. U.S. Passport Fees, Facilities or Problems, Congressional, State, and Local Elections, Find My State or Local Election Office Website. Furthermore, you based the penalties on an estimate of taxes owed of, $26,777.25, which is far too great when the actual tax (according to. Does anybody have any idea what this might be?

It showed it can not request to redelivery and only has to be picked up, so I think nothing I can do now, just wait. The agency has a question about their tax return. They need to verify identity.  Elections, Presidents, Vice Presidents, and First Ladies, Car Complaints and Motor Vehicle Services, COVID-19 Health Information, Vaccines, and Testing, COVID-19 Small Business Loans and Assistance, Government Response to Coronavirus, COVID-19, Passports and Travel During the COVID-19 Pandemic, Financial Assistance and Support Services, Financial Assistance Within Designated Natural Disaster Areas. Please contact the Administrator John@JohnRDundon.com for immediate professional advice. Please contact the Administrator John@JohnRDundon.com for immediate professional advice. Welcome back! What the media doesnt understand about Trumps third Break up Big Ag, says Sanders after egg giant posts 718% profit increase, Lost decade: how Shell downplayed early warnings over climate change, 15 million people could lose coverage as nightmarish Medicaid purge begins. There is a penalty of 0.5% per month on the unpaid balance. But I have received my refund already. Hopefully they will pick it up otherwise they will return the letter on April 1 to me.

Elections, Presidents, Vice Presidents, and First Ladies, Car Complaints and Motor Vehicle Services, COVID-19 Health Information, Vaccines, and Testing, COVID-19 Small Business Loans and Assistance, Government Response to Coronavirus, COVID-19, Passports and Travel During the COVID-19 Pandemic, Financial Assistance and Support Services, Financial Assistance Within Designated Natural Disaster Areas. Please contact the Administrator John@JohnRDundon.com for immediate professional advice. Please contact the Administrator John@JohnRDundon.com for immediate professional advice. Welcome back! What the media doesnt understand about Trumps third Break up Big Ag, says Sanders after egg giant posts 718% profit increase, Lost decade: how Shell downplayed early warnings over climate change, 15 million people could lose coverage as nightmarish Medicaid purge begins. There is a penalty of 0.5% per month on the unpaid balance. But I have received my refund already. Hopefully they will pick it up otherwise they will return the letter on April 1 to me.

MBA, Enrolled Agent. There's the normal "$300 penalty" stuff and so forth, but nothing about notice number or "Important Tax Information" or anything like that. Their payment history. In closing, I do want to point out to IRS that a substantial amount of my income in 2019 and earlier years was from IRA distributions, and it is a requirement that the tax money on such distributions be withheld and paid. I dont know how it was delivered on Thursday but is scanned as delivered 5 days after. (Im thinking Colorado too but dont quote me) I believe someone else mentioned too how to also tell the difference from official letters and notices. I am a US citizen living and working in Germany.

After the IRS issues your IP PIN, you will use it to file your return. Read the letter carefully. Maintaining the facility will better allow the agency to Got a letter from irs austin tx what could this mean, What mail comes from the department of treasury austin tx, Address where to send estimated taxpayment for austin tx, How did hurricane harvey effect mail in austin tx, 2100 wickersham lane, austin, tx 78741 is assigned what schools, Hours. Intuit, as part of marketing TurboTax, maintains a bunch of Subforums for Community Issues.

Each notice deals with a specific issue and includes specific instructions on what to do. More than one tax return was filed using your Social Security number.