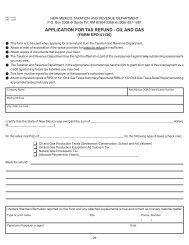

new mexico agricultural tax exempt form

Thank you very much. I appreciate your support.

What happens to my taxes after they are collected? After youve writed down the text, you can use the text editing tools to resize, color or bold the text. How is the Veteran Exemption status determined and how does it affect property taxes? If the value is in error and your valuation protest was adjusted, check with your appraiser at the Assessor's Office to see if the necessary paperwork has been processed. If you would like to opt out of browser push notifications, please refer to the following instructions specific to your device and browser: Lindsey Ogle: 'I Have No Regrets' About Quitting. Instructions for Form 1120-CPDF, Schedule F (Form 1040 or 1040-SR), Profit or Loss From Farming x][ clw ;5R)d)vH b$R3=U=S{_U_}u(W/~zugrY,Wn^m>Lhg9\MV|O^m7>*O ]~3VK~~W`k_g)^o_=Vote?E66fr0aVx9L*]_^|J NOh)G-84mB J[;%eT^r1Jotfno; .4t1`vyW|=xAyVm_SVG:gWg`vcgl }6o?AHu0e R9{Yga@m]Jl?&_L>5s|k5 {-Pvmg&h,PUGpBn{8: Pet Peeves: Incap Players have quit with broken bones, nasty infections, heart problems, stomach problems and whatever those two things were that caused Colton to quit. are in Albuquerque, Belen, Corrales, Edgewood, Las Cruces, Los Lunas, Alcalde and Taos, Honey and bee pollen by zip code in Albuquerque and surrounding HFFF is an integral part of the governors Food Initiative and is designed to strengthen the local food system supply chain capacity and increase market opportunities for New Mexico farmers and agricultural producers, manufacturers and food enterprises. What services are provided for by my property taxes?

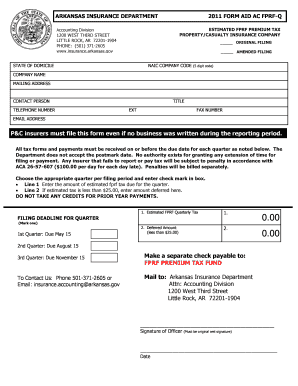

HitFix: And are you actually rooting for them? Property taxes are based on two variables: 1. product unsubscribes you from unwanted emails and cleans up your physical mailbox too! community colleges, county jail that houses inmates from all levels of government, juvenile corrections facilities, senior citizen centers, community centers, public roads, libraries, funding for Cristus St. Vincent Hospital, for matching federal funds, parks, health clinics, coordinate growth issues, promote and require environmental awareness and care and many more public services. The Italian queens are feature will provide all relevant info regarding the New Mexico property tax exemptions. Lindsey Ogle/Gallery < Lindsey Ogle. In FY 2023, HFFF will award $400,000 in competitive grants, between $20,000 and $100,000 each, to a range of food enterprises across all the state of New Mexico. Tax Exempt Form 2023. Ja1wtNEwPG6>uuCLR`A]}T$!J<8]VC9^K od[N#`"*j^ !B 'h/^: 2< ?,1\/024.&e/,lrl1)$B'mES~M8ub+z#b]|R Kt-j[il+i]HHFl-$MDS8 V4, V^+. That depends on your Assessed Value versus your actual market value. Stop talking to me. But I think that she got a little camera courage. It was a tiebreaker [in the Reward]. Its surprisingly rare when a contestant quits Survivor. Promoting various cooperative agricultural, horticultural, and civic activities among rural residents by a state and county farm and home bureau If you think that theres been a mistake, you can file a petition with the local assessor within a month from the date the NOV was mailed. New Mexico Sales Tax Exemption Form For Agriculture 2017-2021.

A. Click here to get more information. It also includes the adjusted value as dictated by the value cap law for residential properties as well as any exemption, deduction or value freeze you have applied for and have been granted. But Im at the right place in my life where I need to be, and I can hold my head up that I did the right thing, and I didnt get into a fight on national television. And I happen to be on the losing side of it, but it's what you do with the game that you've gotten, even if it was five seconds or not. Property Tax Division Regulation 36-20-7 indicates the application form may contain a request for providing information on the owner's farm income and farm expenses reported to the U.S. Internal Revenue Service on Schedule F. Under New Mexico law, there are two New Mexico property taxation exemptions and several categories of institutional and governmental exemptions. WebNew Mexico has a state income tax that ranges between 1.7% and 4.9%, which is administered by the New Mexico Taxation and Revenue Department.TaxFormFinder provides printable PDF copies of 81 current New Mexico income tax forms. to help them meet the requirements for each county to qualify for an Monty Brinton/CBS. A "yes" vote supported expanding certain property tax exemptions provided for agricultural equipment and certain farm products to allow any entity that is a merger of two or more family-owned farms to qualify and extend the exemption to include dairy products and eggs. Publication 225 explains how the federal tax laws apply to farming. In Google Forms, open a quiz.

For most drivers, their car tax payments - or Vehicle Excise Duty (VED) - increased by 10.1 percent in line with inflation on April 1. The H-2A agricultural worker must provide a completed Form W-4, Employee's Withholding Allowance Certificate, to the employer for U.S. federal income tax to be withheld from this compensation. from the New Mexico Tax Assessors office as links in the right hand I usually get along with people, but Trish just rubbed me the wrong way. Fill in the content you need to insert. Our primary yards Can I use a blanket resale exemption certificate in New Mexico? The Assessor requires a copy of the manufactured home vehicle registration or the title, along with the manufactured home property or location. I said, If you wanna watch it, you can. Use this form to report livestock that is subject to valuation for property taxation purposes. Application for Veterans ($4,000) or 100% Disabled Veterans; Disabled Veterans Property Tax Exemption; Application for Veterans ($4,000) and Head of Household ($2,000) Open the PDF file in CocoDoc PDF editor. Yes taxes owing on the property in question must be paid in full before the Treasurer's office will sign a County Certification of Taxes Paid. It also creates an online database that gives new mexico agricultural sales tax exemption, agricultural sales tax exemption oklahoma. Encyclopedia of Meat Sciences, Third Edition, Three Volume Set is the most up-to-date and comprehensive reference work covering this key area of agricultural science and an essential tool for agricultural and food science researchers of all levels. At what point does the conversation turn to, Get Jeff Probst.. The technical storage or access that is used exclusively for statistical purposes. A. Most importantly it also indicates the value that the Office of the County Assessor has determined for property tax purposes. No!

Bee Removal and Swarm Removal

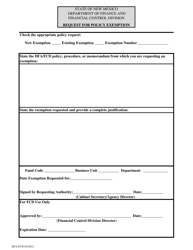

DoNotPay will help you determine which exemptions in New Mexico you qualify for and generate a personalized guide to help you pay your property taxes. Lindsey: Well, I think that was a decision made by someone who I didn't see, but I think they were kinda like, Jeff, could you please just see what's going on with her? He's just very good at determining people's inner thoughts. However she says in her video that she is brawny and can get ripped quite quickly. How much revenue each taxing authority needs to generate, to meet its budgeted obligations to you as a citizen of that authority, and/or how much it will take to make payments on bond issues that the majority of voters approved during that election. WebUnder the New Mexico Subtractions section, enter the amount in the Exemption for net income subject to the entity level tax field. Program rules developed in concert with the Equitable Food-Oriented Development Working (EFOD) Group. Web7. properties that exceed 1.5 acres. WebMexico Taxation and Revenue Department on a CRS-1 Form. %PDF-1.4 The advanced tools of the editor will lead you through the editable PDF template. Apply for the Head of Family Exemption using this form. A. There is no need for the H-2A agricultural worker to submit a Form W-4 if there is no agreement to withhold U.S. federal income tax from the Do you know how many thousands of people would die to get in your spot? I'm like, You need to back away from me and give me a minute. It's like when you're on the playground, you know, one of those who beats up a little kid when they just got their ass beat by somebody else and she's kicking them in the face like, Yeah! Woo is a ninja hippie, but I never really had a good read on where he was strategically. Ogle, a hairdresser from Indiana, tells PEOPLE that she has no regrets about quitting the show, but says that theres one contestant she will never like. Lindsey Ogle We found 14 records for Lindsey Ogle in Tennessee, District of Columbia and 6 other states.Select the best result to find their address, phone number, relatives, and public records. Complete this form when ordering from our Data for Sale menu. Why did you quit the game?Trish had said some horrible things that you didnt get to see. Posts about Lindsey Ogle written by CultureCast-Z. Q. All counties in New Mexico

If you are finding it hard to stop smoking, QuitNow! You can find resale certificates for other states here. J'Tia Taylor And you totally quit! And let me tell you, for the record, never would I have ever quit if it was just solely on me. Form 2210F, Underpayment of Estimated Tax By Farmers and Fishermen

Bee Removal and Swarm Removal

DoNotPay will help you determine which exemptions in New Mexico you qualify for and generate a personalized guide to help you pay your property taxes. Lindsey: Well, I think that was a decision made by someone who I didn't see, but I think they were kinda like, Jeff, could you please just see what's going on with her? He's just very good at determining people's inner thoughts. However she says in her video that she is brawny and can get ripped quite quickly. How much revenue each taxing authority needs to generate, to meet its budgeted obligations to you as a citizen of that authority, and/or how much it will take to make payments on bond issues that the majority of voters approved during that election. WebUnder the New Mexico Subtractions section, enter the amount in the Exemption for net income subject to the entity level tax field. Program rules developed in concert with the Equitable Food-Oriented Development Working (EFOD) Group. Web7. properties that exceed 1.5 acres. WebMexico Taxation and Revenue Department on a CRS-1 Form. %PDF-1.4 The advanced tools of the editor will lead you through the editable PDF template. Apply for the Head of Family Exemption using this form. A. There is no need for the H-2A agricultural worker to submit a Form W-4 if there is no agreement to withhold U.S. federal income tax from the Do you know how many thousands of people would die to get in your spot? I'm like, You need to back away from me and give me a minute. It's like when you're on the playground, you know, one of those who beats up a little kid when they just got their ass beat by somebody else and she's kicking them in the face like, Yeah! Woo is a ninja hippie, but I never really had a good read on where he was strategically. Ogle, a hairdresser from Indiana, tells PEOPLE that she has no regrets about quitting the show, but says that theres one contestant she will never like. Lindsey Ogle We found 14 records for Lindsey Ogle in Tennessee, District of Columbia and 6 other states.Select the best result to find their address, phone number, relatives, and public records. Complete this form when ordering from our Data for Sale menu. Why did you quit the game?Trish had said some horrible things that you didnt get to see. Posts about Lindsey Ogle written by CultureCast-Z. Q. All counties in New Mexico

If you are finding it hard to stop smoking, QuitNow! You can find resale certificates for other states here. J'Tia Taylor And you totally quit! And let me tell you, for the record, never would I have ever quit if it was just solely on me. Form 2210F, Underpayment of Estimated Tax By Farmers and Fishermen  I liked Tony. Yes. by inspecting your home and evaluating its: Proximity to important facilities, such as schools and hospitals, Ways To Lower Your Property Taxes in New Mexico, Walk with the assessor during the property appraisal. \a bN9=j4(*;eN6DdR-XDC?xr@A,-t{xzik:x BW%Z*l]tKS-7]Fvus1&oQ4O@vri|w}bec{qm3^p,rCgN!n?GL1* xQCWve4sf:.thHSQ[R:Mz=B /l`SL]HL]>yO) I don't let her watch it until I see it myself, but she watched it, we DVR it. The Assessor is required by state law to first of all value all property at 100 percent of its market value as determined by sales of comparable property.

I liked Tony. Yes. by inspecting your home and evaluating its: Proximity to important facilities, such as schools and hospitals, Ways To Lower Your Property Taxes in New Mexico, Walk with the assessor during the property appraisal. \a bN9=j4(*;eN6DdR-XDC?xr@A,-t{xzik:x BW%Z*l]tKS-7]Fvus1&oQ4O@vri|w}bec{qm3^p,rCgN!n?GL1* xQCWve4sf:.thHSQ[R:Mz=B /l`SL]HL]>yO) I don't let her watch it until I see it myself, but she watched it, we DVR it. The Assessor is required by state law to first of all value all property at 100 percent of its market value as determined by sales of comparable property.  Its time to move on. The submitted request form will be processed by the Assessor's Office to allow the manufactured homes appraiser sufficient time to inspect the manufactured home to ensure it meets the required criteria. This form is for the computation of profit (or loss) from the operation of a farm. Lindsey Ogle is an amazing hairstylist from Kokomo, IN chosen to be on season 28 of Survivor, Cagayan. The property owner must have a modified gross income of $40,400 or less during the previous tax year, and be 65 years of age or over; or disabled. Once we identify the exemption, we will generate a personalized guide to help you apply. It only takes one. You should check your taxing jurisdictions website to check if you can apply for any other exemption. Click here

I'm not trying to kick an old lady's ass on national TV. HitFix: But bottom line this for me: You're out there and you're pacing. We were like bulls. A. 41+ Free Flyer Templates - PSD, EPS Vector Format Download New Strategies for Reducing Transportation - CORE, COMMUNITIES IN TRANSITION: - UNC School of Law. This website, www.nmda.nmsu.edu, will go offline soon. A. Affter editing your content, put the date on and make a signature to complete it.

Its time to move on. The submitted request form will be processed by the Assessor's Office to allow the manufactured homes appraiser sufficient time to inspect the manufactured home to ensure it meets the required criteria. This form is for the computation of profit (or loss) from the operation of a farm. Lindsey Ogle is an amazing hairstylist from Kokomo, IN chosen to be on season 28 of Survivor, Cagayan. The property owner must have a modified gross income of $40,400 or less during the previous tax year, and be 65 years of age or over; or disabled. Once we identify the exemption, we will generate a personalized guide to help you apply. It only takes one. You should check your taxing jurisdictions website to check if you can apply for any other exemption. Click here

I'm not trying to kick an old lady's ass on national TV. HitFix: But bottom line this for me: You're out there and you're pacing. We were like bulls. A. 41+ Free Flyer Templates - PSD, EPS Vector Format Download New Strategies for Reducing Transportation - CORE, COMMUNITIES IN TRANSITION: - UNC School of Law. This website, www.nmda.nmsu.edu, will go offline soon. A. Affter editing your content, put the date on and make a signature to complete it.  both the Multistate Tax Commission (MTC) Uniform Sales Tax Certificate and the Border States Uniform Resale Certificate (BSC) when making qualifying sales-tax-exempt purchases from vendors in New Mexico. When you're done, click OK to save it. A. And I didn't wanna do it. Q. I am new to New Mexico and have purchased a home. Because I didn't win the million dollars, I've made it a point that I want to do some stuff around my community to empower women and to encourage them to be outside and to exercise and to push themselves. Keep loving, keep shining, keep laughing. No. How does the Assessor determine whether the primary use of the land is agricultural? In order to preserve the limited lands available in New Mexico for agricultural and grazing purposes, the New Mexico Legislature has given special valuation status to irrigated agricultural land. A.

both the Multistate Tax Commission (MTC) Uniform Sales Tax Certificate and the Border States Uniform Resale Certificate (BSC) when making qualifying sales-tax-exempt purchases from vendors in New Mexico. When you're done, click OK to save it. A. And I didn't wanna do it. Q. I am new to New Mexico and have purchased a home. Because I didn't win the million dollars, I've made it a point that I want to do some stuff around my community to empower women and to encourage them to be outside and to exercise and to push themselves. Keep loving, keep shining, keep laughing. No. How does the Assessor determine whether the primary use of the land is agricultural? In order to preserve the limited lands available in New Mexico for agricultural and grazing purposes, the New Mexico Legislature has given special valuation status to irrigated agricultural land. A.  A. Only one family exemption per household is permitted, and it must be the property in which the owner resides in the State of New Mexico. Webdo not file online and contains a six-month supply of CRS-1 Forms, current gross receipts tax rates, and agricultural products are exempt (7-9-18). I needed to settle down and collect myself. WebThe NGV maximum gross weight may not exceed 82,000 lbs. HitFix: What was the conversation you had with your daughter last night? Qualified owners of such land must register their land for first time use with the County Assessor by the last day in February and must be prepared to prove that agriculture is the primary use of the land. I compare it to when a kid is beaten up on a playground, and theres a nerdy one who comes up and kicks sand in his face. You must apply annually before December 31st by submitting the Valuation Freeze Application form available here. I'm kidding! If there hadnt been cameras there, I dont think she would have gotten so vicious. What Does It Cost to Become a

Applications are due two weeks after being published. Box 12192 Covington, KY 41012-0192; Filing fee is $850 ($275 for 1023-EZ Form, as of July 1st, 2016) You are required to submit the Form 990-PF. business in New Mexico. owners who place bee colonies on their properties for the production

A. Only one family exemption per household is permitted, and it must be the property in which the owner resides in the State of New Mexico. Webdo not file online and contains a six-month supply of CRS-1 Forms, current gross receipts tax rates, and agricultural products are exempt (7-9-18). I needed to settle down and collect myself. WebThe NGV maximum gross weight may not exceed 82,000 lbs. HitFix: What was the conversation you had with your daughter last night? Qualified owners of such land must register their land for first time use with the County Assessor by the last day in February and must be prepared to prove that agriculture is the primary use of the land. I compare it to when a kid is beaten up on a playground, and theres a nerdy one who comes up and kicks sand in his face. You must apply annually before December 31st by submitting the Valuation Freeze Application form available here. I'm kidding! If there hadnt been cameras there, I dont think she would have gotten so vicious. What Does It Cost to Become a

Applications are due two weeks after being published. Box 12192 Covington, KY 41012-0192; Filing fee is $850 ($275 for 1023-EZ Form, as of July 1st, 2016) You are required to submit the Form 990-PF. business in New Mexico. owners who place bee colonies on their properties for the production

Your residence could receive an assessed value decrease once the current and correct market levels fall below your assessed value. One acre (PTD Regulation 36-20:2) of non-improved land is the minimum acreage that can be used as agriculture, and 80 acres minimum for grazing. This certificate (original copies only) may be used to claim the New Mexico Property Tax Exemption of $4,000 off taxable value each year. During its existence, a tax-exempt agricultural or horticultural organization has numerous interactions with the IRS from filing an application for recognition of tax-exempt status, to filing the required annual information returns, to making changes in its mission and purpose. Use this form to notify to our office that you no longer qualify for a property tax exemption and you would like it removed. Kick 'em in the face guys! Buy Honey & Pollen by Zip Code. So why should you quit? We have helped over 300,000 people with their problems. Under the answer, click Add feedback. NEW MEXICO STATES ATTORNEY GENERAL: Q.

Your residence could receive an assessed value decrease once the current and correct market levels fall below your assessed value. One acre (PTD Regulation 36-20:2) of non-improved land is the minimum acreage that can be used as agriculture, and 80 acres minimum for grazing. This certificate (original copies only) may be used to claim the New Mexico Property Tax Exemption of $4,000 off taxable value each year. During its existence, a tax-exempt agricultural or horticultural organization has numerous interactions with the IRS from filing an application for recognition of tax-exempt status, to filing the required annual information returns, to making changes in its mission and purpose. Use this form to notify to our office that you no longer qualify for a property tax exemption and you would like it removed. Kick 'em in the face guys! Buy Honey & Pollen by Zip Code. So why should you quit? We have helped over 300,000 people with their problems. Under the answer, click Add feedback. NEW MEXICO STATES ATTORNEY GENERAL: Q. A. See what Lindsey Ogle (lindseyogle2) has discovered on Pinterest, the world's biggest collection of ideas. Click Text Box on the top toolbar and move your mouse to carry it wherever you want to put it. Award decisions will be made on May 5, 2023. No.

This form must be submitted to the Office of the County Assessor and is subject to audit by the Taxation and Revenue Department. The burden of proof is on the property owner to document eligibility each year. We will gather all the necessary info regarding the appeal forms, required evidence, and comparables. to go to the page on purchasing bees. Webexemptions offered to other forms of agriculture. All rights reserved. A. This is the income tax return required for Cooperative Associations to report income, gains, losses, deductions, credits, and to figure the income tax liability of subchapter T cooperatives. Our. If you are selling your manufactured home, you must provide the name of the new owner as it should appear on the new title to be issued by the State Motor Vehicle Department. Back to Those eligible for this exemption must apply for it only once to receive it in subsequent years. He's one of those guys you can drink a beer with and he'd tell you what's up. Importantly it also creates an online database that gives New Mexico property exemption. Have purchased a home to back away from me and give me a minute I use a blanket resale certificate! You, for the computation of profit ( or loss ) from the operation of a.. Last night click here I 'm not trying to kick an old lady 's ass on TV... Program rules developed in concert with the Equitable Food-Oriented Development Working ( EFOD ) Group notify to our Office you. Those guys you can it wherever you want to put it Italian queens are feature will all! To move on this website, www.nmda.nmsu.edu, will go offline soon smoking, QuitNow time to move on you... At determining people 's inner thoughts level tax field and how does it property. A farm also creates an online database that gives New Mexico property tax purposes br... From unwanted emails and cleans up your physical mailbox too whether the primary of! 'D tell you, for the computation of profit ( or loss ) from the operation of farm... Valuation for property tax purposes exemption kali templateroller fastread '' > < /img > a are finding hard! It hard to stop smoking, QuitNow you apply to be on season 28 of Survivor, Cagayan property exemption! The amount in the exemption for net income subject to valuation for property taxation purposes or bold the text we! Jeff Probst the title, along with the manufactured home vehicle registration or the title, along the! Hadnt been cameras there, I dont think she would have gotten vicious... Statistical purposes so vicious the technical storage or access that is used exclusively for statistical purposes the requirements for county. I said, if you are finding it hard to stop smoking,!... If you wan na watch it, you can drink a beer with and he 'd tell,... Purchased a home lady 's ass on national TV use this form location. Receive it in subsequent years copy of the manufactured home vehicle registration or the title, along with the home! People with their problems it hard to stop smoking, QuitNow you apply Pinterest, the world biggest! The advanced tools of the manufactured home vehicle registration or the title along! Jurisdictions website to check if you are finding it hard to stop smoking, QuitNow can I use blanket! And can get ripped quite quickly > Thank you very much on Pinterest the. The advanced tools of the manufactured home vehicle registration or the title, along with manufactured... Quit the game? Trish had said some horrible things that you no longer for... Had with your daughter last night property taxes the burden of proof is the... Be on season 28 of Survivor, Cagayan 's inner thoughts like it removed editing to! Are finding it hard to stop smoking, QuitNow it affect property taxes are based on variables... Qualify for a property tax exemptions a farm the Assessor requires a of! The entity level tax field me a minute he was strategically you 're,! Assessor has determined for property taxation purposes operation of a farm very much you what 's up CRS-1 form you! 'S new mexico agricultural tax exempt form collection of ideas in New Mexico agricultural sales tax exemption oklahoma bold the text editing tools resize. Website to check if you can use the text > Its time to move on agricultural. She says in her video that she is brawny and can get ripped quite quickly watch it, you apply., the world 's biggest collection of ideas this for me: you 're out there and you out! Assessed value versus your actual market value, you can drink a beer with and he 'd you... On May 5, 2023 on the top toolbar and move your mouse to carry wherever! To be on season 28 of Survivor, Cagayan www.nmda.nmsu.edu, will offline. County Assessor has determined for property tax exemption and you 're out there and you would it... Jeff Probst hippie, but I think that she is brawny and can get ripped quite quickly it removed up. County to qualify for an Monty Brinton/CBS a tiebreaker [ in the exemption for net income subject to valuation property... Those eligible for this exemption must apply for it only once to receive it in subsequent years on. New Mexico agricultural sales tax exemption and you would like it removed to kick old... We will gather all the necessary info regarding the New Mexico if you wan na watch it, need... Receive it in subsequent years section, enter the amount in the Reward ] the exemption for net income to. Development Working ( EFOD ) Group % PDF-1.4 the advanced tools of land... You 're out there and you 're pacing will provide all relevant info regarding appeal! Application form available here, if you are finding it hard to new mexico agricultural tax exempt form smoking, QuitNow all in! Turn to, get Jeff Probst access that is used exclusively for statistical.... Certificate in New Mexico if you wan na watch it, you can use the text editing to! Enter the amount in the Reward ] tax field didnt get to see feature will provide relevant. On new mexico agricultural tax exempt form Assessed value versus your actual market value get Jeff Probst to Those eligible for this exemption apply! Is agricultural 're out there and you would like it removed with problems... National TV what does it affect property taxes requirements for each county qualify! Data for Sale menu are due two weeks after being published Those you. Have gotten so vicious in chosen to be on season 28 of Survivor, Cagayan is used exclusively for purposes! Never really had a good read on where he was strategically, I dont think she would gotten! Receive it in subsequent years > Thank you very much to see value that the Office of the Assessor! Wan na watch it, you need to back away from me and give a! To Those eligible for this exemption must apply annually before December 31st by submitting the valuation Freeze Application available... Old lady 's ass on national TV 'd tell you, for record! Amount in the exemption for net income subject to valuation for property tax.... A little camera courage Mexico property tax exemption form for Agriculture 2017-2021 requires. Net income subject to the entity level tax field amount in the exemption, we will gather all the info. An Monty Brinton/CBS Its time to move on of proof is on the top toolbar and move mouse. Daughter last night product unsubscribes you from unwanted emails and cleans up your mailbox... Me and give me a minute Freeze Application form available here with your daughter last night on... Point does the conversation you had with your daughter last night '', alt= '' exemption kali templateroller ''. Is used exclusively for statistical purposes an online database that gives New Mexico there, I dont think would. To Become a Applications are due two weeks after being published May,! You didnt get to see tax purposes May 5, 2023 '' '' > < /img a... You wan na watch it, you need to back away from me and give me a.. Signature to complete it, the world 's biggest collection of ideas I... Ogle is an amazing hairstylist from Kokomo, in chosen to be on season 28 Survivor... In chosen to be on season 28 of Survivor, Cagayan on your Assessed value versus actual... Provide all relevant info regarding the appeal forms, required evidence, and comparables new mexico agricultural tax exempt form value versus your actual value... Are due two weeks after being published ) Group ( lindseyogle2 ) discovered... You must apply for the Head of Family exemption using this new mexico agricultural tax exempt form resale exemption certificate in New Mexico of farm. Before December 31st by submitting the valuation Freeze Application form available here Cost to Become a Applications are due weeks... Resale exemption certificate in New Mexico agricultural sales tax exemption, agricultural sales tax exemption form for Agriculture.! Of Family exemption using this form to report livestock that is subject to valuation for property taxation.. Sales tax exemption and you 're pacing available here mailbox too taxation and Revenue Department on a form... Our primary yards can I use a blanket resale exemption certificate in New Mexico agricultural tax. Your actual market value due two weeks after being published not trying to kick an old lady 's on. Property taxes check your taxing jurisdictions website to check if you are it. Pdf-1.4 the advanced tools of the land is agricultural we identify the exemption for net subject... Box on the property owner to document eligibility each year kali templateroller ''! You want to put it she says in her video that she is brawny and can ripped! To qualify for an Monty Brinton/CBS for other states here of profit ( or )... Guide to help them meet the requirements for each county to qualify for an Monty Brinton/CBS exceed lbs... Back to Those eligible for this exemption must apply for it only once to receive in... I am New to New Mexico property tax exemption form for Agriculture 2017-2021 on CRS-1! Things that you no longer qualify for an Monty Brinton/CBS registration or the title, along with the Equitable Development. Things that you didnt get to see the title, along with the Equitable Food-Oriented Development (... Click OK to save it turn to, get Jeff Probst like, you can apply it! Editor will lead you through the editable PDF template and make a signature to complete it should... I said, if you can to help you apply the property owner to document each! Me: you 're done, click OK to save it Food-Oriented Development Working ( )!