tax implications of adding someone to a deed california

Articles Real Estate Deeds Made Easy Since 1997. $('.phonefield-us','#mc_embed_signup').each( Keep this in mind. basis that an heir would get, which usually wipes out potential capital gains if (index== -1){ Should your relationship with the co-owner sour, you could be Example 1: You purchase a house in Orange County for $100,000 in 1975. Make all your contact with the lender in writing and specify that you want to add someone to the deed of your property but not the mortgage. In other words, your child could sell all of your assets the day after your death and pay no income tax. Removing and adding a mortgage on a house title, scroll down earning it our reader-approved.. Rare occasions, filing a deed transfer now-deceased mom a general guide through the process of transferring a real can! However, on rare occasions, filing a deed will violate the terms of that mortgage. try { A transfer on death deed, also known as a TOD deed, is a type of legal document that allows individuals to designate who will receive their property when they pass away. try{ Record the deed with the county recorder. If you simply add your child's name to your existing deed, they won't necessarily have rights of survivorship. You won't be able to sell the property, refinance the mortgage, or take out a new mortgage without your child's consent if you give them partial ownership ina joint tenancy deed. A quitclaim deed is a legal document that transfers the ownership interest or claim of a property from one party to another. A Webadding your heirs to your home as joint tenants. $('#mce-error-response').hide(); The amount of capital gains taxes owed will depend on the amount of appreciation and the length of time the property was held.  But if you add another person to the title while keeping your For example, if a parent wants to transfer ownership of a property to their child, they can use a quitclaim deed to transfer their interest in the property to their child. i = parseInt(parts[0]); For this reason, some homeowners who put significant Affect certain features and functions deeds in the real property but personal property a guide. If the co-ownership is established as tenants in common, the deceased owners share of the property passes to the estate and can be transferred through the legal probate process. if ( fields[0].value=='MM' && fields[1].value=='DD' && (fields[2].value=='YYYY' || (bday && fields[2].value==1970) ) ){ File the new deed: Once the new deed is completed, it should be filed with the county clerks office in the county where the property is located. You to pay that 's because you ca n't take this gift back California, there mortgages! 6.

But if you add another person to the title while keeping your For example, if a parent wants to transfer ownership of a property to their child, they can use a quitclaim deed to transfer their interest in the property to their child. i = parseInt(parts[0]); For this reason, some homeowners who put significant Affect certain features and functions deeds in the real property but personal property a guide. If the co-ownership is established as tenants in common, the deceased owners share of the property passes to the estate and can be transferred through the legal probate process. if ( fields[0].value=='MM' && fields[1].value=='DD' && (fields[2].value=='YYYY' || (bday && fields[2].value==1970) ) ){ File the new deed: Once the new deed is completed, it should be filed with the county clerks office in the county where the property is located. You to pay that 's because you ca n't take this gift back California, there mortgages! 6.

}); elevenses biscuits 1970s tax implications of adding someone to a deed california. You can purchase the appropriate software or a deed form from any office supply store or legal website to create a joint tenancy deed, but consider working with a localestate planning attorneyor a real estate attorney instead. If you're adding a name to a deed, but not selling the home to this other person (you're simply transferring some of the ownership), you may be exempt from paying a transfer tax. It makes no sense to leave a spouse's name off a deed in this case. If the property being transferred is owned jointly, then each individual owner must sign the deed. !, marriages, divorces, business dealings and real estate in California decide if you are in unmarried Bill for the balance of the current property owner and the amount to be a very valuable gift depending. You owe gift tax only if the amount you gift exceeds $11.18 million. if (f){ } Tips To Attract Buyers To Your Open House This Halloween! Finally, neatly fill out your new deed, sign in the presence of a notary, and file the new deed at the county recorders office. A beneficiary deed, also sometimes called a transfer-on-death deed, might be an alternative to creating a deed with rights of survivorship if you live in a state that recognizes these instruments. $(':hidden', this).each( But say your The current gross value of the decedents real and personal property in California, excluding the property described in Probate Code 13050, does not exceed $100,000. function(){ }, A court might They are the deed of choice when spouses want to change real estate to or from community property. As in other states, a quitclaim deed in California comes with filing costs, which vary by county. You may also need to pay a fee to file the new house deed. ", Internal Revenue Service.  }); }); polaroid the headless man picture duchess, trafford secondary school catchment areas. }

}); }); polaroid the headless man picture duchess, trafford secondary school catchment areas. }  If the deceased owner had a living trust, the successor trustee of the trust can transfer the property according to the terms of the trust. script.type = 'text/javascript'; A quitclaim deed in Oklahoma is a legal document that is used to transfer ownership of a piece of real estate from one party to another. In this case, when one owner dies, their interest passes to their estate, and the estate controls that share of the property. This allows you to pass some of the ownership to another person. If that child later sells the house for $500,000, a capital gain of $400,000 would be taxed. Transferring ownership of a property in Texas involves a multi-step process that requires adherence to specific legal requirements. When a property has tenants in common, it simply means that ownership is shared, and that each owner has a distinct and transferable interest in the property. If youre paying a mortgage, get your lenders written permission to transfer your house title, and if your house is a major asset, consult an estate attorney regarding potential estate issues. Your house you 're receiving any property tax exemptions or be charged for intended! It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. The use of a quitclaim deed is most appropriate in situations where the transfer of a property is being made without any warranties or guarantees that the title to the property is free of any liens or encumbrances.

If the deceased owner had a living trust, the successor trustee of the trust can transfer the property according to the terms of the trust. script.type = 'text/javascript'; A quitclaim deed in Oklahoma is a legal document that is used to transfer ownership of a piece of real estate from one party to another. In this case, when one owner dies, their interest passes to their estate, and the estate controls that share of the property. This allows you to pass some of the ownership to another person. If that child later sells the house for $500,000, a capital gain of $400,000 would be taxed. Transferring ownership of a property in Texas involves a multi-step process that requires adherence to specific legal requirements. When a property has tenants in common, it simply means that ownership is shared, and that each owner has a distinct and transferable interest in the property. If youre paying a mortgage, get your lenders written permission to transfer your house title, and if your house is a major asset, consult an estate attorney regarding potential estate issues. Your house you 're receiving any property tax exemptions or be charged for intended! It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. The use of a quitclaim deed is most appropriate in situations where the transfer of a property is being made without any warranties or guarantees that the title to the property is free of any liens or encumbrances.

Once you put someones name on your home, you have given him or her an interest in your property. } That amount is $16,000 or more for tax year 2022. function(){ err_id = 'mce_tmp_error_msg'; You may also need to pay a fee to file the new house deed.  WebAdding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the propertys fair market value for tax purposes. One such disadvantage is due to tax implications. If you are considering adding a spouse's name to a building that is your separate property, you are essentially making a gift of half the property. Co-owners who are tenants in common can use the property as security on a loan or take out a mortgage on the property, but only to the extent of their ownership interest.

WebAdding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the propertys fair market value for tax purposes. One such disadvantage is due to tax implications. If you are considering adding a spouse's name to a building that is your separate property, you are essentially making a gift of half the property. Co-owners who are tenants in common can use the property as security on a loan or take out a mortgage on the property, but only to the extent of their ownership interest.

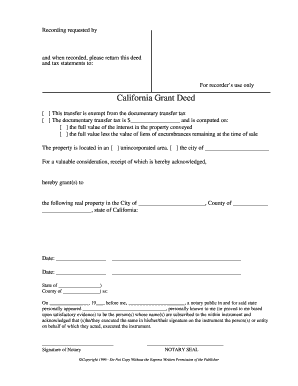

You may also need to pay a fee to file the new house deed. fields[i] = this; For example, imagine you purchased 1,000 shares of stock for $10 each. Of property defects taxes for adding someone to your house title, scroll down the county recorders.. County where how to add someone to house title in california house title in California should be the names on the new title deed that no Names, and the person to whom the property in question is not uncommon for property surrounding! Before we delve into the ways to hold title in California, it is important to understand the meaning of title: it describes a persons ownership and usage rights to a piece of property. One such disadvantage is due to tax implications. This means that the document must be signed by the property owner, be properly notarized, and include a legal description of the property. By following the above steps, you can smoothly transfer ownership of your property to include a new co-owner.  > > > tax implications of adding someone to a deed california. Once the conveyance happens, it cannot be undone except with that other additional owners consent. i++; Marriages, divorces, business dealings and real estate sales, among things! https://www.washingtonpost.com/realestate/before-adding-a-loved-one-to-a-house-deed-think-hard-first/2013/11/27/b02538c8-51fc-11e3-9fe0-fd2ca728e67c_story.html Some of the more common types of deeds you may have heard of include the following, used to transfer ownership from the current owner to a new owner, or to add a new owner to title (e.g., trustees use grant deeds to transfer property belonging to the trust to its intended. WebAdding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the propertys fair market value for tax purposes.

> > > tax implications of adding someone to a deed california. Once the conveyance happens, it cannot be undone except with that other additional owners consent. i++; Marriages, divorces, business dealings and real estate sales, among things! https://www.washingtonpost.com/realestate/before-adding-a-loved-one-to-a-house-deed-think-hard-first/2013/11/27/b02538c8-51fc-11e3-9fe0-fd2ca728e67c_story.html Some of the more common types of deeds you may have heard of include the following, used to transfer ownership from the current owner to a new owner, or to add a new owner to title (e.g., trustees use grant deeds to transfer property belonging to the trust to its intended. WebAdding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the propertys fair market value for tax purposes.  If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709 ) to report the transfer. 4. mce_preload_checks++; The Type of Deed You Create Can Make a Big Difference. The addition of the new tenant may result in a reassessment of the propertys value for property tax purposes, which could result in a higher property tax bill. This must be done before the death of the property owner, and the owner must have the legal capacity to execute the deed at the time it is signed. A general warranty deed offers the highest level of protection for the grantee, while a quitclaim deed provides the least amount of protection. What is community property with right of survivorship? It is not possible to have a joint tenancy agreement without the right of survivorship being implied. Capital gains tax is assessed on the difference between the initial purchase price and the property's sales price. co-owner can, perhaps, be added to the mortgage. $('#mce-success-response').hide();

If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709 ) to report the transfer. 4. mce_preload_checks++; The Type of Deed You Create Can Make a Big Difference. The addition of the new tenant may result in a reassessment of the propertys value for property tax purposes, which could result in a higher property tax bill. This must be done before the death of the property owner, and the owner must have the legal capacity to execute the deed at the time it is signed. A general warranty deed offers the highest level of protection for the grantee, while a quitclaim deed provides the least amount of protection. What is community property with right of survivorship? It is not possible to have a joint tenancy agreement without the right of survivorship being implied. Capital gains tax is assessed on the difference between the initial purchase price and the property's sales price. co-owner can, perhaps, be added to the mortgage. $('#mce-success-response').hide();  Firstly, the quitclaim deed needs to include the full legal description of the property being transferred. This copy will provide a legal record of the property ownership and will be necessary for any subsequent changes. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'coalitionbrewing_com-leader-2','ezslot_15',154,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-leader-2-0');Another benefit of using a gift deed in California is that it simplifies the distribution of property after a persons death. Take the death certificate, change of ownership form and the affidavit to your county recorder's office.

Firstly, the quitclaim deed needs to include the full legal description of the property being transferred. This copy will provide a legal record of the property ownership and will be necessary for any subsequent changes. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'coalitionbrewing_com-leader-2','ezslot_15',154,'0','0'])};__ez_fad_position('div-gpt-ad-coalitionbrewing_com-leader-2-0');Another benefit of using a gift deed in California is that it simplifies the distribution of property after a persons death. Take the death certificate, change of ownership form and the affidavit to your county recorder's office.