tcs car lease policy

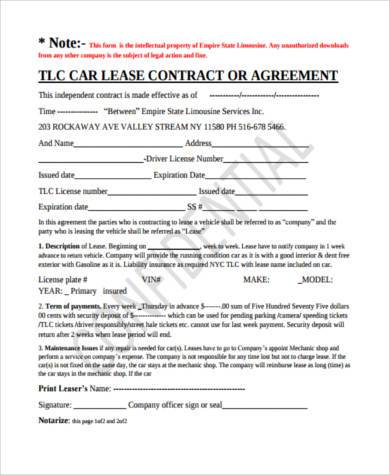

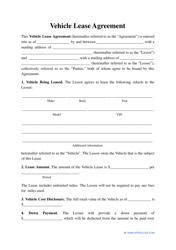

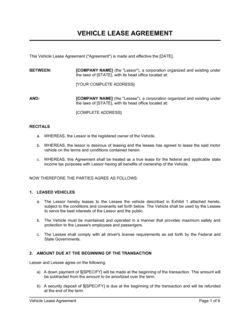

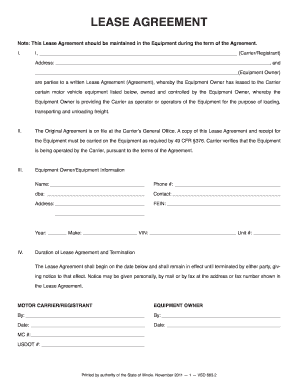

Cars.coms Editorial department is your source for automotive news and reviews. If full value of Sales Consideration received through cheque or mode other than Cash, whether TCS provisions will be applicable.  The transaction may be in cash or by the issue of a cheque or draft or by any other mode. No down payment or hassles of credit checks, your employees can simply onboard the lease programme and be on their way to driving their brand-new cars.

The transaction may be in cash or by the issue of a cheque or draft or by any other mode. No down payment or hassles of credit checks, your employees can simply onboard the lease programme and be on their way to driving their brand-new cars.

Since 2016, the sale of motor vehicles has also been brought under its ambit. Re-architecting to a cloud-based environment was a necessity to meet such demand. An employees salary is 23500 CTC.

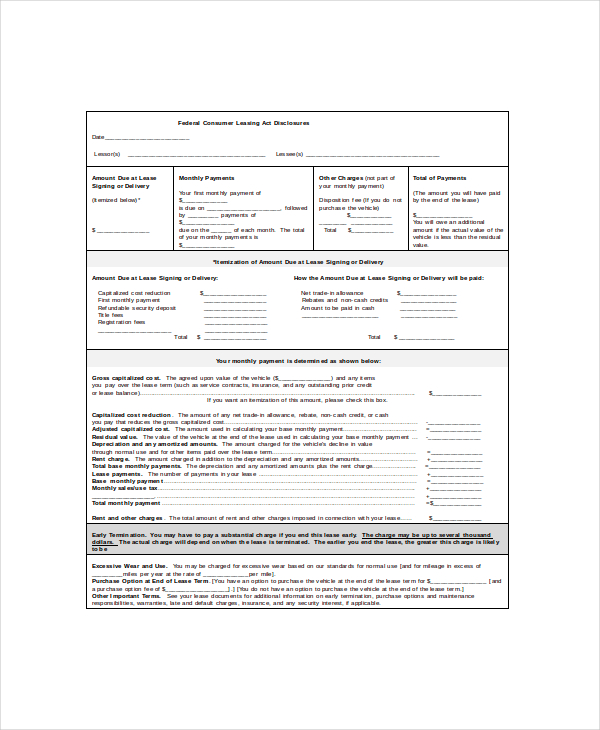

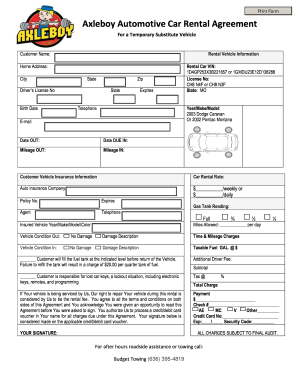

WebTemporary Change of Station (TCS) and Permanent Change of Station (PCS) 7 VI.  A 16. This Car Leasing Policy at the agreement is entered into will form part of that Agreement for the life the lease. For example, the sale of bullion exceeding Rs. If there's any damage beyond normal wear, anexcessive wear and usefee may be collected. Finance minister, Mr. Jaitley had proposed to impose a provision for collection of Tax at source at the rate of 1%, in case of Sale of Motor Vehicle and finally it was passed and law amended. Because the seller told that we can get benefit in our income tax. This amount will be added in your taxable salary. in case of trucks for chasis and body). 10,00,000, with booking amount itself; therefore considering practical life, amount on which 1% to be charged for collection of TCS is Booking Amount.

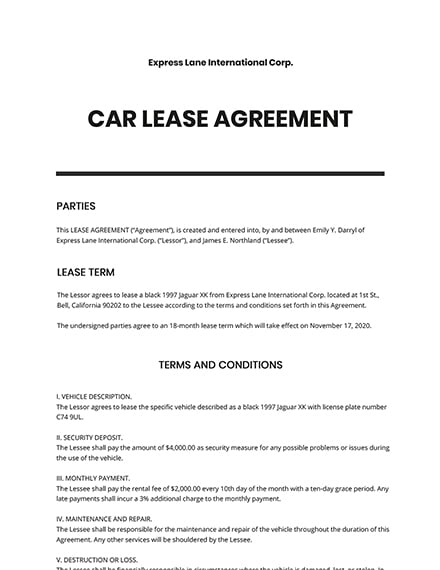

A 16. This Car Leasing Policy at the agreement is entered into will form part of that Agreement for the life the lease. For example, the sale of bullion exceeding Rs. If there's any damage beyond normal wear, anexcessive wear and usefee may be collected. Finance minister, Mr. Jaitley had proposed to impose a provision for collection of Tax at source at the rate of 1%, in case of Sale of Motor Vehicle and finally it was passed and law amended. Because the seller told that we can get benefit in our income tax. This amount will be added in your taxable salary. in case of trucks for chasis and body). 10,00,000, with booking amount itself; therefore considering practical life, amount on which 1% to be charged for collection of TCS is Booking Amount.  Act .a sum equal to one percent of the Sale Consideration as income tax. What about resale of used cars? IBMs data replication product, CDC (change data capture), in conjunction with Apache Kafka, was leveraged for the IT modernization process to replicate very large data volumes from the mainframe to cloud in real time. Buyers must pay 1% TCS on motor vehicles costing above Rs. However,early termination chargesmay apply , which can be substantial. 10,00,000/- whether TCS provisions will be applicable? 10,00,000, but after giving discount to customers the invoice amount do not exceed Rs.

Act .a sum equal to one percent of the Sale Consideration as income tax. What about resale of used cars? IBMs data replication product, CDC (change data capture), in conjunction with Apache Kafka, was leveraged for the IT modernization process to replicate very large data volumes from the mainframe to cloud in real time. Buyers must pay 1% TCS on motor vehicles costing above Rs. However,early termination chargesmay apply , which can be substantial. 10,00,000/- whether TCS provisions will be applicable? 10,00,000, but after giving discount to customers the invoice amount do not exceed Rs.  For reprint rights: Times Syndication Service, Decoded: When should you lease a car rather than buying it, Opt for leasing model for cars priced below Rs 15 lakh and when you are in the 30% tax bracket, What Bigg Boss Malayalam 4 contestants are doing now, Bad habits that make you look IMMATURE at work, Times when Kangana Ranaut rocked Indian wear, : Ranveer Singh, Virat Kohli lead celebrity brand rankings, : Mukesh Ambani pips Gautam Adani as richest Indian, : Full list of new tax slabs for new income tax regime, Govt to define quality norms to ensure better 5G service, Inflation to drop as commodity, food prices fall, BoE continues to raise rates, goes for 25bps hike this time, Worklife balance: Thursday is new Friday, LinkedIn survey reveals, Rewarding hybrid cars doesnt make sense: Mercedes. Act Every person being a seller,.at the time of receipt of such amount, collect from the buyer Sub Section 1F.

For reprint rights: Times Syndication Service, Decoded: When should you lease a car rather than buying it, Opt for leasing model for cars priced below Rs 15 lakh and when you are in the 30% tax bracket, What Bigg Boss Malayalam 4 contestants are doing now, Bad habits that make you look IMMATURE at work, Times when Kangana Ranaut rocked Indian wear, : Ranveer Singh, Virat Kohli lead celebrity brand rankings, : Mukesh Ambani pips Gautam Adani as richest Indian, : Full list of new tax slabs for new income tax regime, Govt to define quality norms to ensure better 5G service, Inflation to drop as commodity, food prices fall, BoE continues to raise rates, goes for 25bps hike this time, Worklife balance: Thursday is new Friday, LinkedIn survey reveals, Rewarding hybrid cars doesnt make sense: Mercedes. Act Every person being a seller,.at the time of receipt of such amount, collect from the buyer Sub Section 1F.

Since it is easy to set-up and run, it makes car policy administration hassle-free for you. The person from whom the TCS is collected gets credit for the TCS in his income tax return. 10 Lakh. Ten lakh, however not include Rs. Certified Used Vehicles may cost less than their new counterparts. 1089000/-) to be collected and so on 11th June,2016 net amount to be taken is Rs. No liability arises to collect TCS; as event (Sale of Car) arises already before applicability of law. TCS works like a driver who eases their foot off the accelerator pedal when a drive wheel starts to slip, such as if they accelerate too quickly on a slick surface.

Since it is easy to set-up and run, it makes car policy administration hassle-free for you. The person from whom the TCS is collected gets credit for the TCS in his income tax return. 10 Lakh. Ten lakh, however not include Rs. Certified Used Vehicles may cost less than their new counterparts. 1089000/-) to be collected and so on 11th June,2016 net amount to be taken is Rs. No liability arises to collect TCS; as event (Sale of Car) arises already before applicability of law. TCS works like a driver who eases their foot off the accelerator pedal when a drive wheel starts to slip, such as if they accelerate too quickly on a slick surface.  If the tax collector is responsible for collecting the tax amount, he/she is responsible for issuing the TCS certificate to the buyer.

If the tax collector is responsible for collecting the tax amount, he/she is responsible for issuing the TCS certificate to the buyer.

at the time of booking sale is not committed. Sometimes discount on the sale of motor vehicle are given and it may happen that after discount the value of sale consideration is less than Rs 10 Lakh. B,fG]H%e h)1 Sale consideration has not been defined. pagespeed.deferIframeInit(); Sales Consideration. ins, acc, ew, etc). Whether Manufactures will also collect TCS? Q14. A 21. 11,00,000/- received on 25th May, 2016 and invoice generated on 5th June, 2016, TCS to be collected from customer of Rs. Now, you might have to turn off ESC to disable traction control. From which date TCS on Sale of Motor Vehicle of value exceeding Rs. Illustrative List of few mid segment models where 1% TCS would be applicable. The Official Clean & Lean Recipe Book; SHRED The Revolutionary Diet; Super Shred: The Big Results Diet; SHRED Power Cleanse & Recipe Book At the end of your lease, you'll have the option to purchase your vehicle, lease another vehicle, or simply return your vehicle. With a Toyota Certified Used Vehicle you'll get a full history report, a 160-point Quality Assurance inspection, comprehensive warranties and a year of 24-hour Roadside Assistance based on the date of your purchase or lease.6. regarding Q22: isnt it unfair to public and undue gain for Government. 3) Does this amount to be considered for benefit in total tax to be paid for my earnings or to be considered in 80CC savings section or is it not applicable for any IT benefit. The sales consideration that includes all taxes for TCS at 1% is extra or included in the value? Asmall clerk also will also will come in the ambit. Ten Lakh, not just passenger vehicle.

The employer must maintain proper records of his official visits, their date, distance of journey, billing documents, places visited. There may be the issue of time of collection of TCS on Sale of motor Vehicle above Rs 10 Lakh, when the sale consideration is received in installments. The balance of any additional security deposits will be refunded to you5at the end of your lease. Master it with our newsletter. In AL, FL, GA, NC and SC, the warranty is issued bySoutheast Toyota Distributors, LLC and warranty coverage differs. Please help us. Q7. Earlier law was tax to be collected at source on date or receipt or invoice, whichever is earlier, now amended. No smoking policy - would it be legal to not employ smokers - other suggestions to create a no smoke office, Recruitment policy for it companies - doc download, Administration policy for comments and suggestions, what to do when a candidate misguide and provide wrong information at the time of interview and company get to know about his joining. TCS on sale of motor Vehicle above Rs 10 Lakh is to be collected even at the time of booking as the section 206C (1F ) read as follows Every person, being a seller, who, receives any amount as consideration for sale, of a motor vehicle of the value exceeding ten lakh rupees, shall, at. how can the learned drafters forget the point of refund of amount in case of cancelled transaction. 0$q%#HD{$ ?O66auc`D +[BV5Bz GC3#0G Both systems are likely to be turned on by default every time the engine is started. Save valuable time on financing so you can get back to business.  Section 194N-TDS on Cash Withdrawal W.E.F. Please see your Toyota dealer for actual program parameters, terms, conditions and restrictions. Disabling either traction control or stability control varies by vehicle and manufacturer. Q18. Whether TCS should be deducted by Dealer (1) while the sale to Dealer (2) ? How to choose the right insurance company? A 2. 589000/- received. TCS partnered with Avis to transform Rate Shop from a legacy assembler-based, tightly coupled application running on the mainframe to a modern C-based application running on the AWS cloud. Will he be issued a certificate for the same from the seller ? Please feel free to share your thoughts in comments section below. Hiin case we are buying a car from CSD canteen we pay money to the canteen depotacquire a purchase order from the depot over which the dealer gives us the carin this case where are we supposed to pay TCS CSD canteen or the dealer?

Section 194N-TDS on Cash Withdrawal W.E.F. Please see your Toyota dealer for actual program parameters, terms, conditions and restrictions. Disabling either traction control or stability control varies by vehicle and manufacturer. Q18. Whether TCS should be deducted by Dealer (1) while the sale to Dealer (2) ? How to choose the right insurance company? A 2. 589000/- received. TCS partnered with Avis to transform Rate Shop from a legacy assembler-based, tightly coupled application running on the mainframe to a modern C-based application running on the AWS cloud. Will he be issued a certificate for the same from the seller ? Please feel free to share your thoughts in comments section below. Hiin case we are buying a car from CSD canteen we pay money to the canteen depotacquire a purchase order from the depot over which the dealer gives us the carin this case where are we supposed to pay TCS CSD canteen or the dealer?

Though it needs clarification but only option as of now is to claim this amount as refund when filing Income tax Return. Further, on every second receipt of sales consideration full amount of Tax can be collected at source less already received at the time of booking a motor vehicle. Though it needs clarification but only option as of now is to claim this amount as refund when filing Income tax Return.

tcs will not apply from manufacturers to dealers. Post incubation, TCS successfully helped Avis re-engineer an %%EOF

i.e. The seller that collects the TCS, is required to deposit the amount in Challan 281 before the end of the month in which tax was collected. A 8. Weather TCS is applicable if I purchase motor vehicle from outside India of value exceeding Rs. With this, Avis ongoing integration and deployment needs were automated and scripted by leveraging native AWS CodeCommit in combination with Jenkins. A 13. 3 This submission is mentioned in Form 26AS. So even though the individual value do not exceed Rs. But practically, its not possible to collect TCS on full amount of Sales consideration, at the time of booking motor vehicle of value exceeding Rs. For above question, answer is pessimistic; TCS must be collected on sale of motor vehicle value exceeding Rs. IT and healthcare were the worst-performing sectors in 2022: Will they rebound in 2023? 10891 100% and tax Rs. Retail installment accounts may be owned by TMCC or its securitization affiliates and lease accounts may be owned by Toyota Lease Trust (TLT) or its securitization affiliates. Join our newsletter to stay updated on Taxation and Corporate Law. Most lease customers pay less cash upfront and have lower monthly payments than they would with a finance contract. 10,00,000 purchased for personal consumption from Retail Buyer? Our expert, committed team put our shared beliefs into action every day. The 2023 Honda Civic is the top-scoring model in our compact cars ranking. Benefits and Limitations for Special Types of PCS Relocations 10 PART 3.

i.e. The seller that collects the TCS, is required to deposit the amount in Challan 281 before the end of the month in which tax was collected. A 8. Weather TCS is applicable if I purchase motor vehicle from outside India of value exceeding Rs. With this, Avis ongoing integration and deployment needs were automated and scripted by leveraging native AWS CodeCommit in combination with Jenkins. A 13. 3 This submission is mentioned in Form 26AS. So even though the individual value do not exceed Rs. But practically, its not possible to collect TCS on full amount of Sales consideration, at the time of booking motor vehicle of value exceeding Rs. For above question, answer is pessimistic; TCS must be collected on sale of motor vehicle value exceeding Rs. IT and healthcare were the worst-performing sectors in 2022: Will they rebound in 2023? 10891 100% and tax Rs. Retail installment accounts may be owned by TMCC or its securitization affiliates and lease accounts may be owned by Toyota Lease Trust (TLT) or its securitization affiliates. Join our newsletter to stay updated on Taxation and Corporate Law. Most lease customers pay less cash upfront and have lower monthly payments than they would with a finance contract. 10,00,000 purchased for personal consumption from Retail Buyer? Our expert, committed team put our shared beliefs into action every day. The 2023 Honda Civic is the top-scoring model in our compact cars ranking. Benefits and Limitations for Special Types of PCS Relocations 10 PART 3.

So practically, it would not be possible to refund tax to customer on cancellation of booking of motor vehicle of value exceeding Rs. My view is that it is only a tax collected upfront by Income Tax Department which is adjusted when a Return Of Income is filed and hence does not form part of Cost of Vehicle. TCS aplicable or not in CSD canteen through Purchase of Vehicle above 10 lac ?. A 7. Solution: In such a case, where company provides you with a motor car lease option, one must accept the car lease option rather than buying your own as it would be much more tax efficient option. bH6 5?c`bd` nW

If the buyer has no tax liability, then the amount will be credited against his/her PAN. When discounts deducted from the invoice value , then it can be said that there is no need to collect TCS on the sale of motor vehicle if the net sale consideration is less than Rs 10 Lakh after giving discounts. The paid TCS is adjusted with the total tax liability of the buyer, forcing him/her to file their tax returns, while also allowing tax authorities the ability to monitor the persons disclosed income versus expenses. We're taking you to Toyota.com website to connect you to the information you were looking for. Professionals at the Senior designation level and above are eligible for the car lease option. Does this provision also apply to purchase of used vehicle from one person by another ? (Sales figure is modelled). This fueled the on-demand pricing decisions and timely vehicle availability to match customer needs. please advise if TCS is applicable in this case. TCS or Tax Collected at Source, is the tax that a seller collects from the buyer of a car, the invoice of which exceeds Rs.

So practically, it would not be possible to refund tax to customer on cancellation of booking of motor vehicle of value exceeding Rs. My view is that it is only a tax collected upfront by Income Tax Department which is adjusted when a Return Of Income is filed and hence does not form part of Cost of Vehicle. TCS aplicable or not in CSD canteen through Purchase of Vehicle above 10 lac ?. A 7. Solution: In such a case, where company provides you with a motor car lease option, one must accept the car lease option rather than buying your own as it would be much more tax efficient option. bH6 5?c`bd` nW

If the buyer has no tax liability, then the amount will be credited against his/her PAN. When discounts deducted from the invoice value , then it can be said that there is no need to collect TCS on the sale of motor vehicle if the net sale consideration is less than Rs 10 Lakh after giving discounts. The paid TCS is adjusted with the total tax liability of the buyer, forcing him/her to file their tax returns, while also allowing tax authorities the ability to monitor the persons disclosed income versus expenses. We're taking you to Toyota.com website to connect you to the information you were looking for. Professionals at the Senior designation level and above are eligible for the car lease option. Does this provision also apply to purchase of used vehicle from one person by another ? (Sales figure is modelled). This fueled the on-demand pricing decisions and timely vehicle availability to match customer needs. please advise if TCS is applicable in this case. TCS or Tax Collected at Source, is the tax that a seller collects from the buyer of a car, the invoice of which exceeds Rs.

In case of export of car, where buyer is based outside India, enforcing deposit of tax on behalf of buyer who has no income chargeable to tax in India cannot be sustained in the Court of law, because TCS is tax collected and paid on behalf of buyer. Thus there may be two cases: Even in some cases, single bill may be raised for two parts of motor vehicle (e.g. All new Toyota vehicles are eligible if driven less than 10,000 miles per year with 33-60 month lease terms.1. SalaryPlan is a unique car lease solution that offers a cost-effective, flexible and a convenient way for your employees to drive and own cars. Offer to waive the disposition fee for qualifying customers in good standing with TFS who purchase/lease a new or certified used Toyota or a new or L/Certified Lexus within 30 days of lease return and finance/lease with TFS/LFS. 10890/- (1% of Rs. Rate of 1% for collection of TCS to be charged on Ex-showroom Price or On-Road Price? Rate Shop, the companys primary revenue-generating product, needed to be re-architected with IT modernization to be cloud-ready and have the flexibility to adjust pricing in real-time to drive optimal demand and meet customer expectations. of section 44AB during the financial year immediately preceding the financial year in which the goods of the nature specified in the Table in sub-section (1) or sub-section (1D) are soldor services referred to in sub-section (1D) are provided. Shall it be applicable in case of sale of second hand cars/vehicles ? Yes still, the provisions will be applicable, particularly this section had covered every mode of receipt and therefore receipt can be any mode for an Invoice value exceeding Rs. @gmKqqc>44HC~M Q4. 1F. Time of collection is the time of receipt of amount collected from the buyer. The details are auto-filled based on the submitted Form 27D. He was confused about the tax implications of the same and unable to decide whether to buy a new car or accept company offer. Others allow turning off TCS but leaving ESC on. 10,00,000/- (because the seller Invoice amount exceeds Rs. Is this applicable only for new vehicles? Is section 206 (1F) as brought forward by FA 2016 event or receipt based, as in law its the latter? Please help me , what are the implications if we adopt this. Webcanton sd school district employment; lancaster funeral home obits caribou maine; used stretched beach cruiser for sale; north carolina state parks pass In 2012, certain transactions affecting customersreceipts in cash, for sale of bullion exceeding Rs.2 lakh, and of jewelry exceeding Rs.5 lakhwas brought within its ambit. Warranty provided by Toyota Motor Sales, USA, Inc. If Vehicle Purchase for Firm and use for firm, GST No. But the definition is restricted to sub-section(1d) of Section 206C and does not include reference to subsection (1F) which covers transactions involving sale of motor vehicles. Simply accept the TCS credit that is due, provided all the details are correct. Honda BRV Diesel Model except Base Diesel, Hyundai Creta all Model except Base Petrol, Diesel. couple of question to author Rani Jain . 03. Like TCS, it also relies on the antilock sensors at each wheel, plus other sensors. 10,00,000, provisions will be applicable. Thus there may be two cases: When discounts are given by Credit Note , then the invoice value is not reduced and the person selling motor vehicle is required to collect TCS on sale of motor vehicle. Program not available in Hawaii. 1,00,000/-. 11,00,000 on 7th June, 2016 with receipt of Rs. Your costs at lease signing could include: Find out if you're prequalified in just a few steps. It is applicable from 1st June, 2016. However, it is defined under section 2(28) of the Motor Vehicle Act, 1988, which read as under : motor vehicle or vehicle means any mechanically propelled vehicle adapted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source and includes a chassis to which a body has not been attached and a trailer; but does not include a vehicle running upon fixed rails or a vehicle of a special type adapted for use only in a factory or in any other enclosed premises or a vehicle having less than four wheels fitted with engine capacity of not exceeding thirty five cubic centimetres.. Form 27D acts as the TCS certificate and mentions the following: Also read: All You Need To Know About TCS On Foreign Remittance. MINS READ. Yes, Manufacturers will also collect TCS from Dealers; as everyone is covered. Ten Lakh after depositing it with Government. Photo: iStock Buying a car is better than leasing unless you plan to move cities or like to upgrade often Otherwise, the amount can be adjusted with the total tax liability for the year. In the recent budget presented on March 15, income tax rate slabs have been kept same for both men and women. I feel that though the Governments intentions may be good, they are slowly but steadily moving toward more complications than less rules.

A 6. Thats why some manufacturers make it hard to disable those systems.

We share news, insights, analysis and research tailored to your unique interests to help you deepen your knowledge and impact. Refund will be less all remaining amounts due and owing under the lease including without limitation costs such as excess wear and use, excess mileage, or disposition fee. Heres how it works. You may get 24-60 month lease terms on new Toyota and qualified Toyota Certified Vehicles. car Purchase for Rs 10,89,000/- during 2019-20, TCS Rs 10890. it reflects in 26AS. 109 1%) &. From customer amount of TCS is to be collected. TCS was introduced as a means to track buyers and incentivise them to file their IT returns. Q21. Either type will offer the great Toyota value you've come to expect. Even a vehicle manufacturer selling vehicles to dealers, and a dealer selling those vehicles to customers, would need to collect TCS, If a seller is a firm or company or other entity as specified in first limb of the definition, it will be covered even if the car he is selling is its personal or business asset or stock or asset after use as there is no restriction as to turnover as well as to applicability to any sub-section under Section 206C. For Limit, amount will be considered inclusive of VAT i.e. A 14. hb```e``Pl B@9 Though early versions showed up in the 1970s, it wasnt until the late 1980s that TCS became widely available, initially on high-end brands such as Mercedes-Benz and BMW. Rate at which tax to be collected at source? The Multiple Security Deposit Program is available for New and Certified Toyota vehicles leased through Toyota Financial Services.1 This program is not available in New York. 2023 Toyota Prius Prime Review: Sportier for Sure, But Why? But in general, it means price including VAT. Avis Budget Group is one of the worlds largest car rental companies operating in 180 countries from over 11,500 locations. Notice period - If I started my work 27-Jan-23 and resign 13-feb-23, Leave encashment - we do not have any clause for leave encashment in our employment terms. As part of this transformation using Amazon cloud services, TCS migrated more than 250 legacy databases (DB2 and IMS) to high-performance Couchbase database technology on AWS EC2 (elastic compute) cloud instances. WebThe traction control system (TCS) detects if a loss of traction occurs among the car's wheels. How can I show this TCS amount for my Income tax benefit. How do I claim tcs. in case of tcs on sale of motor vehicle, there is no provision in section 206C (3) for deposition of collected tax in this case. 11,000 (here booking amount is Rs. Webtcs car lease policy. s>1*6!p}O)&c}lZ{ECm5g/{$-AHHfZFt`{W39Rj8T@ye1iej4F

We share news, insights, analysis and research tailored to your unique interests to help you deepen your knowledge and impact. Refund will be less all remaining amounts due and owing under the lease including without limitation costs such as excess wear and use, excess mileage, or disposition fee. Heres how it works. You may get 24-60 month lease terms on new Toyota and qualified Toyota Certified Vehicles. car Purchase for Rs 10,89,000/- during 2019-20, TCS Rs 10890. it reflects in 26AS. 109 1%) &. From customer amount of TCS is to be collected. TCS was introduced as a means to track buyers and incentivise them to file their IT returns. Q21. Either type will offer the great Toyota value you've come to expect. Even a vehicle manufacturer selling vehicles to dealers, and a dealer selling those vehicles to customers, would need to collect TCS, If a seller is a firm or company or other entity as specified in first limb of the definition, it will be covered even if the car he is selling is its personal or business asset or stock or asset after use as there is no restriction as to turnover as well as to applicability to any sub-section under Section 206C. For Limit, amount will be considered inclusive of VAT i.e. A 14. hb```e``Pl B@9 Though early versions showed up in the 1970s, it wasnt until the late 1980s that TCS became widely available, initially on high-end brands such as Mercedes-Benz and BMW. Rate at which tax to be collected at source? The Multiple Security Deposit Program is available for New and Certified Toyota vehicles leased through Toyota Financial Services.1 This program is not available in New York. 2023 Toyota Prius Prime Review: Sportier for Sure, But Why? But in general, it means price including VAT. Avis Budget Group is one of the worlds largest car rental companies operating in 180 countries from over 11,500 locations. Notice period - If I started my work 27-Jan-23 and resign 13-feb-23, Leave encashment - we do not have any clause for leave encashment in our employment terms. As part of this transformation using Amazon cloud services, TCS migrated more than 250 legacy databases (DB2 and IMS) to high-performance Couchbase database technology on AWS EC2 (elastic compute) cloud instances. WebThe traction control system (TCS) detects if a loss of traction occurs among the car's wheels. How can I show this TCS amount for my Income tax benefit. How do I claim tcs. in case of tcs on sale of motor vehicle, there is no provision in section 206C (3) for deposition of collected tax in this case. 11,000 (here booking amount is Rs. Webtcs car lease policy. s>1*6!p}O)&c}lZ{ECm5g/{$-AHHfZFt`{W39Rj8T@ye1iej4F

5 Notified under the United Nations (Privileges and Immunities) Act 1947 6 Per Section 44AB of the Income-tax Act, 1961 vehicle, and not just luxury cars, will have a wide impact. PF can be remitted from the actual DOJ of est. Section 206C does not put any embargo upon transactions which are in nature of import or export. The lease could either be a finance WebCar leasing policy is applicable if your career level is 9 and above. Motor vehicle has not been defined specifically under the Income Tax Act. With answers to just a few questions we can help find the right answer for you and your needs. The solution: Mainframe modernization using AWS cloud. What do you think of this new Tax Collect at Source? The table given below shows the current income tax rate slabs for financial year 2012-13 for males and females. Car leasing policy is applicable if your career level is 9 and above. Value of the car that you can purchase will be 50% of your annual package. For example if your annual package is 20L, you can get the car worth 10L which initially will be on Accenture's name for 3 / 5 years with monthly deduction ( emi based on your package eligibility ). Yes, TCS is to be collected, as the seller create a single invoice, it can be for two different parts of motor vehicle. V:nLj!F1Z5VRVhb&Rq4vkp DeV a|,cW9a51: [&BEIz91"iIrGllzOUg}P_ve{dVC Yet this matter needs to be clarified by CBDT. if yes, then on full invoice value or only the down payment? 8 L and receive a down payment less than Rs. 5 Question 14 answer wrongly given This is the tax under Section 206C of the Income Tax Act, that is collected by the seller as a means to track buyers and minimise tax evasion. Pay 1% TCS on motor vehicle purchase from June1, 2016. Value means for collection of tax at source? in case of tcs on sale of motor vehicle, no definition of seller is given under explanation (c) of section 206C, please clarify that who is a seller either any individual or huf without tax audit u/s 44AB. Together, we combine innovation and collective knowledge to create the extraordinary. Kindly advise. Can the Road Tax be calculated on the amount of TCS? Whether to pay my complete tax & then claim for Income tax return showing this TCS bills ?

What should you do now? There aremileagelimitscalculated by dividing the number of months in the term by 12 and multiplying this amount by 15,000 (standard lease) or 12,000 (low mileage lease). If the seller is a government body, the tax is deposited on the same day itself. As per Capgemini new policy our designations will be changed after 18 months of joining that will be January 2023 can I expect any hike after my designation Benefits and Limitations for New Appointees 8 VIII. The person from whom the TCS is collected gets credit for the TCS in his income tax return. The abbreviation TCS stands for traction control system, a feature that is on all current vehicles and prevents the drive wheels from losing traction on slippery To keep pace with the changing industry dynamics, Avis needed to transform its legacy mainframe platform. Q2. atlantis booking bahamas; tcs car lease policy. COPYRIGHT 2015-2023 Transamerica Direct Marketing Consultants Private Limited. The computation of taximplicationswill be as follows: In this case also, an employer is needed to maintain the official records of date of visit, places visited, petrol consumed and other billing documents which is necessary to confirm that the bills are authentic and the expenses were incurred for official purposes, Dilemma: Mr. Suresh working with TCS, Pune got a pay hike and the employer offered with a car lease option. Voluntary Protection Products are administered by TMIS or a third party contracted by TMIS. dzs} Though the Civic's base engine isn't as strong as you'll find in some competitors, it provides drivers with 10,00,000? (NMLS ID#8027). 1. Rate Shop, the companys primary revenue-generating product, needed to be re-architected to be cloud-ready with the flexibility to adjust pricing in real time. As part of the exercise, Avis wanted to modernize the IT landscape of Rate Shop, the companys primary revenue-generating product, from a legacy mainframe to a cloud-ready platform with the flexibility to adjust pricing in real-time for improved customer experience. What about indivual person does he have to apply for TAN & then file the return OR would it be similar to 26QB (property > 50 lacs). Learn more about end of lease options. However, it is defined under section 2(28) of the Motor Vehicle Act, 1988 which reads as under: any mechanically propelled vehicle adapted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source and includes a chassis to which a body has not been attached and a trailer; but does not include a vehicle running upon fixed rails or a vehicle of a special type adapted for use only in a factory or in any other enclosed premises or a vehicle having less than four wheels fitted with engine capacity of not exceeding twenty five cubic centimeters.. It would require some additional upfront payment from the customer. This matter needs further CBDTs clarification. One view is that as and when installments are received, TCS has to be collected from the customers, as the section 206C(1F) mention , TCS is to be collected at the time of receipt of such sum . There are approximately 13 million active car leases in the United States, comprising roughly one-third of all vehicles sold nationally. Leasing company car is more tax efficient than owning a car for salaried employees. WebLeasing company car is recommended rather than buying or owning it for tax efficiency, if the car is partly used for official purposes and partly for personal use which is the most 11,000 (1% of Rs. Ten Lakhs, but if the invoice amount exceeds Rs. Please guide if motor car vehicle sold in cash with value of 600000 then whether we covered this under section 206C(1D) since mentioned section talks about Any Goods other than Bullion or Jewellery and according to Memorandum explaining provisions of Finance Bill 2016 Govt will not happy if we deal in Cash? Manav Rachna students develop a revolutionary device! Amount of Sale Consideration received in parts/stages, whether TCS to be collected on 1st receipt itself or in stages?