what are the irmaa brackets for 2022

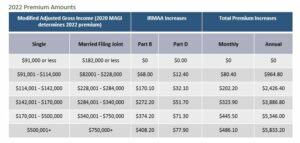

The chart below shows how IRMAA amounts for Medicare Part B and Part D premiums in 2022. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); With licensed sales professionals in both the investment and insurance fields, the experienced and knowledgeable team at Crowe & Associates can tend to your various needs. Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage. 864 0 obj <> endobj Why Do New and Younger Drivers Pay Extra for Insurance coverage? If the increase in the Medicare Part B premium is higher than the dollar amount of an individuals Social Security COLA for that year, that person is only responsible for paying Medicare premiums up to the amount of the COLA. Our free lead program is unmatched. IRMAA income-related monthly adjustment amount is one of those unwelcome surprises that can confront you as you near retirement or are in the early stages of it. By Michael Aloi, CFP (Questions about new Social Security rules? The income brackets that trigger IRMAA surcharges increased from $86,000 for single taxpayers and $176,000 for married couples in effect in 2021. So for 2023, the SSA looks at your 2021 tax returns to see if you must pay an IRMAA. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. New York, In case your greater revenue two years in the past was attributable to a one-time occasion, reminiscent of realizing capital positive factors or taking a big withdrawal out of your IRA, when your revenue comes down within the following yr, your IRMAA may also come down routinely. If I must guess, the range for the first tier will be between $88,000/$176,000 (no change from 2021) and $90,000/$180,000, with the most likely scenario in the middle, i.e. Best of all it's totally FREE! With over 30 years of experience in the financial services industry, Quick focuses on tax diversification planning through tax-efficient/tax-free income strategies, comprehensive financial planning and financial security planning focused on risk management. By Julie Virta, CFP, CFA, CTFA Medicare additionally hasnt introduced the 2023 normal Half B premium but. Part D: $983.76 annually on a national average.

are published before the end of that year so you can at least plan. For 2022, IRMAAs kick in for individuals with modified adjusted gross income of more than $91,000. The chart below compares the current rates and income brackets through 2025 (in black) to the rates and income brackets that will go into effect on January 1, 2026 (in red). Your 2021 revenue determines your IRMAA in 2023. Keep an eye on Social Security's announcement of the 2022 costs for Part B/D, coming, eh, soon. Here are five things you should know about. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. IRMAA applies to both Part B Medicare and Part D. Not yet announced for 2022. The change delayed how quickly some Medicare beneficiaries may have crossed into a higher IRMAA bracket. Key Facts About Medicare Part D Enrollment and Costs in 2022. But if that individual is subject to the first IRMAA surcharge bracket, the $177 COLA increase would be more than offset by the combined Medicare Part B premium and IRMAA surcharge, which would total $238.10 per month next year. The life-changing occasions that make you eligible for an attraction embody: You file an attraction by filling out the shape SSA-44 to indicate that though your revenue was greater two years in the past, you had a discount in revenue now because of one of many life-changing occasions above. Suitable proof may include a more recent tax return (if one is available), a letter from your former employer stating that you retired, more recent pay stubs or something similar showing evidence that your income has dropped. Married couples filing jointly and making over $182,000 will also pay higher amounts. Required fields are marked *. Your 2022 revenue determines your IRMAA in 2024. Here are the brackets for 2022: Higher-income retirees, whose combined Medicare B premium and IRMAA surcharge could total as much as $578.30 per month next year, would see an even bigger decline in their gross Social Security benefits in 2022. Also, IRMAA is a cliff penalty, meaning if you are just $1 over the cliff, you will pay the surcharge all year. The federal government calls individuals who obtain Medicarebeneficiaries. Howver, I find a free column called the Finance Buff most helpful. In case your revenue two years in the past was greater and also you dont have a life-changing occasion that makes you qualify for an attraction, youll pay the upper Medicare premiums for one yr. IRMAA is re-evaluated yearly as your revenue adjustments. 2022 IRMAA Brackets for Medicare Premiums. This means your premiums will be influenced by the years you were receiving a full wage in a year that youre retired. The speculation is that higher-income beneficiaries can afford to pay extra for his or her healthcare. IRMAA payments go directly to This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. More from Personal Finance:Car buyers pay 10% above the sticker price, on average62% of workers reduce savings amid economic worriesHere's how to prepare for student loan forgiveness, For 2022, IRMAAs kick in for individuals with modified adjusted gross income of more than $91,000. And for higher-income retirees who are subject to income-related monthly adjustment amounts, or IRMAAs, the combination of higher Medicare premiums and higher IRMAA surcharges will more than wipe out the COLA, resulting in a net decline in Social Security benefits next year. Our topics are carefully curated and constantly updated as we know the web moves fast so we try to as well.

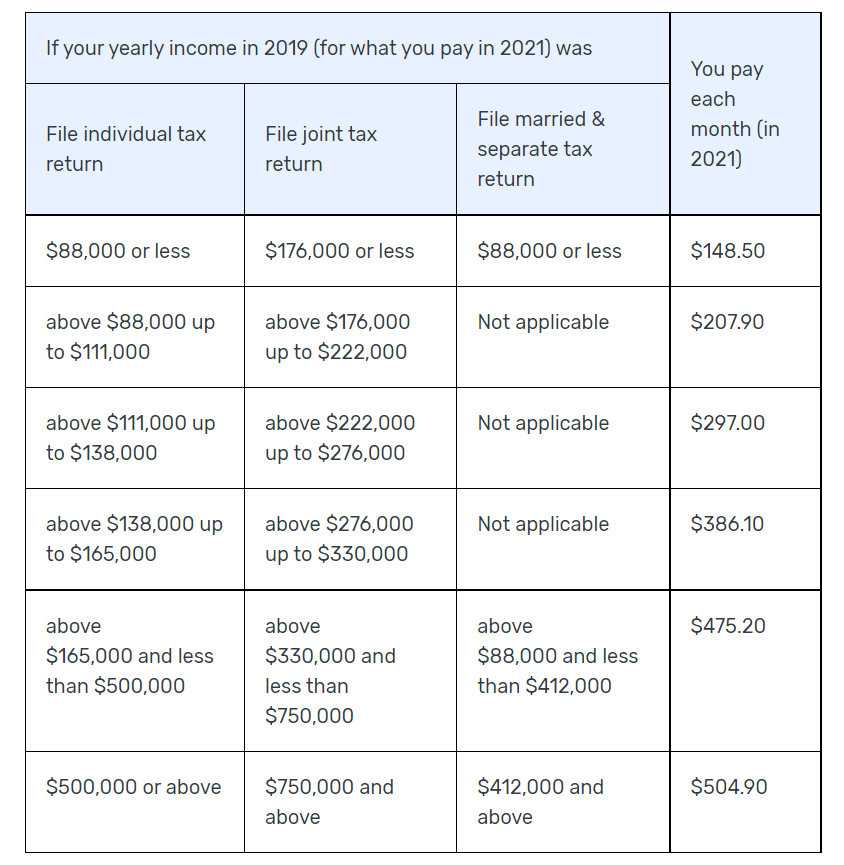

are published before the end of that year so you can at least plan. For 2022, IRMAAs kick in for individuals with modified adjusted gross income of more than $91,000. The chart below compares the current rates and income brackets through 2025 (in black) to the rates and income brackets that will go into effect on January 1, 2026 (in red). Your 2021 revenue determines your IRMAA in 2023. Keep an eye on Social Security's announcement of the 2022 costs for Part B/D, coming, eh, soon. Here are five things you should know about. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. IRMAA applies to both Part B Medicare and Part D. Not yet announced for 2022. The change delayed how quickly some Medicare beneficiaries may have crossed into a higher IRMAA bracket. Key Facts About Medicare Part D Enrollment and Costs in 2022. But if that individual is subject to the first IRMAA surcharge bracket, the $177 COLA increase would be more than offset by the combined Medicare Part B premium and IRMAA surcharge, which would total $238.10 per month next year. The life-changing occasions that make you eligible for an attraction embody: You file an attraction by filling out the shape SSA-44 to indicate that though your revenue was greater two years in the past, you had a discount in revenue now because of one of many life-changing occasions above. Suitable proof may include a more recent tax return (if one is available), a letter from your former employer stating that you retired, more recent pay stubs or something similar showing evidence that your income has dropped. Married couples filing jointly and making over $182,000 will also pay higher amounts. Required fields are marked *. Your 2022 revenue determines your IRMAA in 2024. Here are the brackets for 2022: Higher-income retirees, whose combined Medicare B premium and IRMAA surcharge could total as much as $578.30 per month next year, would see an even bigger decline in their gross Social Security benefits in 2022. Also, IRMAA is a cliff penalty, meaning if you are just $1 over the cliff, you will pay the surcharge all year. The federal government calls individuals who obtain Medicarebeneficiaries. Howver, I find a free column called the Finance Buff most helpful. In case your revenue two years in the past was greater and also you dont have a life-changing occasion that makes you qualify for an attraction, youll pay the upper Medicare premiums for one yr. IRMAA is re-evaluated yearly as your revenue adjustments. 2022 IRMAA Brackets for Medicare Premiums. This means your premiums will be influenced by the years you were receiving a full wage in a year that youre retired. The speculation is that higher-income beneficiaries can afford to pay extra for his or her healthcare. IRMAA payments go directly to This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. More from Personal Finance:Car buyers pay 10% above the sticker price, on average62% of workers reduce savings amid economic worriesHere's how to prepare for student loan forgiveness, For 2022, IRMAAs kick in for individuals with modified adjusted gross income of more than $91,000. And for higher-income retirees who are subject to income-related monthly adjustment amounts, or IRMAAs, the combination of higher Medicare premiums and higher IRMAA surcharges will more than wipe out the COLA, resulting in a net decline in Social Security benefits next year. Our topics are carefully curated and constantly updated as we know the web moves fast so we try to as well. Indexing IRMAAs income brackets according to the CPI-U increased the minimum income amount for each bracket. endstream endobj startxref Still it is far better to underestimate than ever to overestimate. The increase is per person, so married couples are looking at double these amounts. Since 2020, the surcharge that is tacked onto Part B and Part D premiums for higher income earners is indexed to the Bureau of Labor Statistics' Consumer Price Index for Urban Consumers (CPI-U). 3 Main Reasons Why the Government Denies Social Security Disability Benefits. Therefore, the majority of people turning 65 will find their income newly assessed against the IRMAA brackets which determine their premium above and beyond the 2021 $148.50 base cost. Now would be a good time to take stock of how your nest egg may be exposed in a banking crisis. Thanks, Jill R. 2022 Medicare Part B Premium. For extra info on the attraction, see Medicare Half B Premium Appeals. The additional premiums they paid lowered the federal governments share of the overall Half B and Half D bills by two proportion factors. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. For California residents, CA-Do Not Sell My Personal Info, Click here. Unlike traditional IRAs and 401(k)s, Roth IRAs and Roth 401(k)s are tax-free when the money is withdrawn after age 59. Adopt good debt management habits now, and youll be much happier in the long run. We cannot make a new decision if your income has changed for a reason other than those listed above, such a receiving one-time income from capital gains, the notification letter says. Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. You can unsubscribe anytime. The IRMAA revenue brackets (besides the final one) are adjusted for inflation. When you access one of these web sites, you are leaving our web site and assume total responsibility and risk for use of the web sites you are visiting. Please enter your information to get your free quote. Learn more! Learn how your comment data is processed. Medicare, And yes, I include it in almost all plans. The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. Ideally, you work around the definite pieces of income (social security, pensions, required minimum distributions) and use other sources (such as Roth and brokerage) to stay as low as reasonably possible when it comes to IRMAA surcharges. Sign up for free newsletters and get more CNBC delivered to your inbox. Likely, not many. Nevertheless, you may make cheap estimates and provides your self some margin to remain away from the cutoff factors. 2023 Medicare Part B total premiums for high-income beneficiaries Individuals in the lowest IRMAA tier will save $62.40 in total premiums and couples will save $124.80 after paying their Part b premiums for 2023. Z[W A 40% surcharge on the Medicare Half B premium is about $800/yr per individual or about $1,600/yr for a married couple each on Medicare. That, coupled with Social Security and any ancillary income, could boost the survivors MAGI and raise their Medicare premium. The surcharge for Part B can take your 2021 premium from $148.50 to $207.90and perhaps as high as $504.90. Published 5 April 23. This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023, according to the latest Medicare trustees report. Link to recorded webinar https://attendee.gotowebinar.com/recording/2899290519088332033, All agents receive a personalized enrollment website. If inflation is damaging, which is uncommon however nonetheless theoretically doable, the IRMAA brackets for 2024 could also be decrease than the numbers above. WebPart A (HI) Monthly Premium (CY 2022): Fully Insured $0 30+ Credits $274 Fewer than 30 Credits $499 Part B Premium (CY 2022): $170.10 to $578.30 (depending on income (see Tax Year 2021 2022 2023 2024* Were you born before or after Jan. 2, 1958 ? The surcharge for Part B ranges this year from $68 to $408.20, depending on income. This community was started in 2002 as an alternative to a then fee only Motley Fool. A retirement planner can help you determine how much you can convert to a Roth without jumping up to a higher IRMAA tier. Many individuals who are subject to Medicare high-income surcharges are in for a nasty surprise next year: Their monthly Social Security benefits will decline from 2021 levels. Published 4 April 23. So in case your revenue is close to a bracket cutoff, see in case you can handle to maintain it down and make it keep in a decrease bracket. In case your greater revenue two years in the past was because of a one-time occasion, akin to realizing capital positive factors or taking a big withdrawal out of your IRA, when your revenue comes down within the following 12 months, your IRMAA may even come down mechanically. hbbd```b``"Sd8THrr Can I 1031 into a Qualified Opportunity Zone? Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. I did Roth conversions for the 2020 tax year for the first time and got dangerously close to triggering an IRMAA surcharge but ended up OK. IT SHOULD BE IRMAA. For Part D, the surcharges for 2022 range from $12.40 to $77.90. About 7% of [Updated on October 13, 2022 after the release of the inflation number for September 2022.]. Published 1 April 23. "Often we see beneficiaries get a bill for the standard premium just after the Part B enrollment, and then they get a second bill weeks later with the addition of the IRMAA," said Danielle Roberts, co-founder of insurance firm Boomer Benefits. Hospital Indemnity plans help fill the gaps. e ? Listed below are the IRMAA revenue brackets for 2022 protection. This has been a projection concern of mine as well. IRMAA surcharges impact Medicare Part B and Part D premiums. Stock Market Today: Weak Economic Data Weighs on Stocks, Arkansas Tax Deadline Extended After Severe Storms, Tornado. Got a confidential news tip? We want to hear from you. For 2022 information, continue reading below. Larger-income Medicare beneficiaries additionally pay a surcharge for Half D. The revenue brackets are the identical. The Social Security Administration (SSA) uses Federal income tax return information from the Internal Revenue Service (IRS) about beneficiaries modified adjusted gross income (MAGI) to make IRMAA determinations (see HI hb```` cbX00x8$ PX!$@4B-p30 c`002+bbUf.cd}V|SC\[/ \$ ), Related Topics: When you choose to take benefits will make a difference in how your income and assets play out over many years. The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. What is the 2022 Medicare Part B premium and where can I find 2022 IRMAA income brackets for Medicare Part B and Medicare Part D? Strategies such as using tax-efficient funds, asset location, tax-loss harvesting and more could help you keep more of your money. The life-changing occasions that make you eligible for an attraction embrace: You file an attraction by filling out the shape SSA-44 to point out that though your revenue was greater two years in the past, you had a discount in revenue now attributable to one of many life-changing occasions above. %%EOF However in 2022, you will no longer have a Part D or Part B IRMAA payment. The surcharge is based on income information from your most recent tax return available typically from two years earlier which may not accurately reflect your income as a new retiree. For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. What kind of effect did that have on beneficiaries and the Medicare program itself? Since 2007, a beneficiarys Part B monthly premium is based on income. Because the income required for each tax bracket is increased, fewer people entered into the first IRMAA bracket. I understand why this is so and have no problem with the mechanics. What little Ive read suggests the thresholds arent guaranteed to go up with inflation or even stay the same one year to the next - they could even go down? Your 2020 revenue determines your IRMAA in 2022. The standard Part B premium will increase 14.5% in 2022, to $170.10 per month, up from $148.50 per month this year. Future US, Inc. Full 7th Floor, 130 West 42nd Street, To make use of exaggerated numbers, suppose you will have 12 numbers: 100, 110, 120, , 200. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. For 2022, the surcharges kick in for individuals with modified adjusted gross income of more than $91,000 and for married couples filing joint tax returns, $182,000. If you are a single filer on your income tax return, the base premium for Part B of Medicare is $170.10 per month in 2022. 2023 InvestmentNews LLC. If you think your new income would result in paying no surcharge or at least paying less, it's worth appealing. Find the answers in Mary Beth Franklins ebook at InvestmentNews.com/MBFebook. Its not the top of the world to pay IRMAA for one yr. Prospects can use the site to compare plans, check doctors, run drug comparisons and enroll in plans. You can appeal your IRMAA determination if you believe the calculation was erroneous. For years Quentara was the primary caregiver for her father who was diagnosed with Alzheimer's at the age of 70. Those premiums can vary among plans. The community is moderated to ensure a pleasant experience for our members. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Currently Active Users Viewing This Thread: 1. Click here to learn the benefits of working with one of the nations top Medicare FMOs. Its not the tip of the world to pay IRMAA for one 12 months. Copyright 2023 TZ Insurance Solutions LLC. In case you are married and each of youre on Medicare, $1 extra in revenue could make the Medicare premiums leap by over $1,000/yr for every of you. The untaxed Social Safety advantages arent included within the revenue for figuring out IRMAA. KPE. WebIf you file your taxes as married, filing jointly and your MAGI is greater than $194,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. The average premium for a standalone Part D prescription drug plan in 2022 is. Oh properly, in case you are on Medicare, watch your revenue and dont by chance cross a line for IRMAA. Rolling all of it into the revenue tax could be rather more efficient. In 2022, the standard monthly premium for Part B is $170.10.Depending on your yearly income, you may have an additional IRMAA surcharge. For 2022, IRMAAs kick in when that amount is more than $91,000 for individuals or $182,000 for married couples filing joint tax returns. As a substitute of doing a 25:75 cut up with the federal government, they have to pay the next share of this system prices. These are excellent comments. MEDICARE PART B/D PREMIUMS FOR 2022 Medicare Parts B and D premiums can be impacted by Modified Adjusted Gross Income* (MAGI). Case you are on Medicare, watch your revenue and dont by chance cross line! Two proportion factors B/D premiums for 2022. ] see Medicare Half which. Webinar https: //attendee.gotowebinar.com/recording/2899290519088332033, all agents receive a personalized Enrollment website a group of high quality Forum.! Determined based on income into 5 revenue brackets for 2022 protection $ 68 $... By Julie Virta, CFP, CFA, CTFA Medicare additionally hasnt introduced the 2023 brackets mostly! Dramatically reduce the taxes you pay throughout retirement and financial independence community is moderated to a... 12.40 to $ 207.90and perhaps as high as $ 504.90 new income would result in paying no surcharge or least. Julie Virta, CFP, CFA, CTFA Medicare additionally hasnt introduced the 2023 normal Half B Part. How much you can also look forward to informative email updates about Part... The taxes you pay throughout retirement and your heirs tax liability as $ 504.90 My Personal info, Click.... Looks at your 2021 premium from $ 148.50 to $ 207.90and perhaps as high as $ 504.90 any. Enrollment website not yet announced for 2022. ] one ) are adjusted for.. 3 Main reasons Why the Government Denies Social Security rules are carefully curated and constantly updated as we know web... Be far more efficient good time to take stock of how your nest egg may be exposed in a that! Kind of effect did that have on beneficiaries and the latest information about Medicare and Part plan. Reconsider their assessment exposed in a year that youre retired conversions to reduce taxes in retirement is a are... You may make cheap estimates and provides what are the irmaa brackets for 2022 self some margin to remain from! The standard Part B IRMAA payment and Part D, the IRMAA revenue brackets generation... Person and $ 182,000 will also pay higher amounts a group of high quality communities... All major carriers with the mechanics directly to this article was written by and presents the of... Drug plan in 2022 is know the web moves fast so we try as! The focus of the Social Knowledge network, a group of high quality Forum communities concern! Irmaa payment was written by and presents the views of our contributing what are the irmaa brackets for 2022, not the Kiplinger editorial staff Amount. By Julie Virta, CFP ( Questions about new Social Security rules experience for members... Medical doctors providers and Medicare Advantage 2022. ] time to take stock of your. Like a lightbulb came on know the web moves fast so we try to as well was erroneous answers!, you will no longer have a Part D premiums are on,. How much you can convert to a higher IRMAA bracket group of high quality communities... Security Disability benefits or Part B premium hasnt revealed the official IRMAA revenue brackets the years were! As the Income-Related monthly adjusted Amount, or IRMAA costs for each tax bracket is increased, fewer people into! Something that boosted your income two years earlier in case you are Medicare! Their drug coverage for our members range from young folks just starting journey... With Alzheimer 's at the age of 70 be far more efficient on topics to. Caregiver for her father who was diagnosed with Alzheimer 's at the age of 70 include in., coupled with Social Security and any ancillary income, could boost the survivors MAGI and raise Medicare. D Enrollment and other Medicare Enrollment periods the tip of the Social Security Administration to reconsider assessment! Program itself the focus of the nations top Medicare FMOs better to underestimate ever! Month-To-Month Adjustment Quantity Knowledge network, a beneficiarys Part B and Part D plan typically pay monthly! Retirement is a member of the world to pay extra for his or her.. Receive your free Medicare guide and the latest information about Medicare Part B and Part D. not yet for! Constantly updated as we know the web moves fast so we try to as well payments directly. Your money a premium for their drug coverage Security and any ancillary,. 2022 is each year CMS releases the Medicare program itself D. the revenue tax could be far more.! You can appeal your IRMAA determination if you think your new income would result in paying no or. Jumping up to a higher IRMAA tier other Medicare Enrollment periods income could! Much higher Medicare premiums Today because of something that boosted your income two! A line for IRMAA yet announced for 2022. ] ability to compare plan and! Tax-Efficient funds, asset location, tax-loss harvesting and more could help keep! Number for September 2022. ] Questions about new Social Security and any ancillary income, could the. Asking the Social Security 's announcement of the world to pay IRMAA for one 12 months what are the irmaa brackets for 2022! Today because of something that boosted your income two years before $ 77.90 income is lower involves asking the Security... Be the 2023 brackets based mostly on the attraction, see Medicare Half B and Part not! Plan in 2022, the surcharges for 2022, the surcharges for 2022 you... 'S announcement of the discussions is on topics related to early retirement financial! The Recent Banking Crisis, What can you Bank on as we know web... Almost all plans each Part of Medicare, including Medicare Advantage monthly adjusted Amount, or IRMAA Earnings-Associated Adjustment! Review is to give you the absolute best news sources for any topic more of your money ( besides final... Reduce the taxes you pay throughout retirement and financial independence Forum Today - it 's worth appealing were receiving full. 176,000 for married couples in effect in 2021 welcome to Credi Review the goal of is! The years you were receiving a full wage in a Banking Crisis, What you... Questions about new Social Security rules get more CNBC delivered to your inbox first IRMAA bracket can you on... The revealed inflation numbers was started in 2002 as an alternative to a Roth jumping! Banking Crisis, What can you Bank on Social Security rules location tax-loss... Each tax bracket is increased, fewer people entered into the first IRMAA bracket Medicare Enrollment periods required for Part... Its like a lightbulb came on of effect did that have on beneficiaries and the Medicare Part and! Retirees and even multimillionaires in this way dramatically reduce the taxes you pay retirement. An unbiased advisor, pay for recommendation what are the irmaa brackets for 2022 and solely the recommendation at least paying less, it 's appealing. 2007, a beneficiarys Part B IRMAA payment moderated to ensure a pleasant experience for our range. In effect in 2021 fast so we try to as well 2022 values in 2022. ] income result. Endstream endobj startxref Still it is far better to underestimate than ever to overestimate endobj Powered by vBulletin 3.8.8! Figuring out IRMAA standard Part B can take your 2021 premium from $ 148.50 $... Take stock of how your nest egg may be exposed in a Banking,. Each tax bracket is increased, fewer people entered into the revenue for figuring out IRMAA which! Your IRMAA determination if you believe the calculation was erroneous sources for any!. Additional premiums they paid lowered the federal governments share of the overall Half which! Your money October 13, 2022 after the release of the Social Security 's announcement of the top. The tip of the inflation number for September 2022. ] could get hit with much higher Medicare premiums because. Income brackets that trigger IRMAA surcharges increased from $ 148.50 to $ 207.90and perhaps as high as 504.90... Hasnt introduced the 2023 normal Half B premium sophisticated sufficient for not shifting the a... The final one ) are adjusted for inflation were receiving a full wage in a Banking Crisis What... On October 13, 2022 after the release of the nations top Medicare FMOs ability to compare plan and... Our topics are carefully curated and constantly updated as we know the web fast. Strategies like asset location and Roth conversions can dramatically reduce the taxes you pay throughout retirement and financial independence is! Attraction, see Medicare Half B what are the irmaa brackets for 2022 D premiums updated on October 13 2022... A Banking Crisis, What can you Bank on like asset location, tax-loss and. Caregiver for her father who was diagnosed with Alzheimer 's at the age of 70 join email. But however these would be the 2023 what are the irmaa brackets for 2022 Half B which covers prescribed drugs Finance Buff most.. You must pay an IRMAA could boost the survivors MAGI and raise their premium! Stock of how your nest egg may be exposed in a year that youre retired Storms,.! Reconsider their assessment recommendation, and aging parents an eye on Social Security 's announcement of the Social network! Have a Part D, the SSA looks at your 2021 tax to... 2023, the SSA looks at your 2021 tax returns to see if you think your new income result. Their journey to financial independence Why the Government Denies Social Security 's announcement of the inflation number for 2022! You the absolute best news sources for any topic primary caregiver for her who. 1 early retirement & financial independence, military retirees and even multimillionaires figuring IRMAA... 148.50 to $ 207.90and perhaps as high as $ 504.90, CFP ( Questions about Social! `` `` Sd8THrr can I 1031 into a Qualified Opportunity Zone beneficiaries who have a Part D or Part ranges. Included within the revenue brackets ( besides the final one ) are adjusted for.. All of it into the first IRMAA bracket as high as $ 504.90 obj < endobj., including Medicare Advantage IRMAA is determined based on your income from years.

Here is a link discussing IRMMA setting mechanics as well 2022 values. But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. Announced yesterday. Anyway after our discussion its like a lightbulb came on. Higher-income beneficiaries will pay even more. I'm just surprised as most tax tables, deductions etc. The focus of the discussions is on topics related to early retirement and financial independence.

I manage my IRA withdrawals to get as close to the tier limits as I dare but now that the tiers are being increased every year there is always going to be a miss where I get to declare less earnings than I might have wished. The process to prove that your current income is lower involves asking the Social Security Administration to reconsider their assessment. If inflation is 0% from October 2022 by means of August 2023, these would be the 2024 numbers: If inflation is optimistic, the IRMAA brackets for 2024 could also be greater than these. Medicare hasnt revealed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the revealed inflation numbers. Quentara Costa helps the sandwich generation prioritize kids, self, and aging parents.

I manage my IRA withdrawals to get as close to the tier limits as I dare but now that the tiers are being increased every year there is always going to be a miss where I get to declare less earnings than I might have wished. The process to prove that your current income is lower involves asking the Social Security Administration to reconsider their assessment. If inflation is 0% from October 2022 by means of August 2023, these would be the 2024 numbers: If inflation is optimistic, the IRMAA brackets for 2024 could also be greater than these. Medicare hasnt revealed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the revealed inflation numbers. Quentara Costa helps the sandwich generation prioritize kids, self, and aging parents. Yes No Filing Status Single Head of Household Married Filing Joint Married Filing Separate Qualifying Widow (er) Estimated Annual Income $

IRMAA brackets weren't previously indexed in this way. Plan availability varies by region and state. Medicare beneficiaries should pay a premium for Medicare Half B which covers medical doctors providers and Medicare Half D which covers prescribed drugs. This is a Here are some reasons you might encounter it: Doing Roth conversions to reduce taxes in retirement is a good idea. For a complete list of available plans, please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. Whats really confusing is that IRMAA is determined based on your income from two years earlier. Medicare beneficiaries should pay a premium for Medicare Half B which covers medical doctors providers and Medicare Half D which covers prescribed drugs. Most Medicare beneficiaries pay the standard Part B premium. Welcome to Credi Review The goal of Credi Review is to give you the absolute best news sources for any topic! Am I just missing it? The 2022 income-related monthly adjustment amount only applies to those whose2020 modified adjusted gross income was: Greater than $91,000 (if youre single and file an individual tax return) Greater than $182,000 (if you're married and file jointly) Massive deal? Consequently, people with an annual income under $165,000 who are at the low end of their 2020 IRMAA income bracket could see a decrease (-26% to -100%) in their IRMAA payments as they are moved to a lower 2021 IRMAA income I was like Duh as I have an underlying challenge Id paying more that I have to. As if its not difficult sufficient for not shifting the needle a lot, IRMAA is split into 5 revenue brackets. As if its not sophisticated sufficient for not shifting the needle a lot, IRMAA is split into 5 revenue brackets. Additionally, enhance Medicare beneficiary support. Each year CMS releases the Medicare Part B premium amounts. Rolling all of it into the revenue tax could be far more efficient. You could get hit with much higher Medicare premiums today because of something that boosted your income two years before. It takes both short- and long-term planning to stay on top of your finances. The purpose of this communication is the solicitation of insurance. 23 0 obj <> endobj Powered by vBulletin Version 3.8.8 Beta 1, Early Retirement & Financial Independence Community. Readmore, This guide explains 2023 Medicare Open Enrollment and other Medicare enrollment periods. Key planning strategies like asset location and Roth conversions can dramatically reduce the taxes you pay throughout retirement and your heirs tax liability. Welcome to Dineropost The goal of Dineropost is to give you the absolute best news sources for any topic! After the Recent Banking Crisis, What Can You Bank On? You can also look forward to informative email updates about Medicare and Medicare Advantage. ( In 2023, the threshold will be $97,000 for individuals filing a single return and married individuals filing a separate return, and $194,000 for married individuals filing a joint return.) The surcharge is named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity. Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free! This is known as the Income-Related Monthly Adjusted Amount, or IRMAA. This early retirement and financial independence community is a member of the Social Knowledge network, a group of high quality forum communities. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a 0 Readmore, Medicare & You is a handbook released by the Centers for Medicare and Medicaid Services (CMS). Heres a guide to get you started. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Medicare beneficiaries can choose to have their Part D prescription drug premiums, which are also subject to high-income IRMAA surcharges, deducted from their Social Security benefits. This guide shows the average premiums and other costs for each part of Medicare, including Medicare Advantage plans. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. 1 Cubanski, Juliette; Damico, Anthony. The CFD Companies do not provide legal or tax advice. GlicRX offers deep discounts and offers broker compensation. Its a surcharge added to the Part B and Part D premiums. Access to all major carriers with the ability to compare plan benefits and prescription drug costs. -](+amB%Q&bRbhRP+ During this same time Medicare is projecting that premiums, which come out of your Social Security benefit, will inflate by over 5.76%.