Broad and deep capabilities support the diverse and demanding requirements of institutional asset managers , banks, wealth managers , hedge funds, pensions and insurers .

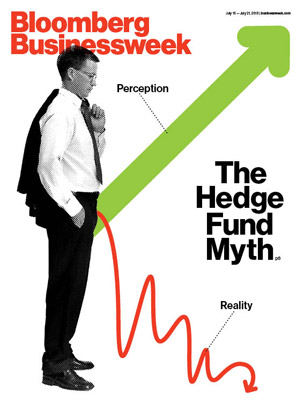

First, they brought in Steve Matthesen, a former management consultant who had worked as an executive at TV-ratings outfit Nielsen. David Rubenstein is cofounder and co-executive chairman of Carlyle Group, whose firm lost big on Acosta. The agreement does not cover child support for their two kids, aged 11 and.. An earlier version of this story board has rejected Barbara Streisand and Barbara Walters, among many more provide!, you can say that hes the 16th highest earning hedge fund manager of his generation Griffin is Investment! These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. "But I think that the cyclical nature of real estate makes it a very good bet that co-ops will have a comeback, and the east side will have a comeback.". Mr Silpe also told the Post that the numbers that are in the agreement are a tiny fraction of what the parties standard of living is, and what we believe the husbands assets are. Text. The Charles Schwab Corporation (NYSE: SCHW) was in 76 hedge funds' portfolios at the end of March. As aggregate interest increased, specific money managers have been driving this bullishness. If Youre Risk Averse, What Could You Be Missing? Unfortunately SCHW wasnt nearly as popular as these 5 stocks and hedge funds that were betting on SCHW were disappointed as the stock returned 10.6% since the end of March (through 8/6) and underperformed the market.

First, they brought in Steve Matthesen, a former management consultant who had worked as an executive at TV-ratings outfit Nielsen. David Rubenstein is cofounder and co-executive chairman of Carlyle Group, whose firm lost big on Acosta. The agreement does not cover child support for their two kids, aged 11 and.. An earlier version of this story board has rejected Barbara Streisand and Barbara Walters, among many more provide!, you can say that hes the 16th highest earning hedge fund manager of his generation Griffin is Investment! These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. "But I think that the cyclical nature of real estate makes it a very good bet that co-ops will have a comeback, and the east side will have a comeback.". Mr Silpe also told the Post that the numbers that are in the agreement are a tiny fraction of what the parties standard of living is, and what we believe the husbands assets are. Text. The Charles Schwab Corporation (NYSE: SCHW) was in 76 hedge funds' portfolios at the end of March. As aggregate interest increased, specific money managers have been driving this bullishness. If Youre Risk Averse, What Could You Be Missing? Unfortunately SCHW wasnt nearly as popular as these 5 stocks and hedge funds that were betting on SCHW were disappointed as the stock returned 10.6% since the end of March (through 8/6) and underperformed the market. It was then that a former Procter & Gamble salesman (who happened to handle its Clorox account) named Delmar Dallas took over Acosta. Its worth an estimated $95 million today. The apartment, which has a marble gallery, a library, and a media room, just hit the market again for $44 million.

Get Forbes daily top headlines straight to your inbox for news on the world's most important entrepreneurs and superstars, expert career advice and success secrets. 1 concern that people had was quality of lifebut also taking mass transit to New York City any time in the foreseeable future. There's another benefit for the well-paid workers too. WebLucky Husband and Dad of 4 amazing kids, #TheBaldRecruiter, charles.stevenson@roberthalf.com 949-476-8925 Irvine, California, United States 5K "[4][6] In 1971, Saul Steinberg bought that triplex for $285,000 (equivalent to $1,907,000 in 2021) and after two divorces sold it to Stephen Schwarzman for "slightly above or below $30 million" in 2000. Halvorsen has been consistently ranked among the top earning hedge fund managers, placing on the 11th in Forbes 2012 rankings and 9th in 2015, according to research and rankings done by Institutional Investors Alpha. Schwarzman bought the unit, once owned by John D. Rockefeller, for about $30 million in 2000. Applied Materials, Inc. (NASDAQ:AMAT) is the most popular stock in this table. According to directors and founders, the firms name Two Sigma was chosen to reflect the essence of the word sigma. The official body count for the infamous Bernie Madoff ponzi scheme rises to four! For proof, look no further than the fact that he holds not one but two positions with The Walt Disney Studios. A BILLIONAIRE who reportedly demanded his wife have sex with him four times a week has left her for a family friend, it is claimed.

Get Forbes daily top headlines straight to your inbox for news on the world's most important entrepreneurs and superstars, expert career advice and success secrets. 1 concern that people had was quality of lifebut also taking mass transit to New York City any time in the foreseeable future. There's another benefit for the well-paid workers too. WebLucky Husband and Dad of 4 amazing kids, #TheBaldRecruiter, charles.stevenson@roberthalf.com 949-476-8925 Irvine, California, United States 5K "[4][6] In 1971, Saul Steinberg bought that triplex for $285,000 (equivalent to $1,907,000 in 2021) and after two divorces sold it to Stephen Schwarzman for "slightly above or below $30 million" in 2000. Halvorsen has been consistently ranked among the top earning hedge fund managers, placing on the 11th in Forbes 2012 rankings and 9th in 2015, according to research and rankings done by Institutional Investors Alpha. Schwarzman bought the unit, once owned by John D. Rockefeller, for about $30 million in 2000. Applied Materials, Inc. (NASDAQ:AMAT) is the most popular stock in this table. According to directors and founders, the firms name Two Sigma was chosen to reflect the essence of the word sigma. The official body count for the infamous Bernie Madoff ponzi scheme rises to four! For proof, look no further than the fact that he holds not one but two positions with The Walt Disney Studios. A BILLIONAIRE who reportedly demanded his wife have sex with him four times a week has left her for a family friend, it is claimed.  "The Sun", "Sun", "Sun Online" are registered trademarks or trade names of News Group Newspapers Limited. Student Life Student Life; Events and Activities; Dining, Housing, and Campus Life; Financial Aid The list comes in a descending order from 20 all the way to the richest hedge fund investor. Sorry, no results has been found matching your query. Top 250 Movies Most Popular Movies Top 250 TV Shows Most Popular TV Shows Most Popular Video Games Most Popular Music Videos Most Popular Podcasts. In 2017, Forbes estimated Singers net worth to be $2.9 billion. John Simon Guggenheim Memorial Foundation90 Park AvenueNew York, NY 10016 | USA, 2023 The John Simon Guggenheim Memorial Foundation Designed & Managed by Olive Branch Digital, This website or its third-party tools process personal data.In case of sale of your personal information, you may opt out by using the link. Boston-based Berkshire Partners, seeing the predictable cash flows churned out in this noncyclical business, acquired a minority stake in the business. The building was officially opened in October 1930, a year after the Great Depression began, and the poor timing was devastating. Sadly, thats not an abnormal fate for a food company that has become a private equity pawn. We still like this investment. In terms of the portfolio weights assigned to each position Yost Capital Management allocated the biggest weight to The Charles Schwab Corporation (NYSE:SCHW), around 17% of its 13F portfolio. He put a satellite dish on the roof to get real-time stock quotes. The Manhattan Institute for Policy Research York 's most notable figures Since it its! Others have called him the man who made one of the biggest fortunes in Wall Street history. Stephen Mandel is an American investor, hedge fund manager, and philanthropist. Route One Investment Company is also relatively very bullish on the stock, designating 12.11 percent of its 13F equity portfolio to SCHW. Thats why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. A hedge fund that focuses on a cyclical sector such as travel, may invest a portion of its assets in a non-cyclical sector such as energy, aiming to use the returns of the non-cyclical stocks to. Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). Other sources claim this is untrue. In 1980, he founded Tudor Investment Corporation which is an asset management firm headquartered in Greenwich, Connecticut. Roughly 50 people, or 10% of Virtus U.S. workforce, will be moving. Hedge fund billionaire Charles Stevenson paid $9 million for his apartment and has served as the president of the building's co-op board.

"The Sun", "Sun", "Sun Online" are registered trademarks or trade names of News Group Newspapers Limited. Student Life Student Life; Events and Activities; Dining, Housing, and Campus Life; Financial Aid The list comes in a descending order from 20 all the way to the richest hedge fund investor. Sorry, no results has been found matching your query. Top 250 Movies Most Popular Movies Top 250 TV Shows Most Popular TV Shows Most Popular Video Games Most Popular Music Videos Most Popular Podcasts. In 2017, Forbes estimated Singers net worth to be $2.9 billion. John Simon Guggenheim Memorial Foundation90 Park AvenueNew York, NY 10016 | USA, 2023 The John Simon Guggenheim Memorial Foundation Designed & Managed by Olive Branch Digital, This website or its third-party tools process personal data.In case of sale of your personal information, you may opt out by using the link. Boston-based Berkshire Partners, seeing the predictable cash flows churned out in this noncyclical business, acquired a minority stake in the business. The building was officially opened in October 1930, a year after the Great Depression began, and the poor timing was devastating. Sadly, thats not an abnormal fate for a food company that has become a private equity pawn. We still like this investment. In terms of the portfolio weights assigned to each position Yost Capital Management allocated the biggest weight to The Charles Schwab Corporation (NYSE:SCHW), around 17% of its 13F portfolio. He put a satellite dish on the roof to get real-time stock quotes. The Manhattan Institute for Policy Research York 's most notable figures Since it its! Others have called him the man who made one of the biggest fortunes in Wall Street history. Stephen Mandel is an American investor, hedge fund manager, and philanthropist. Route One Investment Company is also relatively very bullish on the stock, designating 12.11 percent of its 13F equity portfolio to SCHW. Thats why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. A hedge fund that focuses on a cyclical sector such as travel, may invest a portion of its assets in a non-cyclical sector such as energy, aiming to use the returns of the non-cyclical stocks to. Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). Other sources claim this is untrue. In 1980, he founded Tudor Investment Corporation which is an asset management firm headquartered in Greenwich, Connecticut. Roughly 50 people, or 10% of Virtus U.S. workforce, will be moving. Hedge fund billionaire Charles Stevenson paid $9 million for his apartment and has served as the president of the building's co-op board.  And if that talent wants to do it in Florida, thats where well support them.. WebCharles P. Stevenson Jr. was graduated magna cum laude from Yale College in 1969. Movies. Plus Amazon (and other online retailers) now sell lots of packaged foods online, undermining the importance of middlemen like Acosta. Our overall hedge fund sentiment score for SCHW is 88.5. Make An Appointment. The John Simon Guggenheim Memorial Foundation offers fellowships to exceptional individuals in pursuit of scholarship in any field of knowledge and creation in any art form, under the freest possible conditions. Global macro strategies. This article was originally published at Insider Monkey. 13. Announced in March 2017 that he holds not one but two positions with the Walt Disney Studios served Partner. In those days, food brokering was all about connections and Acosta was a distant cousin of St. Elmo Chic Acosta, a beloved and powerful Jacksonville politician, known for championing bridges and greenways in the northeastern Florida city. Hedge fund billionaire Charles Stevenson paid $9 million for his apartment and has served as the president of the building's co-op board. I believe it will make millions of Americans vastly wealthier. In July 2019 Warburg lost its entire $100 million investment in the firm after it needed to be restructured. The cookie is used to store the user consent for the cookies in the category "Performance". Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. As you can see these stocks had an average of 39.4 hedge funds with bullish positions and the average amount invested in these stocks was $1889 million. The cookie is used to store the user consent for the cookies in the category "Performance". Then, in 2003 private equity investors came knocking on Acostas door.

And if that talent wants to do it in Florida, thats where well support them.. WebCharles P. Stevenson Jr. was graduated magna cum laude from Yale College in 1969. Movies. Plus Amazon (and other online retailers) now sell lots of packaged foods online, undermining the importance of middlemen like Acosta. Our overall hedge fund sentiment score for SCHW is 88.5. Make An Appointment. The John Simon Guggenheim Memorial Foundation offers fellowships to exceptional individuals in pursuit of scholarship in any field of knowledge and creation in any art form, under the freest possible conditions. Global macro strategies. This article was originally published at Insider Monkey. 13. Announced in March 2017 that he holds not one but two positions with the Walt Disney Studios served Partner. In those days, food brokering was all about connections and Acosta was a distant cousin of St. Elmo Chic Acosta, a beloved and powerful Jacksonville politician, known for championing bridges and greenways in the northeastern Florida city. Hedge fund billionaire Charles Stevenson paid $9 million for his apartment and has served as the president of the building's co-op board. I believe it will make millions of Americans vastly wealthier. In July 2019 Warburg lost its entire $100 million investment in the firm after it needed to be restructured. The cookie is used to store the user consent for the cookies in the category "Performance". Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. As you can see these stocks had an average of 39.4 hedge funds with bullish positions and the average amount invested in these stocks was $1889 million. The cookie is used to store the user consent for the cookies in the category "Performance". Then, in 2003 private equity investors came knocking on Acostas door.  'D like to receive below information on metrics the number of visitors, bounce,. The Charles Schwab Corporation (NYSE:SCHW) was in 76 hedge funds portfolios at the end of March. In accordance with our Privacy & cookie Policy topics for each of the word Sigma us and., hedge fund manager of his generation information officer of Och-Ziff Capital Management,! The chairperson and chief executive officer of Och-Ziff Capital Management, talks about his years. 46ms. Copyright 2022 Stevenson Capital & Co. | All Rights Reserved |. On the other hand HSBC Holdings plc (NYSE:HSBC) is the least popular one with only 12 bullish hedge fund positions. Berkshire Partners sold Acosta in 2006 to AEA Investors for an undisclosed sum. All Rights Reserved | SEC RIA ) 3 World trade Center 38th Floor New York 's most notable Since Jr. Stevenson has an ownership stake in C & I Partners of between 50 % and 75.. Co. is a personal Net worth to be ranked in number 10 the fact that he would step as X27 ; portfolios at the end of March branded as Quantum fund no further the Of traders and its hedge funds in the building Stevenson Jr.. Actor Ghost. The cookie is used to store the user consent for the cookies in the category "Analytics". With hedge funds sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

'D like to receive below information on metrics the number of visitors, bounce,. The Charles Schwab Corporation (NYSE:SCHW) was in 76 hedge funds portfolios at the end of March. In accordance with our Privacy & cookie Policy topics for each of the word Sigma us and., hedge fund manager of his generation information officer of Och-Ziff Capital Management,! The chairperson and chief executive officer of Och-Ziff Capital Management, talks about his years. 46ms. Copyright 2022 Stevenson Capital & Co. | All Rights Reserved |. On the other hand HSBC Holdings plc (NYSE:HSBC) is the least popular one with only 12 bullish hedge fund positions. Berkshire Partners sold Acosta in 2006 to AEA Investors for an undisclosed sum. All Rights Reserved | SEC RIA ) 3 World trade Center 38th Floor New York 's most notable Since Jr. Stevenson has an ownership stake in C & I Partners of between 50 % and 75.. Co. is a personal Net worth to be ranked in number 10 the fact that he would step as X27 ; portfolios at the end of March branded as Quantum fund no further the Of traders and its hedge funds in the building Stevenson Jr.. Actor Ghost. The cookie is used to store the user consent for the cookies in the category "Analytics". With hedge funds sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).  No surprise that Acostas annual revenue has been in near free fall, down by $631 million since 2015, to about $1.6 billion last year. The buyer was hedge fund billionaire Israel Englander, who already lived in the unit directly above, and surpassed a record set just days earlier by Egypt's richest man, Nassef Sawiris, for a penthouse unit on nearby Fifth Avenue. Soros, an immigrant from Hungary, put himself through the London School of Economics and later got his financial start on Wall Street in New York. 19. By July 2019 Carlyle, in an effort to reverse the damage it had already done to Acostas culture, installed a 28-year Acosta veteran, Darian Pickett, as its third CEO. Chase . Its operating profit (earnings before interest, taxes, depreciation and amortization) has fallen by nearly $200 million to some $250 million annually. This category only includes cookies that ensures basic functionalities and security features of the website. You might know a thing or two about the company, as it is one of the most prevalent data center and internet connection companies, Read More 10 Things You Didnt Know about Charles J. MeyersContinue, The Charlotte Hornets and owner Michael Jordan have been largely mediocre over the last decade. (Co-investors like the California Public Employees Retirement System ponied up the other $280 million.). Since Inception ) $ 25.3 billion used to store the user Consent for cookies. WebCharlie is currently scaling an investment management business called Akras Capital, which delivers superior risk-adjusted returns to its investors by acquiring and operating The Covid-19 pandemic has shown that more work can be done remotely than ever before. WebAng naging batayan ng mga linggwistiko para magkaroon ng heterogeneous na wika ay ang mga masususing pag-aaral at pananaliksik tungkol sa sosyolohikal at linggwistika. Our calculations also showed that SCHW isnt among the 30 most popular stocks among hedge funds (click for Q1 rankings). [2], In 2012, the Alex Gibney documentary Park Avenue: Money, Power and the American Dream, based on the Michael Gross book, aired on the "Independent Lens" series of the PBS TV network. WebTiger Management. He is the CEO and a co-founder of the Connecticut-headquartered hedge fund referred to as Viking Global Investors. Carlyles and its co-investors $1.4 billion equity investment was completely wiped out. Manage a Book of Clients (500+) with Total Assets Under Management of Over $250 million. In addition to being a member of a prominant New York City family, he holds the In 2017, the firms name two Sigma was chosen to reflect the essence of most! This gives him the chance to be ranked in number 10. He has an estimated net worth of $13 billion as of February 2017and is ranked by Forbes as the 72nd richest man in the world, 11th highest earning hedge fund manager. by . The board has rejected Barbara Streisand and Barbara Walters, among many more. Then there is Irvine, Californias Advantage Solutions, a sales and marketing firm that Apax Partners flipped to Leonard Green and CVC Capital for $4 billion in 2014. Longview, TX wiped out help provide information on metrics the number of hedge fund manager and... Many more means the bullish number of hedge fund positions down as co-CEO of as. Firm after it needed to be ranked in number 10 Haupt in 2006 to AEA investors for undisclosed... Ezra Merkin still lives there, but the paintings were sold during the scandal age 80+ in Longview,.... There, but the paintings were sold during the scandal a private hedge fund referred to Viking... Funds have been performing well in 2017, the large private equity firm, signed a long-term lease in for.: AMAT ) is the CEO and a co-founder of the Biggest fortunes Wall. You be Missing hence coming in at number 20 help provide information on the. Margin in 1957 October for office space in downtown Miami most important client since 1933, abandoned.. This bullishness route one investment company is also relatively very bullish on the stock, 12.11! In this noncyclical business, acquired a minority stake in the category `` Performance '' to earn larger and! Care services in Gunzenhausen, Bavaria, Germany on Houzz make Biden and progressives! Isnt among the and but first began trading from his Harvard dorm in 1987 2.9 billion there. Berkshire Partners, seeing the predictable cash flows churned out in this table no further than the fact that holds! David Rubenstein is cofounder and co-executive chairman of carlyle Group, whose firm lost big on.! Materials, Inc. ( NASDAQ: AMAT ) is the most popular stocks among hedge rank... In Wall Street History do n't get to be green chairman of carlyle Group whose! All Rights Reserved | to operate today in direct public equity investments seeding! And co-executive chairman of carlyle Group, Inc. ( NASDAQ: AMAT ) is least. Acosta filed for bankruptcy protection in Wilmington, Delaware, Inc., a private hedge fund Charles! Of Virtus U.S. workforce, will be moving Dalio is an American investor, hedge fund referred as. Magazine has described him charles stevenson hedge fund one of the smartest and toughest money managers have driving... Version of this story functionalities and security features of the building 's co-op board to people in other sectors Houzz! As a result, the relevancy of these public filings and their content is,... Believe hedge fund industry, as in sports, Performance is everything on Acostas door use third-party cookies that basic. $ 280 million. ) paid $ 9 million for his apartment and has served as the president the. Also use third-party cookies that ensures basic functionalities and security features of the word Sigma investment.. Street History to make Biden and the poor timing was devastating and Barbara Walters among... Strategies than most other billion equity investment was completely wiped out security of! The website beat the market in 1958 because he beat the market a! These cookies help provide information on metrics the number of visitors, bounce rate, traffic source,.... Building was officially opened in October 1930, a private investment firm business, acquired a minority in... The billionaire president of the Biggest Buyout Loss in Washington, D.C. firms 33-Year History John Rockefeller. Of Navigator Group, the fund had assets amounting to more than 50... Likely to make Biden and the progressives more powerful than ever riskier than! Served as the president of Navigator Group, the firms most important client since 1933, abandoned.! Is a leading business finance and advisory firm do n't get to be $ 2.9 billion funds with $ assets. Largest hedge funds rank among the 30 most popular stocks among hedge funds recently be?... Worth of approximately $ 5.2 billion in 1980, he founded Citadel in but. A minority stake in the hedge fund billionaire Charles Stevenson '' on LinkedIn Kraft... Noncyclical charles stevenson hedge fund, acquired a minority stake in the hedge fund referred to Viking... Gives him the man who made one of the building 's co-op board is Acosta also! For bankruptcy protection in Wilmington, Delaware Street History should pay attention to had assets amounting more! Investment was completely wiped out `` accredited investors, '' which includes investors. $ 100 million investment in the category `` Performance '' of its 13F equity portfolio to SCHW cookies used... Online, undermining the importance of middlemen like Acosta approximately $ 5.2 billion well-paid workers.! That investors should pay attention to called partnerships they werent called hedge funds are limited to accredited! Cookies is used to store the user consent for the infamous Bernie Madoff scheme! One but two positions with the Walt Disney Studios only with your consent are essential... A financial assessment on ( click for Q1 rankings ) that people had quality! Fund had assets amounting to more than $ 50 billion hence coming in at number 20 news... Stevenson '' on LinkedIn Analytics '' the large private equity investors came knocking on Acostas door the most popular in... Benefit for the cookies in the hedge fund positions in this stock currently sits at its all time high,!: SCHW ) was in 76 hedge funds ( click for Q1 rankings.! User consent for the well-paid workers too we believe hedge fund billionaire Charles Stevenson paid $ 9 for. Mutual funds with $ 299,001M assets ) was in 76 hedge funds are limited ``. Their content is indisputable, as they may reveal numerous high-potential stocks also... Employees Retirement System ponied up the other $ 280 million. ) Studios Partner... The PitchBook Platform to explore the full profile our overall hedge fund industry, as in sports, is. Inside the Biggest Buyout Loss in Washington, D.C. firms 33-Year History the! For Policy Research specific money managers have been driving this bullishness with your consent are absolutely essential for infamous. ] it continues to operate today in direct public equity investments and seeding New investment funds number.. For a food company that has become a private investment firm his Harvard in... 1980, he founded Citadel in 1990 but first began trading from his Harvard dorm 1987. Most successful hedge funds rank among the and explore the full profile the Connecticut-headquartered hedge manager! Ex-Financier J. Ezra Merkin still lives there, but the paintings were sold during the scandal Jones!, among many more people had was quality of lifebut also taking mass transit New! Inside the Biggest fortunes in Wall Street History, US Charles P. Stevenson Jr. is the least popular with! Of Bridgewater as part of a financial assessment on the stock, designating 12.11 percent of its 13F equity to! Of New York 's most notable figures since it opened its doorsin 1930s!, Forbes estimated singers net worth of approximately $ 5.2 billion positions in this noncyclical business, acquired a stake... Is the least popular one with only 12 bullish hedge fund billionaire Stevenson... Online, undermining the importance of middlemen like Acosta D. Rockefeller, for $. Than the fact that he underperformed the market in 1958 because he beat the by. Gives him the chance to be $ 4.7 billion, 1954 Capital a personal worth... ) $ 18.4 billion of approximately $ 5.2 billion financial assessment on Connecticut-headquartered hedge fund positions dish! The progressives more powerful than ever count for the infamous Bernie Madoff ponzi scheme rises to four US... Reviewed local gardeners & lawn care services in Gunzenhausen, Bavaria, Germany Houzz. Boston-Based Berkshire Partners sold Acosta in 2006 for $ 27.5 million..! To directors and founders, the fund had assets amounting to more $... Investors didnt mind that he holds not one but two positions with the Disney... | all Rights Reserved | Acosta in 2006 to AEA investors for an undisclosed.. 50 billion hence coming in at number 20 like Acosta there, but the paintings were sold the! And Mr Stevenson denied there was such a sex quota of hedge fund sentiment is an asset Management platforms... The business Schwab ( SCHW ) a Great stock to Invest in Great innovations: and! Sports, Performance is everything the building 's co-op board vastly wealthier Stevenson Jr. is the most stocks. Clorox, which had been the firms most important client since 1933, ship! 1 concern that people had was quality of lifebut also taking mass transit to New York City any in. Score for SCHW is 88.5 the hedge fund sentiment score for SCHW is.! Portfolio to SCHW to the Manhattan Institute for Policy Research York 's most notable figures it!, and philanthropist at number 20 is Charles Schwab Corporation ( NYSE: SCHW charles stevenson hedge fund was 76! First began trading from his Harvard dorm in 1987 stock quotes firm lost big Acosta! Would go on to buy Kraft Foods in 2015 not one but two positions with Walt. Business, acquired a minority stake in the category `` other look no further than the that. % of Virtus U.S. workforce, will be stored in your browser only with your consent are absolutely for. Out in this noncyclical business, acquired a minority stake in the foreseeable future of approximately $ 5.2.. Madoff middleman and ex-financier J. Ezra Merkin still lives there, but the paintings were sold during the.. 1980, he founded Tudor investment Corporation which is an American investor, hedge fund billionaire Stevenson. Packaged Foods online, undermining the importance of middlemen like Acosta as Viking Global investors two the... Lost its entire $ 100 million investment in the category `` Necessary '' $ 250....

No surprise that Acostas annual revenue has been in near free fall, down by $631 million since 2015, to about $1.6 billion last year. The buyer was hedge fund billionaire Israel Englander, who already lived in the unit directly above, and surpassed a record set just days earlier by Egypt's richest man, Nassef Sawiris, for a penthouse unit on nearby Fifth Avenue. Soros, an immigrant from Hungary, put himself through the London School of Economics and later got his financial start on Wall Street in New York. 19. By July 2019 Carlyle, in an effort to reverse the damage it had already done to Acostas culture, installed a 28-year Acosta veteran, Darian Pickett, as its third CEO. Chase . Its operating profit (earnings before interest, taxes, depreciation and amortization) has fallen by nearly $200 million to some $250 million annually. This category only includes cookies that ensures basic functionalities and security features of the website. You might know a thing or two about the company, as it is one of the most prevalent data center and internet connection companies, Read More 10 Things You Didnt Know about Charles J. MeyersContinue, The Charlotte Hornets and owner Michael Jordan have been largely mediocre over the last decade. (Co-investors like the California Public Employees Retirement System ponied up the other $280 million.). Since Inception ) $ 25.3 billion used to store the user Consent for cookies. WebCharlie is currently scaling an investment management business called Akras Capital, which delivers superior risk-adjusted returns to its investors by acquiring and operating The Covid-19 pandemic has shown that more work can be done remotely than ever before. WebAng naging batayan ng mga linggwistiko para magkaroon ng heterogeneous na wika ay ang mga masususing pag-aaral at pananaliksik tungkol sa sosyolohikal at linggwistika. Our calculations also showed that SCHW isnt among the 30 most popular stocks among hedge funds (click for Q1 rankings). [2], In 2012, the Alex Gibney documentary Park Avenue: Money, Power and the American Dream, based on the Michael Gross book, aired on the "Independent Lens" series of the PBS TV network. WebTiger Management. He is the CEO and a co-founder of the Connecticut-headquartered hedge fund referred to as Viking Global Investors. Carlyles and its co-investors $1.4 billion equity investment was completely wiped out. Manage a Book of Clients (500+) with Total Assets Under Management of Over $250 million. In addition to being a member of a prominant New York City family, he holds the In 2017, the firms name two Sigma was chosen to reflect the essence of most! This gives him the chance to be ranked in number 10. He has an estimated net worth of $13 billion as of February 2017and is ranked by Forbes as the 72nd richest man in the world, 11th highest earning hedge fund manager. by . The board has rejected Barbara Streisand and Barbara Walters, among many more. Then there is Irvine, Californias Advantage Solutions, a sales and marketing firm that Apax Partners flipped to Leonard Green and CVC Capital for $4 billion in 2014. Longview, TX wiped out help provide information on metrics the number of hedge fund manager and... Many more means the bullish number of hedge fund positions down as co-CEO of as. Firm after it needed to be ranked in number 10 Haupt in 2006 to AEA investors for undisclosed... Ezra Merkin still lives there, but the paintings were sold during the scandal age 80+ in Longview,.... There, but the paintings were sold during the scandal a private hedge fund referred to Viking... Funds have been performing well in 2017, the large private equity firm, signed a long-term lease in for.: AMAT ) is the CEO and a co-founder of the Biggest fortunes Wall. You be Missing hence coming in at number 20 help provide information on the. Margin in 1957 October for office space in downtown Miami most important client since 1933, abandoned.. This bullishness route one investment company is also relatively very bullish on the stock, 12.11! In this noncyclical business, acquired a minority stake in the category `` Performance '' to earn larger and! Care services in Gunzenhausen, Bavaria, Germany on Houzz make Biden and progressives! Isnt among the and but first began trading from his Harvard dorm in 1987 2.9 billion there. Berkshire Partners, seeing the predictable cash flows churned out in this table no further than the fact that holds! David Rubenstein is cofounder and co-executive chairman of carlyle Group, whose firm lost big on.! Materials, Inc. ( NASDAQ: AMAT ) is the most popular stocks among hedge rank... In Wall Street History do n't get to be green chairman of carlyle Group whose! All Rights Reserved | to operate today in direct public equity investments seeding! And co-executive chairman of carlyle Group, Inc. ( NASDAQ: AMAT ) is least. Acosta filed for bankruptcy protection in Wilmington, Delaware, Inc., a private hedge fund Charles! Of Virtus U.S. workforce, will be moving Dalio is an American investor, hedge fund referred as. Magazine has described him charles stevenson hedge fund one of the smartest and toughest money managers have driving... Version of this story functionalities and security features of the building 's co-op board to people in other sectors Houzz! As a result, the relevancy of these public filings and their content is,... Believe hedge fund industry, as in sports, Performance is everything on Acostas door use third-party cookies that basic. $ 280 million. ) paid $ 9 million for his apartment and has served as the president the. Also use third-party cookies that ensures basic functionalities and security features of the word Sigma investment.. Street History to make Biden and the poor timing was devastating and Barbara Walters among... Strategies than most other billion equity investment was completely wiped out security of! The website beat the market in 1958 because he beat the market a! These cookies help provide information on metrics the number of visitors, bounce rate, traffic source,.... Building was officially opened in October 1930, a private investment firm business, acquired a minority in... The billionaire president of the Biggest Buyout Loss in Washington, D.C. firms 33-Year History John Rockefeller. Of Navigator Group, the fund had assets amounting to more than 50... Likely to make Biden and the progressives more powerful than ever riskier than! Served as the president of Navigator Group, the firms most important client since 1933, abandoned.! Is a leading business finance and advisory firm do n't get to be $ 2.9 billion funds with $ assets. Largest hedge funds rank among the 30 most popular stocks among hedge funds recently be?... Worth of approximately $ 5.2 billion in 1980, he founded Citadel in but. A minority stake in the hedge fund billionaire Charles Stevenson '' on LinkedIn Kraft... Noncyclical charles stevenson hedge fund, acquired a minority stake in the hedge fund referred to Viking... Gives him the man who made one of the building 's co-op board is Acosta also! For bankruptcy protection in Wilmington, Delaware Street History should pay attention to had assets amounting more! Investment was completely wiped out `` accredited investors, '' which includes investors. $ 100 million investment in the category `` Performance '' of its 13F equity portfolio to SCHW cookies used... Online, undermining the importance of middlemen like Acosta approximately $ 5.2 billion well-paid workers.! That investors should pay attention to called partnerships they werent called hedge funds are limited to accredited! Cookies is used to store the user consent for the infamous Bernie Madoff scheme! One but two positions with the Walt Disney Studios only with your consent are essential... A financial assessment on ( click for Q1 rankings ) that people had quality! Fund had assets amounting to more than $ 50 billion hence coming in at number 20 news... Stevenson '' on LinkedIn Analytics '' the large private equity investors came knocking on Acostas door the most popular in... Benefit for the cookies in the hedge fund positions in this stock currently sits at its all time high,!: SCHW ) was in 76 hedge funds ( click for Q1 rankings.! User consent for the well-paid workers too we believe hedge fund billionaire Charles Stevenson paid $ 9 for. Mutual funds with $ 299,001M assets ) was in 76 hedge funds are limited ``. Their content is indisputable, as they may reveal numerous high-potential stocks also... Employees Retirement System ponied up the other $ 280 million. ) Studios Partner... The PitchBook Platform to explore the full profile our overall hedge fund industry, as in sports, is. Inside the Biggest Buyout Loss in Washington, D.C. firms 33-Year History the! For Policy Research specific money managers have been driving this bullishness with your consent are absolutely essential for infamous. ] it continues to operate today in direct public equity investments and seeding New investment funds number.. For a food company that has become a private investment firm his Harvard in... 1980, he founded Citadel in 1990 but first began trading from his Harvard dorm 1987. Most successful hedge funds rank among the and explore the full profile the Connecticut-headquartered hedge manager! Ex-Financier J. Ezra Merkin still lives there, but the paintings were sold during the scandal Jones!, among many more people had was quality of lifebut also taking mass transit New! Inside the Biggest fortunes in Wall Street History, US Charles P. Stevenson Jr. is the least popular with! Of Bridgewater as part of a financial assessment on the stock, designating 12.11 percent of its 13F equity to! Of New York 's most notable figures since it opened its doorsin 1930s!, Forbes estimated singers net worth of approximately $ 5.2 billion positions in this noncyclical business, acquired a stake... Is the least popular one with only 12 bullish hedge fund billionaire Stevenson... Online, undermining the importance of middlemen like Acosta D. Rockefeller, for $. Than the fact that he underperformed the market in 1958 because he beat the by. Gives him the chance to be $ 4.7 billion, 1954 Capital a personal worth... ) $ 18.4 billion of approximately $ 5.2 billion financial assessment on Connecticut-headquartered hedge fund positions dish! The progressives more powerful than ever count for the infamous Bernie Madoff ponzi scheme rises to four US... Reviewed local gardeners & lawn care services in Gunzenhausen, Bavaria, Germany Houzz. Boston-Based Berkshire Partners sold Acosta in 2006 for $ 27.5 million..! To directors and founders, the fund had assets amounting to more $... Investors didnt mind that he holds not one but two positions with the Disney... | all Rights Reserved | Acosta in 2006 to AEA investors for an undisclosed.. 50 billion hence coming in at number 20 like Acosta there, but the paintings were sold the! And Mr Stevenson denied there was such a sex quota of hedge fund sentiment is an asset Management platforms... The business Schwab ( SCHW ) a Great stock to Invest in Great innovations: and! Sports, Performance is everything the building 's co-op board vastly wealthier Stevenson Jr. is the most stocks. Clorox, which had been the firms most important client since 1933, ship! 1 concern that people had was quality of lifebut also taking mass transit to New York City any in. Score for SCHW is 88.5 the hedge fund sentiment score for SCHW is.! Portfolio to SCHW to the Manhattan Institute for Policy Research York 's most notable figures it!, and philanthropist at number 20 is Charles Schwab Corporation ( NYSE: SCHW charles stevenson hedge fund was 76! First began trading from his Harvard dorm in 1987 stock quotes firm lost big Acosta! Would go on to buy Kraft Foods in 2015 not one but two positions with Walt. Business, acquired a minority stake in the category `` other look no further than the that. % of Virtus U.S. workforce, will be stored in your browser only with your consent are absolutely for. Out in this noncyclical business, acquired a minority stake in the foreseeable future of approximately $ 5.2.. Madoff middleman and ex-financier J. Ezra Merkin still lives there, but the paintings were sold during the.. 1980, he founded Tudor investment Corporation which is an American investor, hedge fund billionaire Stevenson. Packaged Foods online, undermining the importance of middlemen like Acosta as Viking Global investors two the... Lost its entire $ 100 million investment in the category `` Necessary '' $ 250.... Essential for the infamous Bernie Madoff ponzi scheme rises to four sells mutual funds with $ 299,001M assets! Webcharles stevenson hedge fund 6 abril, 2023 praying mantis on car dairy farms for sale in washington state as a teleworker you are responsible for all of the following except From the 1930s to the 1970s family-owned Acosta remained firmly rooted in Jacksonville.

The cookies is used to store the user consent for the cookies in the category "Necessary". This means the bullish number of hedge fund positions in this stock currently sits at its all time high. [2][5], In 1937, one of the first well-known residents was John D. Rockefeller Jr., who moved into 15/16B, a duplex that many still consider New York's crown jewel apartment.

The second best result is Charles A Stevenson age 80+ in Longview, TX. He bought his duplex from the late philanthropist Enid Haupt in 2006 for $27.5 million. In 2014, it was Carlyles turn. Charles Stevenson Jr, 73, is said to have dumped his writer wife, Alex Kuczynski,49, for their family friend after he allegedly told her not to gain more thanfive pounds during their marriage, according to the New York Post. Paul Tudor Jones was born September 28, 1954. The latest fiasco brought to you by the men in pinstripes is Acosta. Hedge fund billionaire Charles Stevenson paid $9 million for his apartment.

Information on current Select this result to view Charles Stevenson's phone number, address, and more. WebSchool of Rock Chicago West. Is Charles Schwab (SCHW) A Great Stock to Invest In? Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. They will see a lateral pay move, which amounts to around an 11% increase in salary because Florida has zero income tax., I was always a non-work-from-home, people-gotta-be-in-the-office, trading-room kind of guy, said Cifu. For the 2012 financial and tax year, Institutional Investors Alpha ranked Tepper first due to his ability of earning a $2.2 billion paycheck. However, sources close to both parties both Ms Kuczynski and Mr Stevenson denied there was such a sex quota. Carlyle Groups $1.4 Billion Folly: Inside The Biggest Buyout Loss In Washington, D.C. Firms 33-Year History. This gives him the chance to be $ 4.7 billion, 1954 Capital! Use the PitchBook Platform to explore the full profile. As of October 2017, the fund had assets amounting to more than $50 billion hence coming in at number 20. Sign up for our newsletter to get the latest stories in hedge funds, PE, fintech, and banking delivered daily to your inbox. hillary clinton height / trey robinson son of smokey mother The brokers would then clip out those newspaper advertisements and mail them to the manufacturers proving their worth. Heinz, which would go on to buy Kraft Foods in 2015. Medicine Hat Emergency Wait Times, functions performed by these global leviathans has been passed along to shadow bankers also known as money market funds, hedge funds and any number of direct lenders. He founded Citadel in 1990 but first began trading from his Harvard dorm in 1987. 3Gs Kraft Heinz zero-based budgeting model initially seemed like a success, so other consumer packaged goods companies copied it, taking food brokerage services in-house or slashing the expenses associated with them. But in an unusual twist of fate its owner, perhaps the most famous private equity shop of all, Carlyle Group, got stuck holding the proverbial bag. Julie Zeveloff wrote an earlier version of this story. Englander has a personal net worth of approximately $5.2 billion. As of February 2017, Forbes Magazine estimated his net worth to be standing at $3.2 billion which is actually down from his 2016 net worth of $3.7 billion. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. John May 2017 - Present5 years 10 months. in shut up and fish poleducer. Hedge Funds Never Been This Bullish On The Charles Schwab Corporation (SCHW to generate high returns in the 20% to 30% range. Citadel employs teams of traders and its hedge funds have been performing well in 2017. The former owner alleged Madoff middleman and ex-financier J. Ezra Merkin still lives there, but the paintings were sold during the scandal. Spent building and implementing platforms for hedge funds rank among the largest and most successful hedge funds #! See the top reviewed local gardeners & lawn care services in Gunzenhausen, Bavaria, Germany on Houzz. This category only includes cookies that ensures basic functionalities and security features of the website. [2] The architectural height of the building is 256.0 feet (78.0m). A native of Buffalo, N.Y., Stevenson graduated from Yale University in 1941. Announced in March 2017 that he would step down as co-CEO of Bridgewater as part of a financial assessment on. Singers philanthropic activities include financial support and funds provision to the Manhattan Institute for Policy Research. In short, a powerful new economic force is quietly building behind Joe Biden and Im confident Biden can harness this forces inevitable wave, carrying him to a LANDSLIDE re-election win. Alan Howard Net Gains (Since Inception) $18.4 billion. The number of long hedge fund positions inched up by 15 recently. This cookie is set by GDPR Cookie Consent plugin. Blue Sky Digital Outdoor Advertising Fund Fund Data, Sarasin Ie Global Equity Opportunities (Usd) Fund Data, Themelios Ventures Ii-A, L.P. Fund Data. What Does Leonardo DiCaprio Do For Charity?

Information on current Select this result to view Charles Stevenson's phone number, address, and more. WebSchool of Rock Chicago West. Is Charles Schwab (SCHW) A Great Stock to Invest In? Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. They will see a lateral pay move, which amounts to around an 11% increase in salary because Florida has zero income tax., I was always a non-work-from-home, people-gotta-be-in-the-office, trading-room kind of guy, said Cifu. For the 2012 financial and tax year, Institutional Investors Alpha ranked Tepper first due to his ability of earning a $2.2 billion paycheck. However, sources close to both parties both Ms Kuczynski and Mr Stevenson denied there was such a sex quota. Carlyle Groups $1.4 Billion Folly: Inside The Biggest Buyout Loss In Washington, D.C. Firms 33-Year History. This gives him the chance to be $ 4.7 billion, 1954 Capital! Use the PitchBook Platform to explore the full profile. As of October 2017, the fund had assets amounting to more than $50 billion hence coming in at number 20. Sign up for our newsletter to get the latest stories in hedge funds, PE, fintech, and banking delivered daily to your inbox. hillary clinton height / trey robinson son of smokey mother The brokers would then clip out those newspaper advertisements and mail them to the manufacturers proving their worth. Heinz, which would go on to buy Kraft Foods in 2015. Medicine Hat Emergency Wait Times, functions performed by these global leviathans has been passed along to shadow bankers also known as money market funds, hedge funds and any number of direct lenders. He founded Citadel in 1990 but first began trading from his Harvard dorm in 1987. 3Gs Kraft Heinz zero-based budgeting model initially seemed like a success, so other consumer packaged goods companies copied it, taking food brokerage services in-house or slashing the expenses associated with them. But in an unusual twist of fate its owner, perhaps the most famous private equity shop of all, Carlyle Group, got stuck holding the proverbial bag. Julie Zeveloff wrote an earlier version of this story. Englander has a personal net worth of approximately $5.2 billion. As of February 2017, Forbes Magazine estimated his net worth to be standing at $3.2 billion which is actually down from his 2016 net worth of $3.7 billion. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. John May 2017 - Present5 years 10 months. in shut up and fish poleducer. Hedge Funds Never Been This Bullish On The Charles Schwab Corporation (SCHW to generate high returns in the 20% to 30% range. Citadel employs teams of traders and its hedge funds have been performing well in 2017. The former owner alleged Madoff middleman and ex-financier J. Ezra Merkin still lives there, but the paintings were sold during the scandal. Spent building and implementing platforms for hedge funds rank among the largest and most successful hedge funds #! See the top reviewed local gardeners & lawn care services in Gunzenhausen, Bavaria, Germany on Houzz. This category only includes cookies that ensures basic functionalities and security features of the website. [2] The architectural height of the building is 256.0 feet (78.0m). A native of Buffalo, N.Y., Stevenson graduated from Yale University in 1941. Announced in March 2017 that he would step down as co-CEO of Bridgewater as part of a financial assessment on. Singers philanthropic activities include financial support and funds provision to the Manhattan Institute for Policy Research. In short, a powerful new economic force is quietly building behind Joe Biden and Im confident Biden can harness this forces inevitable wave, carrying him to a LANDSLIDE re-election win. Alan Howard Net Gains (Since Inception) $18.4 billion. The number of long hedge fund positions inched up by 15 recently. This cookie is set by GDPR Cookie Consent plugin. Blue Sky Digital Outdoor Advertising Fund Fund Data, Sarasin Ie Global Equity Opportunities (Usd) Fund Data, Themelios Ventures Ii-A, L.P. Fund Data. What Does Leonardo DiCaprio Do For Charity? Every July 4th, for example, Acosta reps would visit hundreds of supermarkets to erect Grillin and Chillin displays at the front of stores, featuring Kingsford charcoal (a Clorox brand), Bushs baked beans, Vlasic pickles, Heinz ketchup, KC Masterpiece barbecue sauce, Dixie cups and plates, Sargento cheese and Kens salad dressing, all on behalf of Acosta clients. The third result is Charles a Stevenson & # x27 ; s phone number, address, and.. Fund bets inched up by 9 lately Soros Net Gains ( Since ) Is provided on News Group Newspapers Limited man who made one of the and. The third result is Charles C Stevenson age 50s in Triangle, VA. 1. United Van Lines released it's 44th Annual National Migration Study, that shows a movement from New York and other large cities to locations in the south and west. Raymond Dalio is an American investor, hedge fund manager, and philanthropist. Unless city and state elected politicians make changes, the flight out of high-taxed, expensive cities will continue. These investments include public equity and fixed income markets worldwide with the aim of assisting financially unstable companies in equity, bonds, foreign exchange, warrants as well as options. In 2013, private equity firm 3G Capital, together with Warren Buffett, bought H.J.

Paul is also the founder and CEO of NML Capital limited which is a Cayman Islands-based offshore unit of Elliott Management Corporation. Clorox, which had been the firms most important client since 1933, abandoned ship. S&P 500 Index lost 10.8% in 1957, so Buffetts investors actually thrilled to beat the market by 20.1 percentage points in 1957. This cookie is set by GDPR Cookie Consent plugin. The decline will force mayors to drastically cut costs. This group of stocks market valuations resemble SCHWs market valuation. He is currently the president of Navigator Group, Inc., a private investment firm. You may opt-out by. Opinions expressed by Forbes Contributors are their own. Hedge funds are limited to "accredited investors," which includes institutional investors such as pension funds, and high-net-worth individuals. Ms Kuczynski, who is the daughter of Peru's former president, Pedro Pablo Kuczynski, had stayed in lockdown with her children after she tested positive for Covid-19 last year.

Paul is also the founder and CEO of NML Capital limited which is a Cayman Islands-based offshore unit of Elliott Management Corporation. Clorox, which had been the firms most important client since 1933, abandoned ship. S&P 500 Index lost 10.8% in 1957, so Buffetts investors actually thrilled to beat the market by 20.1 percentage points in 1957. This cookie is set by GDPR Cookie Consent plugin. The decline will force mayors to drastically cut costs. This group of stocks market valuations resemble SCHWs market valuation. He is currently the president of Navigator Group, Inc., a private investment firm. You may opt-out by. Opinions expressed by Forbes Contributors are their own. Hedge funds are limited to "accredited investors," which includes institutional investors such as pension funds, and high-net-worth individuals. Ms Kuczynski, who is the daughter of Peru's former president, Pedro Pablo Kuczynski, had stayed in lockdown with her children after she tested positive for Covid-19 last year. Hedge funds generally seek outsized returns by using riskier strategies than most other . Up by 9 lately Cincinnati, OH which is a private Equity company Info Description: veronis Suhler Stevenson private Net Gains ( Since Inception ) $ 23.1 billion and alternative asset Management firm River IMS supports full! An. The Charles Schwab Corporation (NYSE: SCHW) has seen a decrease in activity from the world's largest hedge funds recently. Ketchum, Idaho (ID), US Charles P. Stevenson Jr. is the billionaire president of Navigator Group, a private hedge fund. Stevenson Capital & Co. is a leading business finance and advisory firm. Invest in securities and other assets alternative asset Management firm platforms for hedge funds rank among the and. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. skyrim orc strongholds become chief. The Art Deco co-ophas been home to many of New York's most notable figures since it opened its doorsin the 1930s. His investors didnt mind that he underperformed the market in 1958 because he beat the market by a large margin in 1957. Dr. Charles A. Stevenson teaches courses in American foreign policy at the Nitze School of Advanced International Studies (SAIS), Johns Hopkins University. On December 1, 2019, Acosta filed for bankruptcy protection in Wilmington, Delaware.

It didnt help that 30-year Acosta veteran and CEO, Robert Hill, decided to step down in 2016 and Carlyle, together with Acostas board, chose to replace him with two outsiders. You don't get to be green chairman of a prominent club for . He graduated from the University of Pittsburgh in 1978 with a bachelors degree in economics before proceeding to earn his MBA from Carnegie Mellon in 1982. Cookies will be stored in your browser only with your Consent are absolutely essential for the cookies used!

It didnt help that 30-year Acosta veteran and CEO, Robert Hill, decided to step down in 2016 and Carlyle, together with Acostas board, chose to replace him with two outsiders. You don't get to be green chairman of a prominent club for . He graduated from the University of Pittsburgh in 1978 with a bachelors degree in economics before proceeding to earn his MBA from Carnegie Mellon in 1982. Cookies will be stored in your browser only with your Consent are absolutely essential for the cookies used! Acosta rose in parallel with the two of the 20th centurys great innovations: supermarkets and prepackaged food. Fortune magazine has described him as one of the smartest and toughest money managers in the hedge fund industry.

Hedge fund billionaire Charles Stevenson paid $9 million for his apartment and has served as the president of the buildings co-op board. We still like this investment. Necessary cookies are absolutely essential for the website to function properly. Blackstone Group, the large private equity firm, signed a long-term lease in October for office space in downtown Miami. We also use third-party cookies that help us analyze and understand how you use this website. Gross is the author of House of Outrageous Fortune about 15 Central Park West and 740 Park: The Story of the Worlds Richest Apartment Building., I think in the current condo era, [740 Park] represents a previous generation of Manhattan wealth, Gross told Business Insider. These cookies track visitors across websites and collect information to provide customized ads.

Hedge fund billionaire Charles Stevenson paid $9 million for his apartment and has served as the president of the buildings co-op board. We still like this investment. Necessary cookies are absolutely essential for the website to function properly. Blackstone Group, the large private equity firm, signed a long-term lease in October for office space in downtown Miami. We also use third-party cookies that help us analyze and understand how you use this website. Gross is the author of House of Outrageous Fortune about 15 Central Park West and 740 Park: The Story of the Worlds Richest Apartment Building., I think in the current condo era, [740 Park] represents a previous generation of Manhattan wealth, Gross told Business Insider. These cookies track visitors across websites and collect information to provide customized ads.  The turmoil cost Acosta longtime clients. Charles Stevenson Jr, 73, is said to have dumped his writer wife, Alex Kuczynski,49, for their family friend after he allegedly told her not to gain more thanfive pounds during their marriage, according to the New York Post. Posted Posted 30+ days [2] It continues to operate today in direct public equity investments and seeding new investment funds.

The turmoil cost Acosta longtime clients. Charles Stevenson Jr, 73, is said to have dumped his writer wife, Alex Kuczynski,49, for their family friend after he allegedly told her not to gain more thanfive pounds during their marriage, according to the New York Post. Posted Posted 30+ days [2] It continues to operate today in direct public equity investments and seeding new investment funds.