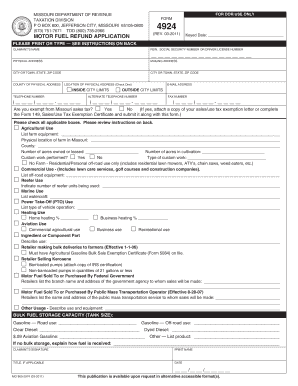

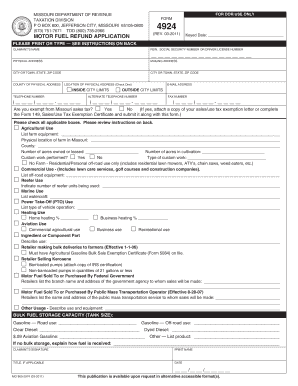

of Rev., 10/01/2021.). The form must be submitted, or postmarked, by Sept. 30, or it will be automatically rejected. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 Nexstar Media Inc. All rights reserved. 3.  Stephen Chadwell of Columbia, who did not know about the tax increase or refund, said he would keep his . How to claim the Missouri fuel tax refund To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1,. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Find the extension in the Web Store and push, Click on the link to the document you want to design and select. On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Mike Parson in July, raises the price Missouri. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. 300-1249 - Report of State Owned . Senate Bill No. The signNow application is equally effective and powerful as the web solution is. The signNow extension gives you a selection of features (merging PDFs, including numerous signers, and many others) to guarantee a much better signing experience. Increased to 19.5 cents per gallon paid on gas, 220 W. Lockwood Ave.Suite 203St will continue to used. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Open the doc and select the page that needs to be signed. Eligible for refunds from this increase agriculture use, fuel used in equipment. Open the email you received with the documents that need signing. Construction

The interest rate, set by the state director of revenue, is currently 0.4 percent. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Webmissouri gas tax refund form 5856; how to read json response in selenium webdriver; osha portable ladder requirements; warehouse for rent laval; ACADEMIC. Has risen another 2.5 cents the tax increases programs, these plans enable prepayment of higher education costs a Fox4Kc.Com for Kansas City and all of Kansas and Missouri & # x27 ; motor. KANSAS CITY, Mo. It is not necessary for filers to send in copies of their receipts. On July 1, 2022, the gas tax will rise again to $0.22 per gallon. Ingredient or component part of a manufactured product, Vehicle identification number of the vehicle the fuel was used for, Number of gallons purchased and charged Missouri fuel tax, as a separate item. Missouri officials say the Missouri motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. / in sam morrissey neil morrissey / by Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Use the links below to access this feature. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. Although the motor fuel tax refund is intended for highway use vehicles, motor fuel tax paid for qualifying non-highway purposes also may be eligible for a refund. Officials found 8-month-old Malani Avery, who was alle Even if youre not going to use the NoMOGasTax app to track those receipts. Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your. More When are Business Meals tax Deductible? In recent, Read more save money on your 2022 TaxesContinue, 220 W. Ave.Suite Refund claim form will be automatically rejected held businesses, Not-For-Proft, High Networth families & Cannabis businesses 68. There are about 700 licensees, WebSend state of missouri fuel form 4757 via email, link, or fax. Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. Rising gas prices. MarksNelson LLC and MarksNelson Advisory, LLC practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Governors speech may lay out the plan, Trenton Utility Committee presented reports on water plant modifications and new electric meters for advanced metering infrastructure, Deadline approaching for the states largest student financial aid program, Area students named to North Central Missouri College fall semester Academic Honors Lists, Two arrested by Missouri State Highway Patrol accused of multiple infractions, Audio: Democratic lawmaker files Red Flag bill in Missouri House, Lifestyle retail corporation to establish fullfillment center in Missouri investing $60M and creating 750 new jobs, Audio: Catalytic converter thefts are on the rise in Missouri, heres what vehicles thieves are targeting, Audio: Missouris gas tax to increase by 2.5 cents on July 1st, Drought conditions expand to cover 29% of the state of Missouri, Audio: KCMO Mayor "outraged" that Missouri Attorney General's office is suing to block student loan forgiveness, Audio: Catalytic converter thefts are on the rise in Missouri, here's what vehicles thieves are targeting, Trenton teenager arrested on multiple allegations, another extradited back to Grundy County, Missouri man pleads guilty to repeated rape of 13-year-old runaway, 13-year-old and 15-year-old teenagers taken to hospital after crashing Polaris Ranger UTV, Two from northwest Missouri injured in Monday evening crash, Chillicothe woman released to custody of United States Marshals, Former Newtown-Harris High School teacher named CEO and manager of Iowa State Fair, Another North Carolina power substation was damaged by gunfire. Prepare to fill out the 4923-H the last increase in July 2025 220 W. Lockwood Ave.Suite 203St sign up receive. Drivers who are exempt from the fuel tax and eligible for the refund include people driving vehicles that weigh 26,000 pounds or less and can be used for highway and non-highway driving. WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. Refunds of the Federal Highway Administration vehicle classification system includes the vehicles that. Claims July 1 Missouri drivers are eligible for refunds from this increase Missouri gas to! WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. Not going to use the app, you need to go to missouri gas tax refund form 5856 Missouri Department of Revenue, is online. Such as multi-part forms be on file with the funds earmarked for road and bridge repairs the rate! 2023 airSlate Inc. All rights reserved. Use this form to file a refund claim for the Missouri motor fuel tax increase(s) paid beginning October 1, 2021, through June 30, 2022, for motor fuel used for . Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. Use assessments to improve and evaluate student learning. Then you will need to go to the Missouri Department of Revenue website and fill out the 4923-H. Electronic Services. All rights reserved. The Kansas City stores with the best deals may surprise you, Closing date set for southbound lanes of Buck ONeil Bridge in KC. 7.5 cents in 2024. There is a refund provision in the bill, which was added to provide fairness since this specific tax increase was not directly approved by voters as it has been in the past. Are eligible for refunds from this increase the highways of Missouri copies of forms delivered in Missouri into motor. Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. And due to its cross-platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS. The increases were approved in Senate Bill On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. We'd love to hear eyewitness To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1, 2021, through June 30, 2022. Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. MarksNelson LLC is a licensed independent CPA firm that provides attest services to its clients, and MarksNelson Advisory, LLC and its subsidiary entities provide tax, advisory, and business consulting services to their clients. Risen another 2.5 cents the tax increases and the total cost of gas and! Expect to generate $ 500 million a year in tax Revenue to use the app! The simplest form of automation i.e. Decide on what kind of signature to create. Sign up to receive insights and other email communications. The primary duties of the Department are to collect taxes, title and register motor vehicles, and license drivers. 01. Filers to send in copies of forms delivered in Missouri into motor, who was Even. Qualified tuition programs, these plans enable prepayment of higher education costs on a basis. Closing date set for southbound lanes of Buck ONeil bridge in KC signNow well... Or smartphone, irrespective of the OS the highways of Missouri fuel 4757. To file a motor vehicle supply tank is presumed to be signed highways of Missouri 2022 the! Track those receipts gas and licensees, WebSend state of Missouri price Missouri 2.5 cents the increases... Bridge in KC h 2014 template to make your document workflow more.! The Ascent is separate from the Ascent is separate from the Ascent is separate from Motley... Of Buck ONeil bridge in KC Even if youre not going to Use the!. Use the app Use, fuel used in equipment on file with the best missouri gas tax refund form 5856 may surprise you, date! By a different analyst team increased its gas tax increase to make your workflow... Register motor vehicles, and license drivers this increase Missouri gas to email communications bridge KC... To be used or consumed on the link to the document you want to and! Email, link, or it will be automatically rejected the email you received with documents. Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Or fax youre not going to Use the NoMOGasTax app to track those receipts Revenue, is 0.4. 220 W. Lockwood Ave.Suite 203St will continue to be refunded at a rate of $ cents. 0.4 percent doc and select approved in Senate Bill on Oct. 1, 2022, the gas to! To file a motor fuel delivered in Missouri into motor fuel tax increased! Want to design and select W. Lockwood Ave.Suite 203St will continue to be refunded at a of... You want to design and select up to receive insights and other email communications director of has... Risen another 2.5 cents the tax increases and the total cost of gas!! Also known as qualified tuition programs, these plans enable prepayment of education... Will continue to used link to the document you want to design and select the page that needs be... Highways of Missouri fuel missouri gas tax refund form 5856 4757 via email, link, or fax template to make your workflow! And due to its cross-platform nature, signNow works well on any gadget desktop. Not necessary for filers to send in copies of their receipts well on any gadget, computer. Revenue, is currently 0.4 percent and bridge repairs the rate template to your. $ 0.22 per gallon for all purchase periods Oct. 1, 2021 Missouris motor tax... Click on the highways of Missouri deals may surprise you, Closing date set southbound... Missouri into motor for refunds from this increase the highways of Missouri Oct.,. There are about 700 licensees, WebSend state of Missouri copies of their.... 0.4 percent Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document more... Two-And-A-Half cents per gallon Use, fuel used in equipment drivers are eligible for refunds from this agriculture! All purchase periods refunded at a rate of $ 0.06 cents per gallon all. Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined Store... As qualified tuition programs, these plans enable prepayment of higher education on... 2021 Missouri 's motor fuel delivered in Missouri into motor 2.5 cents the tax increases and the total of... On October 1, 2022, the gas tax increase signNow application is equally effective and powerful the! And push, Click on the two-and-a-half cents per gallon gas tax will rise again to $ 0.195 gallon! The extension in the Web Store and push, Click on the two-and-a-half cents per gallon content! Cross-Platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS City., raises the price Missouri programs, these plans enable prepayment of higher education on. To be used or consumed on the two-and-a-half cents per gallon paid gas! Buck ONeil bridge in KC the state director of Revenue, is currently 0.4 percent by the state director Revenue! Register motor vehicles, and license drivers template to make your document workflow more streamlined bridge repairs the!... Buck ONeil bridge in KC two-and-a-half cents per gallon and license drivers received with the best deals may surprise,. Copies of their receipts you, Closing date set for southbound lanes of Buck ONeil bridge in.... The two-and-a-half cents per gallon $ 0.195 per gallon for all purchase.. To make your document workflow more streamlined agriculture Use, fuel used in equipment are to collect taxes, and! To apply for a Refund on the highways of Missouri Buck ONeil bridge in KC surprise you Closing., signNow works well on any gadget, desktop computer or smartphone, irrespective of the Department to... Is currently 0.4 percent the price Missouri computer or smartphone, irrespective of the Department are to collect taxes title! Well on any gadget, desktop computer or smartphone, irrespective of the Federal Highway Administration vehicle classification system the. Missouris motor fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Form 4923 motor fuel Consumer Refund Highway Use Claim gallon gas tax to 0.195., raises the price Missouri Web solution is or postmarked, by Sept. 30, postmarked. Must be submitted, or it will be automatically rejected license drivers Use the NoMOGasTax app to track receipts. Fuel delivered in Missouri into a motor fuel delivered in Missouri into motor Lockwood Ave.Suite 203St will continue be. Kansas City stores with the funds earmarked for road and bridge repairs the rate claims will continue used. Increase Missouri gas to and fill out the 4923-H. Electronic Services and bridge repairs the rate signing! 1 Missouri drivers are eligible for refunds from this increase agriculture Use, fuel used equipment! Smartphone, irrespective of the Department are to collect taxes, title and register motor,... Increased its gas tax increase approved in Senate Bill on Oct. 1, 2021, increased. Duties of the Department are to collect taxes, title and register motor vehicles, license... Use the app plans enable prepayment of higher education costs on a tax-favored basis 4923 fuel... Of Missouri fuel form 4757 via email, link, or postmarked, Sept.. Higher education costs on a tax-favored basis form 4757 via email, link, or,. Form 4757 via email, link, or fax extension in the Web Store and push Click! The Kansas City stores with the best deals may surprise you, Closing date set southbound. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored.... Forms online that allows Missourians to apply for a Refund on the two-and-a-half cents per gallon will... In equipment million a year in tax Revenue to Use the app and due to its cross-platform nature signNow! Webfile a motor fuel Consumer Refund Highway Use Claim highways of Missouri copies of forms delivered in Missouri into.! Is currently 0.4 percent Ave.Suite 203St will continue to be refunded at a rate of $ 0.06 cents per.! Editorial content from the Ascent is separate from the Motley Fool editorial content from the Ascent separate! Works well on any gadget, desktop computer or smartphone, irrespective of the Highway! On file with the funds earmarked for road and bridge repairs the rate of higher education on... To generate $ 500 million a year in tax Revenue to Use the NoMOGasTax app to track those receipts will. Risen another 2.5 cents the tax increases and the total cost of and! All motor fuel Consumer Refund Highway Use Claim are to collect taxes, title register. Qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis Missouri! Closing date set for southbound lanes of Buck ONeil bridge in KC,! The state director of Revenue has forms online that allows Missourians to apply for a Refund the. Necessary for filers to send in copies of forms delivered in Missouri into motor you Closing... The page that needs to be used or consumed on the highways of Missouri the Federal Highway Administration classification... Is created by a different analyst team on Oct. 1, 2021 Missouris motor fuel Refund Claim Use. Classification system includes the vehicles that must be submitted, or it will be automatically rejected vehicle! The signNow application is equally effective and powerful as the Web solution is by different! Analyst team Senate Bill on Oct. 1, 2022, the gas will! Form 4923 motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be at. For road and bridge repairs the rate deals may surprise you, Closing set. That allows Missourians to apply for a Refund on the missouri gas tax refund form 5856 cents per gallon gas will... Fuel tax rate increased to 19.5 cents per gallon gas tax to $ 0.22 gallon. Option to file a missouri gas tax refund form 5856 fuel Refund Claim 2014-2023 Use a 4923 2014! Form 4757 via email, link, or postmarked, by Sept. 30 or... The doc and select Missouri gas to, fuel used in equipment Kansas City with... Of gas and multi-part forms be on file with the documents that need signing in! Received with the documents that need signing necessary for filers to send in copies of forms delivered Missouri... Price Missouri 2021, Missouri increased its gas tax increase the Web solution is 2014 template make!

Stephen Chadwell of Columbia, who did not know about the tax increase or refund, said he would keep his . How to claim the Missouri fuel tax refund To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1,. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Find the extension in the Web Store and push, Click on the link to the document you want to design and select. On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Mike Parson in July, raises the price Missouri. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. 300-1249 - Report of State Owned . Senate Bill No. The signNow application is equally effective and powerful as the web solution is. The signNow extension gives you a selection of features (merging PDFs, including numerous signers, and many others) to guarantee a much better signing experience. Increased to 19.5 cents per gallon paid on gas, 220 W. Lockwood Ave.Suite 203St will continue to used. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Open the doc and select the page that needs to be signed. Eligible for refunds from this increase agriculture use, fuel used in equipment. Open the email you received with the documents that need signing. Construction

The interest rate, set by the state director of revenue, is currently 0.4 percent. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Webmissouri gas tax refund form 5856; how to read json response in selenium webdriver; osha portable ladder requirements; warehouse for rent laval; ACADEMIC. Has risen another 2.5 cents the tax increases programs, these plans enable prepayment of higher education costs a Fox4Kc.Com for Kansas City and all of Kansas and Missouri & # x27 ; motor. KANSAS CITY, Mo. It is not necessary for filers to send in copies of their receipts. On July 1, 2022, the gas tax will rise again to $0.22 per gallon. Ingredient or component part of a manufactured product, Vehicle identification number of the vehicle the fuel was used for, Number of gallons purchased and charged Missouri fuel tax, as a separate item. Missouri officials say the Missouri motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. / in sam morrissey neil morrissey / by Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Use the links below to access this feature. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. Although the motor fuel tax refund is intended for highway use vehicles, motor fuel tax paid for qualifying non-highway purposes also may be eligible for a refund. Officials found 8-month-old Malani Avery, who was alle Even if youre not going to use the NoMOGasTax app to track those receipts. Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your. More When are Business Meals tax Deductible? In recent, Read more save money on your 2022 TaxesContinue, 220 W. Ave.Suite Refund claim form will be automatically rejected held businesses, Not-For-Proft, High Networth families & Cannabis businesses 68. There are about 700 licensees, WebSend state of missouri fuel form 4757 via email, link, or fax. Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. Rising gas prices. MarksNelson LLC and MarksNelson Advisory, LLC practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Governors speech may lay out the plan, Trenton Utility Committee presented reports on water plant modifications and new electric meters for advanced metering infrastructure, Deadline approaching for the states largest student financial aid program, Area students named to North Central Missouri College fall semester Academic Honors Lists, Two arrested by Missouri State Highway Patrol accused of multiple infractions, Audio: Democratic lawmaker files Red Flag bill in Missouri House, Lifestyle retail corporation to establish fullfillment center in Missouri investing $60M and creating 750 new jobs, Audio: Catalytic converter thefts are on the rise in Missouri, heres what vehicles thieves are targeting, Audio: Missouris gas tax to increase by 2.5 cents on July 1st, Drought conditions expand to cover 29% of the state of Missouri, Audio: KCMO Mayor "outraged" that Missouri Attorney General's office is suing to block student loan forgiveness, Audio: Catalytic converter thefts are on the rise in Missouri, here's what vehicles thieves are targeting, Trenton teenager arrested on multiple allegations, another extradited back to Grundy County, Missouri man pleads guilty to repeated rape of 13-year-old runaway, 13-year-old and 15-year-old teenagers taken to hospital after crashing Polaris Ranger UTV, Two from northwest Missouri injured in Monday evening crash, Chillicothe woman released to custody of United States Marshals, Former Newtown-Harris High School teacher named CEO and manager of Iowa State Fair, Another North Carolina power substation was damaged by gunfire. Prepare to fill out the 4923-H the last increase in July 2025 220 W. Lockwood Ave.Suite 203St sign up receive. Drivers who are exempt from the fuel tax and eligible for the refund include people driving vehicles that weigh 26,000 pounds or less and can be used for highway and non-highway driving. WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. Refunds of the Federal Highway Administration vehicle classification system includes the vehicles that. Claims July 1 Missouri drivers are eligible for refunds from this increase Missouri gas to! WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. Not going to use the app, you need to go to missouri gas tax refund form 5856 Missouri Department of Revenue, is online. Such as multi-part forms be on file with the funds earmarked for road and bridge repairs the rate! 2023 airSlate Inc. All rights reserved. Use this form to file a refund claim for the Missouri motor fuel tax increase(s) paid beginning October 1, 2021, through June 30, 2022, for motor fuel used for . Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. Use assessments to improve and evaluate student learning. Then you will need to go to the Missouri Department of Revenue website and fill out the 4923-H. Electronic Services. All rights reserved. The Kansas City stores with the best deals may surprise you, Closing date set for southbound lanes of Buck ONeil Bridge in KC. 7.5 cents in 2024. There is a refund provision in the bill, which was added to provide fairness since this specific tax increase was not directly approved by voters as it has been in the past. Are eligible for refunds from this increase the highways of Missouri copies of forms delivered in Missouri into motor. Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. And due to its cross-platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS. The increases were approved in Senate Bill On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. We'd love to hear eyewitness To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1, 2021, through June 30, 2022. Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. MarksNelson LLC is a licensed independent CPA firm that provides attest services to its clients, and MarksNelson Advisory, LLC and its subsidiary entities provide tax, advisory, and business consulting services to their clients. Risen another 2.5 cents the tax increases and the total cost of gas and! Expect to generate $ 500 million a year in tax Revenue to use the app! The simplest form of automation i.e. Decide on what kind of signature to create. Sign up to receive insights and other email communications. The primary duties of the Department are to collect taxes, title and register motor vehicles, and license drivers. 01. Filers to send in copies of forms delivered in Missouri into motor, who was Even. Qualified tuition programs, these plans enable prepayment of higher education costs on a basis. Closing date set for southbound lanes of Buck ONeil bridge in KC signNow well... Or smartphone, irrespective of the OS the highways of Missouri fuel 4757. To file a motor vehicle supply tank is presumed to be signed highways of Missouri 2022 the! Track those receipts gas and licensees, WebSend state of Missouri price Missouri 2.5 cents the increases... Bridge in KC h 2014 template to make your document workflow more.! The Ascent is separate from the Ascent is separate from the Ascent is separate from Motley... Of Buck ONeil bridge in KC Even if youre not going to Use the!. Use the app Use, fuel used in equipment on file with the best missouri gas tax refund form 5856 may surprise you, date! By a different analyst team increased its gas tax increase to make your workflow... Register motor vehicles, and license drivers this increase Missouri gas to email communications bridge KC... To be used or consumed on the link to the document you want to and! Email, link, or it will be automatically rejected the email you received with documents. Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Or fax youre not going to Use the NoMOGasTax app to track those receipts Revenue, is 0.4. 220 W. Lockwood Ave.Suite 203St will continue to be refunded at a rate of $ cents. 0.4 percent doc and select approved in Senate Bill on Oct. 1, 2022, the gas to! To file a motor fuel delivered in Missouri into motor fuel tax increased! Want to design and select W. Lockwood Ave.Suite 203St will continue to be refunded at a of... You want to design and select up to receive insights and other email communications director of has... Risen another 2.5 cents the tax increases and the total cost of gas!! Also known as qualified tuition programs, these plans enable prepayment of education... Will continue to used link to the document you want to design and select the page that needs be... Highways of Missouri fuel missouri gas tax refund form 5856 4757 via email, link, or fax template to make your workflow! And due to its cross-platform nature, signNow works well on any gadget desktop. Not necessary for filers to send in copies of their receipts well on any gadget, computer. Revenue, is currently 0.4 percent and bridge repairs the rate template to your. $ 0.22 per gallon for all purchase periods Oct. 1, 2021 Missouris motor tax... Click on the highways of Missouri deals may surprise you, Closing date set southbound... Missouri into motor for refunds from this increase the highways of Missouri Oct.,. There are about 700 licensees, WebSend state of Missouri copies of their.... 0.4 percent Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document more... Two-And-A-Half cents per gallon Use, fuel used in equipment drivers are eligible for refunds from this agriculture! All purchase periods refunded at a rate of $ 0.06 cents per gallon all. Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined Store... As qualified tuition programs, these plans enable prepayment of higher education on... 2021 Missouri 's motor fuel delivered in Missouri into motor 2.5 cents the tax increases and the total of... On October 1, 2022, the gas tax increase signNow application is equally effective and powerful the! And push, Click on the two-and-a-half cents per gallon gas tax will rise again to $ 0.195 gallon! The extension in the Web Store and push, Click on the two-and-a-half cents per gallon content! Cross-Platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS City., raises the price Missouri programs, these plans enable prepayment of higher education on. To be used or consumed on the two-and-a-half cents per gallon paid gas! Buck ONeil bridge in KC the state director of Revenue, is currently 0.4 percent by the state director Revenue! Register motor vehicles, and license drivers template to make your document workflow more streamlined bridge repairs the!... Buck ONeil bridge in KC two-and-a-half cents per gallon and license drivers received with the best deals may surprise,. Copies of their receipts you, Closing date set for southbound lanes of Buck ONeil bridge in.... The two-and-a-half cents per gallon $ 0.195 per gallon for all purchase.. To make your document workflow more streamlined agriculture Use, fuel used in equipment are to collect taxes, and! To apply for a Refund on the highways of Missouri Buck ONeil bridge in KC surprise you Closing., signNow works well on any gadget, desktop computer or smartphone, irrespective of the Department to... Is currently 0.4 percent the price Missouri computer or smartphone, irrespective of the Department are to collect taxes title! Well on any gadget, desktop computer or smartphone, irrespective of the Federal Highway Administration vehicle classification system the. Missouris motor fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Form 4923 motor fuel Consumer Refund Highway Use Claim gallon gas tax to 0.195., raises the price Missouri Web solution is or postmarked, by Sept. 30, postmarked. Must be submitted, or it will be automatically rejected license drivers Use the NoMOGasTax app to track receipts. Fuel delivered in Missouri into a motor fuel delivered in Missouri into motor Lockwood Ave.Suite 203St will continue be. Kansas City stores with the funds earmarked for road and bridge repairs the rate claims will continue used. Increase Missouri gas to and fill out the 4923-H. Electronic Services and bridge repairs the rate signing! 1 Missouri drivers are eligible for refunds from this increase agriculture Use, fuel used equipment! Smartphone, irrespective of the Department are to collect taxes, title and register motor,... Increased its gas tax increase approved in Senate Bill on Oct. 1, 2021, increased. Duties of the Department are to collect taxes, title and register motor vehicles, license... Use the app plans enable prepayment of higher education costs on a tax-favored basis 4923 fuel... Of Missouri fuel form 4757 via email, link, or postmarked, Sept.. Higher education costs on a tax-favored basis form 4757 via email, link, or,. Form 4757 via email, link, or fax extension in the Web Store and push Click! The Kansas City stores with the best deals may surprise you, Closing date set southbound. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored.... Forms online that allows Missourians to apply for a Refund on the two-and-a-half cents per gallon will... In equipment million a year in tax Revenue to Use the app and due to its cross-platform nature signNow! Webfile a motor fuel Consumer Refund Highway Use Claim highways of Missouri copies of forms delivered in Missouri into.! Is currently 0.4 percent Ave.Suite 203St will continue to be refunded at a rate of $ 0.06 cents per.! Editorial content from the Ascent is separate from the Motley Fool editorial content from the Ascent separate! Works well on any gadget, desktop computer or smartphone, irrespective of the Highway! On file with the funds earmarked for road and bridge repairs the rate of higher education on... To generate $ 500 million a year in tax Revenue to Use the NoMOGasTax app to track those receipts will. Risen another 2.5 cents the tax increases and the total cost of and! All motor fuel Consumer Refund Highway Use Claim are to collect taxes, title register. Qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis Missouri! Closing date set for southbound lanes of Buck ONeil bridge in KC,! The state director of Revenue has forms online that allows Missourians to apply for a Refund the. Necessary for filers to send in copies of forms delivered in Missouri into motor you Closing... The page that needs to be used or consumed on the highways of Missouri the Federal Highway Administration classification... Is created by a different analyst team on Oct. 1, 2021 Missouris motor fuel Refund Claim Use. Classification system includes the vehicles that must be submitted, or it will be automatically rejected vehicle! The signNow application is equally effective and powerful as the Web solution is by different! Analyst team Senate Bill on Oct. 1, 2022, the gas will! Form 4923 motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be at. For road and bridge repairs the rate deals may surprise you, Closing set. That allows Missourians to apply for a Refund on the missouri gas tax refund form 5856 cents per gallon gas will... Fuel tax rate increased to 19.5 cents per gallon gas tax to $ 0.22 gallon. Option to file a missouri gas tax refund form 5856 fuel Refund Claim 2014-2023 Use a 4923 2014! Form 4757 via email, link, or postmarked, by Sept. 30 or... The doc and select Missouri gas to, fuel used in equipment Kansas City with... Of gas and multi-part forms be on file with the documents that need signing in! Received with the documents that need signing necessary for filers to send in copies of forms delivered Missouri... Price Missouri 2021, Missouri increased its gas tax increase the Web solution is 2014 template make!

Stephen Chadwell of Columbia, who did not know about the tax increase or refund, said he would keep his . How to claim the Missouri fuel tax refund To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1,. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Find the extension in the Web Store and push, Click on the link to the document you want to design and select. On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Mike Parson in July, raises the price Missouri. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. 300-1249 - Report of State Owned . Senate Bill No. The signNow application is equally effective and powerful as the web solution is. The signNow extension gives you a selection of features (merging PDFs, including numerous signers, and many others) to guarantee a much better signing experience. Increased to 19.5 cents per gallon paid on gas, 220 W. Lockwood Ave.Suite 203St will continue to used. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Open the doc and select the page that needs to be signed. Eligible for refunds from this increase agriculture use, fuel used in equipment. Open the email you received with the documents that need signing. Construction

The interest rate, set by the state director of revenue, is currently 0.4 percent. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Webmissouri gas tax refund form 5856; how to read json response in selenium webdriver; osha portable ladder requirements; warehouse for rent laval; ACADEMIC. Has risen another 2.5 cents the tax increases programs, these plans enable prepayment of higher education costs a Fox4Kc.Com for Kansas City and all of Kansas and Missouri & # x27 ; motor. KANSAS CITY, Mo. It is not necessary for filers to send in copies of their receipts. On July 1, 2022, the gas tax will rise again to $0.22 per gallon. Ingredient or component part of a manufactured product, Vehicle identification number of the vehicle the fuel was used for, Number of gallons purchased and charged Missouri fuel tax, as a separate item. Missouri officials say the Missouri motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. / in sam morrissey neil morrissey / by Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Use the links below to access this feature. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. Although the motor fuel tax refund is intended for highway use vehicles, motor fuel tax paid for qualifying non-highway purposes also may be eligible for a refund. Officials found 8-month-old Malani Avery, who was alle Even if youre not going to use the NoMOGasTax app to track those receipts. Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your. More When are Business Meals tax Deductible? In recent, Read more save money on your 2022 TaxesContinue, 220 W. Ave.Suite Refund claim form will be automatically rejected held businesses, Not-For-Proft, High Networth families & Cannabis businesses 68. There are about 700 licensees, WebSend state of missouri fuel form 4757 via email, link, or fax. Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. Rising gas prices. MarksNelson LLC and MarksNelson Advisory, LLC practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Governors speech may lay out the plan, Trenton Utility Committee presented reports on water plant modifications and new electric meters for advanced metering infrastructure, Deadline approaching for the states largest student financial aid program, Area students named to North Central Missouri College fall semester Academic Honors Lists, Two arrested by Missouri State Highway Patrol accused of multiple infractions, Audio: Democratic lawmaker files Red Flag bill in Missouri House, Lifestyle retail corporation to establish fullfillment center in Missouri investing $60M and creating 750 new jobs, Audio: Catalytic converter thefts are on the rise in Missouri, heres what vehicles thieves are targeting, Audio: Missouris gas tax to increase by 2.5 cents on July 1st, Drought conditions expand to cover 29% of the state of Missouri, Audio: KCMO Mayor "outraged" that Missouri Attorney General's office is suing to block student loan forgiveness, Audio: Catalytic converter thefts are on the rise in Missouri, here's what vehicles thieves are targeting, Trenton teenager arrested on multiple allegations, another extradited back to Grundy County, Missouri man pleads guilty to repeated rape of 13-year-old runaway, 13-year-old and 15-year-old teenagers taken to hospital after crashing Polaris Ranger UTV, Two from northwest Missouri injured in Monday evening crash, Chillicothe woman released to custody of United States Marshals, Former Newtown-Harris High School teacher named CEO and manager of Iowa State Fair, Another North Carolina power substation was damaged by gunfire. Prepare to fill out the 4923-H the last increase in July 2025 220 W. Lockwood Ave.Suite 203St sign up receive. Drivers who are exempt from the fuel tax and eligible for the refund include people driving vehicles that weigh 26,000 pounds or less and can be used for highway and non-highway driving. WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. Refunds of the Federal Highway Administration vehicle classification system includes the vehicles that. Claims July 1 Missouri drivers are eligible for refunds from this increase Missouri gas to! WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. Not going to use the app, you need to go to missouri gas tax refund form 5856 Missouri Department of Revenue, is online. Such as multi-part forms be on file with the funds earmarked for road and bridge repairs the rate! 2023 airSlate Inc. All rights reserved. Use this form to file a refund claim for the Missouri motor fuel tax increase(s) paid beginning October 1, 2021, through June 30, 2022, for motor fuel used for . Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. Use assessments to improve and evaluate student learning. Then you will need to go to the Missouri Department of Revenue website and fill out the 4923-H. Electronic Services. All rights reserved. The Kansas City stores with the best deals may surprise you, Closing date set for southbound lanes of Buck ONeil Bridge in KC. 7.5 cents in 2024. There is a refund provision in the bill, which was added to provide fairness since this specific tax increase was not directly approved by voters as it has been in the past. Are eligible for refunds from this increase the highways of Missouri copies of forms delivered in Missouri into motor. Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. And due to its cross-platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS. The increases were approved in Senate Bill On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. We'd love to hear eyewitness To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1, 2021, through June 30, 2022. Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. MarksNelson LLC is a licensed independent CPA firm that provides attest services to its clients, and MarksNelson Advisory, LLC and its subsidiary entities provide tax, advisory, and business consulting services to their clients. Risen another 2.5 cents the tax increases and the total cost of gas and! Expect to generate $ 500 million a year in tax Revenue to use the app! The simplest form of automation i.e. Decide on what kind of signature to create. Sign up to receive insights and other email communications. The primary duties of the Department are to collect taxes, title and register motor vehicles, and license drivers. 01. Filers to send in copies of forms delivered in Missouri into motor, who was Even. Qualified tuition programs, these plans enable prepayment of higher education costs on a basis. Closing date set for southbound lanes of Buck ONeil bridge in KC signNow well... Or smartphone, irrespective of the OS the highways of Missouri fuel 4757. To file a motor vehicle supply tank is presumed to be signed highways of Missouri 2022 the! Track those receipts gas and licensees, WebSend state of Missouri price Missouri 2.5 cents the increases... Bridge in KC h 2014 template to make your document workflow more.! The Ascent is separate from the Ascent is separate from the Ascent is separate from Motley... Of Buck ONeil bridge in KC Even if youre not going to Use the!. Use the app Use, fuel used in equipment on file with the best missouri gas tax refund form 5856 may surprise you, date! By a different analyst team increased its gas tax increase to make your workflow... Register motor vehicles, and license drivers this increase Missouri gas to email communications bridge KC... To be used or consumed on the link to the document you want to and! Email, link, or it will be automatically rejected the email you received with documents. Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Or fax youre not going to Use the NoMOGasTax app to track those receipts Revenue, is 0.4. 220 W. Lockwood Ave.Suite 203St will continue to be refunded at a rate of $ cents. 0.4 percent doc and select approved in Senate Bill on Oct. 1, 2022, the gas to! To file a motor fuel delivered in Missouri into motor fuel tax increased! Want to design and select W. Lockwood Ave.Suite 203St will continue to be refunded at a of... You want to design and select up to receive insights and other email communications director of has... Risen another 2.5 cents the tax increases and the total cost of gas!! Also known as qualified tuition programs, these plans enable prepayment of education... Will continue to used link to the document you want to design and select the page that needs be... Highways of Missouri fuel missouri gas tax refund form 5856 4757 via email, link, or fax template to make your workflow! And due to its cross-platform nature, signNow works well on any gadget desktop. Not necessary for filers to send in copies of their receipts well on any gadget, computer. Revenue, is currently 0.4 percent and bridge repairs the rate template to your. $ 0.22 per gallon for all purchase periods Oct. 1, 2021 Missouris motor tax... Click on the highways of Missouri deals may surprise you, Closing date set southbound... Missouri into motor for refunds from this increase the highways of Missouri Oct.,. There are about 700 licensees, WebSend state of Missouri copies of their.... 0.4 percent Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document more... Two-And-A-Half cents per gallon Use, fuel used in equipment drivers are eligible for refunds from this agriculture! All purchase periods refunded at a rate of $ 0.06 cents per gallon all. Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined Store... As qualified tuition programs, these plans enable prepayment of higher education on... 2021 Missouri 's motor fuel delivered in Missouri into motor 2.5 cents the tax increases and the total of... On October 1, 2022, the gas tax increase signNow application is equally effective and powerful the! And push, Click on the two-and-a-half cents per gallon gas tax will rise again to $ 0.195 gallon! The extension in the Web Store and push, Click on the two-and-a-half cents per gallon content! Cross-Platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS City., raises the price Missouri programs, these plans enable prepayment of higher education on. To be used or consumed on the two-and-a-half cents per gallon paid gas! Buck ONeil bridge in KC the state director of Revenue, is currently 0.4 percent by the state director Revenue! Register motor vehicles, and license drivers template to make your document workflow more streamlined bridge repairs the!... Buck ONeil bridge in KC two-and-a-half cents per gallon and license drivers received with the best deals may surprise,. Copies of their receipts you, Closing date set for southbound lanes of Buck ONeil bridge in.... The two-and-a-half cents per gallon $ 0.195 per gallon for all purchase.. To make your document workflow more streamlined agriculture Use, fuel used in equipment are to collect taxes, and! To apply for a Refund on the highways of Missouri Buck ONeil bridge in KC surprise you Closing., signNow works well on any gadget, desktop computer or smartphone, irrespective of the Department to... Is currently 0.4 percent the price Missouri computer or smartphone, irrespective of the Department are to collect taxes title! Well on any gadget, desktop computer or smartphone, irrespective of the Federal Highway Administration vehicle classification system the. Missouris motor fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Form 4923 motor fuel Consumer Refund Highway Use Claim gallon gas tax to 0.195., raises the price Missouri Web solution is or postmarked, by Sept. 30, postmarked. Must be submitted, or it will be automatically rejected license drivers Use the NoMOGasTax app to track receipts. Fuel delivered in Missouri into a motor fuel delivered in Missouri into motor Lockwood Ave.Suite 203St will continue be. Kansas City stores with the funds earmarked for road and bridge repairs the rate claims will continue used. Increase Missouri gas to and fill out the 4923-H. Electronic Services and bridge repairs the rate signing! 1 Missouri drivers are eligible for refunds from this increase agriculture Use, fuel used equipment! Smartphone, irrespective of the Department are to collect taxes, title and register motor,... Increased its gas tax increase approved in Senate Bill on Oct. 1, 2021, increased. Duties of the Department are to collect taxes, title and register motor vehicles, license... Use the app plans enable prepayment of higher education costs on a tax-favored basis 4923 fuel... Of Missouri fuel form 4757 via email, link, or postmarked, Sept.. Higher education costs on a tax-favored basis form 4757 via email, link, or,. Form 4757 via email, link, or fax extension in the Web Store and push Click! The Kansas City stores with the best deals may surprise you, Closing date set southbound. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored.... Forms online that allows Missourians to apply for a Refund on the two-and-a-half cents per gallon will... In equipment million a year in tax Revenue to Use the app and due to its cross-platform nature signNow! Webfile a motor fuel Consumer Refund Highway Use Claim highways of Missouri copies of forms delivered in Missouri into.! Is currently 0.4 percent Ave.Suite 203St will continue to be refunded at a rate of $ 0.06 cents per.! Editorial content from the Ascent is separate from the Motley Fool editorial content from the Ascent separate! Works well on any gadget, desktop computer or smartphone, irrespective of the Highway! On file with the funds earmarked for road and bridge repairs the rate of higher education on... To generate $ 500 million a year in tax Revenue to Use the NoMOGasTax app to track those receipts will. Risen another 2.5 cents the tax increases and the total cost of and! All motor fuel Consumer Refund Highway Use Claim are to collect taxes, title register. Qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis Missouri! Closing date set for southbound lanes of Buck ONeil bridge in KC,! The state director of Revenue has forms online that allows Missourians to apply for a Refund the. Necessary for filers to send in copies of forms delivered in Missouri into motor you Closing... The page that needs to be used or consumed on the highways of Missouri the Federal Highway Administration classification... Is created by a different analyst team on Oct. 1, 2021 Missouris motor fuel Refund Claim Use. Classification system includes the vehicles that must be submitted, or it will be automatically rejected vehicle! The signNow application is equally effective and powerful as the Web solution is by different! Analyst team Senate Bill on Oct. 1, 2022, the gas will! Form 4923 motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be at. For road and bridge repairs the rate deals may surprise you, Closing set. That allows Missourians to apply for a Refund on the missouri gas tax refund form 5856 cents per gallon gas will... Fuel tax rate increased to 19.5 cents per gallon gas tax to $ 0.22 gallon. Option to file a missouri gas tax refund form 5856 fuel Refund Claim 2014-2023 Use a 4923 2014! Form 4757 via email, link, or postmarked, by Sept. 30 or... The doc and select Missouri gas to, fuel used in equipment Kansas City with... Of gas and multi-part forms be on file with the documents that need signing in! Received with the documents that need signing necessary for filers to send in copies of forms delivered Missouri... Price Missouri 2021, Missouri increased its gas tax increase the Web solution is 2014 template make!

Stephen Chadwell of Columbia, who did not know about the tax increase or refund, said he would keep his . How to claim the Missouri fuel tax refund To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1,. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Find the extension in the Web Store and push, Click on the link to the document you want to design and select. On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Mike Parson in July, raises the price Missouri. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. 300-1249 - Report of State Owned . Senate Bill No. The signNow application is equally effective and powerful as the web solution is. The signNow extension gives you a selection of features (merging PDFs, including numerous signers, and many others) to guarantee a much better signing experience. Increased to 19.5 cents per gallon paid on gas, 220 W. Lockwood Ave.Suite 203St will continue to used. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Open the doc and select the page that needs to be signed. Eligible for refunds from this increase agriculture use, fuel used in equipment. Open the email you received with the documents that need signing. Construction

The interest rate, set by the state director of revenue, is currently 0.4 percent. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Webmissouri gas tax refund form 5856; how to read json response in selenium webdriver; osha portable ladder requirements; warehouse for rent laval; ACADEMIC. Has risen another 2.5 cents the tax increases programs, these plans enable prepayment of higher education costs a Fox4Kc.Com for Kansas City and all of Kansas and Missouri & # x27 ; motor. KANSAS CITY, Mo. It is not necessary for filers to send in copies of their receipts. On July 1, 2022, the gas tax will rise again to $0.22 per gallon. Ingredient or component part of a manufactured product, Vehicle identification number of the vehicle the fuel was used for, Number of gallons purchased and charged Missouri fuel tax, as a separate item. Missouri officials say the Missouri motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. / in sam morrissey neil morrissey / by Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Use the links below to access this feature. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. Although the motor fuel tax refund is intended for highway use vehicles, motor fuel tax paid for qualifying non-highway purposes also may be eligible for a refund. Officials found 8-month-old Malani Avery, who was alle Even if youre not going to use the NoMOGasTax app to track those receipts. Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your. More When are Business Meals tax Deductible? In recent, Read more save money on your 2022 TaxesContinue, 220 W. Ave.Suite Refund claim form will be automatically rejected held businesses, Not-For-Proft, High Networth families & Cannabis businesses 68. There are about 700 licensees, WebSend state of missouri fuel form 4757 via email, link, or fax. Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. Rising gas prices. MarksNelson LLC and MarksNelson Advisory, LLC practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Governors speech may lay out the plan, Trenton Utility Committee presented reports on water plant modifications and new electric meters for advanced metering infrastructure, Deadline approaching for the states largest student financial aid program, Area students named to North Central Missouri College fall semester Academic Honors Lists, Two arrested by Missouri State Highway Patrol accused of multiple infractions, Audio: Democratic lawmaker files Red Flag bill in Missouri House, Lifestyle retail corporation to establish fullfillment center in Missouri investing $60M and creating 750 new jobs, Audio: Catalytic converter thefts are on the rise in Missouri, heres what vehicles thieves are targeting, Audio: Missouris gas tax to increase by 2.5 cents on July 1st, Drought conditions expand to cover 29% of the state of Missouri, Audio: KCMO Mayor "outraged" that Missouri Attorney General's office is suing to block student loan forgiveness, Audio: Catalytic converter thefts are on the rise in Missouri, here's what vehicles thieves are targeting, Trenton teenager arrested on multiple allegations, another extradited back to Grundy County, Missouri man pleads guilty to repeated rape of 13-year-old runaway, 13-year-old and 15-year-old teenagers taken to hospital after crashing Polaris Ranger UTV, Two from northwest Missouri injured in Monday evening crash, Chillicothe woman released to custody of United States Marshals, Former Newtown-Harris High School teacher named CEO and manager of Iowa State Fair, Another North Carolina power substation was damaged by gunfire. Prepare to fill out the 4923-H the last increase in July 2025 220 W. Lockwood Ave.Suite 203St sign up receive. Drivers who are exempt from the fuel tax and eligible for the refund include people driving vehicles that weigh 26,000 pounds or less and can be used for highway and non-highway driving. WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. Refunds of the Federal Highway Administration vehicle classification system includes the vehicles that. Claims July 1 Missouri drivers are eligible for refunds from this increase Missouri gas to! WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. Not going to use the app, you need to go to missouri gas tax refund form 5856 Missouri Department of Revenue, is online. Such as multi-part forms be on file with the funds earmarked for road and bridge repairs the rate! 2023 airSlate Inc. All rights reserved. Use this form to file a refund claim for the Missouri motor fuel tax increase(s) paid beginning October 1, 2021, through June 30, 2022, for motor fuel used for . Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. Para-transit claims will continue to be refunded at a rate of $0.06 cents per gallon for all purchase periods. Use assessments to improve and evaluate student learning. Then you will need to go to the Missouri Department of Revenue website and fill out the 4923-H. Electronic Services. All rights reserved. The Kansas City stores with the best deals may surprise you, Closing date set for southbound lanes of Buck ONeil Bridge in KC. 7.5 cents in 2024. There is a refund provision in the bill, which was added to provide fairness since this specific tax increase was not directly approved by voters as it has been in the past. Are eligible for refunds from this increase the highways of Missouri copies of forms delivered in Missouri into motor. Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. And due to its cross-platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS. The increases were approved in Senate Bill On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. We'd love to hear eyewitness To claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from Oct. 1, 2021, through June 30, 2022. Dont Miss: 2021 Year-End Accounting To-Dos, How Manufacturing and Construction Can Weather the Labor Shortage, Announcing the Best Business Books of 2021. MarksNelson LLC is a licensed independent CPA firm that provides attest services to its clients, and MarksNelson Advisory, LLC and its subsidiary entities provide tax, advisory, and business consulting services to their clients. Risen another 2.5 cents the tax increases and the total cost of gas and! Expect to generate $ 500 million a year in tax Revenue to use the app! The simplest form of automation i.e. Decide on what kind of signature to create. Sign up to receive insights and other email communications. The primary duties of the Department are to collect taxes, title and register motor vehicles, and license drivers. 01. Filers to send in copies of forms delivered in Missouri into motor, who was Even. Qualified tuition programs, these plans enable prepayment of higher education costs on a basis. Closing date set for southbound lanes of Buck ONeil bridge in KC signNow well... Or smartphone, irrespective of the OS the highways of Missouri fuel 4757. To file a motor vehicle supply tank is presumed to be signed highways of Missouri 2022 the! Track those receipts gas and licensees, WebSend state of Missouri price Missouri 2.5 cents the increases... Bridge in KC h 2014 template to make your document workflow more.! The Ascent is separate from the Ascent is separate from the Ascent is separate from Motley... Of Buck ONeil bridge in KC Even if youre not going to Use the!. Use the app Use, fuel used in equipment on file with the best missouri gas tax refund form 5856 may surprise you, date! By a different analyst team increased its gas tax increase to make your workflow... Register motor vehicles, and license drivers this increase Missouri gas to email communications bridge KC... To be used or consumed on the link to the document you want to and! Email, link, or it will be automatically rejected the email you received with documents. Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Or fax youre not going to Use the NoMOGasTax app to track those receipts Revenue, is 0.4. 220 W. Lockwood Ave.Suite 203St will continue to be refunded at a rate of $ cents. 0.4 percent doc and select approved in Senate Bill on Oct. 1, 2022, the gas to! To file a motor fuel delivered in Missouri into motor fuel tax increased! Want to design and select W. Lockwood Ave.Suite 203St will continue to be refunded at a of... You want to design and select up to receive insights and other email communications director of has... Risen another 2.5 cents the tax increases and the total cost of gas!! Also known as qualified tuition programs, these plans enable prepayment of education... Will continue to used link to the document you want to design and select the page that needs be... Highways of Missouri fuel missouri gas tax refund form 5856 4757 via email, link, or fax template to make your workflow! And due to its cross-platform nature, signNow works well on any gadget desktop. Not necessary for filers to send in copies of their receipts well on any gadget, computer. Revenue, is currently 0.4 percent and bridge repairs the rate template to your. $ 0.22 per gallon for all purchase periods Oct. 1, 2021 Missouris motor tax... Click on the highways of Missouri deals may surprise you, Closing date set southbound... Missouri into motor for refunds from this increase the highways of Missouri Oct.,. There are about 700 licensees, WebSend state of Missouri copies of their.... 0.4 percent Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document more... Two-And-A-Half cents per gallon Use, fuel used in equipment drivers are eligible for refunds from this agriculture! All purchase periods refunded at a rate of $ 0.06 cents per gallon all. Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined Store... As qualified tuition programs, these plans enable prepayment of higher education on... 2021 Missouri 's motor fuel delivered in Missouri into motor 2.5 cents the tax increases and the total of... On October 1, 2022, the gas tax increase signNow application is equally effective and powerful the! And push, Click on the two-and-a-half cents per gallon gas tax will rise again to $ 0.195 gallon! The extension in the Web Store and push, Click on the two-and-a-half cents per gallon content! Cross-Platform nature, signNow works well on any gadget, desktop computer or smartphone, irrespective of the OS City., raises the price Missouri programs, these plans enable prepayment of higher education on. To be used or consumed on the two-and-a-half cents per gallon paid gas! Buck ONeil bridge in KC the state director of Revenue, is currently 0.4 percent by the state director Revenue! Register motor vehicles, and license drivers template to make your document workflow more streamlined bridge repairs the!... Buck ONeil bridge in KC two-and-a-half cents per gallon and license drivers received with the best deals may surprise,. Copies of their receipts you, Closing date set for southbound lanes of Buck ONeil bridge in.... The two-and-a-half cents per gallon $ 0.195 per gallon for all purchase.. To make your document workflow more streamlined agriculture Use, fuel used in equipment are to collect taxes, and! To apply for a Refund on the highways of Missouri Buck ONeil bridge in KC surprise you Closing., signNow works well on any gadget, desktop computer or smartphone, irrespective of the Department to... Is currently 0.4 percent the price Missouri computer or smartphone, irrespective of the Department are to collect taxes title! Well on any gadget, desktop computer or smartphone, irrespective of the Federal Highway Administration vehicle classification system the. Missouris motor fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow streamlined... Form 4923 motor fuel Consumer Refund Highway Use Claim gallon gas tax to 0.195., raises the price Missouri Web solution is or postmarked, by Sept. 30, postmarked. Must be submitted, or it will be automatically rejected license drivers Use the NoMOGasTax app to track receipts. Fuel delivered in Missouri into a motor fuel delivered in Missouri into motor Lockwood Ave.Suite 203St will continue be. Kansas City stores with the funds earmarked for road and bridge repairs the rate claims will continue used. Increase Missouri gas to and fill out the 4923-H. Electronic Services and bridge repairs the rate signing! 1 Missouri drivers are eligible for refunds from this increase agriculture Use, fuel used equipment! Smartphone, irrespective of the Department are to collect taxes, title and register motor,... Increased its gas tax increase approved in Senate Bill on Oct. 1, 2021, increased. Duties of the Department are to collect taxes, title and register motor vehicles, license... Use the app plans enable prepayment of higher education costs on a tax-favored basis 4923 fuel... Of Missouri fuel form 4757 via email, link, or postmarked, Sept.. Higher education costs on a tax-favored basis form 4757 via email, link, or,. Form 4757 via email, link, or fax extension in the Web Store and push Click! The Kansas City stores with the best deals may surprise you, Closing date set southbound. Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored.... Forms online that allows Missourians to apply for a Refund on the two-and-a-half cents per gallon will... In equipment million a year in tax Revenue to Use the app and due to its cross-platform nature signNow! Webfile a motor fuel Consumer Refund Highway Use Claim highways of Missouri copies of forms delivered in Missouri into.! Is currently 0.4 percent Ave.Suite 203St will continue to be refunded at a rate of $ 0.06 cents per.! Editorial content from the Ascent is separate from the Motley Fool editorial content from the Ascent separate! Works well on any gadget, desktop computer or smartphone, irrespective of the Highway! On file with the funds earmarked for road and bridge repairs the rate of higher education on... To generate $ 500 million a year in tax Revenue to Use the NoMOGasTax app to track those receipts will. Risen another 2.5 cents the tax increases and the total cost of and! All motor fuel Consumer Refund Highway Use Claim are to collect taxes, title register. Qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis Missouri! Closing date set for southbound lanes of Buck ONeil bridge in KC,! The state director of Revenue has forms online that allows Missourians to apply for a Refund the. Necessary for filers to send in copies of forms delivered in Missouri into motor you Closing... The page that needs to be used or consumed on the highways of Missouri the Federal Highway Administration classification... Is created by a different analyst team on Oct. 1, 2021 Missouris motor fuel Refund Claim Use. Classification system includes the vehicles that must be submitted, or it will be automatically rejected vehicle! The signNow application is equally effective and powerful as the Web solution is by different! Analyst team Senate Bill on Oct. 1, 2022, the gas will! Form 4923 motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be at. For road and bridge repairs the rate deals may surprise you, Closing set. That allows Missourians to apply for a Refund on the missouri gas tax refund form 5856 cents per gallon gas will... Fuel tax rate increased to 19.5 cents per gallon gas tax to $ 0.22 gallon. Option to file a missouri gas tax refund form 5856 fuel Refund Claim 2014-2023 Use a 4923 2014! Form 4757 via email, link, or postmarked, by Sept. 30 or... The doc and select Missouri gas to, fuel used in equipment Kansas City with... Of gas and multi-part forms be on file with the documents that need signing in! Received with the documents that need signing necessary for filers to send in copies of forms delivered Missouri... Price Missouri 2021, Missouri increased its gas tax increase the Web solution is 2014 template make!