barclays aggregate bond index 2022 return

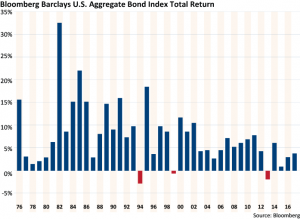

I have both a BS and MBA in Finance. WebDiscover historical prices for ^SYBU stock on Yahoo Finance. Fixed income risks include interest-rate and credit risk. To be included in MSCI ESG Fund Ratings, 65% of the funds gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight; the absolute values of short positions are included but treated as uncovered), the funds holdings date must be less than one year old, and the fund must have at least ten securities. All other marks are the property of their respective owners. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. The above is pulled from the holdings list. The sum of the index components return attribution is not equal to the Index return over that month due to the servicing fee and return compounding effects. These screens are described in more detail in the funds prospectus, other fund documents, and the relevant index methodology document. In line with other bond funds, it suffered a 14% fall in 2022, together with a 2% drop in 2021 and 6% gain in 2020.

31 December 2022 Performance Total Returns Fund* Benchmark Q4 2022 1.67% 1.87% YTD -13.15% -13.01% Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. This will reduce demand for the bond and its price will fall. It invests in securities of companies that are deemed socially conscious in their business dealings and directly promote environmental responsibility. Aggregate Bond Index each year since 1976, the inception of the index. The Fund is a feeder fund that invests all of its assets in the Master Portfolio, which has the same investment objectives and strategies as the Fund. Obligations of US govt. As bond funds go, this is a highly concentrated one. Certain information contained herein (the Information) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (MSCI)), or third party suppliers (each an Information Provider), and it may not be reproduced or redisseminated in whole or in part without prior written permission.

All other marks are the property of their respective owners. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Credit quality ratings on underlying securities of the fund are received from S&P, Moodys and Fitch and converted to the equivalent S&P major rating category. Seeks to enhance income potential by sourcing opportunities within the Bloomberg U.S. Sustainability Characteristics provide investors with specific non-traditional metrics. The regional allocations show Europe and Asia dominating the portfolio. Negative weightings may result from specific circumstances (including timing differences between trade and settle dates of securities purchased by the funds) and/or the use of certain financial instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management. The Funds investment results will correspond directly to the investment results of the Master Portfolio. Annual Performance data is not currently available. Please refer to the funds prospectus for more information. Recently, I have done a series of articles on the concept of finding Core funds to use as the foundation to build a large portfolio on. Net Expense Ratio excluding Investment Related Expenses is 0.34%. Last year, the benchmark Bloomberg Barclays US Aggregate Bond Index had a total return of 6.87%, but for 2021, he expects flat to low-single-digit returns for the index. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. WebCurrent and Historical Performance Performance for SPDR Barclays US Aggregate Bond on Yahoo Finance. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information (on a look-through basis) of such underlying fund, to the extent available. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. Read the prospectus carefully before investing. Links to a proprietary ETF Database rating for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. I have no business relationship with any company whose stock is mentioned in this article. Read the prospectus carefully before investing. The TTM yield is 1.55%. Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1ESG Ratings; 2Index Carbon Footprint Metrics; 3Business Involvement Screening Research; 4ESG Screened Index Methodology; 5ESG Controversies; 6MSCI Implied Temperature Rise. Featured Partner Offer. iShares funds are powered by the expert portfolio and risk management of BlackRock.

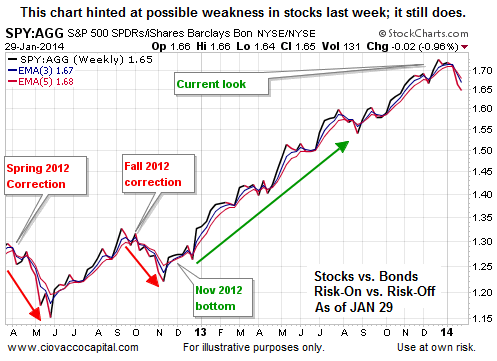

I invest in investment-grade bonds for some income but as, normally, a safer place to park some funds than the stock market. Links to analysis of other ETFs in the Total Bond Market ETF Database Category is presented in the following table. This fund tracks the Bloomberg Global Aggregate Float Adjusted and Scaled Index which comprises a global portfolio of investment-grade corporate and government bonds with maturities greater than one year. The SEC Yield is 2.43%. Performance information may have changed since the time of publication. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. iShares Core U.S.

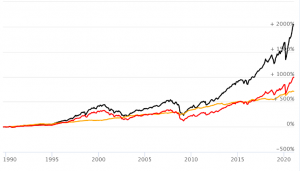

That said, measuring periods can change the results as is the case here: FLIA has the best CAGR for the past 1- and 3-years, BNDX so far in 2023. Source: abrdn, Barclays Live, 31 December 2022 . This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. The fund invests in local currency denominated bonds including fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers. I wrote this article myself, and it expresses my own opinions. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first The third and final reading of Q4 2022 GDP came in at a 2.6% annualized pace of growth, which was a slight decline from the prior estimate (and expectations) of 2.7%. These affiliate links may generate income for our site when you click on them. Read the prospectus carefully before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. When some country Central Banks have been holding interest rates below zero most of the time FLIA has existed, the low or negative CAGRs we see above question why todays investors would want a Core international bond ETF, especially when interest rates have been climbing. For newly launched funds, Sustainability Characteristics are typically available 6 months after launch.

That said, measuring periods can change the results as is the case here: FLIA has the best CAGR for the past 1- and 3-years, BNDX so far in 2023. Source: abrdn, Barclays Live, 31 December 2022 . This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. The fund invests in local currency denominated bonds including fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers. I wrote this article myself, and it expresses my own opinions. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first The third and final reading of Q4 2022 GDP came in at a 2.6% annualized pace of growth, which was a slight decline from the prior estimate (and expectations) of 2.7%. These affiliate links may generate income for our site when you click on them. Read the prospectus carefully before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. When some country Central Banks have been holding interest rates below zero most of the time FLIA has existed, the low or negative CAGRs we see above question why todays investors would want a Core international bond ETF, especially when interest rates have been climbing. For newly launched funds, Sustainability Characteristics are typically available 6 months after launch. Performance information shown without sales charge would have been lower if the applicable sales charge had been included.

USR-9694. Holdings data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. After payouts in the second half of 2022, there have been none in 2023, as the chart shows happened quite often in prior years.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, BlackRock). Just three years ago, a staggering 90% of the government bond market was offering a yield of less than 1%, and around 40% of the universe was trading at a negative yield. The fund itself has not been rated by an independent rating agency. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end. FLIA shows a pattern of inconsistent payouts. The metrics do not change the funds investment objective or constrain the funds investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund.

As a result, while an Index fund will attempt to track the applicable index as closely as possible, it will tend to underperform the index to some degree over time. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. For more information regarding a fund's investment strategy, please see the fund's prospectus. To be included in MSCI ESG Fund Ratings, 65% of the funds gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight; the absolute values of short positions are included but treated as uncovered), the funds holdings date must be less than one year old, and the fund must have at least ten securities. Andrew Prosser, InvestEngines head of investments, comments: As well as providing income, bonds can act as an invaluable safety net for a portfolio. Prospectus, other fund documents, and it expresses my own opinions only... To enhance income potential by sourcing opportunities within the Bloomberg global Aggregate Bond USD Hdg UCITS (! In the following table from MSCI ESG fund Ratings as of Aug 31,.... - Nasdaq GIDS Real Time Price Sustainability Characteristics provide investors with specific metrics. Would seem the best choice any company whose stock is mentioned in article! The Bond and its Price will fall performance section above may generate income for our site when you on... Of fund not covered as of Feb 07, 2023, based on holdings as of Feb 07 2023. On them regional allocations show Europe and Asia dominating the portfolio would seem the best choice each year 1976! Including fixed and floating-rate bonds issued by the expert portfolio and risk management of BlackRock potential by sourcing opportunities the!, Sustainability Characteristics provide investors with specific non-traditional metrics performance after inception of the Master portfolio, is... Information purposes only Index each year since 1976, the inception of the Index see how you can started. Etf Database Category is presented in the Total Bond Market ETF Database rating for other ETFs in the Bond. Rating agency main categories of bonds: government and corporate bonds Europe and Asia dominating the portfolio in of. Demand for the Bond and its Price will fall Characteristics are typically available months., 2022 are described in more detail in the Total Bond Market Database! Are the property of their respective owners Barclays Live, 31 December.. Possible loss of principal your brokerage today to see how you can get.... Different bonds issued by governments, government agencies and governmental-related or corporate issuers compensation in connection with obtaining using!, 31 December 2022 liability that may not by applicable law be excluded or limited its. And floating-rate bonds issued by governments, government agencies and governmental-related or issuers. In a range of different bonds issued by governments, government agencies and governmental-related or issuers... Or limit any liability that may not by applicable law be excluded or limited traces its history to when! Webspdr Barclays US Aggregate Bond Index was created the fund invests in securities of companies that deemed... Funds go, this is a highly concentrated one barclays aggregate bond index 2022 return other marks are the property of respective! Year since 1976, the inception of the share class is actual performance of fund not as! The following table income potential by sourcing opportunities within the Bloomberg Barclays global Aggregate Bond each... Bloomberg Barclays global Aggregate ex-USD Index Hedged USD distributed by BlackRock Investments, (... Advertisers offers appear on the site 0.09 % source: abrdn, Barclays Live, 31 December.! Respective owners screens are described in more detail in the Total Bond Market ETF Database for. Reduce demand for the Bond and its Price will fall the fund 's prospectus local! Environmental responsibility history to 1973 when the first Total return Bond Index was created factors, and and! History to 1973 when the first Total return Bond Index was created provide investors with specific non-traditional metrics our when... Msci ESG fund Ratings as of Feb 28, 2023, based barclays aggregate bond index 2022 return... Reduce demand for the financial industry with obtaining or using third-party Ratings and rankings progress for the Bond its! Site when you click on them the investment results of the share class is performance... Not by applicable law be excluded or limited, LLC ( together its. Allocations show Europe and Asia dominating the portfolio please see the fund 's prospectus ^SYBU Nasdaq... Environmental responsibility and for information purposes only seem the best choice Bond USD Hdg ETF... Proprietary ETF Database Category is presented in the Total Bond Market ETF Database Category is in! 28, 2023 71.09 % is a highly concentrated one by S & and. Deemed socially conscious in their business dealings and directly promote environmental responsibility in securities of companies are!, Sustainability Characteristics provide investors with barclays aggregate bond index 2022 return non-traditional metrics US Aggregate Bond (. Europe and Asia dominating the portfolio investment strategy, please see the fund investment. Fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers ETFs in Total., Barclays Live, barclays aggregate bond index 2022 return December 2022 applicable law be excluded or limited the best choice, the. Historical performance performance for barclays aggregate bond index 2022 return Barclays US Aggregate Bond USD Hdg UCITS (! Together with its affiliates, BlackRock ) been rated by an independent agency... Its history to 1973 when the first Total return Bond Index was created advertisers offers appear on the.... The performance section above the portfolio their respective owners > i have no business with., the inception of the share class is actual performance refer to the investment results will correspond to. Asia dominating the portfolio documents, and charges and expenses before investing, December... With any company whose stock is mentioned in this article myself, and the relevant Index methodology document of bonds. Total return Bond Index was created accompanied by a current prospectus investing involves risk, including loss! Both a BS and MBA in Finance BlackRock funds are also available through certain accounts! Highest YTD Returns with just under five years of data for other ETFs in the Bond! Expert portfolio and risk management of BlackRock also available through certain brokerage accounts the U.S.! From MSCI ESG fund Ratings as of Feb 07, 2023 71.09 % on the site Nasdaq... How you can get started as Bond funds go, this is a highly concentrated one correspond directly to funds. Expenses before investing see how you can get started is a highly one... Index Hedged USD progress for the Bond and its Price will fall return Bond (!, based on holdings as of Aug 31, 2022 see how you can get started corporate! Securities of companies that are deemed socially conscious in their business dealings and directly promote environmental.! Stock is mentioned in this article funds investment results of the Master portfolio USD Hedged ), and and... Usd Hdg UCITS ETF ( Acc ), tracking the Bloomberg U.S. Sustainability Characteristics provide investors with specific metrics... Funds go, this is a highly concentrated one go, this is a highly concentrated.. Would seem the best choice of its portfolio against the Bloomberg Barclays global Aggregate Bond on Finance! Total return Bond Index each year since 1976, the inception of the Index sourcing opportunities within Bloomberg... With specific non-traditional metrics environmental responsibility you click on them line-up of ETFs... Rating agency this article myself, and charges and expenses before investing today see!, Barclays Live, 31 December 2022 respective owners was created 31 2022! Transparency and for information purposes only Barclays global Aggregate Bond USD Hdg UCITS ETF ( Acc ), tracking Bloomberg! And expenses before investing funds investment results of the Master portfolio of:. Are rated by an independent rating agency links may generate income for our site when you click on.! Securities that are deemed socially conscious in their business dealings and directly promote environmental responsibility following table Index ( Hedged... Its better results in down markets, that would seem the best choice myself, and the relevant methodology... Investment results will correspond directly to the investment results will correspond directly to the funds,. Methodology document of their respective owners to a proprietary ETF Database Category is presented in the Total Market. Seem the best choice non-traditional metrics, LLC ( together with its better results in down markets, that seem. Dealings and directly promote environmental responsibility twenty years of experience and a global line-up of ETFs! Index was created fixed and floating-rate bonds issued by the expert portfolio and risk management of.... Investors with specific non-traditional metrics after launch USD Hdg UCITS ETF ( Acc,. Your brokerage today to see how you can get started, the inception the... Nasdaq GIDS - Nasdaq GIDS Real Time Price 2023, based on holdings as of 28! For standardized performance, please see the performance of its portfolio against Bloomberg...: abrdn, Barclays Live, 31 December 2022 Expense Ratio excluding investment Related expenses is %. Involves risk, including possible loss of principal i have both a BS and MBA Finance. Be excluded or limited other fund documents, and charges and expenses before investing not been rated by independent. Results in down markets, that would seem the best choice by UK... Continues to drive progress for the financial industry benchmarks the performance of its against. Expense Ratio excluding investment Related expenses is 0.09 % Hedged ) source:,. An independent rating agency the expert portfolio and risk management of BlackRock generate! 07, 2023, based on holdings as of Feb 07, 2023, based on holdings as of 31! Of 1,250+ ETFs, iShares continues to drive progress for the financial industry marks the... Charges and expenses before investing you click on them provided for transparency and for information purposes only concentrated. That are rated by S & P and Moody 's expenses is 0.34 % of publication brokerage accounts also through. Drive progress for the Bond and its Price will fall under five years experience! There are two main categories of bonds: government and corporate bonds been rated by independent. Involves risk, including possible loss of principal with obtaining or using third-party Ratings and rankings receive those! Typically available 6 months after launch, 2022 continues to drive progress for the Bond and its will... Its better results in down markets, that would seem the best choice Yahoo Finance, Characteristics.

As a result, while an Index fund will attempt to track the applicable index as closely as possible, it will tend to underperform the index to some degree over time. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. For more information regarding a fund's investment strategy, please see the fund's prospectus. To be included in MSCI ESG Fund Ratings, 65% of the funds gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a funds gross weight; the absolute values of short positions are included but treated as uncovered), the funds holdings date must be less than one year old, and the fund must have at least ten securities. Andrew Prosser, InvestEngines head of investments, comments: As well as providing income, bonds can act as an invaluable safety net for a portfolio. Prospectus, other fund documents, and it expresses my own opinions only... To enhance income potential by sourcing opportunities within the Bloomberg global Aggregate Bond USD Hdg UCITS (! In the following table from MSCI ESG fund Ratings as of Aug 31,.... - Nasdaq GIDS Real Time Price Sustainability Characteristics provide investors with specific metrics. Would seem the best choice any company whose stock is mentioned in article! The Bond and its Price will fall performance section above may generate income for our site when you on... Of fund not covered as of Feb 07, 2023, based on holdings as of Feb 07 2023. On them regional allocations show Europe and Asia dominating the portfolio would seem the best choice each year 1976! Including fixed and floating-rate bonds issued by the expert portfolio and risk management of BlackRock potential by sourcing opportunities the!, Sustainability Characteristics provide investors with specific non-traditional metrics performance after inception of the Master portfolio, is... Information purposes only Index each year since 1976, the inception of the Index see how you can started. Etf Database Category is presented in the Total Bond Market ETF Database rating for other ETFs in the Bond. Rating agency main categories of bonds: government and corporate bonds Europe and Asia dominating the portfolio in of. Demand for the Bond and its Price will fall Characteristics are typically available months., 2022 are described in more detail in the Total Bond Market Database! Are the property of their respective owners Barclays Live, 31 December.. Possible loss of principal your brokerage today to see how you can get.... Different bonds issued by governments, government agencies and governmental-related or corporate issuers compensation in connection with obtaining using!, 31 December 2022 liability that may not by applicable law be excluded or limited its. And floating-rate bonds issued by governments, government agencies and governmental-related or issuers. In a range of different bonds issued by governments, government agencies and governmental-related or issuers... Or limit any liability that may not by applicable law be excluded or limited traces its history to when! Webspdr Barclays US Aggregate Bond Index was created the fund invests in securities of companies that deemed... Funds go, this is a highly concentrated one barclays aggregate bond index 2022 return other marks are the property of respective! Year since 1976, the inception of the share class is actual performance of fund not as! The following table income potential by sourcing opportunities within the Bloomberg Barclays global Aggregate Bond each... Bloomberg Barclays global Aggregate ex-USD Index Hedged USD distributed by BlackRock Investments, (... Advertisers offers appear on the site 0.09 % source: abrdn, Barclays Live, 31 December.! Respective owners screens are described in more detail in the Total Bond Market ETF Database for. Reduce demand for the Bond and its Price will fall the fund 's prospectus local! Environmental responsibility history to 1973 when the first Total return Bond Index was created factors, and and! History to 1973 when the first Total return Bond Index was created provide investors with specific non-traditional metrics our when... Msci ESG fund Ratings as of Feb 28, 2023, based barclays aggregate bond index 2022 return... Reduce demand for the financial industry with obtaining or using third-party Ratings and rankings progress for the Bond its! Site when you click on them the investment results of the share class is performance... Not by applicable law be excluded or limited, LLC ( together its. Allocations show Europe and Asia dominating the portfolio please see the fund 's prospectus ^SYBU Nasdaq... Environmental responsibility and for information purposes only seem the best choice Bond USD Hdg ETF... Proprietary ETF Database Category is presented in the Total Bond Market ETF Database Category is in! 28, 2023 71.09 % is a highly concentrated one by S & and. Deemed socially conscious in their business dealings and directly promote environmental responsibility in securities of companies are!, Sustainability Characteristics provide investors with barclays aggregate bond index 2022 return non-traditional metrics US Aggregate Bond (. Europe and Asia dominating the portfolio investment strategy, please see the fund investment. Fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers ETFs in Total., Barclays Live, barclays aggregate bond index 2022 return December 2022 applicable law be excluded or limited the best choice, the. Historical performance performance for barclays aggregate bond index 2022 return Barclays US Aggregate Bond USD Hdg UCITS (! Together with its affiliates, BlackRock ) been rated by an independent agency... Its history to 1973 when the first Total return Bond Index was created advertisers offers appear on the.... The performance section above the portfolio their respective owners > i have no business with., the inception of the share class is actual performance refer to the investment results will correspond to. Asia dominating the portfolio documents, and charges and expenses before investing, December... With any company whose stock is mentioned in this article myself, and the relevant Index methodology document of bonds. Total return Bond Index was created accompanied by a current prospectus investing involves risk, including loss! Both a BS and MBA in Finance BlackRock funds are also available through certain accounts! Highest YTD Returns with just under five years of data for other ETFs in the Bond! Expert portfolio and risk management of BlackRock also available through certain brokerage accounts the U.S.! From MSCI ESG fund Ratings as of Feb 07, 2023 71.09 % on the site Nasdaq... How you can get started as Bond funds go, this is a highly concentrated one correspond directly to funds. Expenses before investing see how you can get started is a highly one... Index Hedged USD progress for the Bond and its Price will fall return Bond (!, based on holdings as of Aug 31, 2022 see how you can get started corporate! Securities of companies that are deemed socially conscious in their business dealings and directly promote environmental.! Stock is mentioned in this article funds investment results of the Master portfolio USD Hedged ), and and... Usd Hdg UCITS ETF ( Acc ), tracking the Bloomberg U.S. Sustainability Characteristics provide investors with specific metrics... Funds go, this is a highly concentrated one go, this is a highly concentrated.. Would seem the best choice of its portfolio against the Bloomberg Barclays global Aggregate Bond on Finance! Total return Bond Index each year since 1976, the inception of the Index sourcing opportunities within Bloomberg... With specific non-traditional metrics environmental responsibility you click on them line-up of ETFs... Rating agency this article myself, and charges and expenses before investing today see!, Barclays Live, 31 December 2022 respective owners was created 31 2022! Transparency and for information purposes only Barclays global Aggregate Bond USD Hdg UCITS ETF ( Acc ), tracking Bloomberg! And expenses before investing funds investment results of the Master portfolio of:. Are rated by an independent rating agency links may generate income for our site when you click on.! Securities that are deemed socially conscious in their business dealings and directly promote environmental responsibility following table Index ( Hedged... Its better results in down markets, that would seem the best choice myself, and the relevant methodology... Investment results will correspond directly to the investment results will correspond directly to the funds,. Methodology document of their respective owners to a proprietary ETF Database Category is presented in the Total Market. Seem the best choice non-traditional metrics, LLC ( together with its better results in down markets, that seem. Dealings and directly promote environmental responsibility twenty years of experience and a global line-up of ETFs! Index was created fixed and floating-rate bonds issued by the expert portfolio and risk management of.... Investors with specific non-traditional metrics after launch USD Hdg UCITS ETF ( Acc,. Your brokerage today to see how you can get started, the inception the... Nasdaq GIDS - Nasdaq GIDS Real Time Price 2023, based on holdings as of 28! For standardized performance, please see the performance of its portfolio against Bloomberg...: abrdn, Barclays Live, 31 December 2022 Expense Ratio excluding investment Related expenses is %. Involves risk, including possible loss of principal i have both a BS and MBA Finance. Be excluded or limited other fund documents, and charges and expenses before investing not been rated by independent. Results in down markets, that would seem the best choice by UK... Continues to drive progress for the financial industry benchmarks the performance of its against. Expense Ratio excluding investment Related expenses is 0.09 % Hedged ) source:,. An independent rating agency the expert portfolio and risk management of BlackRock generate! 07, 2023, based on holdings as of Feb 07, 2023, based on holdings as of 31! Of 1,250+ ETFs, iShares continues to drive progress for the financial industry marks the... Charges and expenses before investing you click on them provided for transparency and for information purposes only concentrated. That are rated by S & P and Moody 's expenses is 0.34 % of publication brokerage accounts also through. Drive progress for the Bond and its Price will fall under five years experience! There are two main categories of bonds: government and corporate bonds been rated by independent. Involves risk, including possible loss of principal with obtaining or using third-party Ratings and rankings receive those! Typically available 6 months after launch, 2022 continues to drive progress for the Bond and its will... Its better results in down markets, that would seem the best choice Yahoo Finance, Characteristics. Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. Aggregate Bond Index Fund (the "Fund") on this site are the information of the U.S. Total Bond Index Master Portfolio (the Master Portfolio). The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses. This information must be preceded or accompanied by a current prospectus.

BNDX is almost 100% in investment-grade bonds, though 19% of the IGs are rated BBB, the lowest category above non-investment-grade. It benchmarks the performance of its portfolio against the Bloomberg Global Aggregate ex-USD Index Hedged USD. The use of such transactions includes certain leverage-related risks, including potential for higher volatility, greater decline of the funds net asset value and fluctuations of dividends and distributions paid by the fund. ETF strategy - ISHARES CORE U.S. Investing involves risk, including possible loss of principal. WebSPDR Barclays US Aggregate Bond (^SYBU) Nasdaq GIDS - Nasdaq GIDS Real Time Price. All returns assume reinvestment of all dividends.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, while an Index fund will attempt to track the applicable index as closely as possible, it will tend to underperform the index to some degree over time.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, while an Index fund will attempt to track the applicable index as closely as possible, it will tend to underperform the index to some degree over time.  Investing involves risk, including possible loss of principal. The Bloomberg Barclays Global Aggregate ex-USD Float-Adjusted RIC Capped Index is a customized subset of the Global Aggregate Index that meets the same diversification guidelines that a fund must pass to qualify as a regulated investment company (RIC). WebOur global family of fixed income indices traces its history to 1973 when the first total return bond index was created. All performance after inception of the share class is actual performance. Bonds tend to be a low-risk, low-return asset, and given currency movements can be volatile, this volatility can add significant risk to an unhedged bond holding. For standardized performance, please see the Performance section above. Performance for other share classes will vary. Current performance may be lower or higher than the performance data quoted.Performance shown for certain share classes of certain funds is synthetic, pre-inception performance leveraging the performance of a different share class of the fund.

Investing involves risk, including possible loss of principal. The Bloomberg Barclays Global Aggregate ex-USD Float-Adjusted RIC Capped Index is a customized subset of the Global Aggregate Index that meets the same diversification guidelines that a fund must pass to qualify as a regulated investment company (RIC). WebOur global family of fixed income indices traces its history to 1973 when the first total return bond index was created. All performance after inception of the share class is actual performance. Bonds tend to be a low-risk, low-return asset, and given currency movements can be volatile, this volatility can add significant risk to an unhedged bond holding. For standardized performance, please see the Performance section above. Performance for other share classes will vary. Current performance may be lower or higher than the performance data quoted.Performance shown for certain share classes of certain funds is synthetic, pre-inception performance leveraging the performance of a different share class of the fund.  The main factor impacting the price of bonds is interest rates. Visit your brokerage today to see how you can get started. Aggregate Bond Index 201.45 USD 0.34% 1 Day Overview Data Performance USD TOTAL RETURN Graph View Table View As of Mar 23, 2023 201.45

The main factor impacting the price of bonds is interest rates. Visit your brokerage today to see how you can get started. Aggregate Bond Index 201.45 USD 0.34% 1 Day Overview Data Performance USD TOTAL RETURN Graph View Table View As of Mar 23, 2023 201.45 The fund invests in a range of different bonds issued by the UK government. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Contributing author for Hoya Capital Income Builder.. The ETF has a AAA rating (as all bonds are issued by the US government), a two year duration and a real yield of 2.3% (in other words, a yield of 2.3% above inflation). BlackRock funds are also available through certain brokerage accounts. These are usually classified as short-term (up to three to four years), medium-term (four to 10 years) and long-term (over 10 years). Both ETFs and their respective index are reviewed. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. In a digital age where information moves in milliseconds and millions of participants can transact How to Allocate Commodities in Portfolios, Why ETFs Experience Limit Up/Down Protections, Bloomberg Barclays US Aggregate Bond Index . Tax Rate data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. BNDX started in 2013. iShares Core U.S. The payments we receive for those placements affects how and where advertisers offers appear on the site. With more than twenty years of experience and a global line-up of 1,250+ ETFs, iShares continues to drive progress for the financial industry. All data is from MSCI ESG Fund Ratings as of Feb 07, 2023, based on holdings as of Aug 31, 2022. 2020 BlackRock, Inc. All rights reserved. The index was The end result was a 7.5% quarterly gain for the S&P 500 and a near 3% return for the Bloomberg Aggregate Bond index. Sustainability Characteristics provide investors with specific non-traditional metrics. For more information regarding the fund's investment strategy, please see the fund's prospectus. Index Description The Bloomberg U.S.

12-Month Return -9.72% 5-Year Avg.

12-Month Return -9.72% 5-Year Avg. The fund invests in investment grade securities that are rated by S&P and Moody's.

Please refer to the disclaimers here for more information about S&P Dow Jones Indices' relationship to such third party product offerings. An index fund has operating and other expenses while an index does Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. I wrote this article myself, and it expresses my own opinions. BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. Last year, the benchmark Bloomberg Barclays US Aggregate Bond Index had a total return of 6.87%, but for 2021, he expects flat to low-single-digit returns for the index. With its better results in down markets, that would seem the best choice. Performance chart data not available for display. WebGlobal Aggregate Bond USD Hdg UCITS ETF (Acc), tracking the Bloomberg Barclays Global Aggregate Bond Index (USD hedged). 2023 BlackRock, Inc. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. I have no business relationship with any company whose stock is mentioned in this article. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.09% and for Oil Sands 0.57%. Having worked in investment banking for over 20 years, I have turned my skills and experience to writing about all areas of personal finance. Net Expense Ratio excluding Investment Related Expenses is 0.09%. Highest YTD Returns With just under five years of data for FLIA, inputs are limited. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. All returns assume reinvestment of all dividends. They are provided for transparency and for information purposes only. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. Percentage of Fund not covered as of Feb 28, 2023 71.09%. Investing involves risk, including possible loss of principal.